Marvell Technology (MRVL) is doubling down on the booming data center wave, supplying advanced chips that help power the artificial intelligence (AI) revolution. But even with all the excitement around AI, shares of this chipmaker have struggled to woo investors this year. Wins in the data center space keep getting overshadowed by concerns about intense competition and the company’s ability to fully execute on its ambitions.

And now, investors have another reason to tread carefully. HSBC analyst Frank Lee recently cautioned that while Marvell’s profile as an AI supplier is rising, chip giant Broadcom (AVGO) currently holds stronger momentum in the highly competitive Application-Specific Integrated Circuit (ASIC) market heading into the next cycle. So, with the company’s Q3 earnings results fast approaching and market sentiment still fragile, here is a closer look at MRVL stock.

About Marvell Stock

Delaware-based Marvell plays a behind-the-scenes role in much of the technology we rely on every day. Its chips help data travel quickly between AI tools, cloud platforms, and communication networks, supporting the growing demand for speed and reliability in the digital world. One of Marvell’s key strengths lies in custom ASICs, which are tailored for demanding, high-performance environments such as next-generation 5G networks and hyperscale data centers.

By focusing on specialized silicon for these fast-growing markets, Marvell aims to stay competitive as computing workloads become more complex and energy-intensive. With a market capitalization sitting near $72 billion, Marvell’s stock has had a hard time finding its footing in 2025. A broader tech selloff, sparked by trade tensions and mounting concerns over slowing global growth, had weighed heavily on the shares earlier this year.

On top of that, questions about the future of key customer Amazon Web Services (AWS) added further uncertainty, prompting investors to think twice. To its credit, the stock has staged an impressive rebound, climbing almost 88.45% off its April low of $47.08. Even so, Marvell still sits about 19.64% lower for the year, a sharp contrast to the S&P 500 Index ($SPX), which is up 16% over the same stretch. In other words, despite some recovery, Marvell remains well behind the broader market.

Marvell’s Q2 Earnings Snapshot

Marvell released its fiscal 2026 second-quarter results on Aug. 28, and the numbers landed right in line with Wall Street expectations. The company posted record revenue of $2.01 billion, up a remarkable 58% year-over-year (YOY), fueled by booming AI demand in data centers, along with signs of recovery in enterprise networking and carrier infrastructure.

Digging into the details, data center revenue surged 69% YOY to $1.49 billion, while enterprise networking and carrier infrastructure sales jumped 28% and 71%, respectively. Profitability also took a sharp turn in the right direction. Gross margin expanded 420 basis points to 50.4%, and net income swung from a $193.3 million loss last year to a $194.8 million profit. On an adjusted basis, earnings per share soared 123% YOY to $0.67, undoubtedly a big improvement.

CEO Matt Murphy attributed the performance to strong AI demand for Marvell’s custom silicon and electro-optics products, paired with a meaningful rebound in enterprise and carrier spending. He added that AI design activity is at an all-time high, with over 50 new design opportunities underway across more than 10 customers, a promising glimpse into the company’s future growth pipeline.

Next up, Marvell will report its fiscal 2026 third-quarter earnings on Tuesday, Dec. 2, after the market closes. The company expects non-GAAP gross margins for the quarter between 59.5% and 60%, and projects non-GAAP EPS in the range of $0.69 to $0.79. Looking further out, analysts foresee earnings rising 137% YOY to $2.18 per share in fiscal 2026, followed by another 22% increase to $2.66 per share in fiscal 2027

How Are Analysts Viewing Marvell Stock?

Marvell investors were met with some unwelcome news recently, as HSBC kicked off coverage on the stock with a “Hold” rating and an $85 price target. Analyst Frank Lee acknowledged that Marvell’s role in AI continues to grow, especially as an emerging supplier of advanced data center chips. But he warned that the company’s ASIC business could lag behind peers through 2027.

In his view, Broadcom has a much clearer path to maintaining ASIC leadership as the next upgrade cycle takes shape. HSBC expects ASIC spending to climb meaningfully, forecasting hyperscalers’ capex allocation to rise from 2% in 2023 to 13% in 2027. However, the firm believes Marvell may not fully capitalize on that growth.

Lee pointed out that Amazon (AMZN) remains Marvell’s biggest ASIC customer, yet its participation in Trainium 2 and Trainium 2.5 appears limited, and it could lose even more share on Trainium 3. Also, the analyst flagged a delay risk tied to another key customer, saying that Marvell’s next major ASIC program with Microsoft (MSFT) likely won’t ramp until 2027, due to constrained CoWoS packaging availability.

