Over the last six months, Enovis’s shares have sunk to $30.86, producing a disappointing 14.8% loss - a stark contrast to the S&P 500’s 16.3% gain. This might have investors contemplating their next move.

Is now the time to buy Enovis, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think Enovis Will Underperform?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons there are better opportunities than ENOV and a stock we'd rather own.

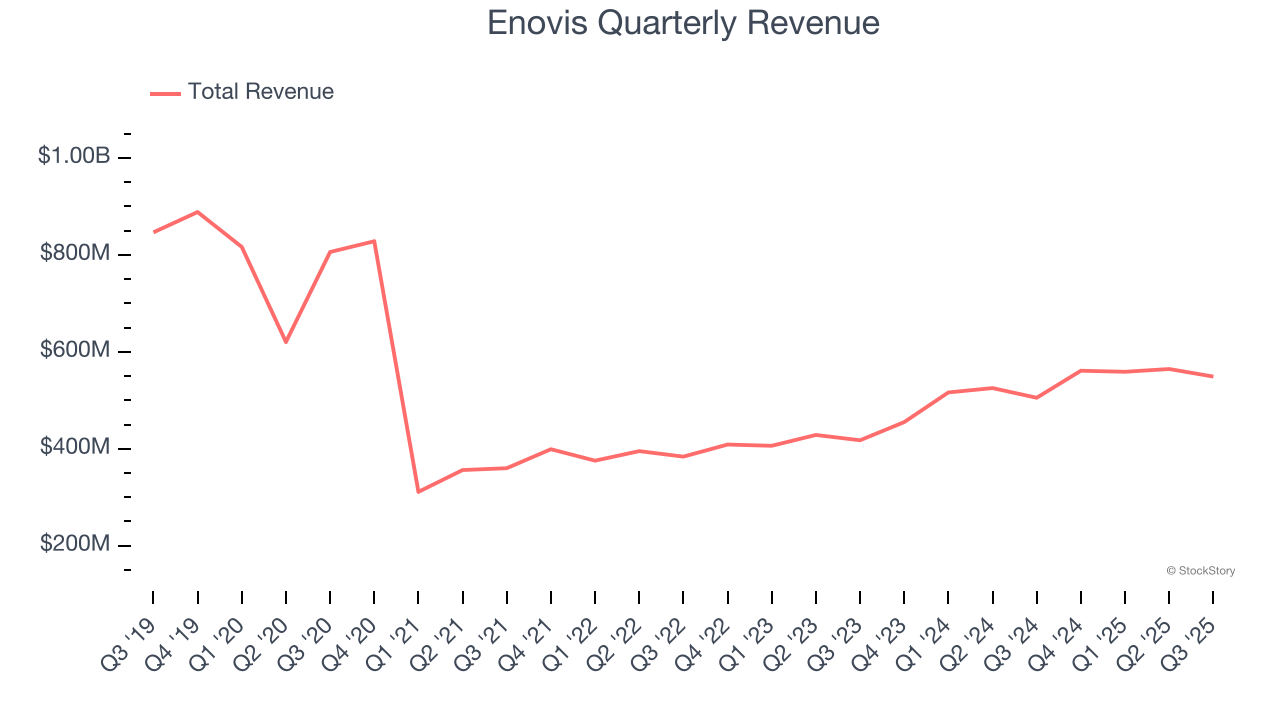

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Enovis’s demand was weak over the last five years as its sales fell at a 6.5% annual rate. This was below our standards and is a sign of poor business quality.

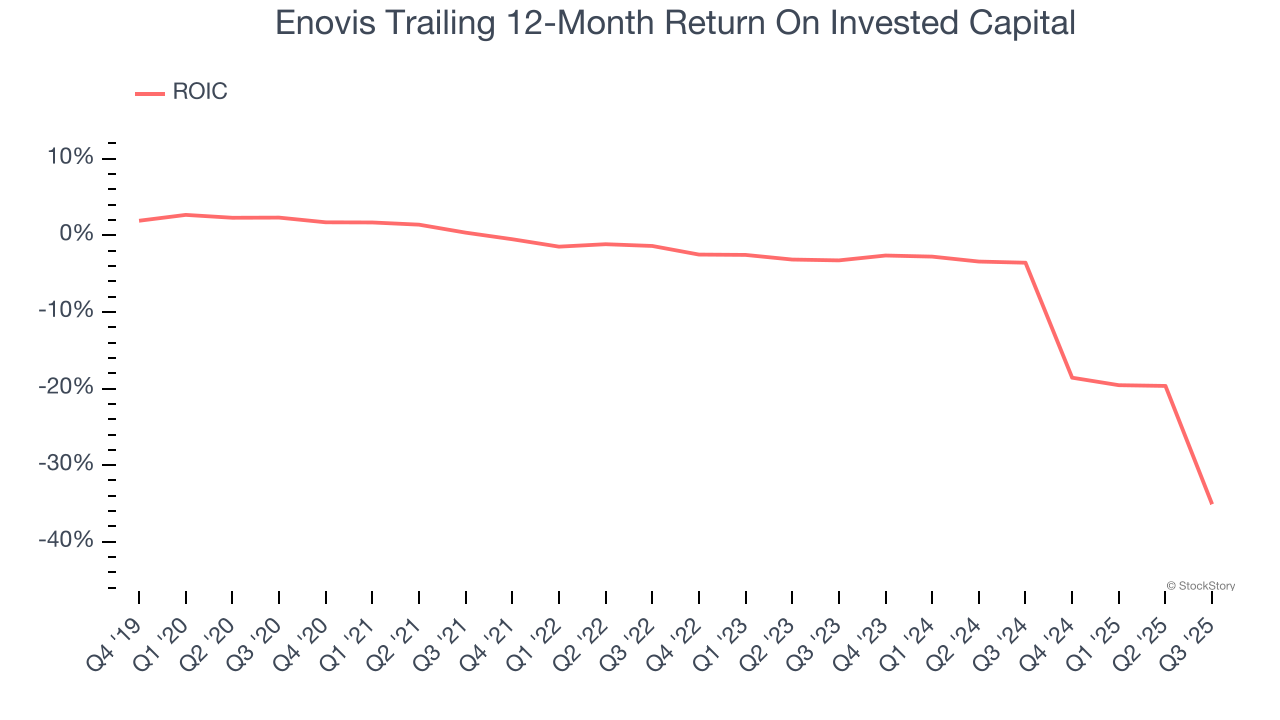

2. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Enovis’s five-year average ROIC was negative 8.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Enovis’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Enovis falls short of our quality standards. Following the recent decline, the stock trades at 9.6× forward P/E (or $30.86 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.