Nvidia’s (NVDA) latest earnings were undeniably strong, but the stock’s reaction told a different story.

After an initial jump, the gains faded and the shares drifted back toward their pre-earnings levels, a pattern that often appears once the headline numbers are fully absorbed. And when a mega-cap settles into a post-catalyst phase, the trading range can tighten. That environment can make the far-dated upside calls particularly appealing for investors who want to stay long while also collecting premium through a covered-call approach.

Nvidia Earnings Shine, But Stock Momentum Fades

Nvidia delivered another standout quarter that easily cleared Wall Street forecasts. Fiscal Q3 revenue reached $57 billion, well ahead of the $54.9 billion consensus. Adjusted earnings of $1.30 per share also topped expectations. Management guided Q4 revenue to about $65 billion, comfortably above the $61.6 billion analysts were expecting.

The Data Center segment remained the growth engine. Nvidia reported $51.2 billion in data center revenue, a 66% increase from a year ago. Compute revenue reached $43 billion, and networking contributed another $8.2 billion. Demand for Blackwell continues to surge, and CEO Jensen Huang noted again that cloud GPUs are sold out across the major hyperscalers. With Big Tech firms lifting their AI-related capital spending plans above $380 billion for the year, Nvidia sits at the center of one of the strongest multi-year investment cycles in the market.

Margins improved as well. Nvidia generated $23.8 billion in operating cash flow and ended the quarter with more than $60 billion in cash and short-term investments. The company also returned $12.5 billion to shareholders through buybacks and dividends.

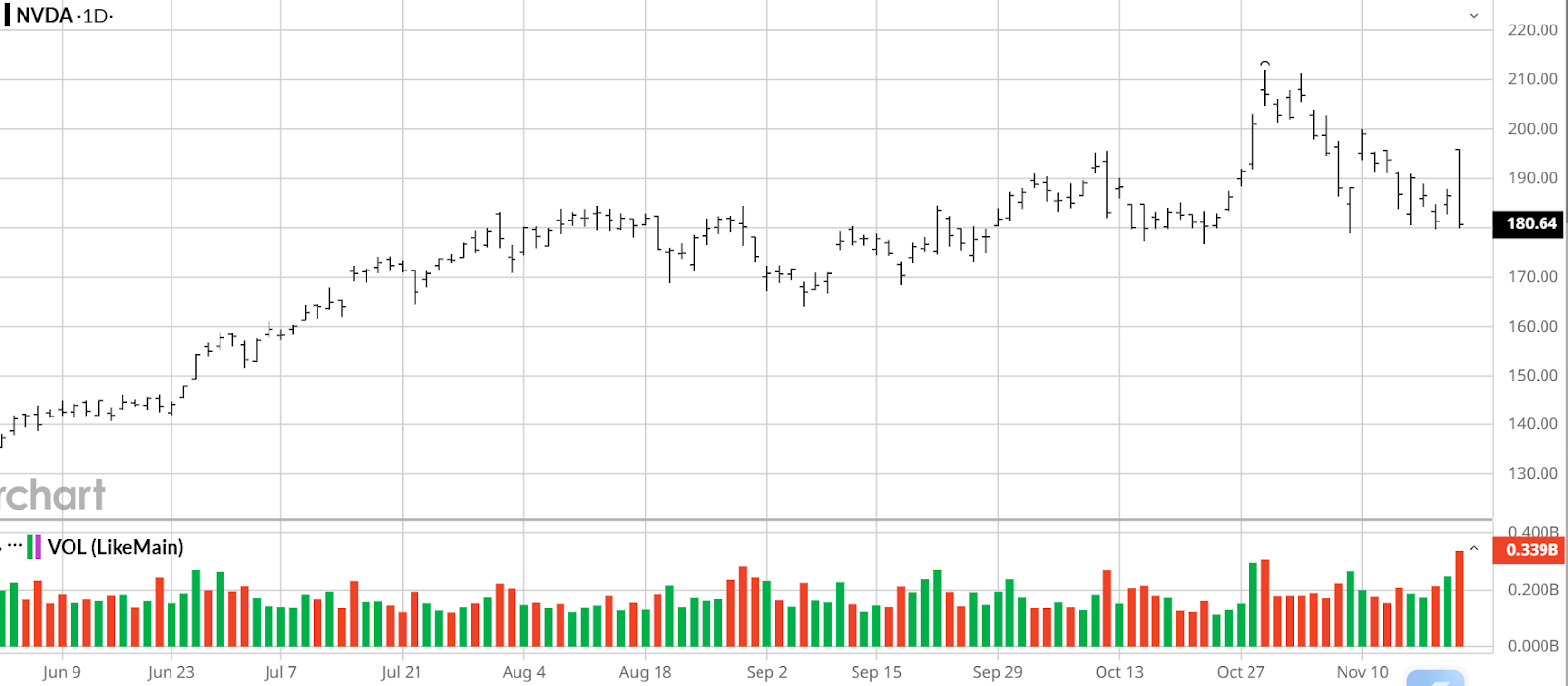

Initially, the stock responded the way many expected. NVDA rallied about 5% after the release, climbing near $197 and inching closer to its 52-week high around $212. But the strength didn’t last.

By the close on Nov. 20, NVDA had not only surrendered its entire post-earnings gain, it had also slipped below the prior day’s close, finishing near $181.

The broader market followed the same path. The S&P 500 Index ($SPX) opened strong, up about 1.5% on Nvidia’s results, but faded sharply into the close and ended down roughly 1.5%. The three-point swing stood out even in a volatile season.

