CoreWeave (CRWV) is caught between explosive growth potential and execution delays as J.P. Morgan downgraded the Nvidia (NVDA)-backed AI cloud provider to “Neutral” from “Overweight” following its Q3 results. J.P. Morgan cited supply chain pressures that demonstrate "the phenomenon is also spreading to CoreWeave." JPM slashed its price target on CRWV stock to $110 from $135 after the latter trimmed full-year revenue guidance by $150 million to $5.1 billion, which disappointed investors.

CRWV stock went public in March 2025 and has returned 120% to shareholders, despite the ongoing selloff, valuing the company at a market capitalization of $45.8 billion. Despite beating third-quarter revenue estimates with $1.36 billion in sales, CoreWeave revealed that a singular third-party data center provider fell behind schedule on construction, forcing it to push some fourth-quarter revenue into 2026.

J.P. Morgan Remains Optimistic on CoreWeave’s Long-Term Growth

CEO Mike Intrator attempted damage control during a CNBC appearance, insisting every aspect of the quarter went exactly as planned except for delays at what he initially called one data center but later clarified as a single provider operating multiple sites.

CNBC's Jim Cramer directly suggested that the troubled partner was Core Scientific (CORZ), the company CoreWeave had unsuccessfully tried to acquire for $9 billion earlier this year. Intrator declined to confirm the identity but acknowledged CoreWeave deployed teams to work alongside the provider at affected facilities in Texas, Oklahoma, and North Carolina.

The situation forced CoreWeave to reduce its year-end active power target from above 900 megawatts to over 850 megawatts while slashing its capital expenditure guidance from $8.5 billion to $13 billion.

J.P. Morgan analysts reiterated their view that CoreWeave's long-term potential remains unchanged, citing a backlog that nearly doubled sequentially to $56 billion, as well as notable contract expansions. CoreWeave also added notable customers, including CrowdStrike (CRWD), Poolside, Rakuten (RKUNY), and Jasper, while launching CoreWeave Federal to serve government agencies like NASA.

However, operating margins compressed to 16% from 21% a year earlier as the company posted a net loss of $110 million. Management expects the delays to be resolved by the first quarter of 2026, with capital expenditures then exceeding the total for 2025 by 100%.

CoreWeave Grew Q3 Sales by 134%

In Q3, CoreWeave increased its sales by 134% year-over-year (YoY) to $1.36 billion. It also ended Q3 with a backlog of $55.6 billion, up from $28 billion in Q2. CEO Mike Intrator emphasized that CoreWeave operates across 41 data centers and has diversified its provider relationships so that no single developer represents more than 20% of its 2.9 gigawatts in contracted power capacity.

The company added eight new data centers during the quarter while expanding internationally into Scotland through a partnership with the U.K. government. CoreWeave also advanced self-build projects in Pennsylvania to gain greater operational control and reduce dependency on third-party developers.

Customer concentration has improved substantially, as no single client now accounts for more than 35% of the revenue backlog, compared to roughly 85% at the beginning of 2025. It signed contract expansions with Meta (META), valued at $14.2 billion over six years, and OpenAI, totaling $22.4 billion. Additionally, CoreWeave executed its sixth agreement with an unnamed leading hyperscaler, with nine of its ten largest customers having signed multiple contracts.

Management expects 2026 capital expenditures to exceed double the 2025 total of $12 billion to $14 billion as the company scales to meet insatiable demand. CoreWeave maintained that over 60% of its backlog comes from investment-grade customers, providing financial stability as it navigates near-term infrastructure challenges.

CoreWeave also introduced innovative financing structures, including an interruptible capacity arrangement with Nvidia, designed to serve emerging AI startups unable to secure long-term compute commitments.

Notably, interest expense increased to $311 million from $104 million YoY, primarily due to higher debt financing. However, management continues to lower its cost of capital through progressively better lending terms.

What Is the CRWV Stock Price Target?

Despite its stellar returns since going public, CRWV stock is down over 50% from all-time highs. Analysts tracking the AI infrastructure giant forecast revenue to increase from $5.1 billion in 2025 to $25.8 billion in 2029.

While CoreWeave is forecast to report a free cash flow of $5.68 billion in 2029, the company’s massive investments in capital expenditures suggest it could report a cumulative free cash outflow of almost $34 billion between 2025 and 2028. CoreWeave ended Q3 with less than $2 billion in cash, indicating that it will need to raise additional capital to support its cash burn rates.

