Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Boston Scientific (NYSE:BSX) and the best and worst performers in the medical devices & supplies - diversified industry.

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

The 4 medical devices & supplies - diversified stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was in line.

While some medical devices & supplies - diversified stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.2% since the latest earnings results.

Best Q4: Boston Scientific (NYSE:BSX)

Founded in 1979, Boston Scientific (NYSE:BSX) is a medical device company that designs, manufactures, and sells a wide range of technologies used in minimally-invasive medical procedures.

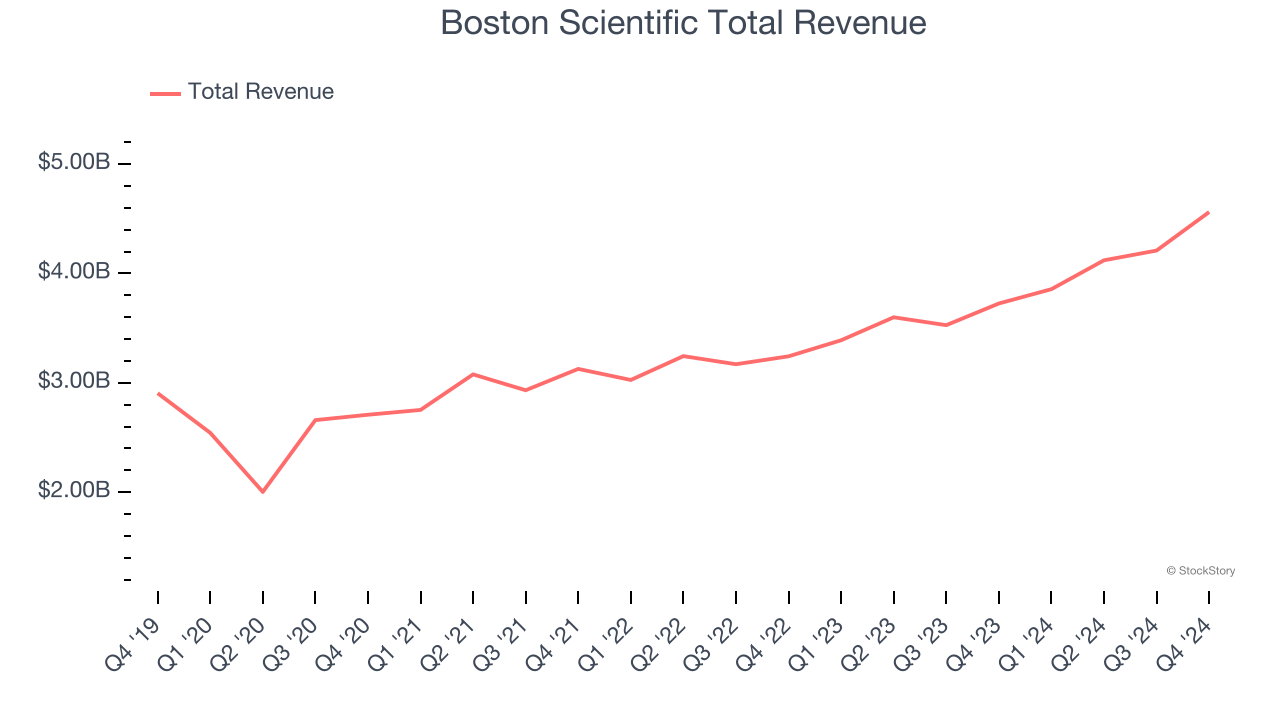

Boston Scientific reported revenues of $4.56 billion, up 22.4% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ organic revenue estimates.

"2024 was one of the best years in the history of Boston Scientific, fueled by our innovative portfolio, the launch of our FARAPULSE™ Pulsed Field Ablation System as well as significant clinical achievements and commercial excellence across businesses and regions," said Mike Mahoney, chairman and chief executive officer, Boston Scientific.

Boston Scientific achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 1.7% since reporting and currently trades at $105.27.

Is now the time to buy Boston Scientific? Access our full analysis of the earnings results here, it’s free.

Stryker (NYSE:SYK)

Founded in 1941 as a specialty medical products business, Stryker Corporation today designs and sells a wide range of medical devices, equipment, and technology across areas like orthopedics (bones, joints, ligaments, etc.), surgical equipment, and spine.

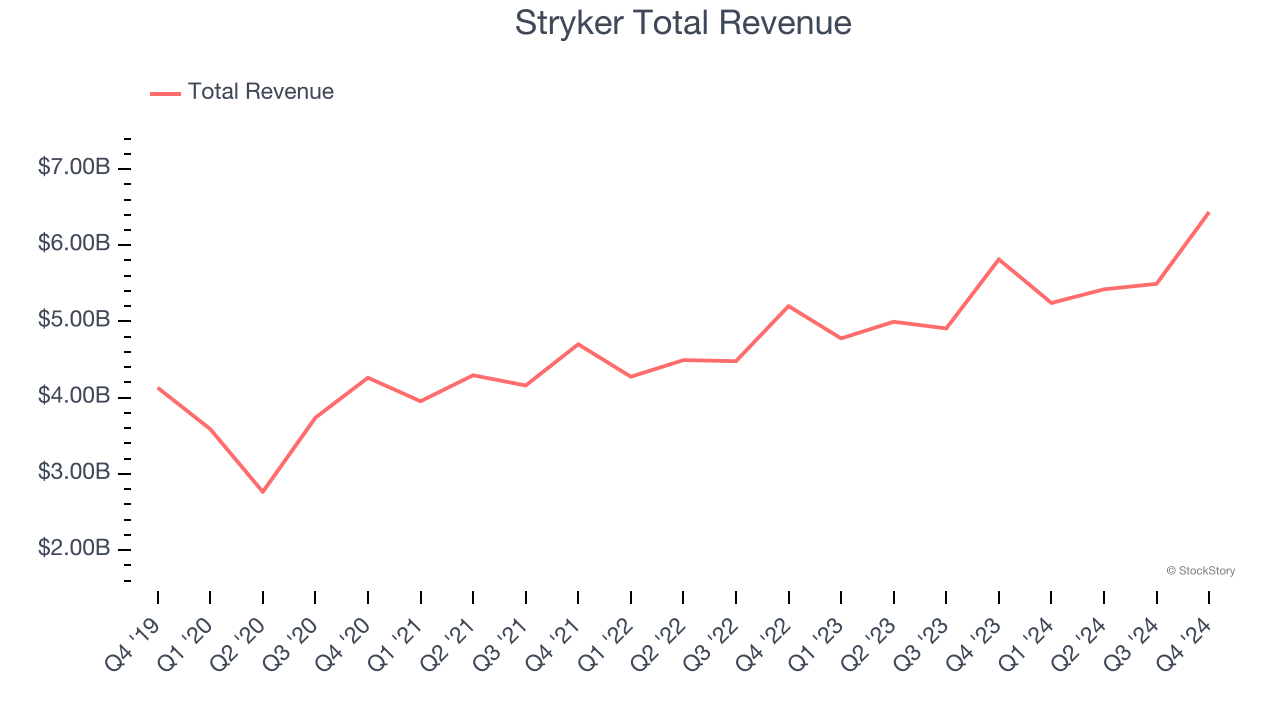

Stryker reported revenues of $6.44 billion, up 10.7% year on year, outperforming analysts’ expectations by 1.4%. The business had a satisfactory quarter with an impressive beat of analysts’ organic revenue estimates but EPS in line with analysts’ estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $393.19.

Is now the time to buy Stryker? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Abbott Laboratories (NYSE:ABT)

Founded in 1888 as a small pharmaceutical company, Abbott Laboratories (NYSE:ABT) develops and sells a wide range of nutrition products, medical devices, and branded pharmaceuticals.

Abbott Laboratories reported revenues of $10.97 billion, up 7.2% year on year, in line with analysts’ expectations. It was a slower quarter as it posted EPS in line with analysts’ estimates.

Abbott Laboratories delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 10.4% since the results and currently trades at $128.95.

Read our full analysis of Abbott Laboratories’s results here.

Neogen (NASDAQ:NEOG)

Founded in 1982, Neogen (NASDAQ:NEOG) provides a broad range of products and services to ensure food safety and animal health, including diagnostic tests, food safety equipment, and veterinary pharmaceuticals.

Neogen reported revenues of $231.3 million, flat year on year. This result topped analysts’ expectations by 1.4%. Taking a step back, it was a mixed quarter as it logged EPS in line with analysts’ estimates.

Neogen had the slowest revenue growth among its peers. The stock is down 20.6% since reporting and currently trades at $10.40.

Read our full, actionable report on Neogen here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.