Healthcare tech company Omnicell (NASDAQ:OMCL) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 18.6% year on year to $306.9 million. On the other hand, next quarter’s revenue guidance of $260 million was less impressive, coming in 2% below analysts’ estimates. Its non-GAAP profit of $0.60 per share was 2.8% above analysts’ consensus estimates.

Is now the time to buy Omnicell? Find out by accessing our full research report, it’s free.

Omnicell (OMCL) Q4 CY2024 Highlights:

- Revenue: $306.9 million vs analyst estimates of $300.2 million (18.6% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.60 vs analyst estimates of $0.58 (2.8% beat)

- Adjusted EBITDA: $46.42 million vs analyst estimates of $42.65 million (15.1% margin, 8.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.13 billion at the midpoint, missing analyst estimates by 1.9% and implying 1.6% growth (vs -2.4% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $1.75 at the midpoint, missing analyst estimates by 2.5%

- EBITDA guidance for the upcoming financial year 2025 is $147.5 million at the midpoint, above analyst estimates of $143.1 million

- Operating Margin: 4%, up from -9% in the same quarter last year

- Free Cash Flow Margin: 10.1%, down from 11.3% in the same quarter last year

- Backlog: $1.20 billion at quarter end

- Market Capitalization: $2.06 billion

“We delivered solid financial results for the fourth quarter of 2024, including returning to year-over-year revenue growth. We are pleased with the improved execution of the business throughout 2024, including strong free cash flows achieved in the year,” stated Randall Lipps, chairman, president, chief executive officer, and founder of Omnicell.

Company Overview

Founded in 1992, Omnicell (NASDAQ:OMCL) provides automation solutions for pharmacies and healthcare providers, with a focus on improving medication management, operational efficiency, and patient safety.

Healthcare Technology for Providers

The healthcare technology industry focuses on delivering software, data analytics, and workflow solutions to hospitals, clinics, and other care facilities. These companies enable providers to streamline operations, optimize patient outcomes, and transition to value-based care models. They boast subscription-based revenues or long-term contracts, providing financial stability and growth potential. However, they face challenges such as lengthy sales cycles, significant upfront investment in technology development, and reliance on providers’ adoption of new tools, which can be hindered by budget constraints or resistance to change. Over the next few years, the sector is poised for growth as providers increasingly prioritize digital transformation and efficiency in response to rising healthcare costs and patient demand for seamless care. Tailwinds include the growing adoption of AI-driven tools for patient engagement and operational improvements, government incentives for digitization, and the expansion of telehealth and remote patient monitoring. However, headwinds such as tightening hospital budgets, cybersecurity threats, and the fragmented nature of healthcare systems could slow adoption.

Sales Growth

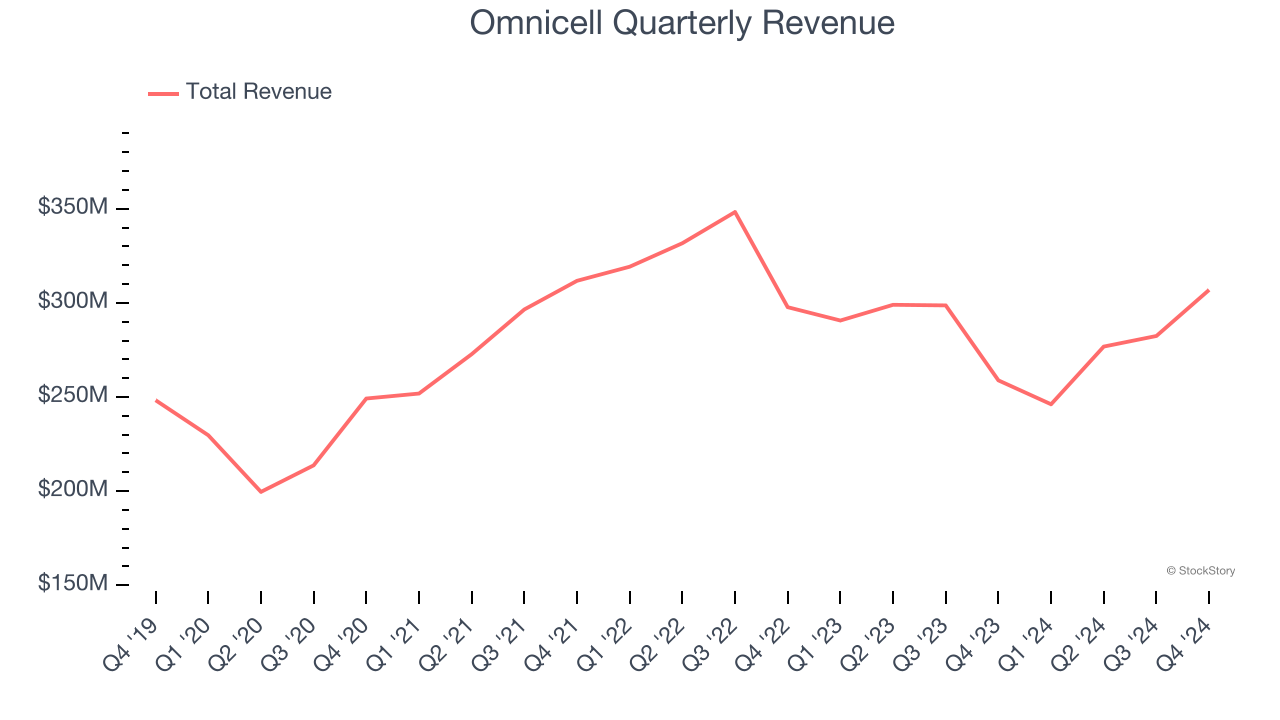

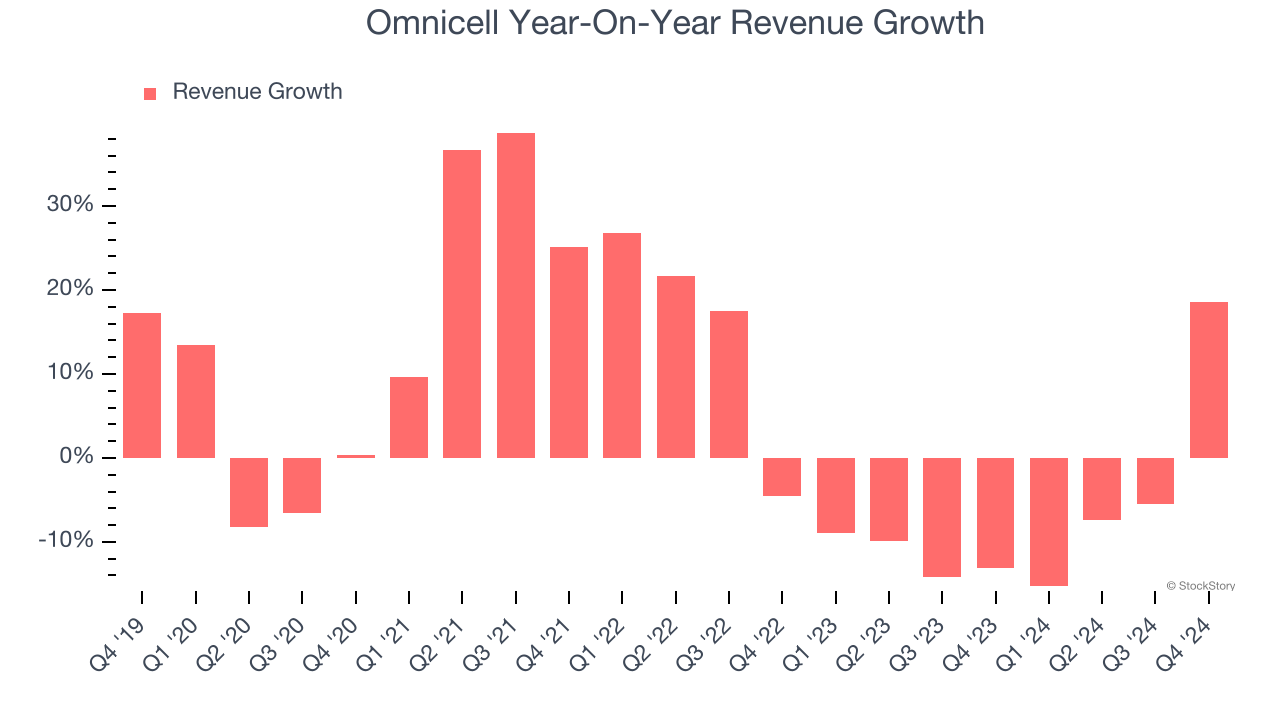

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Omnicell grew its sales at a mediocre 4.4% compounded annual growth rate. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Omnicell’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.4% annually.

Omnicell also breaks out the revenue for its most important segment, Product. Over the last two years, Omnicell’s Product revenue averaged 15.3% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, Omnicell reported year-on-year revenue growth of 18.6%, and its $306.9 million of revenue exceeded Wall Street’s estimates by 2.2%. Company management is currently guiding for a 5.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

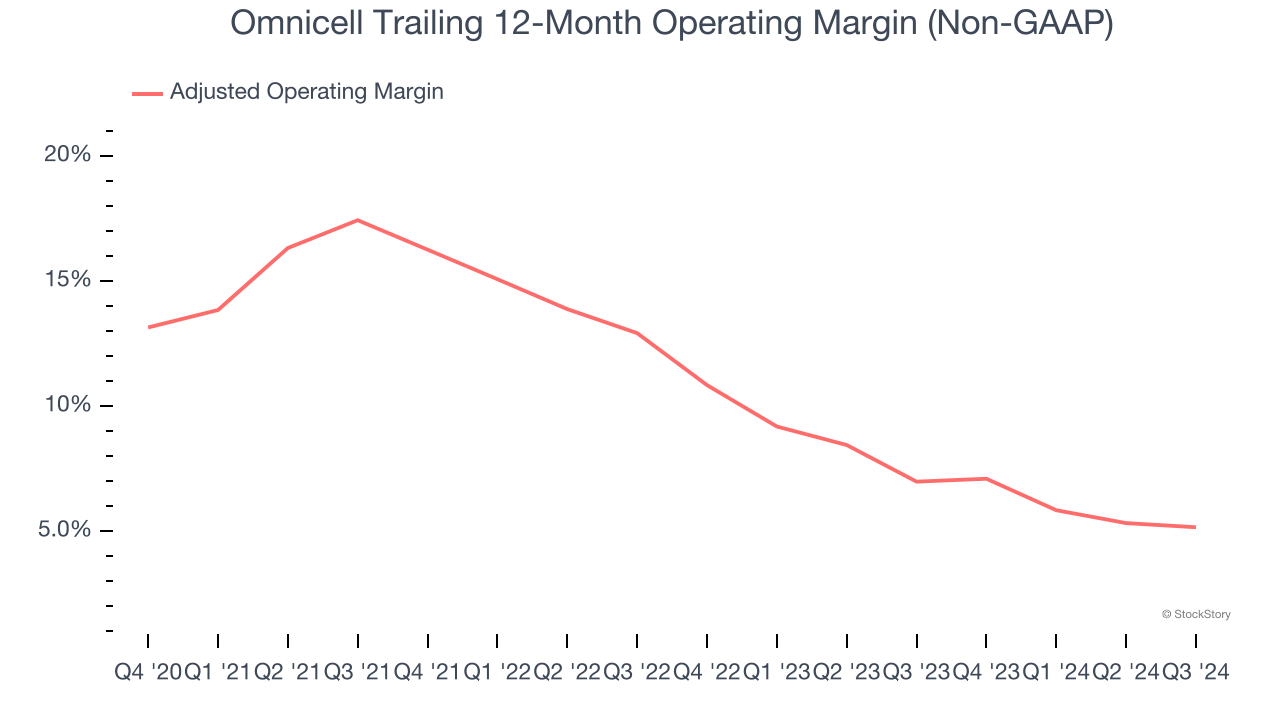

Omnicell has done a decent job managing its cost base over the last five years. The company has produced an average adjusted operating margin of 10.8%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Omnicell’s adjusted operating margin decreased by 6.1 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 7.3 percentage points on a two-year basis. We’re disappointed in these results because it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Omnicell generated an adjusted operating profit margin of 15.1%, up 11.5 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

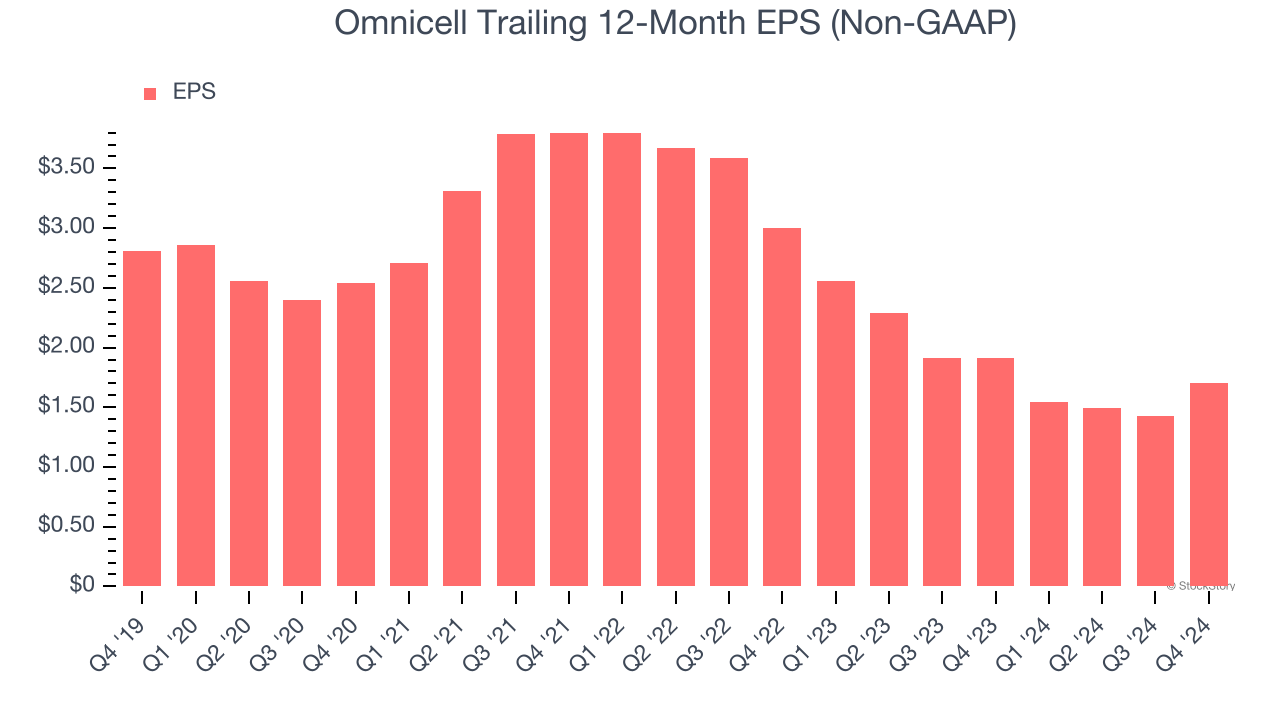

Sadly for Omnicell, its EPS declined by 9.6% annually over the last five years while its revenue grew by 4.4%. This tells us the company became less profitable on a per-share basis as it expanded.

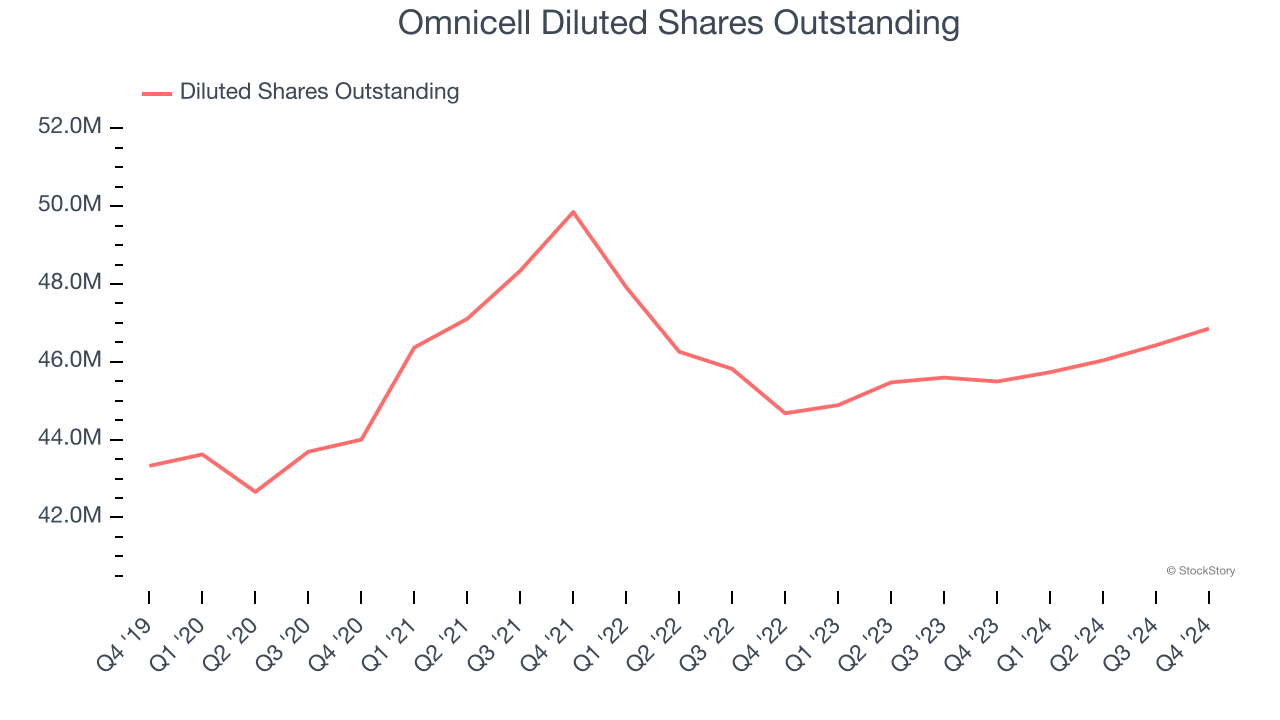

Diving into the nuances of Omnicell’s earnings can give us a better understanding of its performance. As we mentioned earlier, Omnicell’s adjusted operating margin improved this quarter but declined by 6.1 percentage points over the last five years. Its share count also grew by 8.1%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Omnicell reported EPS at $0.60, up from $0.33 in the same quarter last year. This print beat analysts’ estimates by 2.8%. Over the next 12 months, Wall Street expects Omnicell’s full-year EPS of $1.70 to grow 6.3%.

Key Takeaways from Omnicell’s Q4 Results

It was encouraging to see Omnicell beat analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance came in higher than Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed significantly and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $44.20 immediately following the results.

Omnicell didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.