I concluded my Q3 2025 Barchart report on the cattle and hog futures markets with the following:

The forward curves for beef and pork futures highlight the expectations for continued tightness and high prices during the 2026 peak grilling season. Any significant correction in the deferred contracts over the coming weeks and months could be a buying opportunity for the peak season in 2026.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Cattle prices began a correction in Q4, with prices turning significantly lower during the offseason for demand.

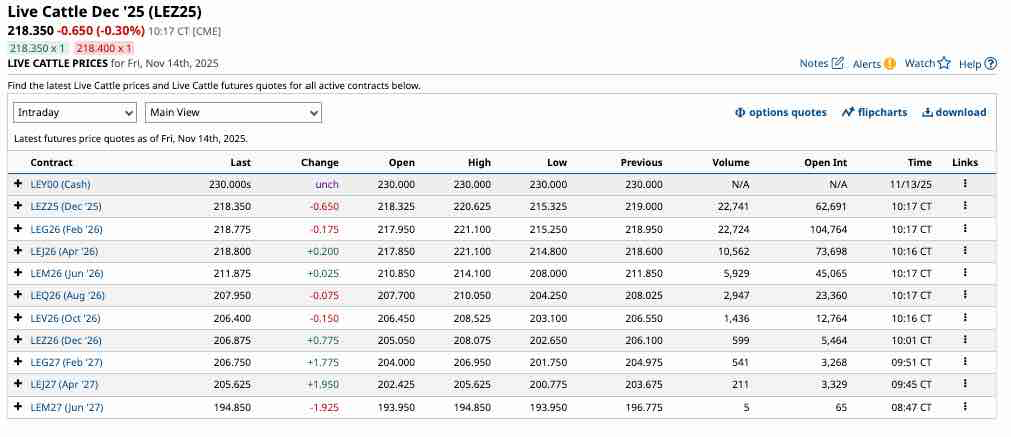

Live cattle futures turn lower

After closing Q3 at $2.34775 and rising to a new record high of $2.4830 in October, the bullish live cattle futures trend turned bearish.

The ten-year monthly continuous futures chart indicates that live cattle futures have declined by over 12% from the October high and were trading under $2.20 per pound on Friday, November 14. While the long-term monthly path of least resistance remains higher, the short-term trend has turned decisively bearish.

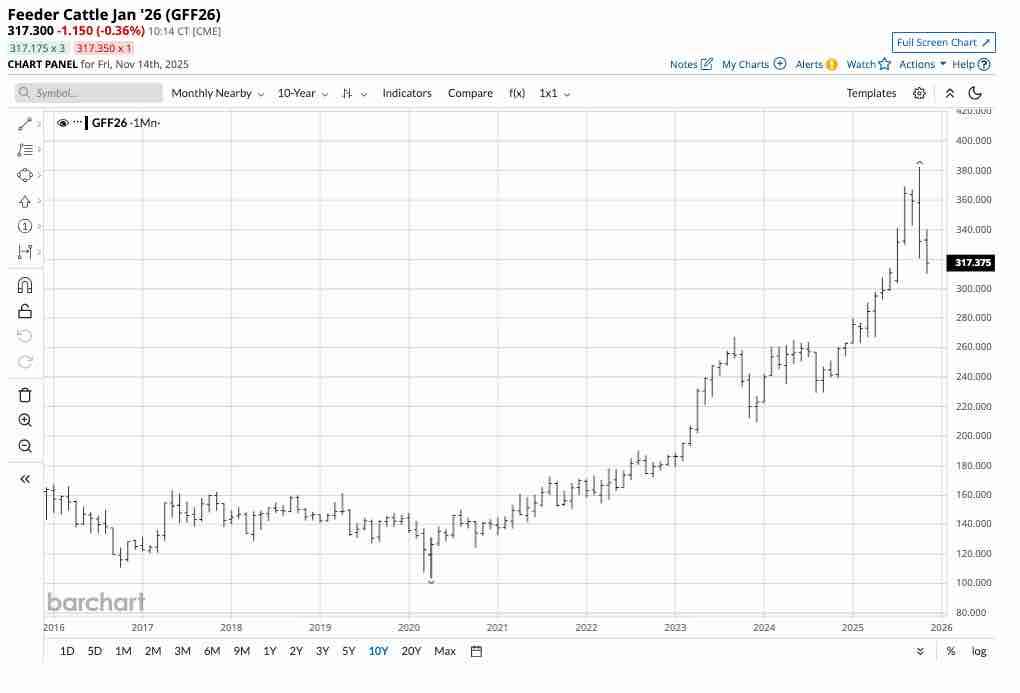

Feeder cattle fall more on a percentage basis

After closing Q3 at $3.5935 and rising to a new record high of $3.8230 in October, the even more bullish feeder cattle futures trend ran out of upside steam.

The ten-year monthly continuous futures chart indicates that feeder cattle futures have declined by over 17% from the October high and were under $3.18 per pound on Friday, November 14. The short-term feeder cattle futures trend has turned decisively bearish.

The U.S. administration is addressing high beef prices

President Trump has addressed historically high beef prices. On Thursday, November 6, his comment from the Oval Office was, “We have much lower prices than they (Biden Administration) do. We only have one thing, beef, because the cattle ranchers are doing well. We’re going to bring the beef prices down; they understand that, even if we have to help them out.” In October, the U.S. provided aid to Argentina, a significant beef-producing country, opening the door to lower consumer beef prices. Feeder cattle prices have dropped dramatically since the record highs in October, and the live cattle futures have also been trending lower.

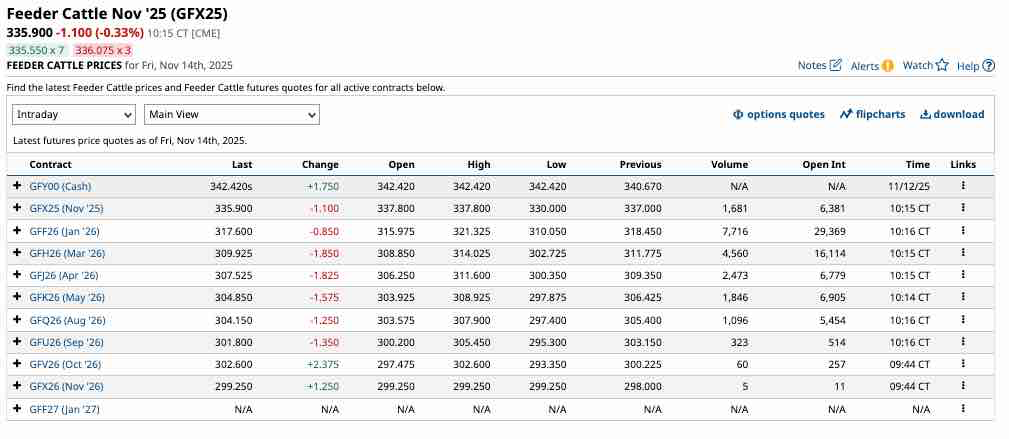

Forward curves reflect tightness, but expectations for lower prices during the 2026 peak grilling season

Aside from the potential for rising Argentinian beef exports to the U.S. to lower prices, seasonal factors support lower beef prices as the peak grilling season runs from late May through early September each year. While beef prices have skyrocketed since the pandemic-inspired lows of 2020, and have largely ignored seasonality over the past years, the 2025/2026 offseason for demand is shaping up to be a return to traditional seasonal price dynamics.

Meanwhile, the forward curves for live and feeder cattle futures continue to reflect supply tightness.

As the chart highlights, the feeder cattle forward curve displays declining prices for deferred delivery months.

The live cattle forward curve reflects the same declining prices for deferred delivery. Backwardation, or declining future delivery prices, signals supply tightness. However, the extent of the backwardation has narrowed over the past months, signaling that the prospects for lower prices have increased the potential for a continuation of price declines. If the live and feeder cattle forward curves shift from backwardation to contango, a condition where deferred prices are progressively higher, it will signal that supply concerns have significantly declined.

Commodity cyclicality is impacting the beef market

Commodity cyclicality is a core concept in the asset class. During bear markets, prices tend to fall to levels where production declines, inventories begin to decrease, and consumer demand increases, leading to price bottoms and upward trend reversals. Conversely, during bull markets, such as those in the live and feeder cattle futures markets over the past years, prices tend to rise to levels where production increases, inventories begin to rise, and consumers seek substitutes or limit their purchases, leading to price tops and downward trend reversals.

Time will tell if the price action in the cattle futures markets since October reflects commodity cyclicality or if seasonality alone is weighing on prices.

If prices extend on the downside, it could create a juicy buying opportunity

Inflation remains elevated in November 2025, as it is above the Fed’s 2% target. While short-term interest rates are declining, longer-term interest rates remain elevated because of several factors, including, but not limited to, the U.S. debt level. Elevated inflation is bullish for commodity prices, and cattle are no exception, as the economic condition increases production costs, supporting higher prices. Therefore, further declines in cattle futures could present a buying opportunity for the 2026 peak grilling season, which will begin in late May.

Meanwhile, the trend reversal could cause the volatile cattle futures to fall far below levels that technical and fundamental analysis suggest. Therefore, any long risk positions in the live and feeder cattle futures markets require careful and disciplined risk-reward dynamics. Buying cattle futures in the current environment involves a contrarian approach, as it goes against prevailing short-term trends. However, in early 2026, at lower levels, a scale-down approach to long positions could be optimal as prices tend to rise to annual highs as the grilling season in late May approaches.

No ETF or ETN products track the live and feeder cattle futures markets. Some of the diversified commodity ETF products have exposure to cattle futures, but they also hold long positions in a variety of other commodities. The only direct approach is through the CME’s live and feeder cattle futures market.

At $3.1760 per pound, each feeder cattle futures contract contains 50,000 pounds, with a contract value of $158,800. The CME’s original margin requirement is $6,600 per contract, or 4.16% of the contract’s value at the current price level. A market participant can control $158,800 worth of feeder cattle futures for a small 4.16% down payment. If equity on the long or short position falls below $6,000, the CME requires maintenance margin payments.

At $2.1830 per pound, each live cattle futures contract contains 40,000 pounds, with a contract value of $87,320. The CME’s original margin requirement is $3,630 per contract, or 4.16% of the contract’s value at the current price level. A market participant can control $87,320 worth of live cattle futures for a small 4.16% down payment. If equity on the long or short position falls below $3,300, the CME requires maintenance margin payments.

In November 2025, the trend in cattle futures is lower, and the trend is always a trader’s best friend. However, a significant decline over the coming weeks and months could send beef prices to levels that are attractive for a seasonal long position as the 2026 grilling season approaches towards the end of winter and in early spring. When considering how low cattle futures can fall, it is essential to remember that bearish trends can drive prices to levels that defy even the most rigorous technical and fundamental analysis. We learned this the hard way in 2020 when the pandemic drove prices down, and over the past months, when they soared to record highs. Cattle prices are volatile, and volatility creates trading opportunities. In the current environment, only approach the cattle futures markets with a predetermined risk-reward plan and stick to the program. Only adjust stop and profit horizons when the price action moves in the anticipated direction. Small losses in the quest for oversized gains can be a winning strategy.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart