Action camera company GoPro (NASDAQ:GPRO) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales fell by 32% year on year to $200.9 million. On the other hand, next quarter’s revenue guidance of $125 million was less impressive, coming in 8.8% below analysts’ estimates. Its non-GAAP loss of $0.09 per share was 21.7% above analysts’ consensus estimates.

Is now the time to buy GoPro? Find out by accessing our full research report, it’s free.

GoPro (GPRO) Q4 CY2024 Highlights:

- Revenue: $200.9 million vs analyst estimates of $199.2 million (32% year-on-year decline, 0.8% beat)

- Adjusted EPS: -$0.09 vs analyst estimates of -$0.12 (21.7% beat)

- Adjusted EBITDA: -$14.36 million vs analyst estimates of -$15.83 million (-7.1% margin, 9.3% beat)

- Revenue Guidance for Q1 CY2025 is $125 million at the midpoint, below analyst estimates of $137 million

- Adjusted EPS guidance for Q1 CY2025 is -$0.13 at the midpoint, below analyst estimates of -$0.08

- Operating Margin: -19.5%, down from -3.2% in the same quarter last year

- Free Cash Flow was -$25.52 million, down from $43.19 million in the same quarter last year

- Market Capitalization: $168.7 million

"In 2024 we undertook several initiatives to put us back on a path to return to growth and profitability in 2026. This includes our plan to reduce operating expenses for 2025 by nearly 30% and refining our roadmap to pursue improved product diversification and how efficiently we design our products," said Nicholas Woodman, GoPro's founder and CEO.

Company Overview

Known for sponsoring extreme athletes, GoPro (NASDAQ:GPRO) is a camera company known for its POV videos and editing software.

Consumer Electronics

Consumer electronics companies aim to address the evolving leisure and entertainment needs of consumers, who are increasingly familiar with technology in everyday life. Whether it’s speakers for the home or specialized cameras to document everything from a surfing session to a wedding reception, these businesses are trying to provide innovative, high-quality products that are both useful and cool to own. Adding to the degree of difficulty for these companies is technological change, where the latest smartphone could disintermediate a whole category of consumer electronics. Companies that successfully serve customers and innovate can enjoy high customer loyalty and pricing power, while those that struggle with these may go the way of the VHS tape.

Sales Growth

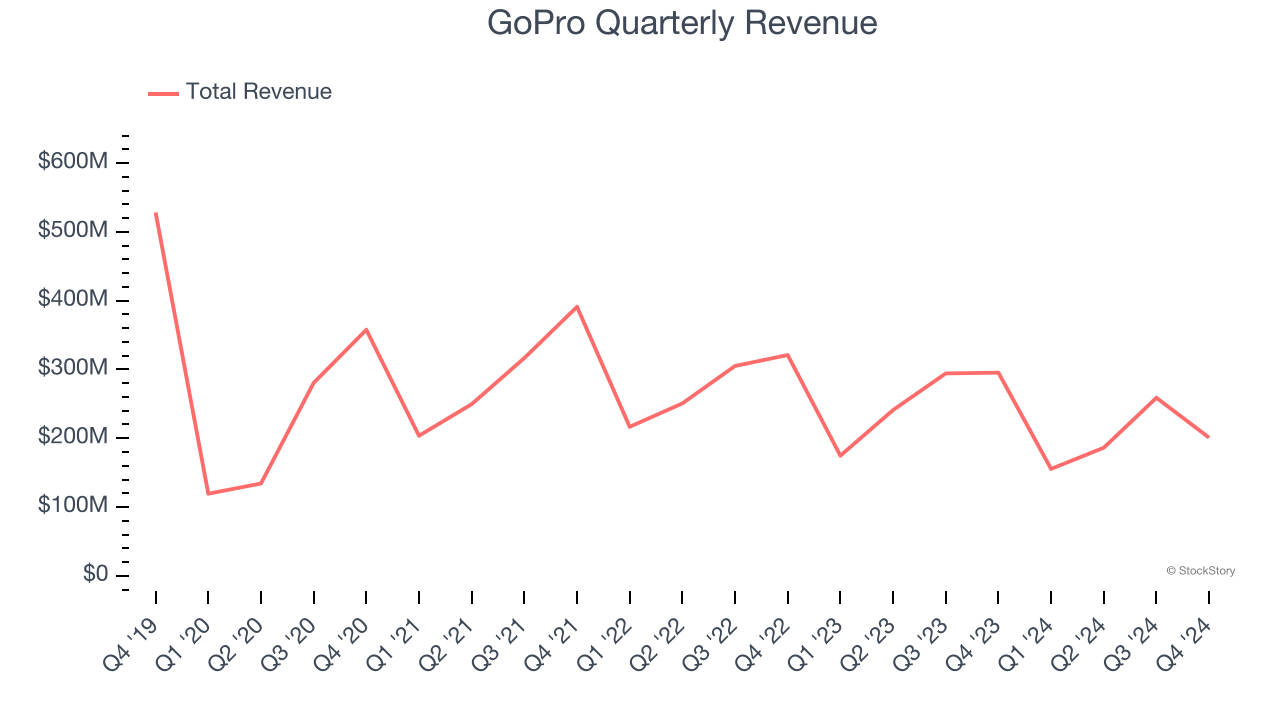

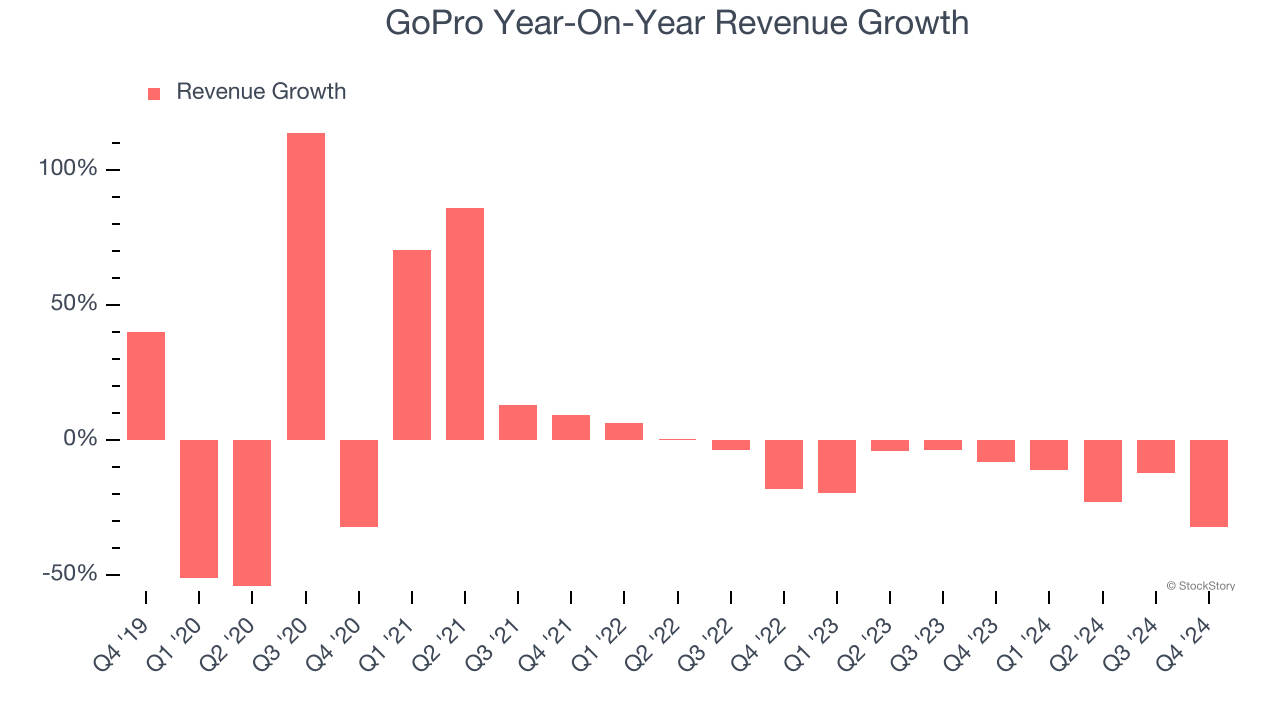

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. GoPro’s demand was weak over the last five years as its sales fell at a 7.7% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. GoPro’s recent history shows its demand has stayed suppressed as its revenue has declined by 14.4% annually over the last two years.

This quarter, GoPro’s revenue fell by 32% year on year to $200.9 million but beat Wall Street’s estimates by 0.8%. Company management is currently guiding for a 19.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 6.1% over the next 12 months. While this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

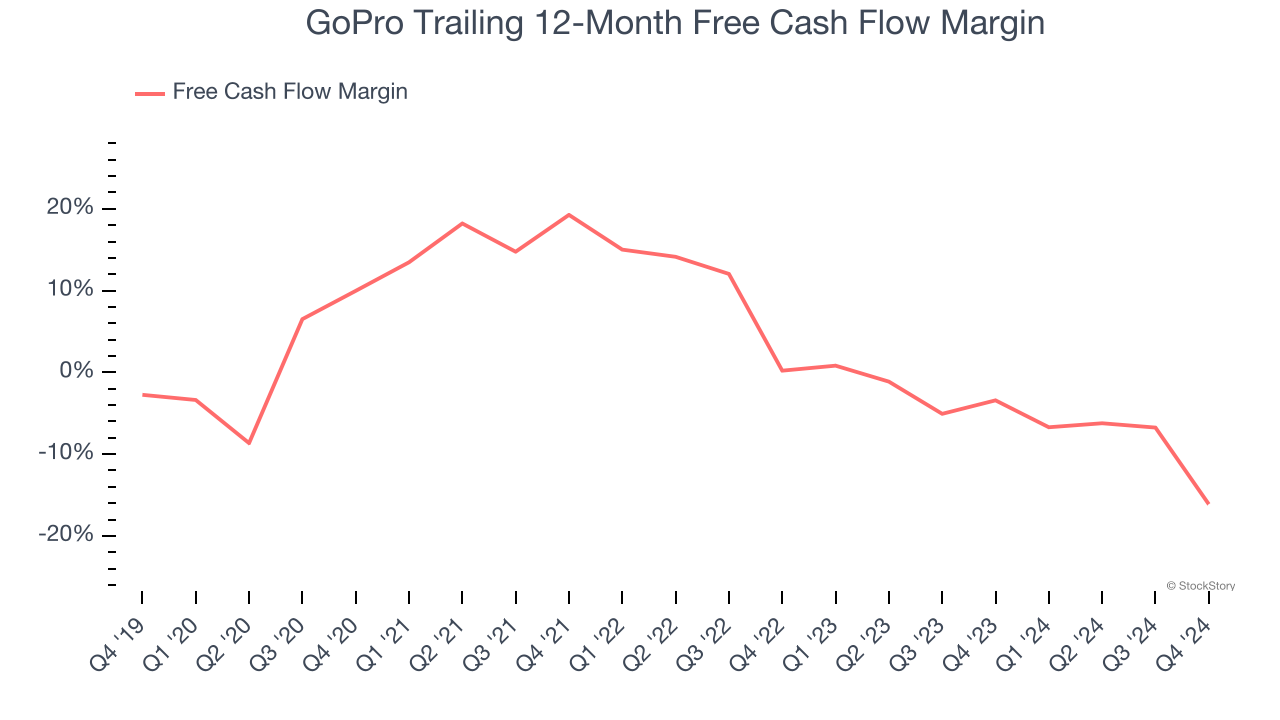

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the last two years, GoPro’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.1%, meaning it lit $9.05 of cash on fire for every $100 in revenue.

GoPro burned through $25.52 million of cash in Q4, equivalent to a negative 12.7% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Looking forward, analysts predict GoPro will generate cash on a full-year basis. Their consensus estimates imply its free cash flow margin of negative 16.1% for the last 12 months will increase to positive 2.4%, giving it more money to invest.

Key Takeaways from GoPro’s Q4 Results

We enjoyed seeing GoPro exceed analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its revenue and EPS guidance for next quarter missed significantly. Overall, this was a weaker quarter. The stock traded down 5.9% to $1.04 immediately after reporting.

The latest quarter from GoPro’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.