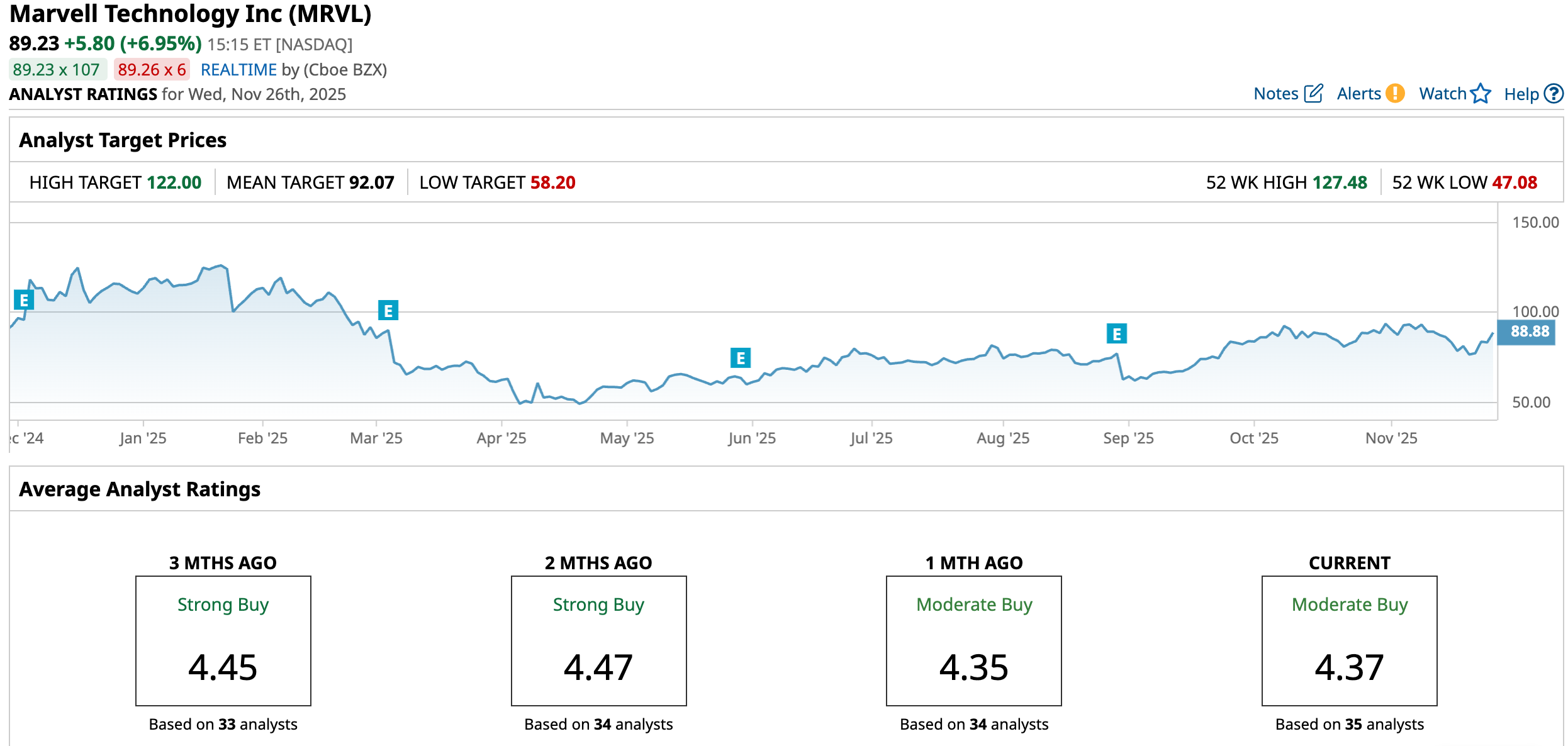

Despite doubts creeping in, Wall Street remains somewhat optimistic on MRVL, with the stock carrying a consensus “Moderate Buy” rating overall, even if enthusiasm has cooled from the consensus “Strong Buy” rating it held just two months ago. Of the 35 analysts offering recommendations now, a majority of 23 analysts are giving it a solid “Strong Buy,” two suggest a “Moderate Buy,” and the remaining 10 provide a “Hold.”

Analysts believe Marvell still has upside relative to its intrinsic worth. The consensus price target of $92.07 implies shares could rise about 3.28% as the stock moves closer to what Wall Street views as fair value. More optimistic analysts set their sights much higher, with a $122 target that reflects a potential 36.79% upside if Marvell delivers on its AI ambitions.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?

- Google Is Getting the AI Spotlight, But Nvidia Says Its GPUs Are a ‘Generation Ahead.’ How Should You Play NVDA Stock Here?