Valued at a market cap of $2.1 billion, C3.ai (AI) stock is down over 45% in the last 12 months. C3.ai aims to compete in the crowded enterprise AI market, which is dominated by larger rivals such as Palantir Technologies (PLTR). The enterprise-facing AI software company is now exploring a potential sale following the departure of founder Thomas Siebel as CEO due to health issues.

C3.ai’s struggles have been mounting throughout the year due to its weak financial performance. In the most recent quarter, it reported revenue of $70.3 million, a 19% year-over-year (YoY) decrease, along with a net loss of nearly $117 million. Two months back, C3.ai withdrew its full-year guidance, citing leadership changes and a restructuring of sales operations.

Salesforce veteran Stephen Ehikian took over as CEO in September, following Siebel's transition to executive chairman. During the earnings call, Siebel revealed that he suffers from an autoimmune disease, which causes significant vision problems, which, on top of the company's poor financial data, drove AI stock significantly lower.

Is C3.ai Stock a Good Buy Right Now?

C3.ai's disastrous first quarter (ended in July) exposed operational headwinds that management attributed to sales execution failures rather than market conditions. Founder Thomas Siebel admitted that the results were unacceptable in virtually every respect, attributing roughly 70% of the blame to sales disruption caused by leadership changes and 30% to his reduced involvement due to health issues.

The company brought in new leadership across sales and services mid-quarter, creating what Siebel described as confusion in the sales process akin to replacing a car's transmission and wheels while driving down the road.

The restructuring proved costly, as C3.ai managed to close just 28 initial production deployments during the quarter. Revenue from demonstration licenses decreased $15.9 million sequentially to $17.9 million, contributing to a 19% YoY decline in revenue. These licenses enable distribution partners and strategic customers to effectively showcase C3.ai software.

Professional services revenue remained steady at $10 million, but gross margins compressed to 52% due to higher costs associated with supporting initial deployments and reduced economies of scale.

Management withdrew full-year guidance entirely, citing the CEO transition and ongoing sales reorganization. For the second quarter, C3.ai projects revenue between $72 million and $80 million with operating losses ranging from $49.5 million to $57.5 million. Chief Financial Officer Hitesh Lath indicated that analysts' forecasts for fiscal 2026 revenue, between $290 million and $300 million, were in the right ballpark, though the company stopped short of endorsing specific numbers.

Despite the turbulence, C3.ai maintains that it faces no new competitive threats or secular market changes that would undermine long-term prospects.

The company emphasized strong customer satisfaction through high Net Promoter Scores and highlighted that roughly 90% of business now flows through partnerships with Microsoft's (MSFT) Azure, Amazon's (AMZN) AWS, and Alphabet's (GOOG) (GOOGL) Google Cloud Platform.

A new Strategic Integrator Program launched during the quarter enables systems integrators to build industry-specific applications on C3.ai's platform, potentially opening significant revenue streams in defense and government sectors.

The AI company ended fiscal Q1 with $711.9 million in cash and marketable securities, providing runway to weather near-term challenges. However, its free cash outflow totaled $34.3 million as the company continues to expand support capacity for a growing base of 374 production deployments.

Is AI Stock Undervalued?

Analysts tracking AI stock forecast revenue to decline from $389 million in fiscal 2025 to $299 million in fiscal 2026. The top line is estimated to increase to $370 million in fiscal 2028.

Wall Street expects C3.ai to remain unprofitable in the near term, as it is forecast to report an adjusted loss of $0.47 per share in 2028, compared to a loss of $1.27 per share in 2026. Between fiscal 2026 and 2028, its free cash outflow is projected to total roughly $270 million.

