As November came to an end and December began, one constant in the commodity complex was continued volatility in the cattle markets.

Fundamentally, despite social media posts by the US president, both live and feeder cattle markets remain bullish, though there was some commercial selling in deferred live cattle.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.Technically, if this is still a valid school of analysis, both markets have turned long-term bearish.

My friend in the cattle industry sent me his daily update on cash feeder cattle indexes before my appearance on RFD-TV Tuesday morning. Index prices jumped post-Thanksgiving holiday on small numbers at sale barns. I mentioned how, to me, these looked like big moves. My friend replied, “This is not surprising to some of us in the feeder cattle industry, but the television cowboys will be all over this like a yearling bull on a fresh pen of heifers.” I laughed about that one for a long time. My mind immediately went back to the same group industry legends John Harrington and Walt Hackney classified as “All hat, no cattle”, not to mention the classic Glen Campbell song Rhinestone Cowboy. All these titles fit the majority of those who talk about cattle markets on television, meaning they have no idea. As it turns out, though, Watson is a member in good standing of this illustrious group, as indicated by the strong noncommercial buying seen in both live and feeder futures Tuesday. In reality, it comes down to Rule #6: Fundamentals win in the end, and as the curtain came down on November, futures spreads for both markets remained mostly bullish. That’s all we need to know.

Fundamental Analysis

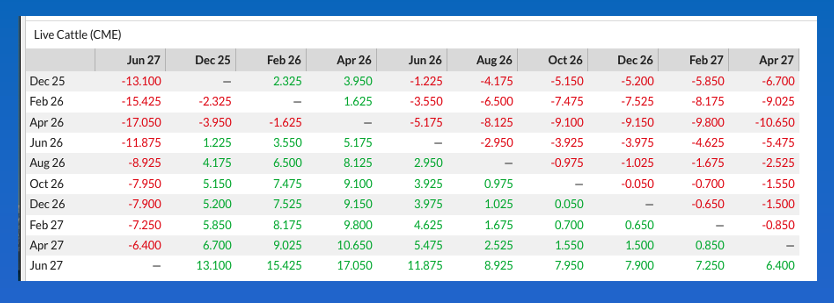

Live Cattle futures spreads: Neutral-to-Bullish

- The December-February closed November at (-$2.275)

- as compared to the end of October settlement at $2.00

- and the previous 5-year high weekly close for the last week of November at (-$1.05)

- with the previous 5-year average weekly close for the last week of November at (-$2.55)

- The February-April closed November at (-$1.70)

- as compared to the end of October settlement at $0.95

- and the previous 5-year high weekly close for the last week of November at (-$2.15)

- The April-June closed November at $5.15

- as compared to the end of October settlement at $7.325

- and the previous 5-year high weekly close for the last week of November at $8.65

- with the previous 5-year average weekly close for the last week of November at $4.075

- Bottom Line: Due to commercial selling in live cattle during November, seen across the board in the spreads, the fundamental read dropped from Bullish to Neutral-to-Bullish heading into the winter season. Time will tell if this is the first peek at long-term herd expansion.

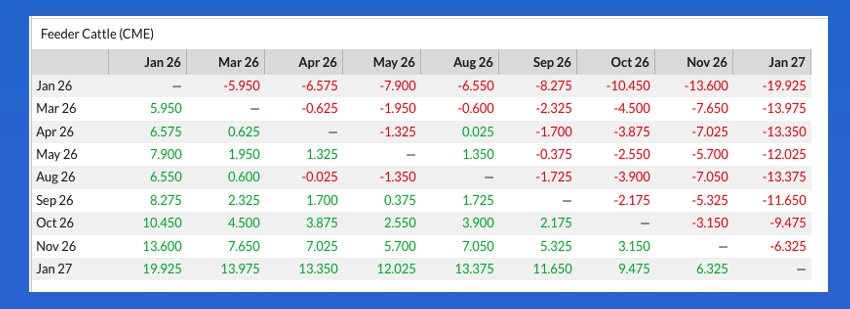

Feeder Cattle futures spreads: Bullish

- The January-March closed November at $6.125

- as compared to the end of October settlement at $4.775

- and the previous 5-year high weekly close for the last week of November at $0.85 from 2024

- Indicating feeder cattle fundamentals were more bullish than a year ago.

- The March-April closed November at $1.225

- as compared to the end of October settlement at $1.40

- and the previous 5-year high weekly close for the last week of November at (-$1.225) from 2024

- indicating longer-term fundamentals are also more bullish than a year ago.

