Highlights:

Base Case shows US$426.0M post tax NPV5, 28.1% IRR, with a 2.9 year payback at a US$2,400/oz gold price

Upside Case shows US$1,012M post tax NPV5, 51.3% IRR, with a 1.9 year payback at a US$3,800/oz gold price

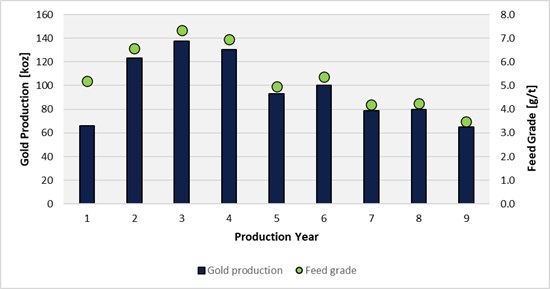

874,700 oz of gold produced over a nine year mine life averaging 101 koz/yr after initial ramp-up

Life-of-mine average AISC of US$1,011/oz putting it in the lowest 13% of the global costs curve for currently producing gold mines with a US$300M CAPEX

Average annual after-tax free cash flow of US$93.8M at US$2,400/oz gold price (US$168.0M at US$3,800/oz gold price) driven by combination of high grade and bulk tonnage mining method

Comprehensive plan for path forward and early works program at Ana Paula including accelerating completion of the underground decline, exploration drilling, permit amendment submission and Feasibility Study with plan to bring Ana Paula into production in 2028

Vancouver, British Columbia--(Newsfile Corp. - November 6, 2025) - Heliostar Metals Ltd. (TSXV: HSTR) (OTCQX: HSTXF) (FSE: RGG1) ("Heliostar" or the "Company") is pleased to announce the results of a Preliminary Economic Assessment ("PEA") evaluating the potential for an underground mine development at the Ana Paula Project in Guerrero, Mexico and a comprehensive plan to advance the project to production.

Heliostar CEO, Charles Funk, commented, "Today's PEA demonstrates Ana Paula can be a low CAPEX, high margin gold mine. Ana Paula is expected to drive the Company's transition to mid-tier status in 2028 by significantly expanding our production profile at one of the industry's lowest cost bases. As we proceed with the Feasibility Study, the current 15,000m drill program, engineering and metallurgical programs all have the potential to improve the mine's economics and are being advanced with the aim of confirming a mine life of at least 10-years. The Company plans to accelerate key development steps to bring Ana Paula forward including a restart of decline development in 2026. This early access to the deposit will allow us to further de-risk development and provide a location to conduct exploration drilling to test for a potential larger deposit at depth. We are excited at the prospect of bringing Ana Paula into production as a robust free-cash-flow-generating mine that will underpin Heliostar's share price for the next decade."

A report supporting this news release will be available on SEDAR+ (www.sedarplus.ca) and on the Company's website (www.heliostarmetals.com) within the next 45 days. All dollar amounts referenced in this news release are in United States dollars (USD or US$) unless otherwise noted.

The results of the PEA are preliminary in nature and include Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the results of the PEA will be realized. The Company has not made a production decision.

Ana Paula PEA Webinar

Heliostar will host a conference call on Monday, November 11, 2025, at 2:00 PM, Eastern Time/11:00 AM Pacific Time. The call will present the PEA highlights, the path toward a Feasibility Study, and the Company's accelerated development plan.

Please use the link here to register for the call or visit the Company website at www.heliostarmetals.com.

Ana Paula PEA Mineral Resource Estimate

The PEA is based on a resource update of the November 27, 2023 resource with 742,000 ounces of Measured and Indicated and 514,000 ounces of Inferred resources.

| Classification | Kilotonnes (kt) | Gold Grade (g/t) | Contained Gold Ounces |

| Measured | 1,300 | 7.60 | 317,000 |

| Indicated | 2,970 | 4.44 | 424,000 |

| Measured & Indicated | 4,270 | 5.40 | 742,000 |

| Inferred | 4,040 | 3.96 | 514,000 |

- Mineral Resources are reported insitu, using 2014 CIM definition standards.

- Mineral Resources have an effective date of 30 July 2025. The Qualified Person for the estimate is Mr. Richard Schwering, RM SME, a Hard Rock Consulting employee.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported above a 2.10 g/t gold cut-off grade constrained within optimized stopes using the following input parameters: A gold price of US$2,500/oz; a gold metallurgy recovery of 90%; an external mining dilution of 5%; a mining cost US$72.00/t mined; a processing cost of US$43.00/t processed, general and administrative costs of US$8.84/t processed; a sustaining CAPEX of US$7.54/t; a NSR royalty of 3.00%; and finishing and selling costs of US$2.50/gold ounce processed.

- Stopes were variably oriented along strike and down dip of mineralization. Longitudinal stopes, oriented along strike, are 20m long by 25m high and transverse stopes, across strike, are 10m long by 25m high. Both longitudinal and transverse stopes have a minimum width of 4m and 5m after ELOS dilution. Sub-stoping is allowed in both longitudinal and transverse directions. In the transverse direction, the minimum sub-stope is one half the total stope height (back stope), and in the longitudinal direction the minimum sub-stope is one half the stope length.

- Numbers have been rounded.

Ana Paula PEA Mill Feed Inventory

| Classification | Kilotonnes (kt) | Gold Grade (g/t) | Contained Gold Ounces | Contained Gold Ounces (%) |

| Measured | 1,103 | 8.12 | 288 ,000 | 30% |

| Indicated | 2,305 | 4.81 | 356,000 | 37% |

| Measured & Indicated | 3,408 | 5.88 | 644,000 | 66% |

| Inferred | 2,024 | 5.04 | 327,000 | 34% |

| Dilution | 193 | - | 0% | |

| Total | 5,625 | 5.37 | 972,000 | 100% |

- Dilution is non-mineralized material outside of the proposed stopes that already include planned and unplanned dilution.

- Numbers presented above include mining dilution and mining recovery.

Ana Paula Underground PEA Overview

The study outlines a nine year mine life producing 101.1koz/yr on average after ramp-up, at a cash cost of US$923/oz and an all-in sustaining cost (AISC) of US$1,011/oz, costing US$300M in initial capex to bring into production. At the base case gold price of US$2,400/oz, this results in an after-tax NPV of US$426M at a 5% discount rate, an IRR of 28%, and a payback period of three years.

Key Highlights

| Forecast Production Highlights | ||

| Mill Feed - LOM | 5,625 | kt |

| Gold Grade - LOM | 5.37 | g/t Au |

| Gold Grade - Years 1-4 | 6.64 | g/t Au |

| Gold Produced - LOM | 875 | Koz Au |

| Processing Rate | 1,800 | tpd feed |

| Process Recovery | 90 | % |

| Life of Mine (LOM) | 9 | years |

| Average Annual Production - (LOM post six month ramp-up) | 101.0 | koz |

| Forecast Financial Highlights | |||

| Average Cash Costs (US$ per oz Au) 1 | 923 | /oz | |

| Average AISC (US$ per oz Au) 1 | 1,011 | /oz | |

| Total Initial Capital Cost | 300.1 | M | |

| Total Sustaining Capital Cost | 73.2 | M | |

| Total Life of Mine Capital Cost 2 | 376.3 | M | |

- Non-International Financial Reporting Standards (IFRS) measures. All-in sustaining costs (AISC) were first issued by the World Gold Council (WGC) in 2013 with an updated Guidance note issued in 2018.

- Includes US$3.0 million in indirect costs.

| Forecast Return Estimates based on Gold Price 1, 2 | |||

| US$2,400/oz 3 | US$3,800/oz 4 | ||

| IRR | 28.1% | 51.3% | |

| NPV @ 5.0% discount | US$426.0M | US$1,012M | |

| Payback | 2.9 years | 1.9 years | |

- All other key parameters set at base assumptions, including the 5% discount rate used. More detailed analysis will be presented in the full technical report.

- After tax return estimates.

- Base gold price assumption used in the Ana Paula technical report.

- Comparison gold price of US$3,800 with reference to US$3,995 London Bullion Market Association (LBMA) PM gold price on trading day November 5, 2025.

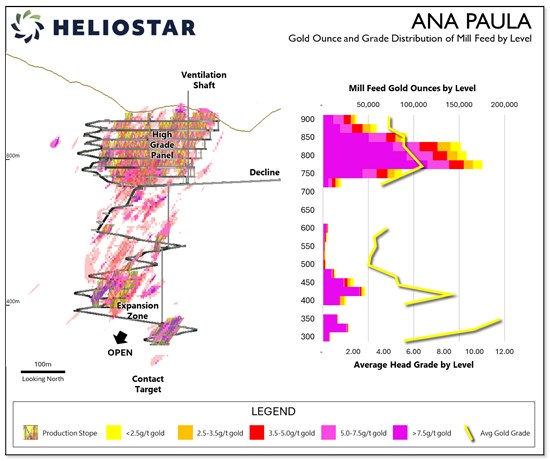

Figure 1 - Ana Paula Resource with Gold Ounce and Grade Distribution of Mill Feed by Level

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/273392_6ab78f34047fc858_001full.jpg

The mine will consist of an 1,800 tpd underground mining operation extracting mineralized material using transverse and longitudinal, long hole open stoping. The existing exploration adit will be extended by 1.2 km where it will split into incline and decline ramps to access the working levels of the mine. Production will be predominantly transverse longhole stoping with paste backfill in a bottom-up mining sequence. Where the mineralization is narrower, longitudinal longhole stoping will be utilized. Stopes will be backfilled using cemented paste backfill. Rock passes in the upper portion of the deposit will be used to reduce trucking requirements and mining costs. Trucks will be loaded at the bottom of the rock pass and material hauled to the process plant. The primary ventilation fans will be located on surface at the top of an exhaust raise with the portal acting as the main air intake. Levels will be connected together via short ventilation drop raises or longer ventilation raises depending on the mining level and zone.

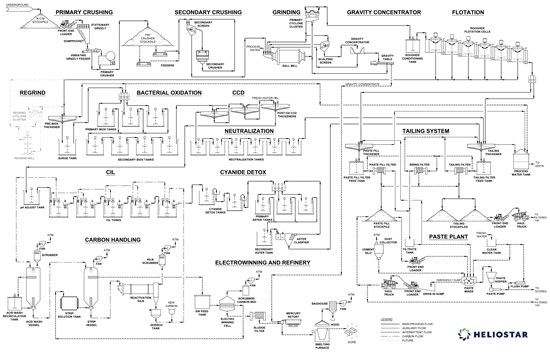

Mill feed will be fed to an 1,800 tpd processing facility consisting of a 2-stage crushing circuit feeding a ball mill. Free gold will be captured using gravity concentrators before moving into a flotation circuit. It is expected that the gravity circuit will recover 15-20% of the gold. The flotation concentrate will be fed into a 250 tpd bio-oxidation (BIOX) circuit, expected to increase the overall recovery to 90%. The operation is planned to produce doré bars on site. Approximately 40% of the tailings will be placed back underground as paste backfill with the remainder stored in a lined, dry-stack tailings storage facility. A maintenance shop, warehouse and offices will also be constructed. Power is expected to be connected to the national grid system by installing an electrical substation and new transmission line. Water will be sourced from mine de-watering activities during operations, augmented by groundwater from a new well, as required. A new camp will be developed to accommodate an estimated 336 people in addition to employing people in the nearby communities. Mining will be carried out by a contractor supplying their own mobile equipment.

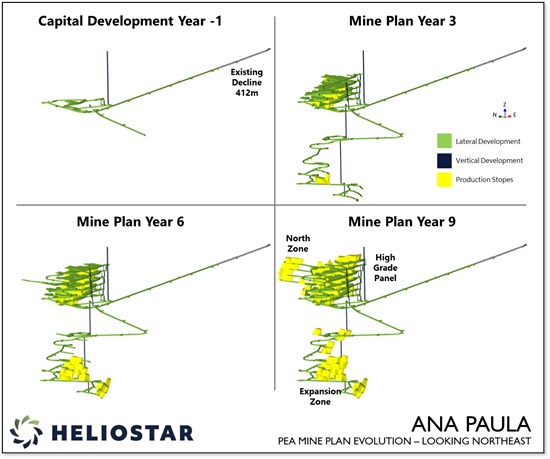

Figure 2 -Ana Puala Underground Development Schedule and Stope Layout Over the Life of Mine

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/273392_6ab78f34047fc858_002full.jpg

Figure 3 - Planned Ana Paula Production Schedule

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/273392_6ab78f34047fc858_003full.jpg

Forecast Operating Cost Estimates

Operating costs benefit from the low level of development required to support the bulk long hole transverse open stoping mining method. The operating unit costs also benefit from low-cost power supplied from the national grid and proximity to national highways to facilitate transportation of consumables.

Mining will access 35 ounces of gold per development metre at Ana Paula. Within the High Grade Panel (725 to 925m levels) the mine plan contains over 3,900 ounces per vertical metre. These metrics drive significantly lower development cost per ounce mined than industry comparables.

The construction of the BIOX plant allows the Company to include additional mineralized material into the mine plan, leveraging the planned underground infrastructure and adding mine life to the operation. Bio oxidation is a technology that utilizes conventional hydrometallurgical equipment and has produced more than 36 million ounces globally over the past 40 years.

Forty percent of the mill feed in the mine plan is characterized as having good conventional metallurgy with 76% recovery utilizing flotation and CIL and 90% utilizing bio-oxidation. 40% of the mill feed in the mine plan is characterized as having poor conventional metallurgy with 37% recovery utilizing flotation and CIL and 90% utilizing bio-oxidation. 20% remains untested, but of similar mineralogical characteristics. This material is being tested in the current metallurgical testing program.

The BIOX flowsheet and projected metallurgical performance was developed by Metso Corporation using standard batch amenability testing. Two LOM composites were developed representing the higher and lower recovery feed types. After evaluating the mineralogical makeup of each, these were combined into a single LOM composite for batch oxidation testing. A total of eight tests were performed to develop recovery estimates, process design criteria, and operating cost estimates resulting in an overall recovery of 90%.

Total Operating Cost Summary

| Operating Costs | Operating Cost (US$/oz Au) | Operating Cost (US$/t feed) |

| Total mining | 421 | 64.85 |

| Total processing | 227 | 34.94 |

| BIOX processing | 87 | 12.59 |

| Total site general and administrative | 50 | 7.75 |

| Refinery and transport | 11 | 1.63 |

| Cash operating costs | 709 | 109.17 |

| Production taxes | 166 | 25.53 |

| Royalties | 48 | 7.36 |

| Total cash costs | 922 | 142.06 |

| Sustaining capital costs | 84 | 13.01 |

| Total AISC | 1,011 | 155.07 |

Figure 4 - Ana Paula Process flow sheet

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/273392_6ab78f34047fc858_004full.jpg

Forecast Capital Cost Estimates

The initial capital cost for the project is estimated to be US$300.1M including US$15M to extend the existing decline into the deposit, US$45.8M for the BIOX circuit and US$56.8M in total contingency. Sustaining capital costs are primarily related to underground development through the life of the mine to support production. The cost estimate is based on work feeding into the Feasibility Study but includes a contingency of 23% of the total.

Forecast Capital Cost Summary

| Capital Costs | Initial (US$M) | Sustaining (US$M) | Total LOM (US$M) |

| Underground mining | 43.4 | 70.1 | 113.5 |

| Process plant | 61.6 | - | 61.6 |

| BIOX plant | 45.8 | - | 45.8 |

| Tailings management | 26.9 | 3.1 | 30.0 |

| Site infrastructure | 20.2 | - | 20.2 |

| Power line upgrade and substation | 6.2 | - | 6.2 |

| Camp expansion | 6.8 | - | 6.8 |

| Total direct costs | 210.9 | 73.2 | 284.1 |

| Indirects | 15.7 | - | 15.7 |

| Contingency | 56.8 | - | 56.8 |

| EPCM | 16.7 | - | 16.7 |

| Closure and reclamation | - | 3.0 | 3.0 |

| Total indirect costs | 89.2 | 3.0 | 92.2 |

| Total | 300.1 | 76.2 | 376.3 |

Economic Analysis

The economic analysis shows a base case after-tax net present value at a discount rate of 5% of US$426.0M, an after-tax internal rate of return of 28.1%, and a payback period of 2.9 years at US$2,400/oz gold. The forecast mine life is 9 years in the study. Approximately 866koz of gold are projected to be produced and sold over the life of the mine.

Summary Economic Results

| Project Valuation Overview | Units | After Tax | Before Tax |

| Total cashflow | US$ M | 631.3 | 903.1 |

| Average annual cash flow | US$ M | 70.1 | 100.3 |

| Average annual cash flow - Years 1-4 | US$ M | 119.2 | 161.0 |

| NPV @ 5.0% (base case) | US$ M | 426.0 | 642.7 |

| NPV @ 8.0% | US$ M | 333.0 | 524.0 |

| Internal rate of return | % | 28.1% | 38.0% |

| Payback period | Years | 2.9 | 2.4 |

| Payback multiple | x | 2.1 | 3.1 |

Metal Prices

The gold market has experienced significant upward price movement in the past few years. The gold price as of November 5th, 2025 is 65% above the base case gold price used in the study.

The sensitivity analysis presents gold price scenarios up to US$4,000/oz Au (near spot prices) to understand the potential impact of continued gold price movement. From the base case price of US$2,400/oz, a change in the average gold price of 10% (US$240/oz Au) would change the after tax NPV5 by approximately US$84M.

The economics of the PEA are most sensitive to gold price variability and, to a lesser extent, the gold recovery and capital expenditure.

Gold Price Sensitivity Analysis

| Au Price (US$/oz Au) | Net Cash Flow (US$M) | After-Tax NPV @ 5.0% Discount Rate (US$ M) | IRR (%) | Payback Period (years) | Payback Multiple |

| 1,600 | 197 | 88 | 10.6 | 4.9 | 0.7 |

| 1,800 | 308 | 174 | 15.5 | 4.0 | 1.0 |

| 2,000 | 417 | 259 | 20.0 | 3.5 | 1.4 |

| 2,200 | 524 | 342 | 24.2 | 3.2 | 1.7 |

| 2,400 | 631 | 426 | 28.1 | 2.9 | 2.1 |

| 2,600 | 739 | 510 | 31.8 | 2.7 | 2.5 |

| 2,800 | 846 | 593 | 35.3 | 2.5 | 2.8 |

| 3,000 | 954 | 677 | 38.7 | 2.4 | 3.2 |

| 3,200 | 1,061 | 761 | 42.0 | 2.2 | 3.5 |

| 3,400 | 1,168 | 845 | 45.2 | 2.1 | 3.9 |

| 3,600 | 1,276 | 928 | 48.3 | 2.0 | 4.3 |

| 3,800 | 1,383 | 1,012 | 51.3 | 1.9 | 4.6 |

| 4,000 | 1,490 | 1,096 | 54.2 | 1.8 | 5.0 |

Next Steps

As of the date of this release, the Company has completed 10,909 metres of a 15,000m drilling program with assay results expected to be released every 4-6 weeks. The program aims to convert Inferred ounces to higher classifications to support technical aspects of an ongoing Feasibility Study and to test exploration targets north of the High Grade Panel. Work is ongoing on a permit amendment to alter the previously granted open pit permits to include the lower-impact underground extraction plan. The Company expects to submit this amendment in Q1, 2026.

