Latest News

Trading.biz is a leading online platform providing market insights, educational resources, and interactive tools for traders and investors. Designed to support informed decision-making, the platform covers forex trading, cryptocurrency trading, and options trading, helping users navigate financial markets with confidence. Data-Driven Market Analysis for Traders Trading.biz focuses on data-driven market analysis, empowering users to evaluate [...]

Via Visibility · February 2, 2026

Verizon is going on the offensive, which should be good for the stock.

Via The Motley Fool · February 3, 2026

So much of what we believe we "should" do is a figment of our imaginations.

Via The Motley Fool · February 3, 2026

One day late on a credit card payment usually won't hurt your credit, but it can still trigger fees and interest. Here's what happens.

Via The Motley Fool · February 3, 2026

Pan American Silver Corp (NYSE:PAAS) Fits the 'Growth at a Reasonable Price' Modelchartmill.com

Via Chartmill · February 3, 2026

Why Is MAMO Stock Falling Pre-Market Today?stocktwits.com

Via Stocktwits · February 3, 2026

Paycom Software Inc (NYSE:PAYC) Passes Peter Lynch's GARP Investment Screenchartmill.com

Via Chartmill · February 3, 2026

RB Global Inc. (NYSE:RBA) Passes the "Caviar Cruise" Quality Investing Screenchartmill.com

Via Chartmill · February 3, 2026

Brookfield Infrastructure is building a leader in AI infrastructure.

Via The Motley Fool · February 3, 2026

Netflix shares keep falling despite solid earnings. Here's what's driving the drama.

Via The Motley Fool · February 3, 2026

This company's end markets are firing on all cylinders right now.

Via The Motley Fool · February 3, 2026

Cryptocurrencies are already seeing plenty of volatility in 2026.

Via The Motley Fool · February 3, 2026

The energy sector is chock-full of high-yield stocks to boost your passive income stream.

Via The Motley Fool · February 3, 2026

Central Bancompany delivers community banking, wealth management, and financial services across nine states with a diversified portfolio.

Via The Motley Fool · February 3, 2026

Fluor's construction business is more reliable than it was before, but it's still cyclical.

Via The Motley Fool · February 3, 2026

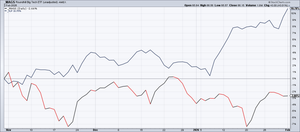

There is something interesting happening beneath the surface in the market right now.

Via Talk Markets · February 3, 2026

Meta Platforms' stock looks ready to rebound in 2026 after a lackluster 2025 performance.

Via The Motley Fool · February 3, 2026

Bitcoin ETFs Kick Off February With $560 Million Inflows After $1.5 Billion Selloffstocktwits.com

Via Stocktwits · February 3, 2026

Things are turning around, and investors want to be a part of the story.

Via The Motley Fool · February 3, 2026

Merck quashed fourth-quarter expectations Tuesday, but the Dow Jones health giant issued lackluster expectations for 2026.

Via Investor's Business Daily · February 3, 2026

DAX rebounds as metals recover and Palantir eases AI fears. Oil falls amid de-escalating geopolitical tensions and a stronger USD.

Via Talk Markets · February 3, 2026

You may just find that 67 is the sweet spot for claiming Social Security. Here's why.

Via The Motley Fool · February 3, 2026

The US natural gas prices plummeted by 21% to $3.42 per MMBtu, completely erasing Friday’s 11% gain.

Via Talk Markets · February 3, 2026

Wall Street analysts forecast material upside in Palantir and Microsoft.

Via The Motley Fool · February 3, 2026

The firm’s review suggests the challenges impacting Affirm are likely temporary and should ease over time.

Via Stocktwits · February 3, 2026