Pet company Central Garden & Pet (NASDAQ:CENT) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 1.3% year on year to $678.2 million. Its non-GAAP loss of $0.09 per share was 54.3% above analysts’ consensus estimates.

Is now the time to buy Central Garden & Pet? Find out by accessing our full research report, it’s free for active Edge members.

Central Garden & Pet (CENT) Q3 CY2025 Highlights:

- Revenue: $678.2 million vs analyst estimates of $652.7 million (1.3% year-on-year growth, 3.9% beat)

- Adjusted EPS: -$0.09 vs analyst estimates of -$0.20 (54.3% beat)

- Adjusted EBITDA: $25.67 million vs analyst estimates of $18.88 million (3.8% margin, 36% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.70 at the midpoint, missing analyst estimates by 1.5%

- Operating Margin: -0.9%, in line with the same quarter last year

- Free Cash Flow Margin: 25.3%, down from 28.8% in the same quarter last year

- Market Capitalization: $1.87 billion

"This was a record year on the bottom line, marked by continued margin expansion and disciplined execution of our Cost and Simplicity agenda," said Niko Lahanas, CEO of Central Garden & Pet.

Company Overview

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $3.13 billion in revenue over the past 12 months, Central Garden & Pet carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

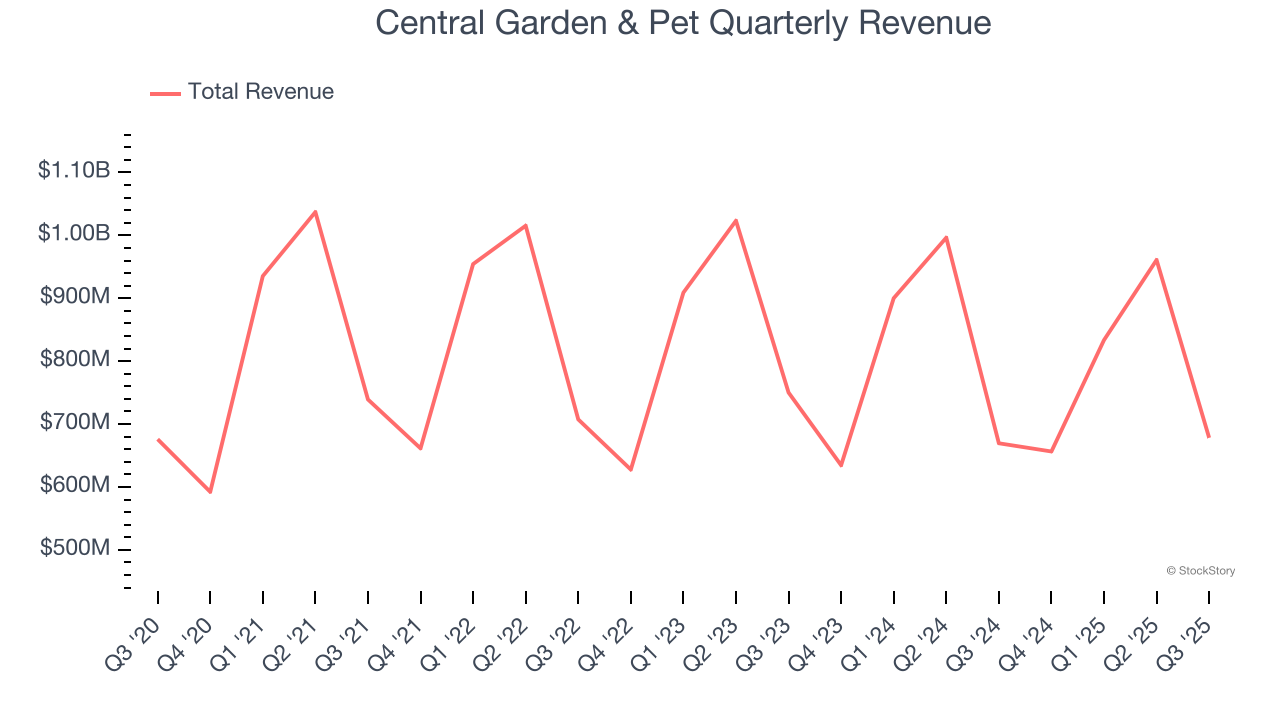

As you can see below, Central Garden & Pet’s revenue declined by 2.1% per year over the last three years, a poor baseline for our analysis.

This quarter, Central Garden & Pet reported modest year-on-year revenue growth of 1.3% but beat Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products will spur better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

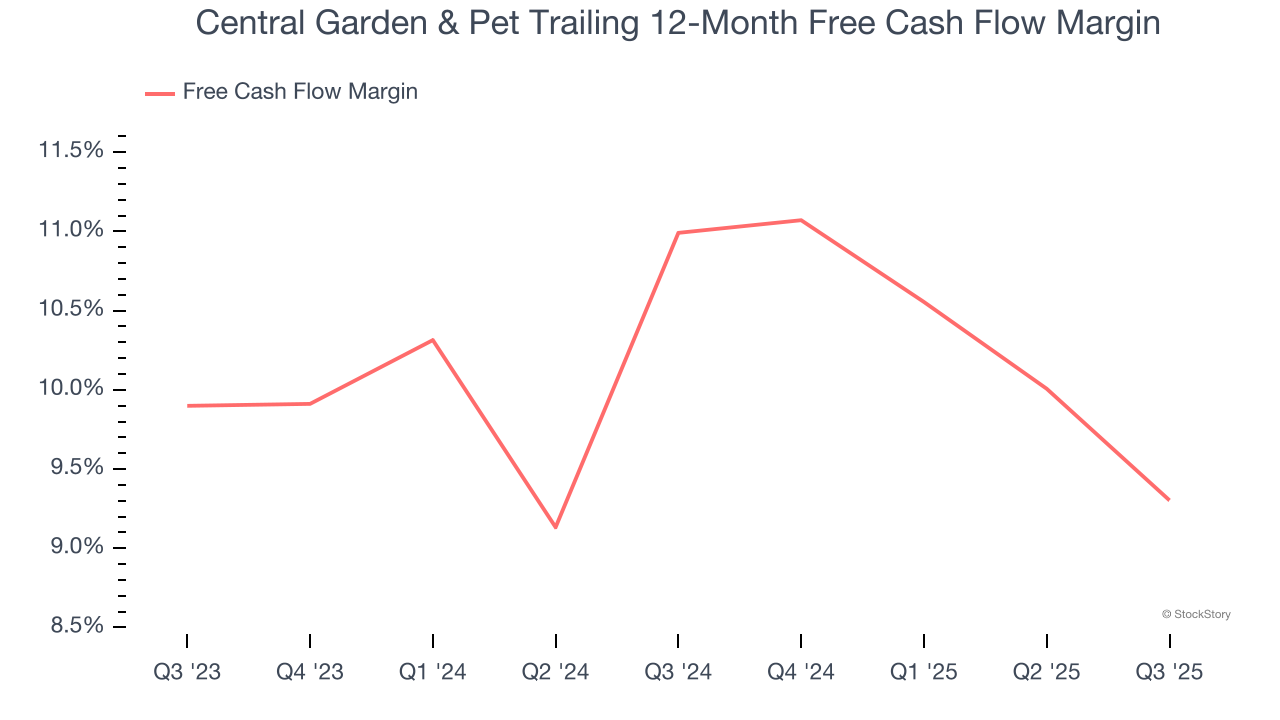

Central Garden & Pet has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.2% over the last two years, quite impressive for a consumer staples business.

Taking a step back, we can see that Central Garden & Pet’s margin dropped by 1.7 percentage points over the last year. This decrease warrants extra caution because Central Garden & Pet failed to grow its revenue organically. Its cash profitability could decay further if it tries to reignite growth through investments.

Central Garden & Pet’s free cash flow clocked in at $171.9 million in Q3, equivalent to a 25.3% margin. The company’s cash profitability regressed as it was 3.5 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

Key Takeaways from Central Garden & Pet’s Q3 Results

It was good to see Central Garden & Pet beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EPS guidance slightly missed. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 1.8% to $30.86 immediately after reporting.

So should you invest in Central Garden & Pet right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.