With a market cap of $74.9 billion, Emerson Electric Co. (EMR) is a global technology and engineering company specializing in innovative solutions for industrial, commercial, and residential markets. The company is organized into seven segments: Final Control, Measurement & Analytical, Discrete Automation, Safety & Productivity, Control Systems & Software, Test & Measurement, and AspenTech.

Companies valued $10 billion or more are generally classified as “large-cap” stocks, and Emerson Electric fits this criterion perfectly. Emerson’s advanced technologies include intelligent instrumentation, asset optimization software, automated test systems, and cybersecurity solutions.

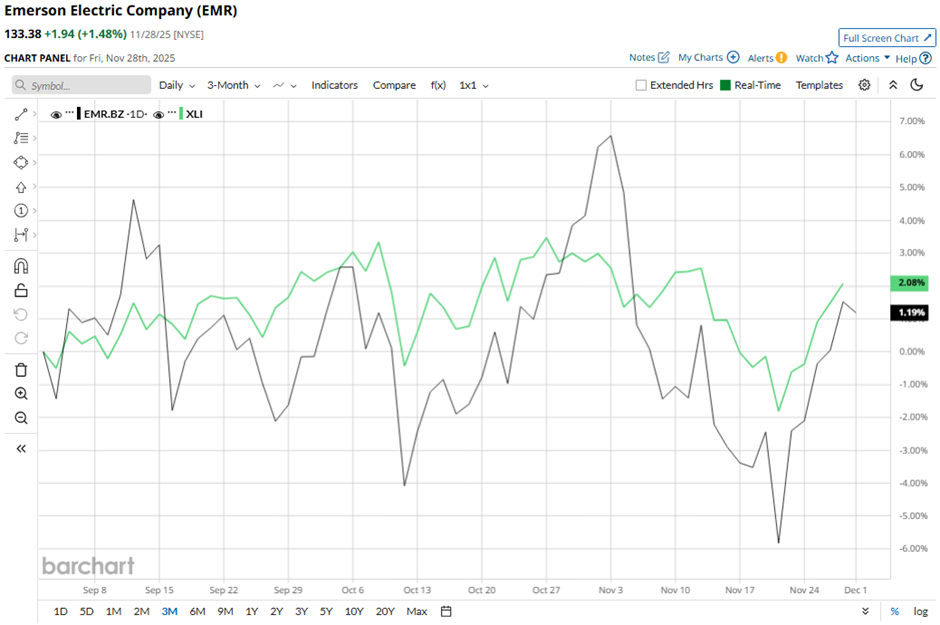

EMR stock has declined 11.2% from its 52-week high of $150.27. Shares of the company have fallen marginally over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) slight rise during the same period.

In the longer term, EMR stock is up 7.6% on a YTD basis, lagging behind XLI’s 16.6% increase. Moreover, shares of Emerson Electric have risen marginally over the past 52 weeks, compared to XLI’s 7.3% return over the same time frame.

The stock has been trading below its 50-day average since August. Yet, it has moved above its 200-day moving average since early May.

Shares of Emerson Electric fell 3.8% on Nov. 5 because the company reported lower-than-expected Q4 2025 revenue of $4.86 billion. Emerson also cited choppy demand for its automation equipment and ongoing difficulty generating stronger margins from its automation-focused business. Although adjusted EPS matched estimates at $1.62, the revenue miss and demand pressures drove the sell-off.

Moreover, EMR stock has underperformed compared to its rival, Parker-Hannifin Corporation (PH). Shares of Parker-Hannifin have surged 23.1% over the past 52 weeks and 35.5% on a YTD basis.

Despite EMR’s weak performance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 23 analysts covering the stock, and the mean price target of $151.08 is a premium of 13.3% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart