Valued at $10.2 billion by market cap, Cambridge, Massachusetts-based Moderna, Inc. (MRNA) operates as a clinical-stage pharmaceutical company. It focuses on discovering and developing messenger RNA (mRNA) based therapies and vaccines for the treatment of autoimmune conditions, infectious diseases, immuno-oncology, rare, and cardiovascular diseases.

Companies worth $10 billion or more are generally referred to as “large-cap stocks.” Moderna fits right into that category, with its market cap exceeding the threshold, reflecting its substantial size, influence, and dominance in the healthcare sector.

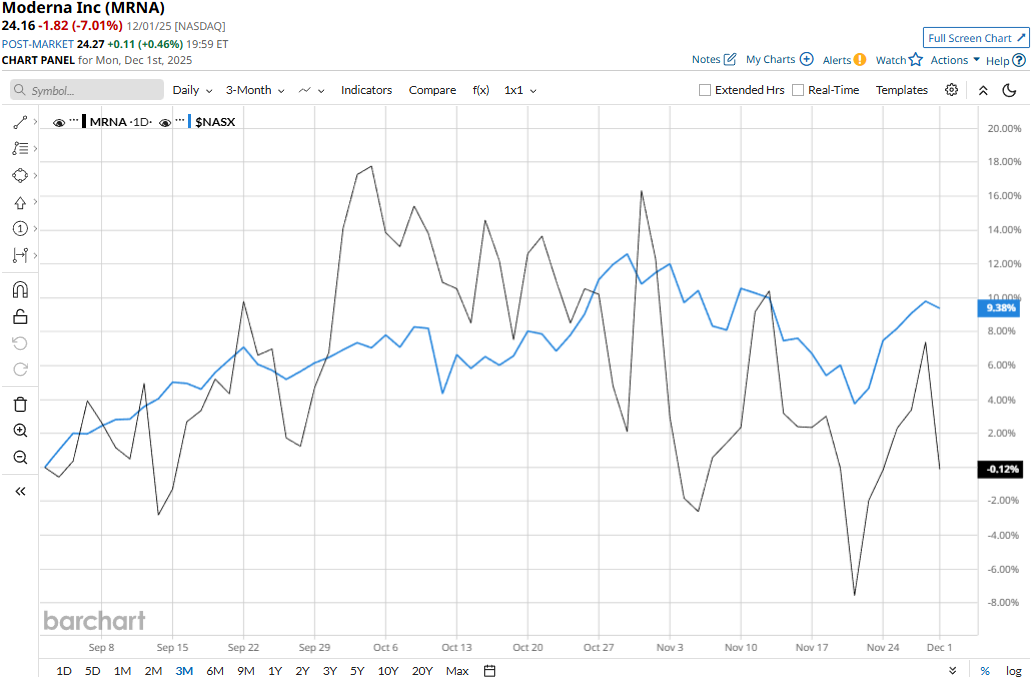

Despite its notable strengths, MRNA stock has dropped 50.6% from its 52-week high of $48.92 touched on Jan. 7. Meanwhile, its stock prices have observed a marginal 29 bps uptick over the past three months, compared to the Nasdaq Composite’s ($NASX) 8.5% gains during the same time frame.

Moderna has underperformed the broader market over the longer term as well. MRNA stock prices have tanked 41.9% on a YTD basis and 43.9% over the past 52 weeks, compared to the Nasdaq’s 20.5% surge in 2025 and 21.1% gains over the past year.

Further, Moderna has traded consistently below its 200-day moving average and mostly below its 50-day moving average over the past year, underscoring its bearish trend.

Moderna’s stock prices gained 3.3% in the trading session following the release of its better-than-expected Q3 results on Nov. 6. Due to a continued decline in the demand for its vaccines, the company’s product revenues have remained under pressure. Overall, its topline for the quarter plunged 45.4% year-over-year to $1 billion, but surpassed the Street’s expectations by 18.1%. Meanwhile, it reported a net loss of $0.51 per share, but exceeded the consensus estimates by a staggering 76.3%.

Nonetheless, Moderna has also underperformed its peer BridgeBio Pharma, Inc.’s (BBIO) 161.6% surge in 2025 and 165% gains over the past 52 weeks.

Among the 23 analysts covering the MRNA stock, the consensus rating is a “Hold.” Its mean price target of $35.68 suggests a 47.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Options Strategy Turns Your Stock Portfolio Into a Consistent Income Generator

- This ‘Strong Buy’ Dividend Stock Looks Set to Raise Payouts. Should You Buy Shares Now?

- JPMorgan Just Upgraded CleanSpark Stock. Should You Buy Shares Here?

- Dear Walmart Stock Fans, Mark Your Calendars for December 9