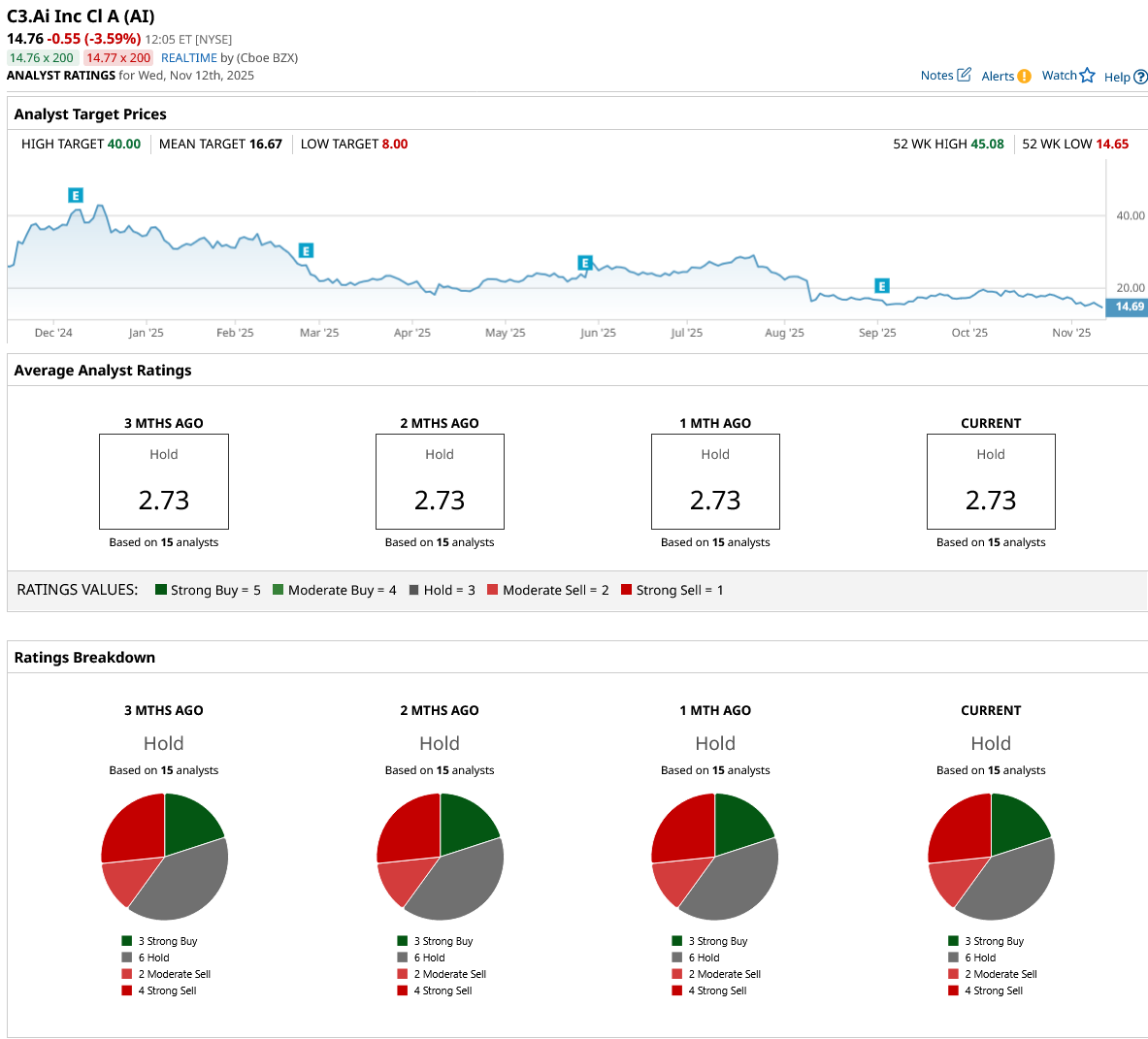

C3.ai is a loss-making company struggling with slowing sales, making it a high-risk investment at present. Out of the 15 analysts covering AI stock, three recommend “Strong Buy,” six recommend “Hold,” two recommend “Moderate Sell,” and four recommend “Strong Sell.” The average C3.ai stock price target is $16.67, above the current price of $14.76.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AMD Strengthens Its Bull Case. Can the Stock Hit $350 in a Year?

- Is GOOG Stock a Buy or Sell as Michael Burry Accuses Hyperscalers of ‘Fraud’?

- Western Digital Stock Soars 280% This Year. Is WDC Worth Chasing Now?

- Heavy Put Option Activity in Advanced Micro Devices Implies AMD Stock Is Overvalued - But Is It?