Netflix (NFLX) shares just became a lot more affordable for investors to buy. After completing a 10-for-1 stock split, the price of each NFLX share has dropped, making the stock more accessible and boosting overall trading liquidity. The move comes during a strong year for the company. Netflix is up roughly 25% so far in the year to date. But a lower share price alone doesn’t automatically make the stock a buy.

What continues to support the long-term story is Netflix’s steady growth in paid memberships, a trend that has held firm across several quarters. The company has also leaned into strategic revenue boosters such as subscription price increases and the rapid expansion of its ad-supported tier. Together, these initiatives have helped Netflix broaden its revenue mix as the streaming landscape has become more crowded and competitive.

Still, not all analysts back Netflix stock as its premium valuation already reflects much of its recent momentum, potentially limiting further upside. However, with the stock now more affordable and the company growing its subscriber base, let’s examine whether Netflix’s long-term fundamentals justify its current premium.

Netflix to Deliver Solid EPS Growth Despite Q3 Miss

Netflix’s latest quarterly report may have included a headline earnings miss, but the company’s fundamentals remain solid. The company reported third-quarter earnings of $5.87 per share, falling short of Wall Street estimates. The gap was driven primarily by one-off expenses tied to a dispute with Brazilian tax authorities, which weighed on earnings. However, it will not have any meaningful effect on the company’s future financials.

What matters more is that Netflix’s underlying business remains exceptionally healthy. Subscriber growth continues across global markets, and the company’s push into advertising is gaining momentum as its ad-supported tier becomes a larger part of the revenue mix. This shift is creating a solid new earnings engine at a time when streaming competition is prompting many platforms to rethink their models. For Netflix, however, the combination of a growing user base, rising engagement, and expanding monetization options is laying the groundwork for strong EPS growth in the quarters ahead, which will likely support its share price.

Content remains Netflix’s core competitive advantage, and its recent performance shows why. New seasons of fan favorites and a steady pipeline of fresh releases continue to draw viewers, supporting retention even as the company raises prices. The upcoming fourth-quarter slate looks strong, positioning Netflix to sustain subscriber momentum and carry that strength into 2026.

The company is also pushing further into live programming, an area long dominated by traditional television but now ripe for digital disruption. High-profile events such as NFL Christmas Day games and the Jake Paul vs. Tank Davis boxing match are set to draw large, diverse audiences. These events will deepen viewer engagement and enhance Netflix’s appeal to advertisers.

Notably, price increases have contributed to revenue growth without triggering a meaningful slowdown in signups or churn, a sign of the platform’s pricing power. With this additional revenue flexibility, Netflix can reinvest confidently in premium content and advertising technology, which augurs well for growth.

The advertising segment, in particular, is emerging as a major driver of Netflix’s next phase of growth. Management expects ad revenue to double in 2025, powered by the rollout of the Netflix Ads Suite across all of its advertising markets. Enhanced targeting capabilities and broader global availability are likely to accelerate adoption among brands, creating another solid base of sustainable, high-margin growth.

Is Netflix Stock a Buy?

Netflix’s earnings growth rate could accelerate in the coming quarters. Its paid membership base continues to expand, advertising revenue is gaining traction, and the company’s steady stream of popular content is strengthening its ability to raise prices. Together, these factors suggest Netflix is positioned to deliver strong margins and bottom-line growth.

Analysts expect NFLX’s earnings to climb 17.2% in 2025 and then surge another 26.3% in 2026. Even so, it doesn’t justify its premium valuation. With its shares trading at about 44 times forward earnings, much of this optimism is already reflected in the stock.

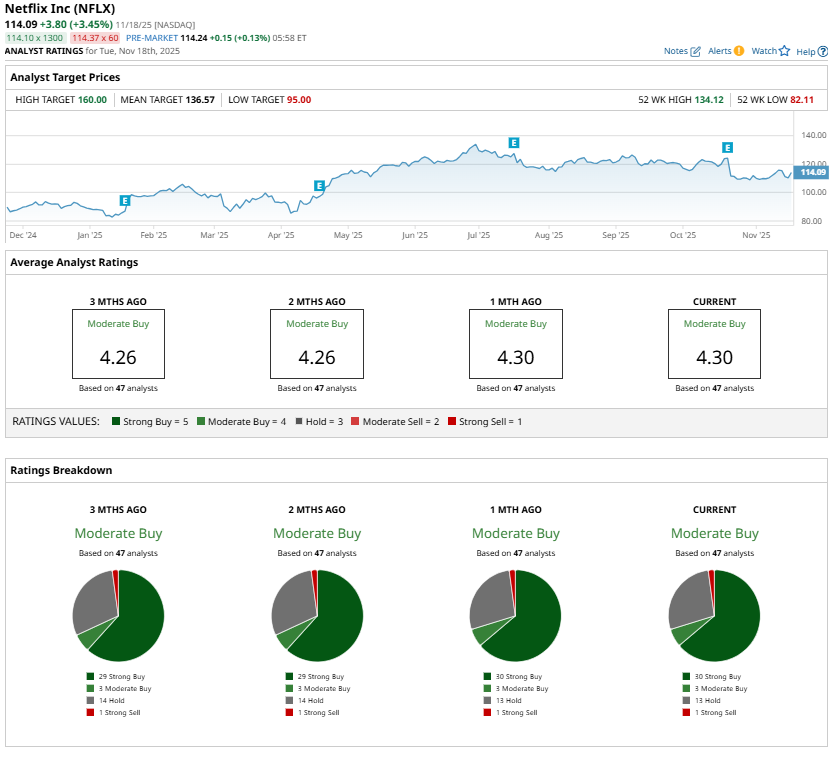

That premium valuation explains why Wall Street’s outlook, while positive, remains measured. The consensus rating on Netflix stands at “Moderate Buy,” and analysts’ average price target of $136.57 suggests potential upside of around 20% from the Nov. 18 closing price of $114.09.

For investors, Netflix remains a compelling long-term story, but not an obvious bargain at current levels.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Meta Stock a Buy or a Sell Before Michael Burry Drops His Bombshell on November 25?

- 22 ADRs Hit New 52-Week Lows: Are Any Worth Buying?

- Klarna Stock Plunges Toward Oversold Territory on Post-Earnings Selloff. Should You Buy the Dip?

- As Super Micro Reveals a New AI Factory, Should You Buy, Sell, or Hold SMCI Stock?