Alphabet (GOOGL) stock has been on a tear, breaking to a fresh high of $326.87 on Tuesday, Nov. 25. Investors are rewarding GOOGL stock for the company’s advances in artificial intelligence (AI) and the commercial opportunities that accompany them.

Over the past six months, Alphabet has surged by more than 92%, outpacing most big tech stocks and signaling the market’s conviction in Google’s long-term AI strategy.

The latest catalyst came with the debut of Gemini 3, Google’s newest AI model. For investors, the announcement offers fresh reassurance that Google intends not only to keep pace with rivals but also to shape the future direction of the AI market. Investors’ mood turned even more optimistic after The Information reported that Alphabet will sell its internal Tensor Processing Units (TPUs) or AI chips to Meta (META), a potential shift in its strategy that could open a new, high-value revenue stream.

Google has historically reserved its custom TPUs for internal use across its own data centers. But the company is reportedly now willing to sell these chips for deployment in customers’ facilities and to rent capacity through Google Cloud. Meta is said to be exploring a multibillion-dollar purchase beginning in 2027, with cloud rentals potentially starting as early as 2026.

If finalized, such a deal would reposition Google as a formidable supplier in a market long dominated by Nvidia (NVDA), with competitive implications that could ripple through the broader AI hardware landscape. For Google, it represents a chance to diversify its AI monetization strategy beyond software and cloud services, strengthening its role in the AI infrastructure development.

Further supporting investor sentiment, Alphabet announced a significant new cloud agreement with NATO’s Communication and Information Agency. The multi-year, multimillion-dollar deal aims to modernize NATO’s digital operations and expand its AI capabilities.

These developments suggest that Alphabet is deepening its reach across the AI value chain, from model innovation to hardware infrastructure to enterprise-grade cloud solutions, positioning it well to deliver solid gains ahead.

Is GOOGL Stock a Buy Now?

Alphabet’s rally has pushed its valuation higher. However, GOOGL stock’s valuation still looks reasonable relative to peers. Trading at about 28.5 times forward earnings, it remains cheaper than many large-cap tech names.

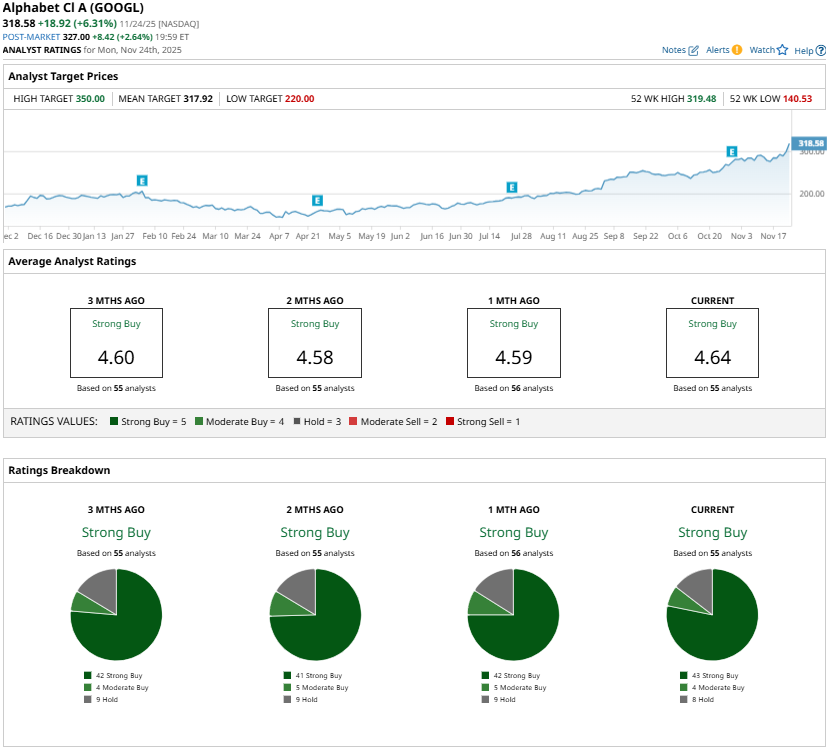

Analysts have a bullish stance on GOOGL, thanks to its accelerating AI strategy, which is supporting growth across all of its business segments. They maintain a “Strong Buy” consensus rating.

Its latest AI-driven features, including AI Overviews and AI Mode, are deepening user engagement and should meaningfully support ad and product revenue over time. Further, Google’s Cloud business is performing exceptionally well, thanks to the AI-powered demand. The segment posted 34% revenue growth to $15.2 billion in Q3 2025, driven by surging demand for enterprise AI tools.

Google has already secured more billion-dollar cloud deals this year than in the previous two years combined, and more than 70% of its cloud customers now use Google’s AI products. With over a dozen product lines generating $1 billion or more annually and generative-AI revenue up over 200%, the cloud unit is emerging as Alphabet’s next major profit center.

Alphabet’s push into workplace AI with Gemini Enterprise extends this momentum. Early adoption, with more than 2 million subscribers across hundreds of companies, signals a strong appetite for AI-embedded productivity solutions. Meanwhile, YouTube continues to benefit from AI-enhanced recommendations, lifting ad revenue by 15% as Shorts, connected TV, and long-form content all see engagement gains. Gemini tools are also helping creators produce content more efficiently, strengthening YouTube’s monetization prospects.

While advertising growth may face tougher comparisons in the short term due to last year’s U.S. election cycle, Alphabet’s broader trajectory remains compelling. Rapid cloud adoption, rising enterprise AI demand, and continued investment in advanced models and hardware suggest the stock’s long-term upside is far from exhausted, making GOOGL an appealing investment.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart