Whether you are lactose intolerant, avoiding gluten, a heart healthy type, or a weight watcher of some other sort, you’ll be thrilled to know this article is not about what not to eat. We’ve all had plenty of that for one lifetime, no matter how old we are.

But “diet” is the term Cathie Wood’s Ark Invest chose for a new set of ETFs.

What’s Different About ARK Diet ETFs?

As detailed on ARK’s site, this new set of ETFs takes ARK’s funds, notorious for their volatility, and cuts that down. Not out, but down.

It does so through a popular technique used elsewhere, and one that has been in the Wall Street brokerage playbook for decades. The modern, ETF-linked version is known as a “buffer” fund. The bottom line is that, as ARK states regarding its new entries, “ARK DIET ETFs are designed to give investors exposure to ARK’s innovation strategy with built-in, limited downside protection and a limit on how much of the upside they keep. They work over 12-month periods, with a 50% downside buffer, a 5% upside hurdle, and a 50–80% upside participation rate thereafter.”

I’ll Have a Diet… ETF With That?

The ARK Diet Q4 Buffer ETF (ARKT) initiated this quarterly series at the end of September. That ETF is reset at the same time each year. In between, the proposition is as follows:

The return of ARK’s flagship ETF, the $7.4 billion ARK Innovation Fund (ARKK), is the basis for how ARKT’s value is determined. The main idea of a buffer ETF is that some of the downside risk is removed, in exchange for sacrificing some of the initial upside.

So for example, if ARKK falls by 50%, as it has done in under 12 months during its life, ARKT would lose half of that, or 25%. And if ARKK is up over that October to October time frame, the first 5% of that return is not earned by ARKT shareholders. In addition, any return beyond that 5% hurdle partially accrues to ARKT investors.

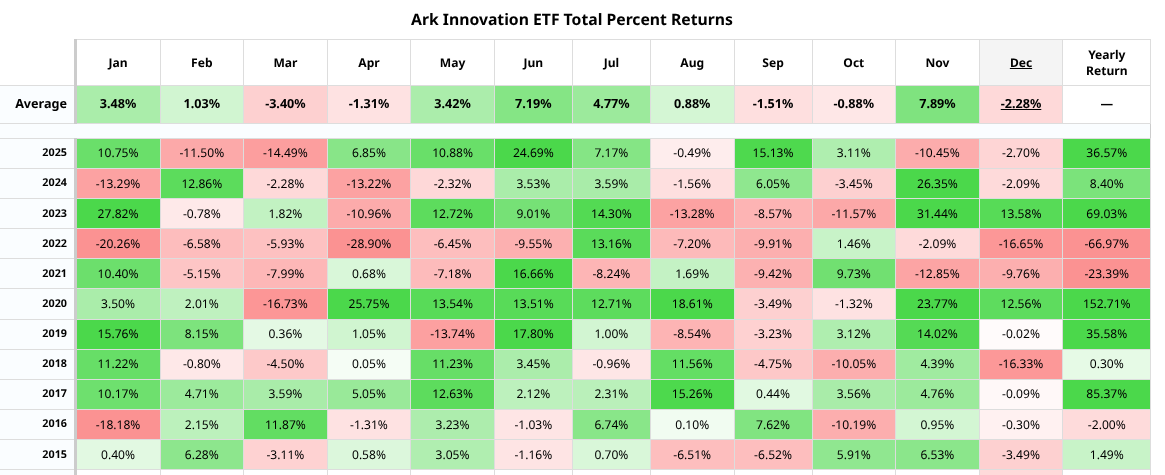

How much? About 62%, though some documents for the ETF state a range of 50%-80%. This table shows ARKK’s past returns for each of its full years. If investors wanted to backtest how it would have done with the ARKT buffer structure applied, they could run this from October to October for each year instead.

In typical buffer ETF style, the structure of ARKT’s holdings is built through options as a supplement to the equity position, ARKK in this case.

All of the options expire at the end of September 2026. The cocktail includes a call option purchase above the current market and a covered call sale below the current price of ARKK. And a put purchase at that same strike price as the covered call.

That is a strategy that doesn’t exactly roll off the tongue. But, it’s what allows the fund to provide downside protection, sacrifice some upside, and get a chunk of the higher ARKK upside, if any, in a 12-month period.

The intriguing thing for ETF geeks is to see how this setup might “mark to market” in different environments. That is, based on how ARKK’s price fluctuates. Depending on that, ARKT could become very attractive or unattractive during the 12-month period, during which time it is daily liquid.

The fund’s prospectus emphasizes that its objectives are designed to be met by buying ARKT at the start of the period, and holding it through the 12 months.

ARKT Is Only as Good as ARKK. And ARKK Just Isn’t That Good.

Additional ARKK-based buffers will be issued quarterly. This is a creative setup, but my main concern is with ARKK itself. The ETF is flat since very early in 2022. Last I checked, it’s almost 2026. So no matter how one massages the reward-risk tradeoff, sometimes it’s not the diet. It’s the manager.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How Micron Stock Could Be an Even Bigger Winner Than GOOGL from a Google-Meta Deal

- Beyond Meat Just Broke Through This Key Resistance Level. Should You Buy the Meme Resurgence in BYND Stock?

- Boeing Stock Looks Set to Challenge Its 50-Day MA. Should You Buy BA on Turnaround Hopes?

- Applied Calculus Says Nutanix (NTNX) Is Mispriced—And the Math Is Hard to Ignore