- Bottom Line: Nearly every aspect of the feeder cattle market remains volatile. However, at face value, if we can believe what we see, futures spreads are telling us supply and demand is more bullish than a year ago.

Technical Analysis

This analysis is assuming the Cash Indexes reflect the actual cash markets. Something I’m not sure of at this time.

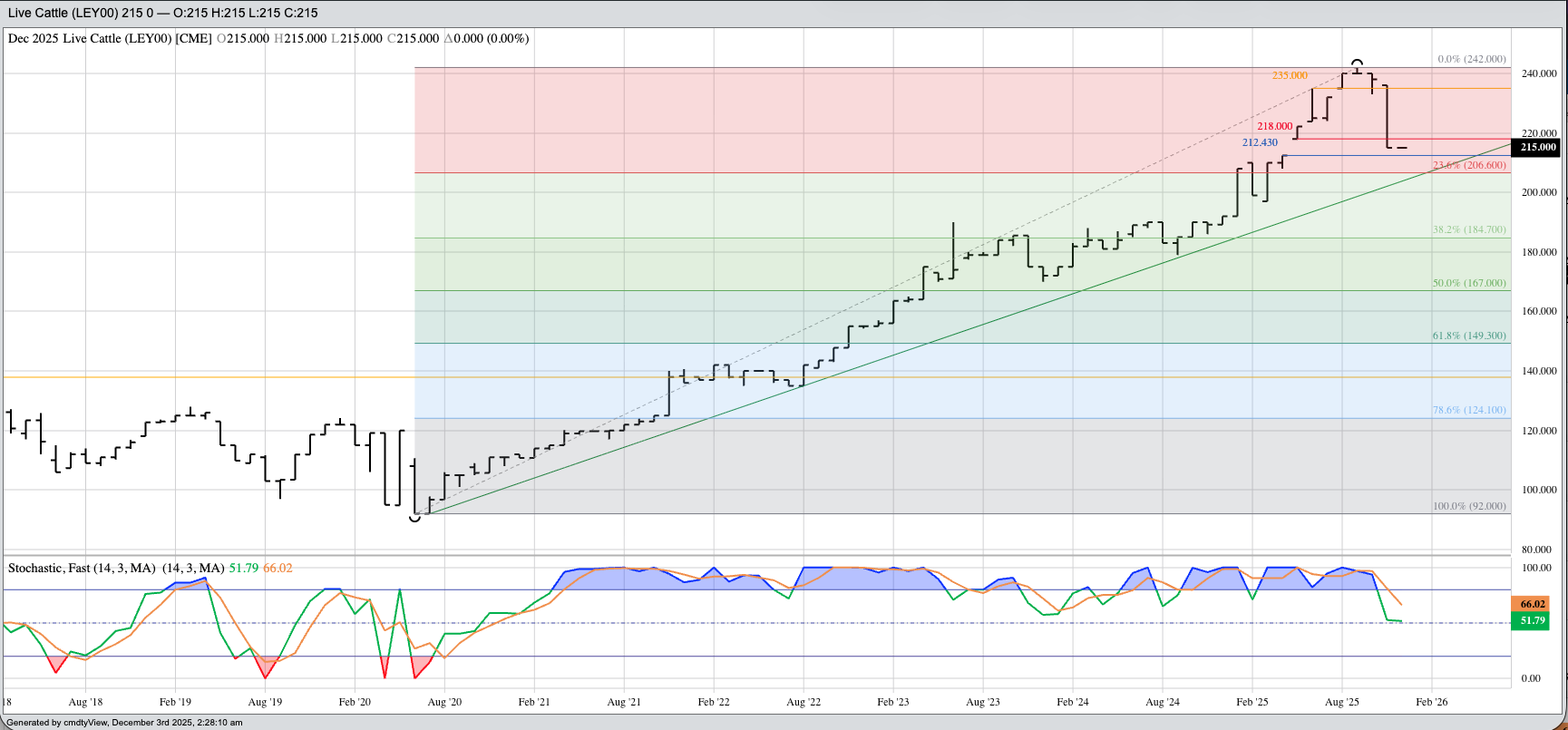

- Live Cattle (Cash Index) (LEY00): The Index took out its previous 4-month low of $224 during November, on its way to a monthly low and settlement of $215. This was down $23 (9.7%) and confirmed a new major (long-term) downtrend. The Index is in position for a possible bearish gap down during December. Theoretical Positions: Long-term investors likely shorted cattle on the move to a new 4-month low during November, putting the position at roughly $223.