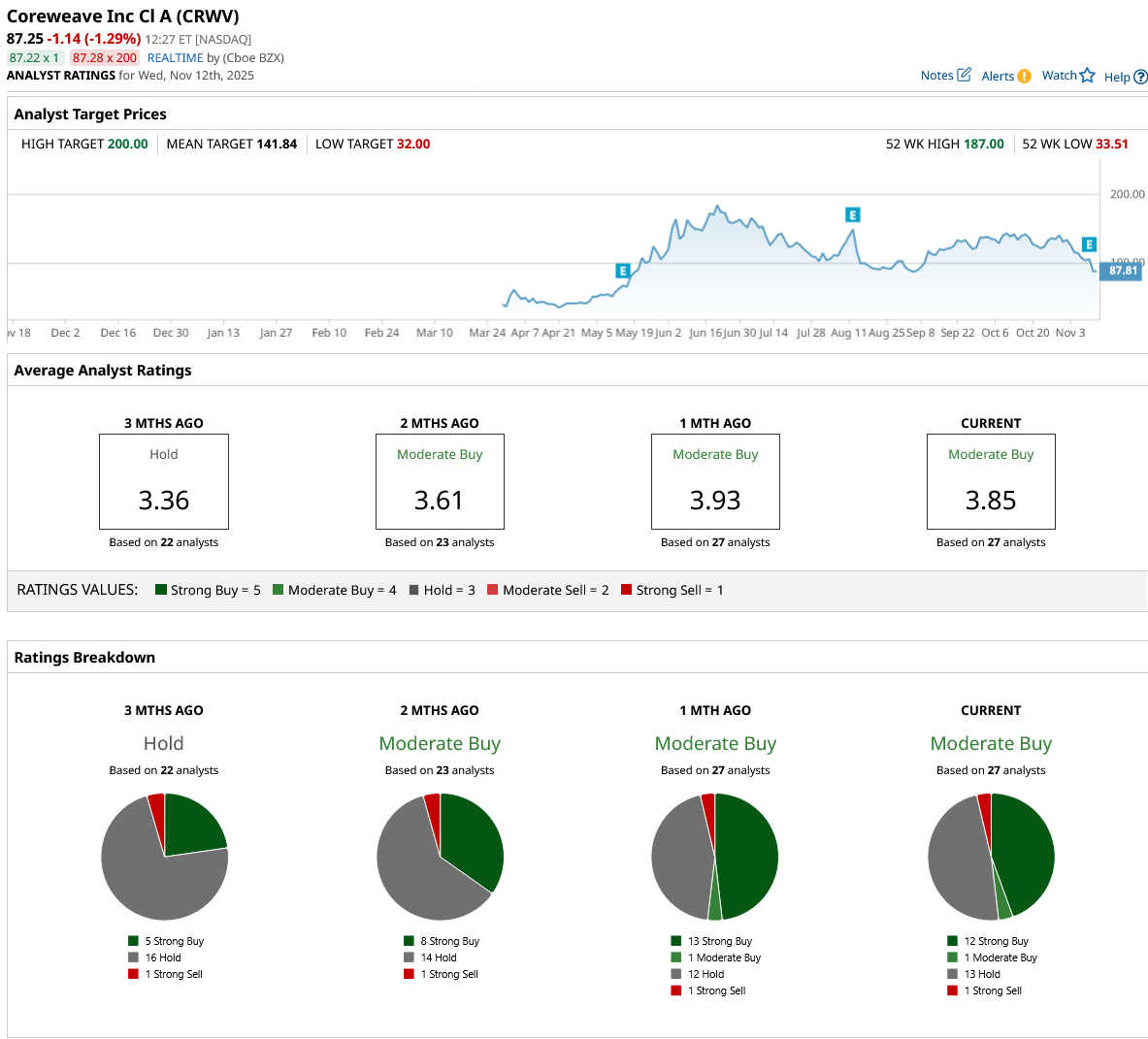

If CRWV stock is priced at 30x forward FCF, which is a reasonable valuation, it could return over 200% within the next three years. Out of the 27 analysts covering the stock, 12 recommend “Strong Buy,” one recommends “Moderate Buy,” 13 recommend “Hold,” and one recommends “Strong Sell.” The average CoreWeave stock price target is $141.84, above the current price of about $87.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AMD Strengthens Its Bull Case. Can the Stock Hit $350 in a Year?

- Is GOOG Stock a Buy or Sell as Michael Burry Accuses Hyperscalers of ‘Fraud’?

- Western Digital Stock Soars 280% This Year. Is WDC Worth Chasing Now?

- Heavy Put Option Activity in Advanced Micro Devices Implies AMD Stock Is Overvalued - But Is It?