With a market cap of $252.4 billion, Micron Technology, Inc. (MU) is a leading American semiconductor company specializing in memory and storage solutions. Headquartered in Boise, Idaho, Micron designs, develops, and manufactures dynamic random-access memory (DRAM), NAND flash memory, and solid-state drives (SSDs) that are used in computing, mobile devices, automotive applications, networking equipment, and data centers.

Companies valued at $200 billion or more are generally considered "mega-cap" stocks, and Micron Technology fits this criterion perfectly. The company operates globally, serving major technology firms and cloud-service providers, and is a critical player in the supply chain for memory components that power everything from personal computers to AI servers. Micron is known for its focus on innovation, high-performance memory solutions, and scaling advanced semiconductor processes, making it a key driver in the rapidly evolving memory and storage market.

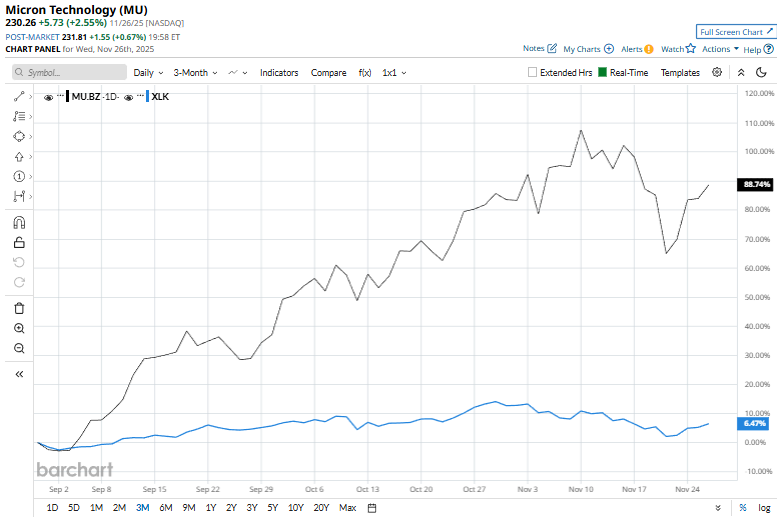

Shares of the Boise, Idaho-based company have declined 11.6% from its 52-week high of $260.58. Over the past three months, Micron Technology's shares have surged 97.7%, outpacing the Technology Select Sector SPDR Fund's (XLK) 7.9% returnduring the same period.

Longer term, MU stock has climbed 173.6% YTD, surpassing DOWI's 22.1% gain. Moreover, shares of the chipmaker have increased 126.2% over the past 52 weeks, compared to XLK’s 20.9% over the same time frame.

MU stock has been trading above its 50-day and 200-day moving averages since early May, indicating an uptrend.

On Nov. 24, Micron Technology shares surged 7.2% following a wave of positive analyst sentiment, highlighted by Morgan Stanley (MS) raising its price target from $325 to $338. Other firms, including Citigroup, Wedbush, and Piper Sandler, had also recently increased their targets, reflecting optimism about Micron’s strong performance. The upbeat outlook is driven by rising memory demand from data center operators for AI applications, positioning Micron as a key player in AI-optimized memory and storage solutions.

By comparison, Micron has outperformed its competitor, Analog Devices, Inc. (ADI), whose stock has returned 21.4% year-to-date and a 17.7% return over the past 52 weeks.

Due to the stock’s outperformance, analysts remain bullish about its prospects. MU stock has a consensus rating of “Strong Buy” from 37 analysts in coverage, and the stock currently trades above the mean price target of $224.06.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?