Chances are you haven’t heard of ETF manager Kelly Intelligence. But in my opinion, what it does to help traders and investors is far superior to its reputation and assets under management.

Case in point: I am a big fan of option collars. I’ve written about them here many times. But not everyone wants to be a do-it-yourself trader like me. Even I would not mind being able to “outsource” some of my research and decision-making process at times.

There are a few ETFs that offer collared investing. But they are, for the most part, ignored by investors. They simply do not have the sex appeal of an artificial intelligence ETF in late 2025.

To me, an ETF is viable if it can execute its strategy without egregious costs. I’ve noted here before that smaller ETFs do not necessarily have a liquidity issue. It all depends on the portfolio of assets they trade regularly.

For instance, if I ran an ETF that only bought the Magnificent 7 stocks, the bid-offer spread to transact in those ETFs would be very tight. Because it is determined by the liquidity of the underlying investments, not the shares of the ETF itself that investors exchange in buying and selling.

And, while this article is about alerting traders to a pair of new, tiny ETFs, and not about passing judgement on them, I will say I am quite intrigued. Specifically at the potential for them to be highly useful tools, not by themselves, but when paired up with other, bigger ETFs.

Here are the six ETFs listed on Kelly’s website, a fund firm that launched earlier this year. The biggest one is only $15 million. The two I’m focused on here are the last two on the list.

In the March 15 press release launching the two strategies, the firm described the ETFs as follows:

What Is the QDWN ETF?

QDWN’s objective is to profit from daily drops in the value of the Nasdaq 100 Index, which tracks the top 100 nonfinancial companies listed on the Nasdaq. The goal is to capture the downside of the Nasdaq-100’s value on a daily basis while keeping any losses to a maximum of 10% of the fund’s net value in a single day.

To achieve this, the ETF invests in cash-settled index put options. These are contracts that pay out in cash instead of the actual stocks. The fund uses these options to bet against the Nasdaq-100, profiting when the index falls.

The put options held by the fund typically have a short-term expiration — sometimes as brief as one trading day. To balance the risk, QDWN holds about 90% of its funds in short-term U.S. Treasury securities.

What Is the QUP ETF?

QUP is essentially the same strategy, but in reverse. It is aiming for unlimited upside from buying call options, but keeps the same 90% buffer.

The key to these obscure but intriguing ETFs is that they use zero days to expiration (0DTE) ETFs, and buy them. This is very different from ETFs that sell covered call options on indexes or securities. With a call option, upside is unlimited, just limited to what the option can do in a single day. And then, the next day comes and the same opportunity is in play.

I like the long side of options investing. A lot. I think too much has been made of covered call writing. And to me, ETFs like these potentially represent a surrogate for owning the Invesco QQQ Trust (QQQ), or owning an inverse of it. And, while investors can buy call and put options on QQQ out to many expiration dates, including the next day or even the current day, this saves some time. Since the funds do the work near the end of each trading day.

How Have QUP and QDWN Performed?

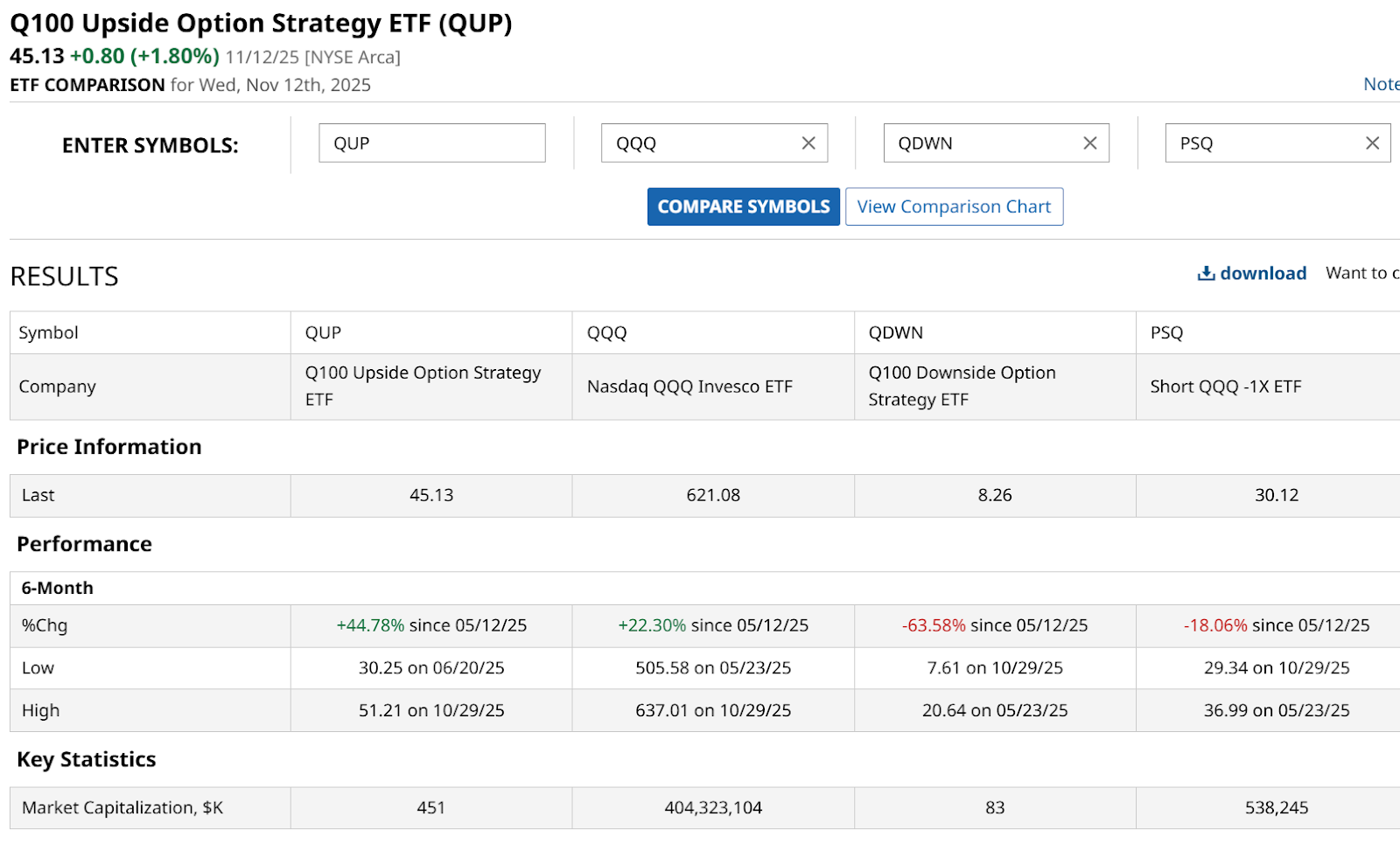

It’s early, but these completely unknown ETFs are showing signs they could be useful in some portfolios. The Q100 Upside Option Strategy ETF (QUP) is compared below to QQQ, and the Q100 Downside Option Strategy ETF (QDWN) to the Short QQQ -1X ETF (PSQ), an ETF that runs opposite QQQ. The two funds on the right each suffer from the fact that QQQ, the underlying index, has had a historically rare, nearly uninterrupted run higher over the past 6 months.

For the very small crowd that owned QUP throughout this 6 month time frame, they saw that a portfolio of T-bills and 0DTE call options produced a return of more than 44%. That’s double that of QQQ.

Given the environment, QDWN was essentially helpless, as were any type of aggressive downside bet against QQQ. It lost 63%. That’s more than three times the downside of QQQ.

Let’s put this all together, speaking as much about the strategy of T-bills and 0DTE options as anything specific to these new ETFs.

As I see it, anything that allows traders and investors to take a small position in something that can either avoid sudden disaster (a QQQ crash) or serve as a substitute for putting a lot of capital at risk, this late in the AI bull cycle, is worth a conversation. That’s why I chose to have it here.

How Should Traders Use These ETFs?

Not for a moment should anyone view QUP or QDWN as an ETF they would invest more than a “garnish” size position in for now.

And, if QQQ had fallen hard throughout this period, there’s a good chance QDWN’s return would look like QUP’s and vice-versa. So I see them as a pair, which could in some cases be used alongside QQQ or another equity ETF position, with the goal of using a little part of the portfolio to defend or enhance overall returns. And doing so using 0DTE options, in both directions, without the issue of having to set the alarm clock for 3:45 p.m. Eastern every trading day to place positions for the following day’s option expiration.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 2 ETFs May Be the Best-Kept Secrets on Wall Street

- Two Straddles Define Wednesday’s Unusual Options Activity Across Key Stocks

- Nvidia Stock Is a High-Stakes Trade Ahead of November 19. How to Hedge the Risk of a Post-Earnings Plunge.

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity