Famed Bitcoin (BTCUSD) enthusiast Michael Saylor has long touted the world's largest cryptocurrency as the best investment of our era. His leadership of Strategy (MSTR), formerly MicroStrategy, has resulted in a marked shift from the company's previous core focus (the software industry) to becoming a fully entrenched Bitcoin treasury company. This move has led to a massive surge in the company's share price in recent years, as the chart below shows.

However, one thing investors will also note about the move we've seen in MSTR stock in recent years is that lately, the stock has been moving in the wrong direction. In fact, zooming in over the past year, shares of MSTR stock have dropped roughly 34% from the start of the year and are down more than 60% from their peak right around one year ago.

There are many reasons for this, including calls from billionaire hedge fund managers to short the stock, given its previous massive dislocation between its mNAV (its net asset value) and the actual value of the Bitcoin on Strategy's books. This premium has since dissipated to around 1.1 from around 2 at its peak, so there have been some recent indications that various short-sellers have closed out their bearish bets on this stock.

So, why is MSTR stock continuing to decline? Let's dive in.

Strategy Continues Buying, No Matter What

The price of Bitcoin matters a great deal to a company like Strategy. That's because this entire business' underlying model is relatively simple: use preferred debt and equity issuances (issuing shares) to buy Bitcoin and sit on this Bitcoin. In other words, the company is borrowing money using its Bitcoin as collateral, but there aren't the kind of growing cash flows typically associated with such businesses to support its debt position over the long term.

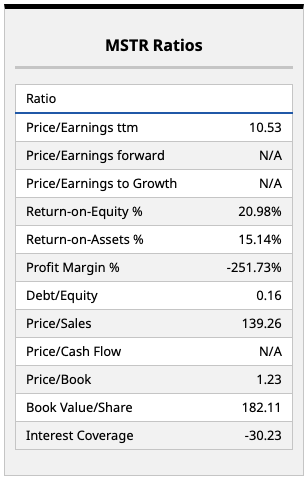

What this has led to is some rather intriguing fundamentals (shown above). And as Strategy CEO Michael Saylor recently pointed out, he's still in buying mode (perhaps in an even more aggressive fashion than in the past), suggesting that any sort of meaningful price decline in Bitcoin could force Saylor to sell some of his Bitcoin hoard.

That's clearly not something he wants to do. And Bitcoin would need to still drop another $20,000-$30,000 per token to hit some of the limits many experts believe would trigger selling pressure. But that's a factor to watch, considering the price of Bitcoin is now down to around $95,000 per token, which is a considerable drop from its peak near $125,000 apiece.

What Do the Analysts Think of MSTR Stock Here?

Wall Street appears to be behind the curve, in some respects, regarding the recent moves we've seen in MSTR stock. Prior to August, shares were trading around $400 per share, so the $541.62 consensus price target may have made sense at that time, given the upward momentum both Bitcoin and MSTR shared as the price of digital assets continued to soar.

That said, this price target now does not appear to make sense, and I wouldn't be surprised to see major price target downgrades (and overall downgrades) for MSTR stock moving forward. As is the case with past crypto cycles, MSTR stock can boom in good times and absolutely tank during times of poor performance in this sector.

I think we're entering the latter stage of this market cycle for Bitcoin, so MSTR stock is one I'd urge investors to take caution with, especially now.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Options Activity Shows 71,000 Calls Hit the Tape for Applied Digital Stock – How You Should Play APLD Here

- AMD Is Powering the New Steam Machine. Will It Move the Needle for AMD Stock?

- MicroStrategy Is Buying the Bitcoin Dip. Should You Buy the Dip in MSTR Stock?

- Should You Buy Netflix Stock Today After Its 10-for-1 Split?