Footwear, apparel, and accessories retailer Genesco (NYSE:GCO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 3.3% year on year to $616.2 million. Its non-GAAP profit of $0.79 per share was 8.1% below analysts’ consensus estimates.

Is now the time to buy Genesco? Find out by accessing our full research report, it’s free for active Edge members.

Genesco (GCO) Q3 CY2025 Highlights:

- “We experienced a meaningful pullback in the back half of the third quarter, as consumers retreated following the back-to-school season when there was less of a reason to shop."

- Revenue: $616.2 million vs analyst estimates of $618.4 million (3.3% year-on-year growth, in line)

- Adjusted EPS: $0.79 vs analyst expectations of $0.86 (8.1% miss)

- Management lowered its full-year Adjusted EPS guidance to $0.95 at the midpoint, a 36.7% decrease

- Operating Margin: 1.4%, in line with the same quarter last year

- Locations: 1,245 at quarter end, down from 1,302 in the same quarter last year

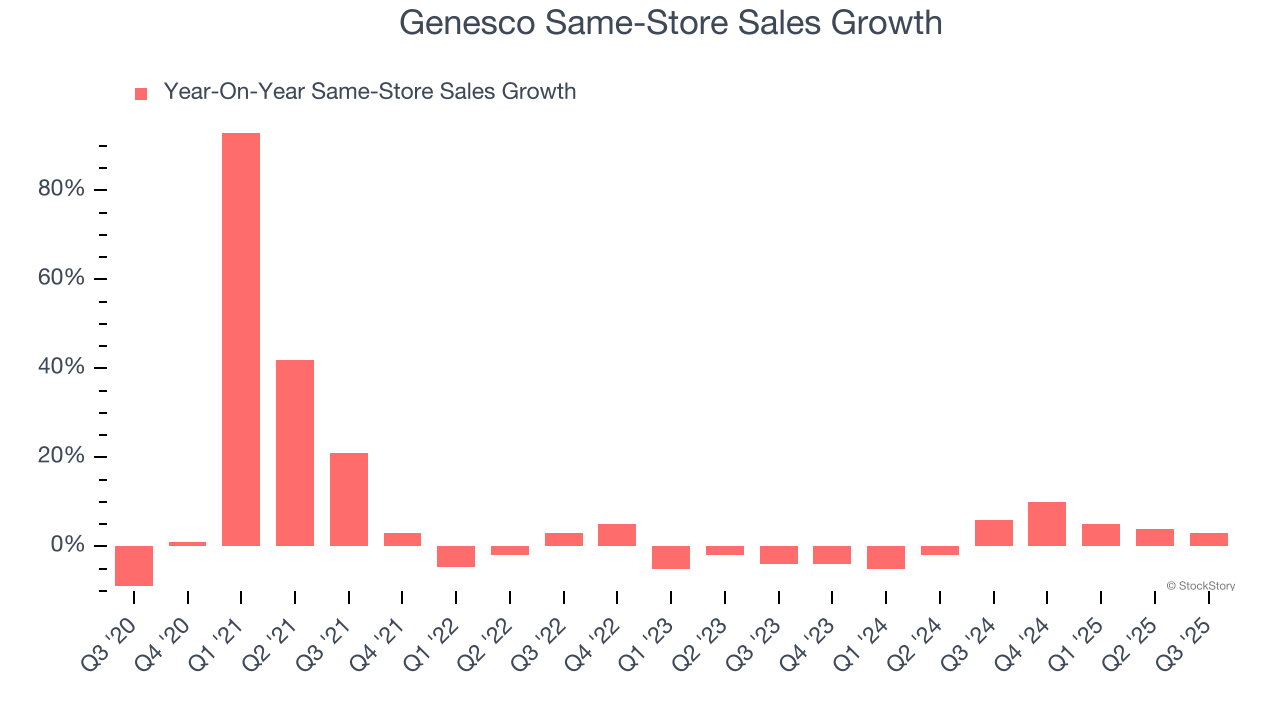

- Same-Store Sales rose 3% year on year (6% in the same quarter last year)

- Market Capitalization: $380.5 million

Mimi E. Vaughn, Genesco's Board Chair, President and Chief Executive Officer, said, “We delivered another quarter of top and bottom-line growth, marking our fifth consecutive quarter of positive comparable sales increases. The third quarter demonstrated the power of our strategic initiatives, with Journeys delivering strong double-digit comp growth during back-to-school on top of double-digit growth last year. This performance reinforces that when consumers shop for footwear, they are increasingly choosing Journeys, underscoring the momentum of our product elevation and diversification strategy as we continue to gain market share and establish ourselves as the destination for the style-led teen.”

Company Overview

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Revenue Growth

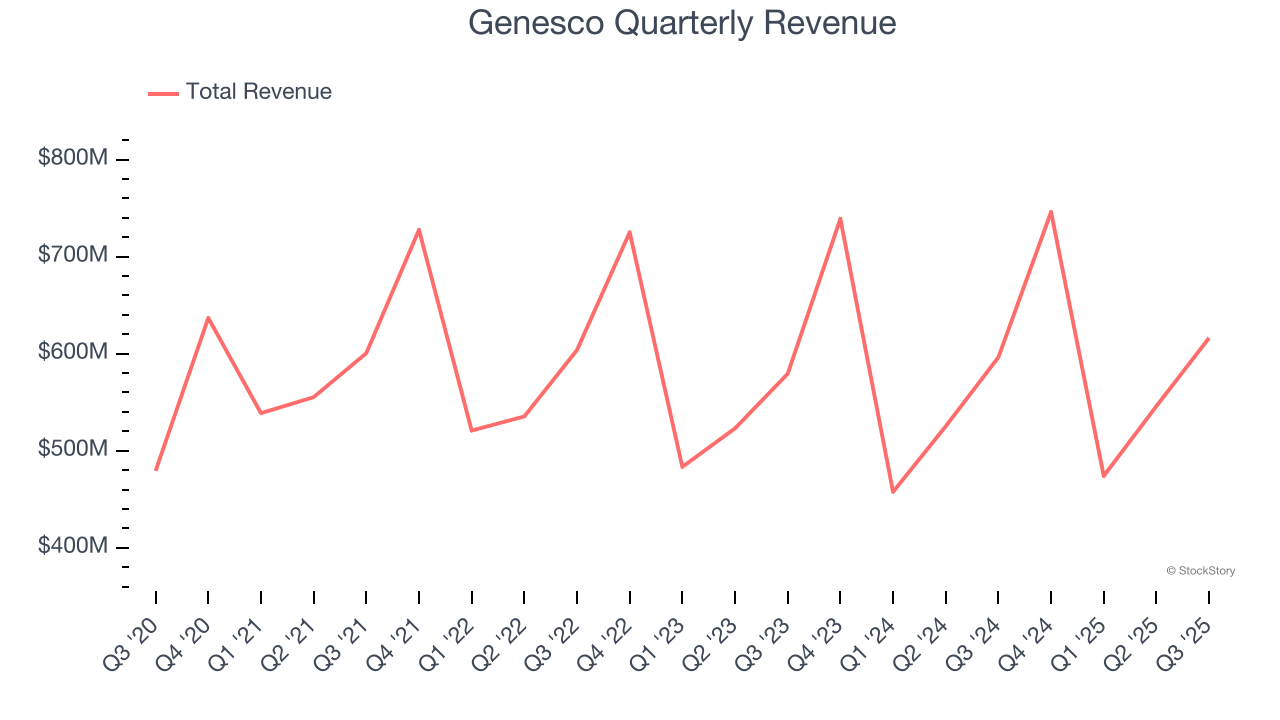

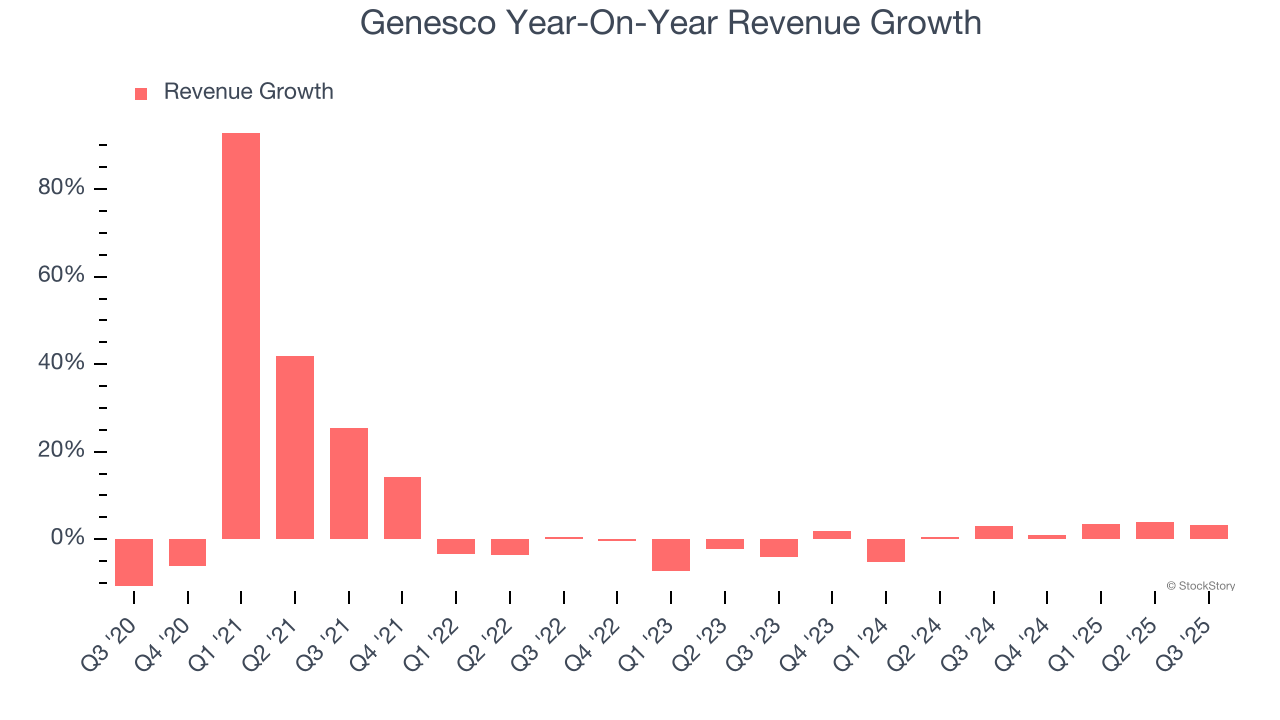

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Genesco’s 5.4% annualized revenue growth over the last five years was weak. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Genesco’s recent performance shows its demand has slowed as its annualized revenue growth of 1.5% over the last two years was below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Genesco’s same-store sales averaged 2.1% year-on-year growth. This number doesn’t surprise us as it’s in line with its revenue growth.

This quarter, Genesco grew its revenue by 3.3% year on year, and its $616.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not lead to better top-line performance yet.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Genesco’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same. The company broke even over the last two years, inadequate for a consumer discretionary business. Its large expense base and inefficient cost structure were the main culprits behind this performance.

This quarter, Genesco generated an operating margin profit margin of 1.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Genesco’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Genesco reported adjusted EPS of $0.79, up from $0.61 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Genesco’s full-year EPS of $0.86 to grow 136%.

Key Takeaways from Genesco’s Q3 Results

We struggled to find many positives in these results. Its EPS missed and its full-year EPS guidance also fell short of Wall Street’s estimates. Management was blunt, remarking that the company “...experienced a meaningful pullback in the back half of the third quarter, as consumers retreated following the back-to-school season when there was less of a reason to shop." Overall, this was a softer quarter. The stock traded down 26.6% to $25.80 immediately following the results.

Genesco’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.