Building products manufacturer Simpson (NYSE:SSD) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 3.1% year on year to $517.4 million. Its GAAP profit of $1.31 per share was 3.6% above analysts’ consensus estimates.

Is now the time to buy Simpson? Find out by accessing our full research report, it’s free.

Simpson (SSD) Q4 CY2024 Highlights:

- Revenue: $517.4 million vs analyst estimates of $496 million (3.1% year-on-year growth, 4.3% beat)

- EPS (GAAP): $1.31 vs analyst estimates of $1.27 (3.6% beat)

- Adjusted EBITDA: $102 million vs analyst estimates of $96.99 million (19.7% margin, 5.2% beat)

- Operating Margin: 14.9%, in line with the same quarter last year

- Market Capitalization: $6.97 billion

"During 2024, we grew revenues modestly in a challenging year where housing starts in both the U.S. and Europe declined," commented Mike Olosky, President and Chief Executive Officer of Simpson Manufacturing Co.,

Company Overview

Aiming to build safer and stronger buildings, Simpson (NYSE:SSD) designs and manufactures structural connectors, anchors, and other construction products.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

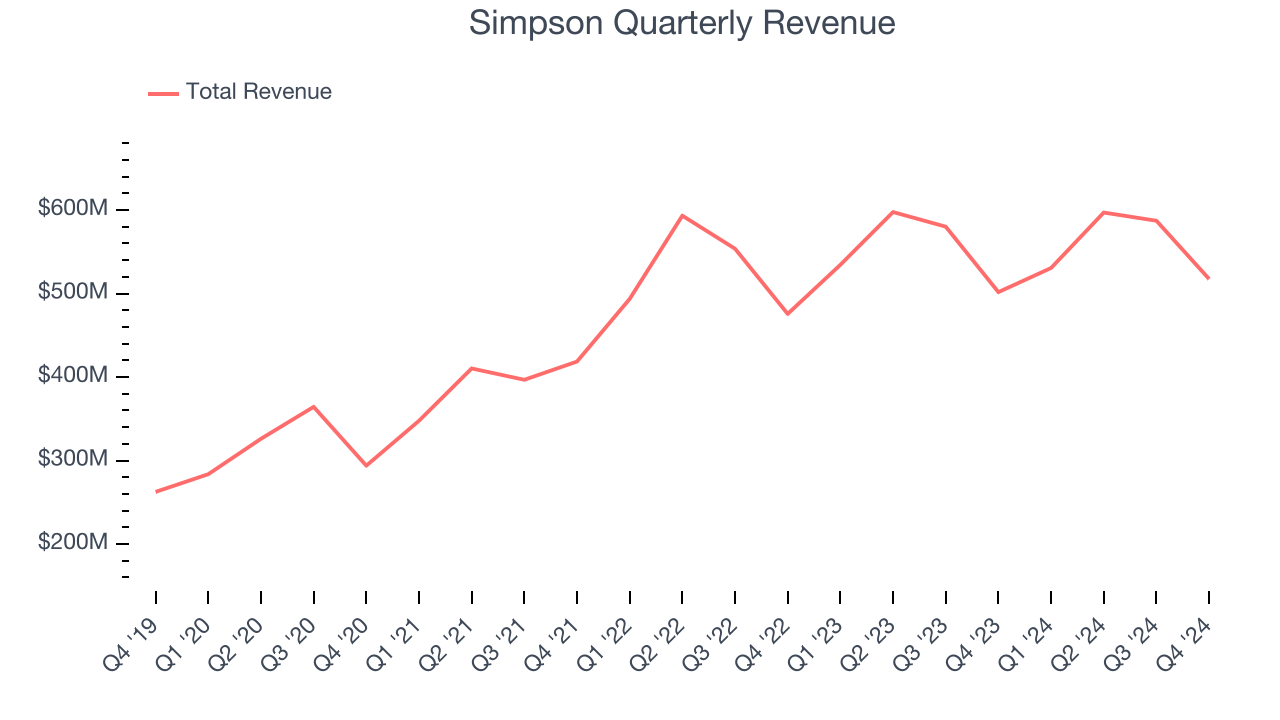

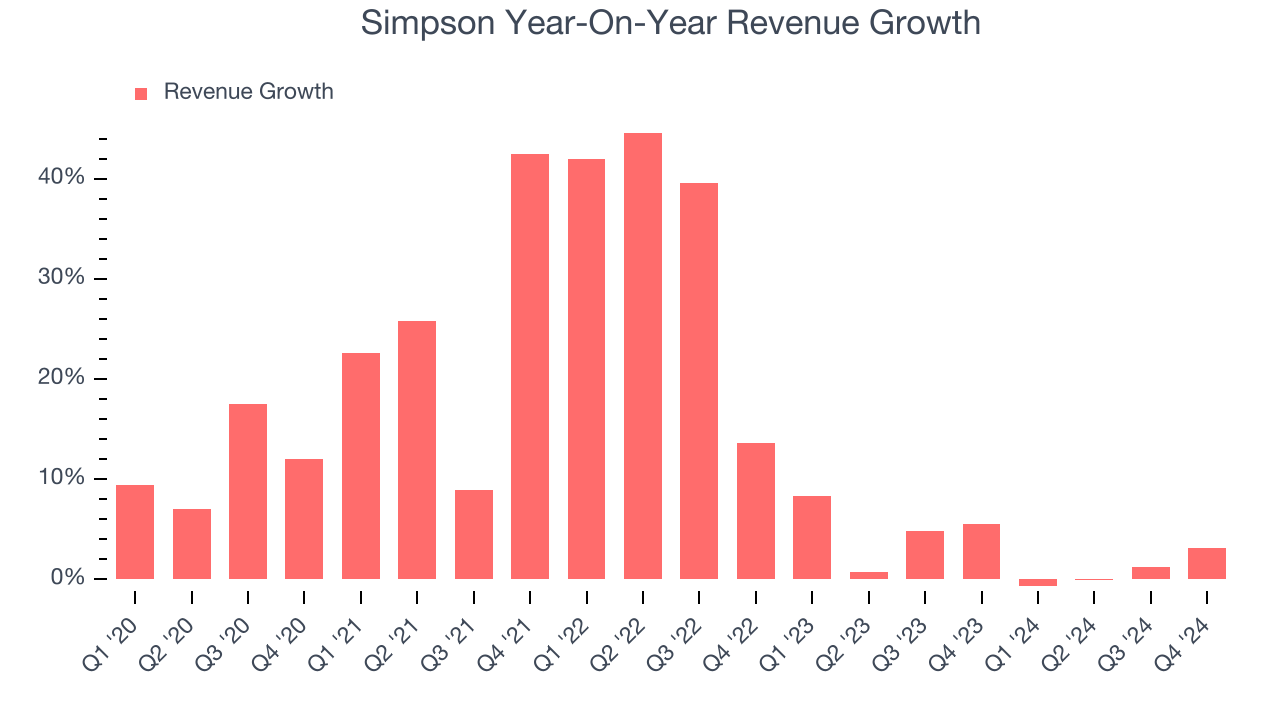

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Simpson’s 14.5% annualized revenue growth over the last five years was exceptional. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Simpson’s recent history shows its demand slowed significantly as its annualized revenue growth of 2.7% over the last two years is well below its five-year trend.

This quarter, Simpson reported modest year-on-year revenue growth of 3.1% but beat Wall Street’s estimates by 4.3%.

Looking ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

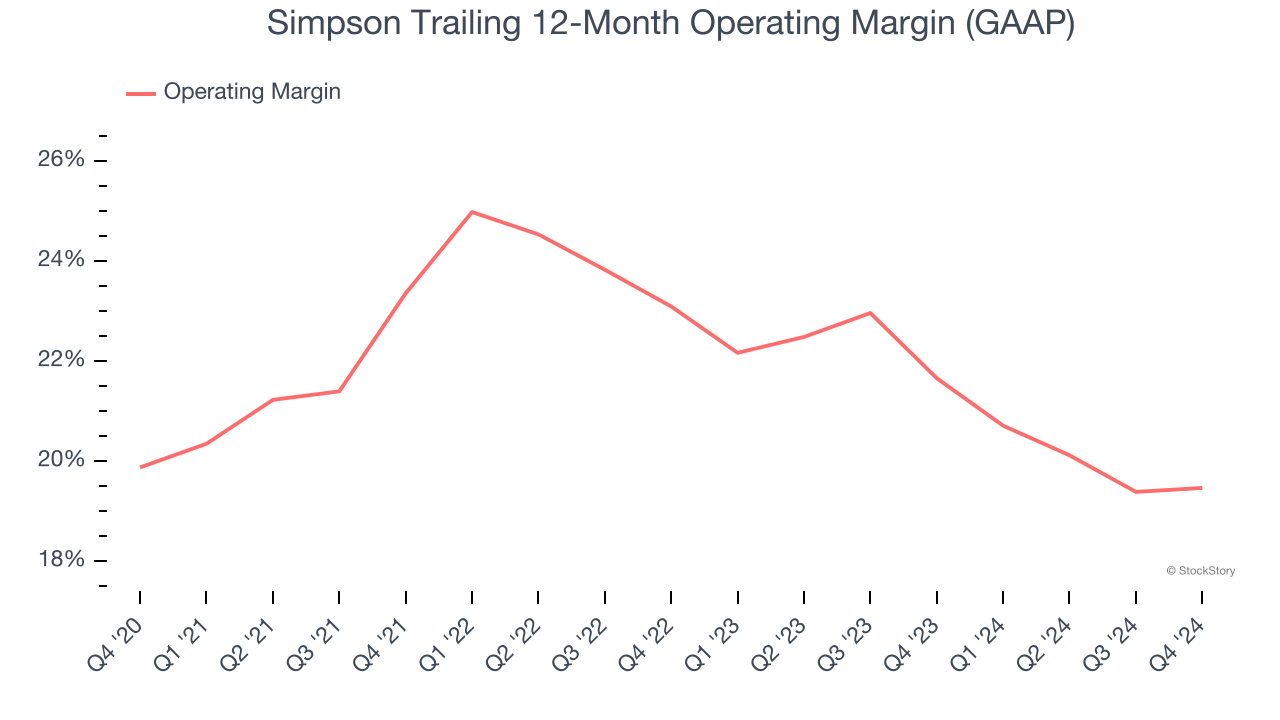

Operating Margin

Simpson has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 21.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Simpson’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years , highlighting the long-term consistency of its business.

In Q4, Simpson generated an operating profit margin of 14.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

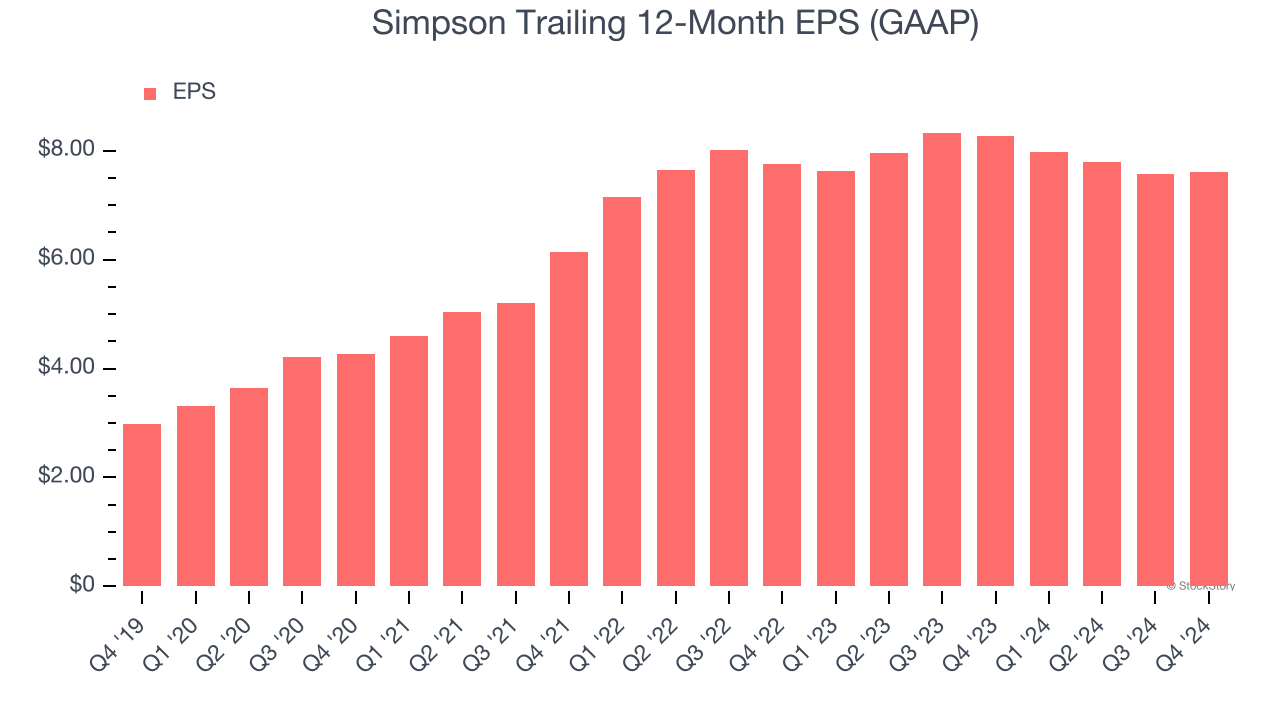

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

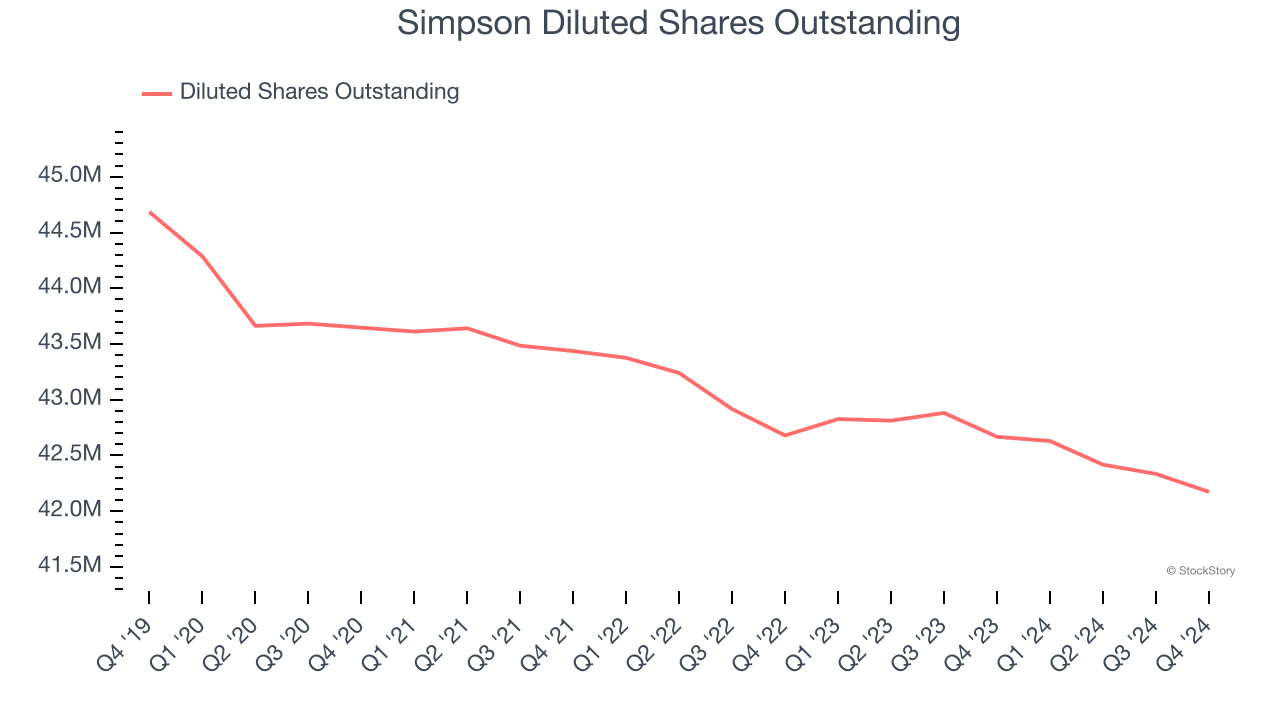

Simpson’s EPS grew at an astounding 20.6% compounded annual growth rate over the last five years, higher than its 14.5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

We can take a deeper look into Simpson’s earnings quality to better understand the drivers of its performance. A five-year view shows that Simpson has repurchased its stock, shrinking its share count by 5.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Simpson, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q4, Simpson reported EPS at $1.31, up from $1.28 in the same quarter last year. This print beat analysts’ estimates by 3.6%. Over the next 12 months, Wall Street expects Simpson’s full-year EPS of $7.60 to grow 7.7%.

Key Takeaways from Simpson’s Q4 Results

We were impressed by how significantly Simpson blew past analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $166.88 immediately following the results.

Sure, Simpson had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.