Heliostar intends to extend an existing 400m decline an additional 1.2km as part of an early works program through 2026. This is expected to cost approximately US$15M and to be funded from free cash flow generated by the Company from its producing La Colorada and San Agustin mines. It is estimated that it will about eight months to establish access into the deposit and allow for the extraction of a bulk sample from a test stope prior to the start of production.

A further objective from this early works development program is to establish an underground drill platform to be able to test the down plunge extensions of the deposit. The deposit minerology shows that the polymictic breccia that hosts the mineralization that is the focus of the PEA is an upper, distal expression of a larger skarn system. Drilling done by previous operators from surface returned significant intercepts of structurally controlled, high grade mineralization at depth including 13.5m of 29.1 g/t gold from 677.5 metres downhole and 40.7m of 6.3 g/t gold from 677.1 metres downhole. Heliostar sees excellent prospectivity in continuing to trace this mineralization down plunge, potentially vectoring towards the causative intrusion and an interpreted contact skarn. This is the same geological setting that hosts the multi-million ounce endowments at the nearby Moreles Complex (operated by Torex Gold) and Los Filos mine (owned by Equinox Gold).

Heliostar expects to generate enough free cash flow from its two operating mines over the next two years to fund the construction of Ana Paula with the support of a project financing facility. The Company intends to continue working with project financing groups during 2026 with the aim of securing a project financing partner ahead of a potential construction decision for Ana Paula in the first half of 2027.

No production decision has been made at this time.

Qualified Persons

The technical report for the Ana Paula Project will be prepared for Heliostar Metals Ltd. by Mr. Alberto Bennett, PE, Mr. Richard Schwering, SME-RM, Mr. Paul Thornton, P.Eng., Mr. Andrew Kelly, P.Eng., Mr. Art Ibrado, PE, PhD, and Mr. Gilberto Dominguez, PE. Each of these Qualified Persons has reviewed and approved the technical information contained in this news release in their area of expertise and are independent of the Company.

Qualified Persons with Respect to this News Release

Gregg Bush, P.Eng. and Mike Gingles, the Company's Qualified Persons, as such term is defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, have reviewed the scientific and technical information not derived from the updated technical reports and included in this news release in the Company Overview, Commentary by the Company on Relevant Matters and Commentary by the Company on Next Steps and Permitting sections for each property and have approved the disclosure herein.

Data Verification

In addition, the Qualified Persons for each of the technical reports verified the data in the reports in their areas of expertise and concluded that the information supported Mineral Resource estimation, and could be used in mine planning and economic analysis. The verification completed by each Qualified Person is discussed in each technical report and included site visits, and could include data audits, suitability of data for use in estimation and mine planning, quality assurance and quality control checks, review of available technical and economic study data, review of data collection and evaluation methods, review of production data including reconciliation where available, review of actual cost data for operations, and review of third-party inputs to forecasts.

The Company's Qualified persons verified the information that was not derived from the technical reports. The data verification included site visits, data audits, review of available study data, review of data collection and evaluation methods, review of production data including reconciliation where available, review of actual cost data for operations, and review of third-party inputs to forecasts, and consideration of the Company's plans for the projects.

About Heliostar Metals Ltd.

Heliostar is a gold mining company with production from operating mines in Mexico. This includes the La Colorada Mine in Sonora and the San Agustin Mine in Durango. The Company also has a strong portfolio of development and exploration stage projects in Mexico and the USA. These include the Ana Paula project in Guerrero, the Cerro del Gallo project in Guanajuato, the San Antonio project in Baja Sur, all in Mexico and the Unga project in Alaska, USA.

FOR ADDITIONAL INFORMATION PLEASE CONTACT:

| Charles Funk President and Chief Executive Officer Heliostar Metals Limited Email: charles.funk@heliostarmetals.com Phone: +1 844-753-0045 | Rob Grey Investor Relations Manager Heliostar Metals Limited Email: rob.grey@heliostarmetals.com Phone: +1 844-753-0045 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (together, "forward-looking statements") within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are forward-looking statements and are based on the opinions and estimates of management as of the date hereof. Forward-looking statements in this release include, but are not limited to: the results, interpretation and economic projections of the Ana Paula Preliminary Economic Assessment, including estimates of capital and operating costs, mine life, throughput, grades, recoveries, production rates, payback period, NPV and IRR; statements regarding expected timing, scope and cost of planned exploration, drilling, metallurgical and engineering programs; the anticipated timing of completion of a Feasibility Study; expectations concerning permitting, submission and approval of amendment applications; the timing and potential development of an underground decline or early-works program; the potential for additional mineralization at depth and future exploration success; the Company's plans regarding financing arrangements, including the potential for a project finance facility; the expectation that cash flow from existing operations may fund future development; the potential for Ana Paula to be placed into production and the timing thereof; and other statements regarding the Company's future plans, strategies, objectives, expectations and intentions.

Forward-looking statements are based on a number of assumptions considered reasonable by management at the time of making such statements, including, without limitation: the accuracy of the PEA assumptions and parameters; that required permits and approvals will be obtained on reasonable terms and within expected timeframes; the availability of financing for exploration and development activities on acceptable terms; that projected metallurgical recoveries and operating costs will be achieved; that community and governmental support for operations will continue; and general stability in economic and market conditions, exchange rates and commodity prices.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied. Such risks include, without limitation: the preliminary nature of the PEA, which includes Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves; the possibility that future studies will not confirm the PEA results; risks related to exploration, development, permitting and operating activities; cost escalation and inflation; changes in metal prices and exchange rates; financing and liquidity risks; community and environmental risks; reliance on contractors and third parties; title, tax and legal risks; and those risks set out in the Company's continuous disclosure filings available on SEDAR+ (www.sedarplus.ca).

There can be no assurance that the Ana Paula Project will be developed into a producing mine or that the results of the PEA will be realized. The purpose of the forward-looking statements is to provide information about management's current expectations and plans and may not be appropriate for other purposes. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this release. Except as required by applicable securities laws, the Company does not undertake to update any forward-looking statements, whether as a result of new information, future events or otherwise.

No Production Decision: The Company cautions that it has not made a production decision with respect to the Ana Paula Project. Any such decision would only be made following completion of a Feasibility Study, the arrangement of project financing, and receipt of all necessary permits and approvals.

Cautionary Note to U.S. Investors

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability, and U.S. investors are cautioned that terms such as "Measured," "Indicated" and "Inferred Mineral Resource" are recognized and required by Canadian regulations but may not be comparable to similar terms used in U.S. reporting standards.

Non-IFRS Financial Measures

This news release includes certain non-International Financial Reporting Standards ("IFRS") performance measures, including cash costs ("Cash Costs") and all-in sustaining costs ("AISC"). These measures are not standardized financial measures under IFRS and may not be comparable to similar measures used by other issuers. They are provided as additional information to investors and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Cash Costs and AISC are common financial performance measures in the gold mining industry but do not have any standardized meaning under IFRS. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use these metrics to evaluate the economic performance of mining projects and their potential to generate operating earnings and cash flow.

AISC is calculated in accordance with the guidelines published by the World Gold Council ("WGC") in 2013, as updated in 2018, which define AISC as the sum of total cash costs, sustaining capital expenditures, and corporate general and administrative costs, among other items. Other companies may calculate this measure differently due to variations in underlying principles and policies applied. Note that in respect of AISC metrics disclosed herein, corporate general and administrative expenses have not been included, as such economics are presented at the project level.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273392