With a market cap of $175.8 billion, Intel Corporation (INTC) is a global leader in designing, developing, and manufacturing computing technologies and semiconductor products. The company provides a wide range of hardware and software solutions from CPUs and GPUs to AI, networking, edge computing, and advanced process technologies, serving industries from cloud to automotive.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Intel fits right into that category. Intel supports major OEMs, ODMs, cloud providers, and other technology partners worldwide.

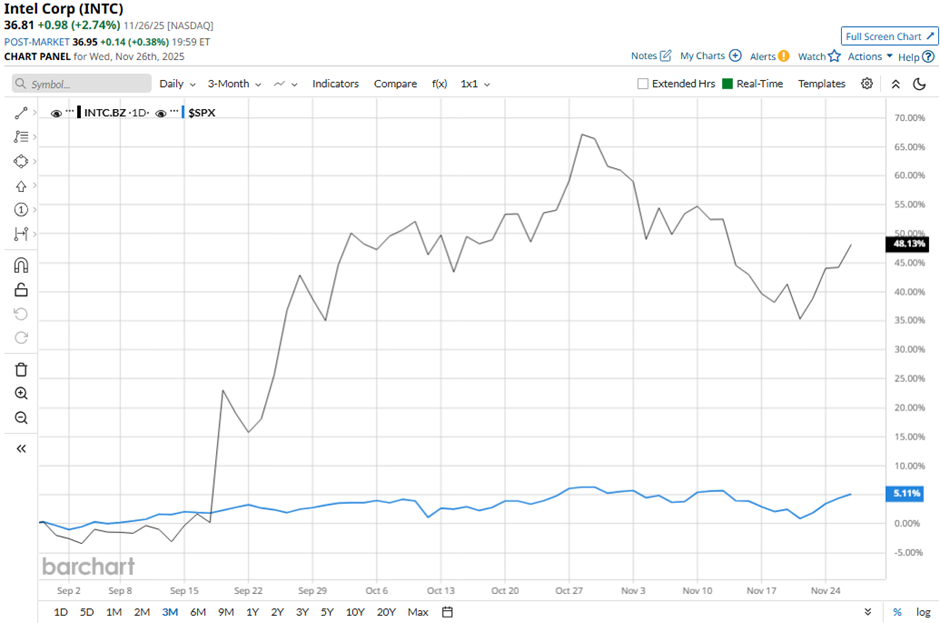

Shares of the Santa Clara, California-based company have fallen 13.4% from its 52-week high of $42.48. Intel’s shares have climbed 51.2% over the past three months, surpassing the broader S&P 500 Index’s ($SPX) 5.4% gain over the same time frame.

In the longer term, INTC stock is up 83.6% on a YTD basis, exceeding SPX’s 15.8% rise. Moreover, shares of the company have soared 53.1% over the past 52 weeks, compared to the 13.1% return of the SPX over the same time frame.

The stock has been trading above its 50-day and 200-day moving averages since early August.

Intel shares rose marginally following its Q3 2025 results on Oct. 23 as revenue reached $13.7 billion, up 3%, and adjusted EPS improved to $0.23. Investors also welcomed Intel’s strengthened financial position, supported by $5.7 billion in U.S. government funding and major strategic investments of $5 billion from NVIDIA and $2 billion from SoftBank. Sentiment was further boosted by management’s note that current demand is outpacing supply and is expected to continue into 2026.

In comparison, rival Apple Inc. (AAPL) has lagged behind INTC stock. AAPL stock has increased 10.8% on a YTD basis and 18.1% over the past 52 weeks.

Despite the stock’s strong performance over the past year, analysts remain cautious on INTC. It has a consensus rating of “Hold” from the 42 analysts in coverage, and as of writing, the stock is trading above the mean price target of $35.98.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Founder Ray Dalio Warns the Market Is in a Bubble, Bridgewater Associates Just Bought CoreWeave Stock

- Eli Lilly’s Stock Price Has Fattened Up Like a Thanksgiving Turkey. Time to (Options) Collar That Green!

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip