What a brutal six months it’s been for Compass Diversified. The stock has dropped 28.5% and now trades at $5.70, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Compass Diversified, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Compass Diversified Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons you should be careful with CODI and a stock we'd rather own.

1. Lackluster Revenue Growth

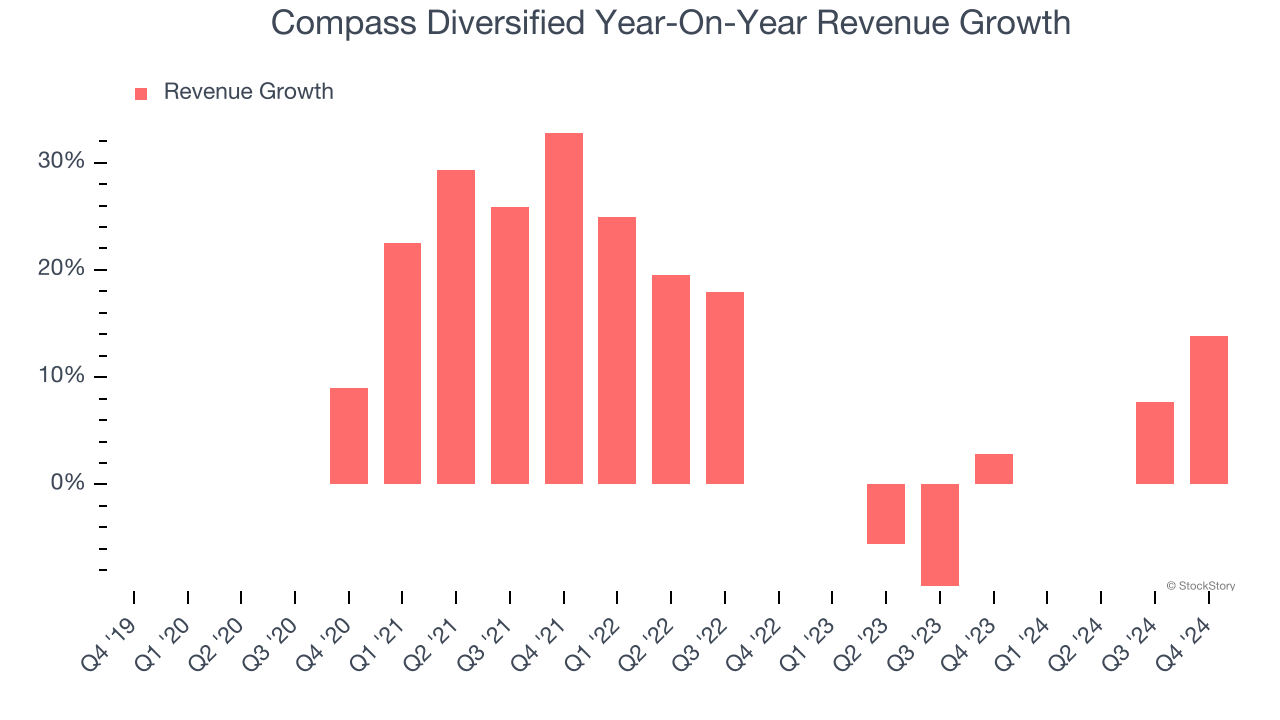

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Compass Diversified’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. Recent EPS Growth Below Our Standards

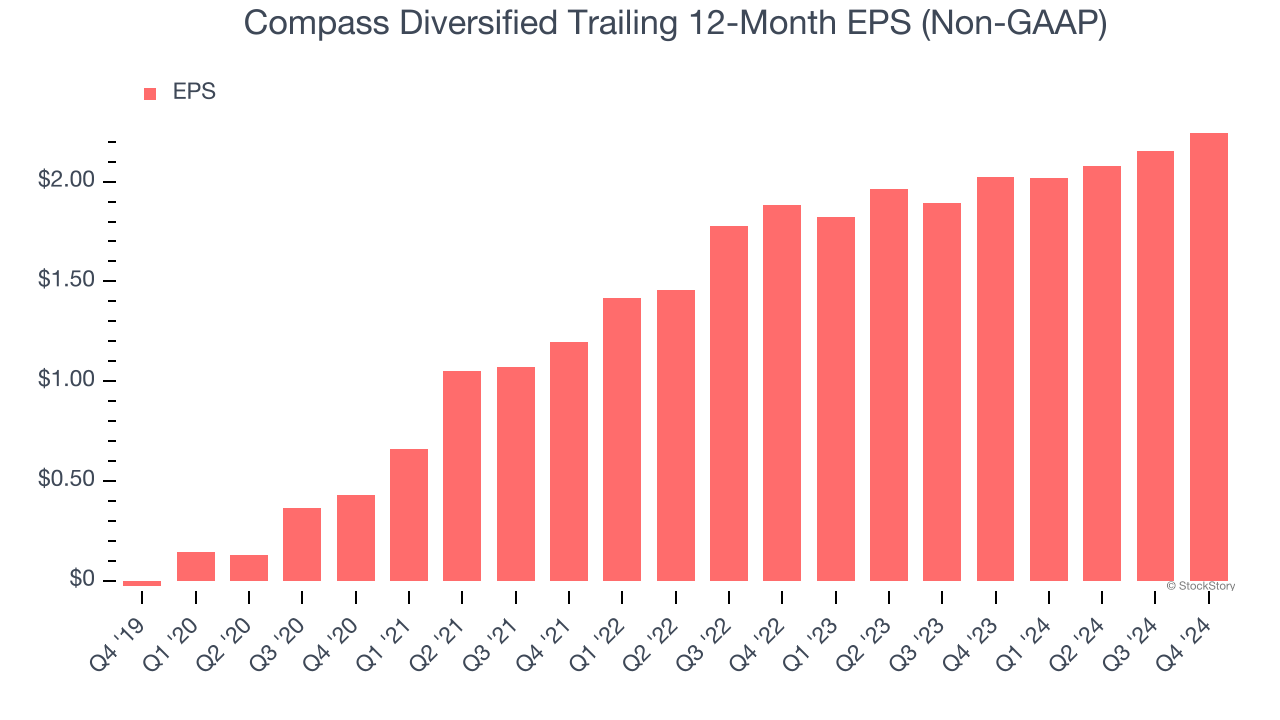

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Compass Diversified’s EPS grew at an unimpressive 9.2% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 1.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Haven’t Paid Off Yet

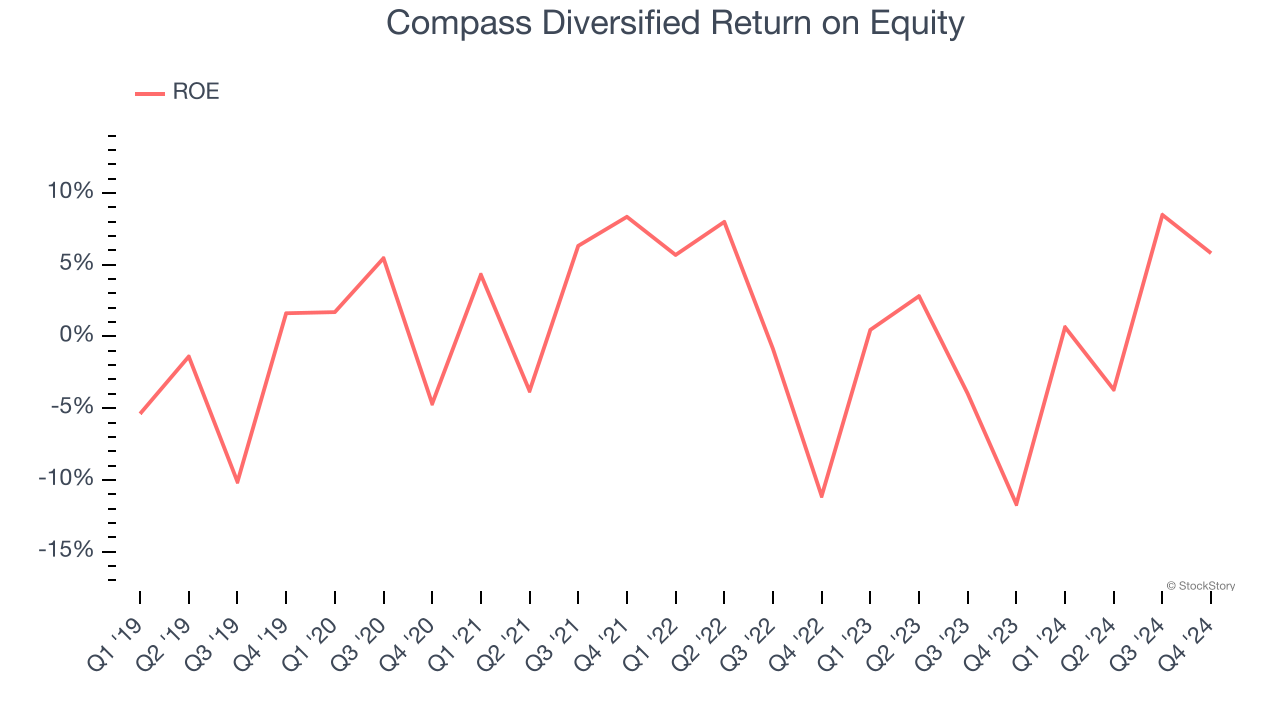

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Compass Diversified has averaged an ROE of 1%, uninspiring for a company operating in a sector where the average shakes out around 10%.

Final Judgment

Compass Diversified isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 2.3× forward P/E (or $5.70 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Compass Diversified

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.