This is where things get interesting. Nvidia’s results were impressive, but the market showed how quickly earnings news can be absorbed, even for a company of this size. The excitement that lifted the stock in the first hour after the release simply wasn’t durable.

With the latest numbers and guidance now fully priced in, NVDA may settle into a narrower range until the next major catalyst arrives. And that shift opens the door to some compelling positioning opportunities.

When the Catalyst Passes, Options Opportunities Often Appear

After a major earnings event, mega-cap stocks sometimes drift into a period of rangebound trading. Nvidia has followed this pattern before. After its Aug. 27 earnings release, the stock traded around $182 a share, and despite a steady flow of positive news in the weeks that followed, NVDA was only modestly higher by Nov. 18 (around $187 a share). Now, after a brief earnings-driven price spike, the stock has worked its way back toward $180.

That backdrop is where selling upside calls (e.g. covered calls) becomes interesting.

Near-term implied volatility often drops after an earnings event, but middle and long-dated contracts usually still hold meaningful premium. For example, in NVDA, the IV Rank on the January 2027 options sits near 45%.

That’s a little below the threshold many short-premium traders prefer when selling options (50%). But covered calls are arguably different. They are more tactical in nature, especially when the investor is managing an existing long position, and looking to enhance returns during a period when upside momentum may cool. That means the absolute level of volatility isn’t as critical.

With NVDA trading near $181 a share, the January 2027 $270 calls are priced around $15, creating a breakeven near $285 per share. That is more than $100 above the current stock price. The January 2027 $300 calls, trading near $11, have a breakeven near $311, or about $130 above current levels. For long-term holders, those breakevens show how much room remains before assignment becomes a concern. The stock would need to stage a significant rally before either strike begins to cap gains.

If Nvidia spends the next several months in a narrower range, as mega-caps often do after a major event, short options traders can benefit from a gradual decline in implied volatility. Even modest volatility contraction can support the short call’s decay, and potentially boost the return of the combined position. In fact, this is the type of environment where covered calls tend to work best: modestly elevated premium, wide strike buffers, and a stock that may be in consolidation mode.

This approach isn’t about calling a top or fading Nvidia’s long-term trajectory. The fundamental story remains intact. The point is that after a major earnings event, large-cap stocks often slip into calmer, more measured trading. Covered calls fit neatly within that shift, helping long-term holders turn a quieter stretch into a productive one.

A Closer Look at the Covered-Call Setup

To see how this setup works, consider a long-term Nvidia holder with 1,000 shares who sells five of the January 2027 $270 calls. Selling calls against only half the position keeps some of the long exposure intact, while allowing the investor to collect premium from a far-dated expiration. With the $270 calls recently trading near $15, selling five contracts brings in about $7,500. The premium is collected upfront and stays with the investor regardless of how the stock performs.

If Nvidia rises over the next year but remains below $270, the calls expire worthless. The investor keeps all 1,000 shares and the full $7,500 premium. That premium transforms into added yield on top of any gains from the underlying stock position. Many covered-call sellers view this as a favorable scenario, because the stock performs well and income is generated without reducing the long position.

If Nvidia trades above $270 by early 2027, the outcome is still constructive. The 500 shares tied to the short calls can generate gains from the current price near $181 per share all the way up to the $270 strike price — nearly $90 of upside per share before assignment becomes a factor. The other 500 shares remain uncovered, and therefore continue to benefit from any further rally. And the short premium from the options is collected in full. For some investors, that mix of realized gains, continued upside exposure, and collected premium may be favored over a simple long position.

Looking at an extreme scenario — if Nvidia rallies sharply and pushes well beyond the strike — the mechanics do not change. Assignment caps gains above $270 on half the position, but the other 500 shares remain fully exposed to any additional upside.

On the other hand, if Nvidia trades sideways or drifts lower, the options premium still works in the investor’s favor. That $7,500 functions as a buffer, softening downside moves and adding income. For many long-term holders, this is exactly why covered calls are used during quieter stretches: the strategy smooths returns and generates cash flow while the stock waits for its next catalyst.

Taken together, these scenarios show how selling five upside calls against a 1,000-share position can balance income, risk control, and continued upside. The trade captures the elevated premiums that linger after a major earnings event while still allowing Nvidia room to rally before the strike price comes into play. For investors who want to stay aligned with Nvidia’s long-term AI story while extracting value from a cooler, post-catalyst tape, this structure checks both boxes.

Takeaways

The covered call in Nvidia won’t appeal to every trader. Some want unrestrained upside, others prefer shorter durations or strikes that sit closer to the money. But when a mega-cap like NVDA exhausts its catalyst and shifts into a steadier rhythm, the balance of risk and reward on an upside call sale naturally becomes more compelling.

And this dynamic isn’t unique to Nvidia. Large-caps regularly drift into quieter phases once the headlines fade, and those stretches often reward investors who are comfortable trading around a long position. Whether it’s NVDA after a later earnings beat or another heavyweight cooling off after a sharp move, the covered-call structure can be an effective tool—when it aligns with the trader’s outlook and the tempo of the stock.

On the date of publication, Andrew Prochnow did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With Earnings Behind It, Nvidia Stock Looks Ripe for Covered Calls

- Bitcoin Prices Are Falling, But MicroStrategy Is Not Sweating the Selloff. MSTR Stock Has a 71-Year Runway, According to Management.

- Eli Lilly Stock Just Joined the $1 Trillion Club. Should You Buy LLY Here?

- 3 Risks Investors Face Right Now and 2 Charts That Should Ease Your Stock Market Panic