SoFi (SOFI) stock has gained significantly in value, climbing nearly 108% in six months. This rally is driven by a steady stream of strong quarterly results and an improving interest rate environment. SoFi’s revenue growth has accelerated, with momentum remaining strong across all its business segments. This signals that SoFi has steadily transitioned into a more durable, diversified financial platform.

A key part of SoFi’s evolution has been its shift toward a lower-risk, fee-driven, non-lending model. By reducing its reliance on traditional lending and expanding businesses such as financial services, technology platforms, and deposit products, the company has strengthened its balance sheet, improved credit stability, and generated more predictable earnings. This mix of expanding revenue streams and disciplined risk management has contributed meaningfully to the stock’s sharp climb.

The macroeconomic backdrop could soon become even more supportive. The market is expecting interest rates to decline, a trend that would typically reduce funding costs for financial institutions while stimulating demand for borrowing. For SoFi, which has been growing deposits rapidly, a friendlier rate environment could unlock additional profitability, drive loan refinancing, and boost its growth trajectory.

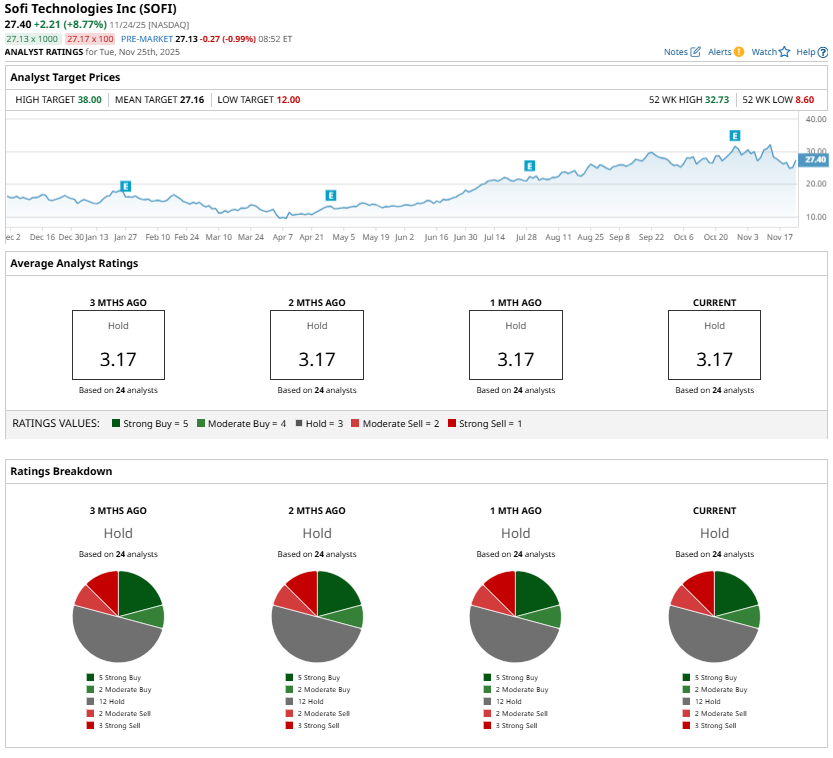

With these tailwinds in place, SoFi’s prospects remain optimistic. The highest current price target for SoFi stock sits at $38 per share, implying roughly 39% upside from the Nov. 24 closing price of $27.40.

Momentum in SoFi’s Business to Sustain

SoFi appears well-positioned to sustain the momentum in its business, supported by an expanding member base, rising fee-based revenue, and strategic investments that widen its financial ecosystem.

The company’s ability to attract new members while deepening relationships with existing ones remains a core competitive advantage. The cross-buy activity on its platform has improved for four consecutive quarters, with 40% of new products now opened by existing members. This trend reflects the effectiveness of SoFi’s all-in-one platform strategy and signals untapped upside as more users integrate multiple services into their financial lives.

A catalyst for the company is the strengthening contribution from capital-light, non-lending businesses. These segments generated $534 million in revenue in the third quarter, a 57% year-over-year increase, while fee-based revenue across all segments surged 50% to a record $409 million. Financial services revenue per product surpassed $100 for the first time, reaching $104, up more than 28% from last year. Moreover, management is expecting further improvement as newer offerings scale.

SoFi’s Loan Platform Business is also emerging as a meaningful driver of fee revenue. By originating customized loans for third parties and transferring them off its balance sheet, SoFi reduces credit exposure while unlocking a scalable revenue stream. Meanwhile, the Tech Platform continues to gain traction through deeper monetization of existing clients and new customer wins, diversifying its revenue.

In the lending business, student loan originations jumped 58% year-over-year to $1.5 billion in the third quarter, while home loan originations nearly doubled to $945 million. With potential rate cuts on the horizon, the lending business could gain additional momentum. Supporting this strength is SoFi’s $32.9 billion deposit base, which lowers funding costs and enhances earnings power.

Further, the launch of SoFi Pay introduces a blockchain-powered international payments product designed to be faster and cheaper than traditional methods. The company is also expanding into crypto trading, offering a wide range of tokens directly within the SoFi app. At the same time, SoFi is deploying AI tools to streamline operations and drive efficiency across the organization.

Overall, SoFi’s broadening product ecosystem, rising fee-based revenue mix, and strengthening platform capabilities position the company for sustained growth in the quarters ahead.

The Bottom Line

Analysts currently maintain a “Hold” rating on SoFi stock due to the considerable rally in its price. However, SoFi’s rapid growth, expanding fee-based revenue, and strengthened balance sheet highlight a business that is durable and scalable.

With more members joining its platform, faster growth in non-lending revenue, and interest rates that may soon become more favorable, SoFi is set up for solid growth. Because of this, the stock could reach $38 within 12 months.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart