Silver’s value has seen an increase in 2025, driven by booming industrial use and a growing wave of investors treating the metal as a safety net. Recently, the December silver futures contract (SIZ25) rallied to an all-time high of $51.590 per ounce. This surge comes as the silver market enters a fifth straight year of sizable supply deficits, with demand consistently outpacing supply.

Meanwhile, HSBC has lifted its silver price forecast to $35.14 per ounce, citing the likelihood of sustained safe-haven demand in a riskier global environment. Pan American Silver (PAAS) has capitalized on this favorable environment with exceptional stock performance. Its shares have climbed 88% year-to-date (YTD), a rally that set the stage for the company’s 16.7% quarterly dividend increase, following director approval of the payout.

With record free cash and accelerating returns, investors must now ask. Is Pan American Silver destined for more upside, or is its rally nearly done? Let’s dive in.

Pan American Silver’s Financial Strength

Pan American Silver operates internationally as a precious metals mining company with a market capitalization of $16.19 billion. This company declared a cash dividend of $0.14 per common share on Nov. 12, marking a 16.7% increase and setting the payout for Q3 2025. It is payable on Dec. 5 to shareholders of record as of Nov. 24. This payment follows the most recent dividend of $0.12 announced on Aug. 18.

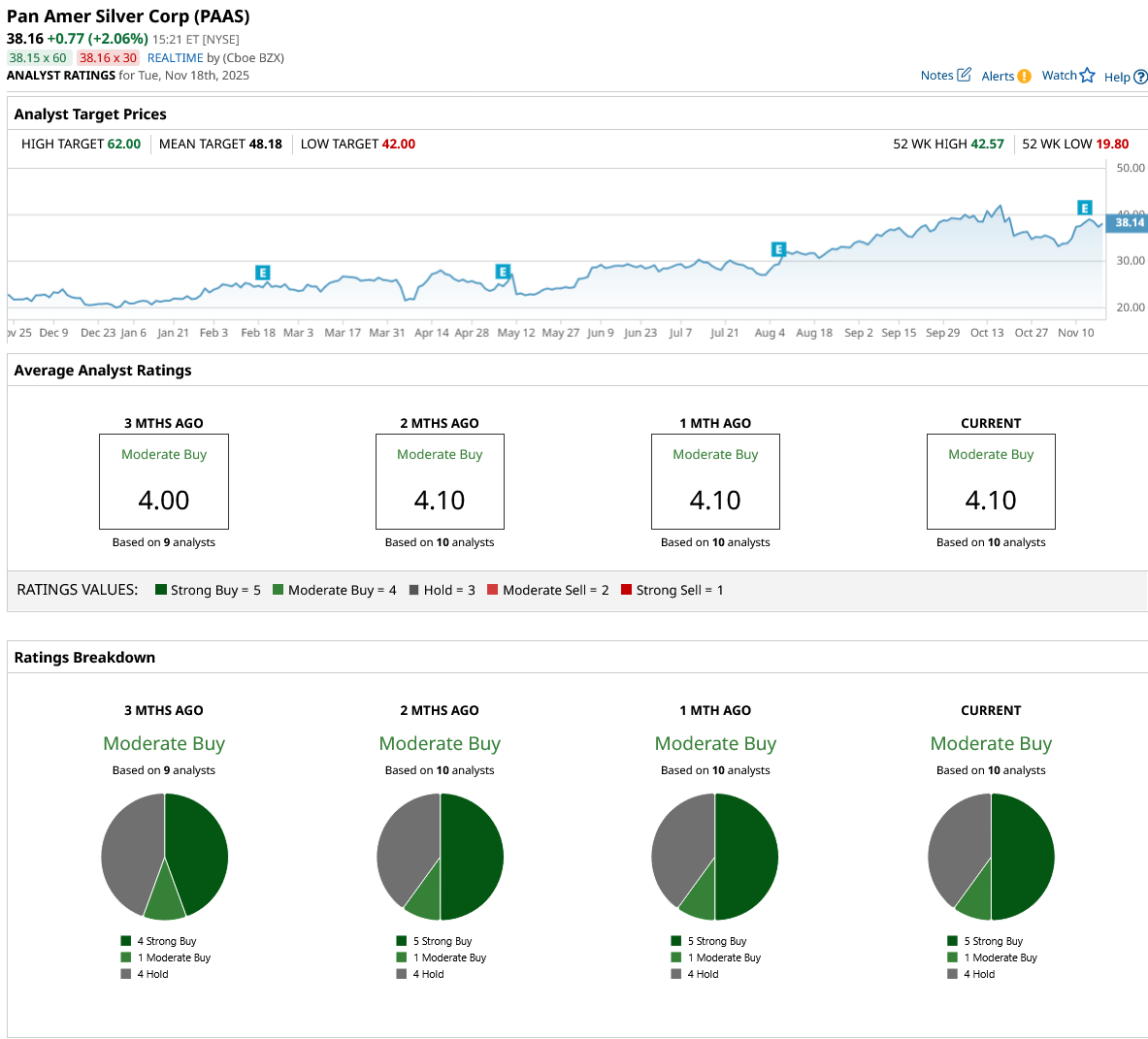

PAAS’s shares are trading at $38.12 with a rally of 88% YTD and 67% in the past 52 weeks.

The company has a trailing price-to-earnings (P/E) ratio of 24.73x, while the sector median is 17.43x, and its forward P/E is 17.41x, compared to a sector average of 16.06x. These valuations show that investors are willing to pay a premium for Pan American’s growth and cash generation.

The Nov. 12 earnings report detailed Q3 2025 performance. This release showed record attributable revenue at $884.4 million and record attributable free cash flow of $251.7 million for the quarter. This result lifted cash and short-term investments to $910.8 million, alongside an additional $85.8 million at Juanicipio, which represents a 44% stake.

The company reported net earnings of $169.2 million, or $0.45 per basic share, impacted by a $21.7 million loss tied to subsidiary sales and $16.3 million in joint venture income. This impact stemmed from net working capital adjustments on the La Arena S.A. sale, offset by a gain from the divestiture of La Pepa. Adjusted earnings reached $181 million, or $0.48 per share.

This quarter delivered attributable cash flow from operations of $323.6 million. PAAS generated 5.5 million ounces of silver and 183.5 thousand ounces of gold at competitive costs, maintaining sector leadership. This performance allowed YTD capital returns to shareholders to reach $146.9 million through dividends and repurchases.

PAAS’s Strategic Silver Expansion

Pan American Silver closed on a transformative $2.1 billion acquisition of MAG Silver, first announced on May 11, 2025, with terms of $20.54 per MAG share via $500 million in cash plus 0.755 Pan American shares per MAG share, subject to proration. The transaction offered premiums of roughly 21% to MAG’s closing price and 27% to its 20-day VWAP as of May 9, underscoring the strategic value Pan American placed on MAG’s assets and pipeline.

The deal cleared key approvals, including Mexico’s Federal Economic Competition Commission (COFECE) on Aug. 25, and was completed on Sept. 4, with approximately 60.2 million Pan American shares issued to MAG holders, who now own about 14.3% of the company on a fully diluted basis. The structure allowed PAAS to center on higher-grade exposure and deepening influence at Juanicipio, with management highlighting a meaningful contribution to future silver production, reserves, and cash flow for the enlarged portfolio.

Beyond M&A, Pan American also announced promising drill results at La Colorada in Mexico, identifying high-grade intercepts beyond current resource boundaries. This work has more than replaced production at the mine and added 52.7 million ounces of silver to inferred resources, expanding the long‑term inventory.

Earnings Momentum Points Higher

Pan American Silver’s recent dividend hike is supported by strong growth expectations, as the numbers for the next few quarters and fiscal years make the bullish thesis for PAAS challenging to ignore. The current quarterly average earnings estimate stands at $0.74. This shows a significant jump from the prior year’s $0.35. For the full fiscal year 2025, the average earnings estimate is $2.16, while last year’s figure was just $0.79.

The mood among analysts covering PAAS reinforces these figures. The ten surveyed have placed the stock in the consensus “Moderate Buy” camp, a notable show of confidence when compared to many of its sector peers. The consensus price target is $48.18. That target points to a clear 26% upside for investors considering this silver stock right now.

Pan American Silver looks set to keep rewarding investors, both with earnings momentum and generous dividends. The story points toward more upside in the coming months, especially with analysts confident and fundamentals clearly strong. PAAS stock is likely to trend higher, and any dip could be a smart entry. This silver stock just might be a solid buy for investors ready to ride the next leg of the precious metals rally.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Silver Stock Just Raised Its Dividend 16%. Should You Buy Shares Now?

- Is GOOGL Stock a Buy, Sell, or Hold as Google Launches Gemini 3?

- Elliott Management Is Betting Big on This Dividend-Paying Gold Stock. Should You Buy Shares Now?

- This Leading Gene-Editing Stock Could Be Going Private. Should You Buy Its Shares First?