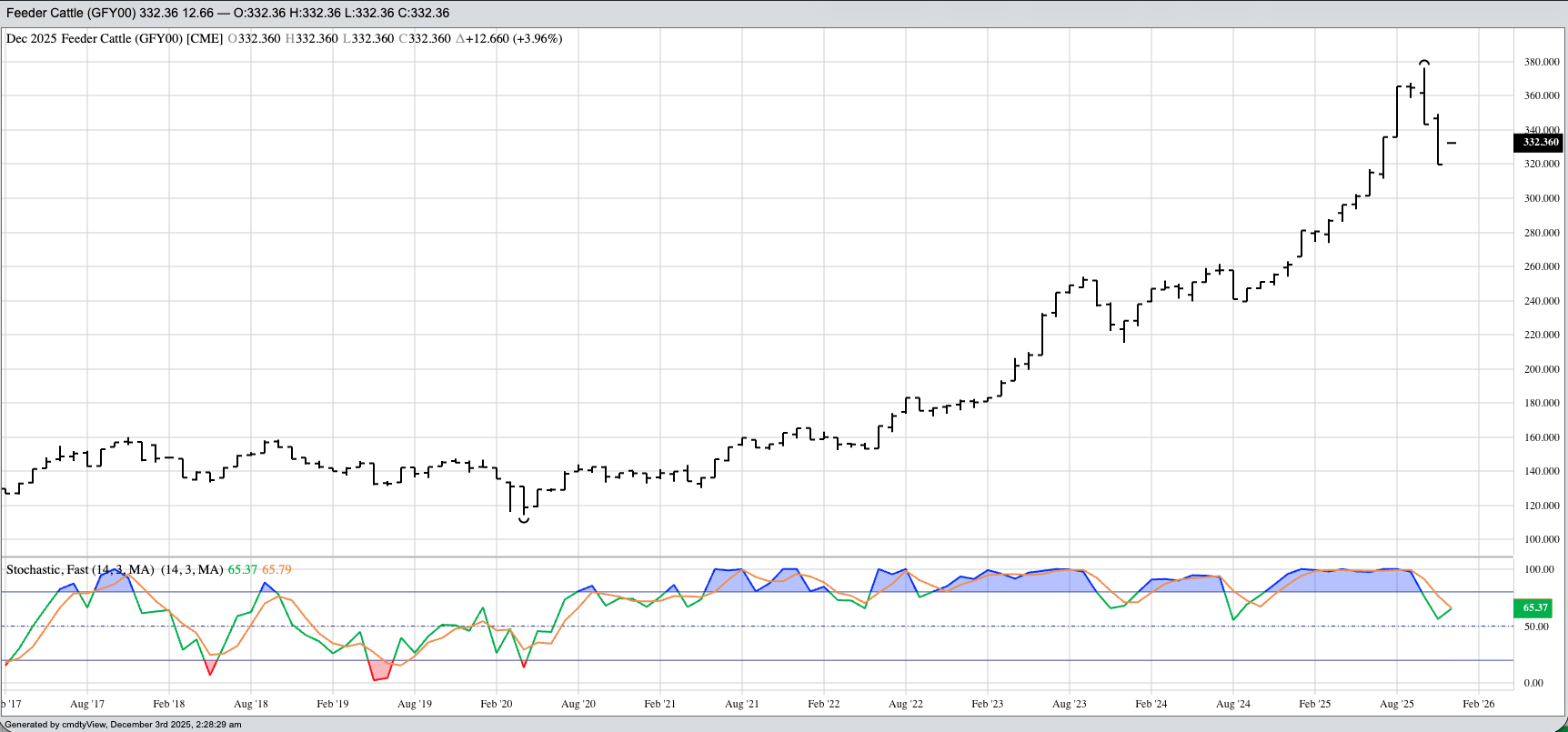

- Feeder Cattle (Cash Index) (GFY00): The cash index extended its major downtrend to a low of $329.88 during November before closing at that price, down $13.45 (3.9%) for the month. Recall the index completed a bearish key reversal at the end of October telling us the major trend had turned down. Theoretical Positions: Long-term investors likely sold the market near the October settlement of $343.33 based on the completed bearish key reversal.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart