Household products company Spectrum Brands (NYSE:SPB) missed Wall Street’s revenue expectations in Q4 CY2024 as sales only rose 1.2% year on year to $700.2 million. Its non-GAAP profit of $1.02 per share was 11.1% above analysts’ consensus estimates.

Is now the time to buy Spectrum Brands? Find out by accessing our full research report, it’s free.

Spectrum Brands (SPB) Q4 CY2024 Highlights:

- Revenue: $700.2 million vs analyst estimates of $704.2 million (1.2% year-on-year growth, 0.6% miss)

- Adjusted EPS: $1.02 vs analyst estimates of $0.92 (11.1% beat)

- Adjusted EBITDA: $77.8 million vs analyst estimates of $65.63 million (11.1% margin, 18.5% beat)

- "Maintaining Fiscal 2025 Earnings Framework and Continue to Expect Low Single-Digit Net Sales Growth and Mid to High Single-Digits Adjusted EBITDA Growth for Fiscal 2025, Targeting ~50% Conversion of Adjusted EBITDA to Adjusted Free Cash Flow"

- Operating Margin: 6.4%, up from 3.6% in the same quarter last year

- Free Cash Flow was -$78.3 million compared to -$12.7 million in the same quarter last year

- Organic Revenue rose 1.9% year on year (-4.6% in the same quarter last year)

- Market Capitalization: $2.32 billion

"We are pleased with the start of the year. The brand-focused investments we started making in 2024, and are continuing to make in 2025, are driving innovation in our products and consumer demand. Our investments in e-commerce are helping us win in what is the fastest growing channel for most of our products. The momentum we built last year is carrying over into this year. Our Home and Personal Care business had a solid holiday season, and our Home and Garden business had one of its best first quarters in recent history. Global Pet Care's quarterly sales were negatively impacted by the acceleration of retailer purchases into last quarter ahead of the business' go-live on S/4Hana. GAAP net income and diluted earnings per share both increased, and our adjusted EBITDA was 26.9% higher than last year's adjusted EBITDA excluding investment income. Gross margins are also up 140 basis points over the first quarter of fiscal 24. Our operations are continuing to deliver cost improvements and we are staying lean," said David Maura, Chairman and Chief Executive Officer of Spectrum Brands.

Company Overview

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.97 billion in revenue over the past 12 months, Spectrum Brands carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

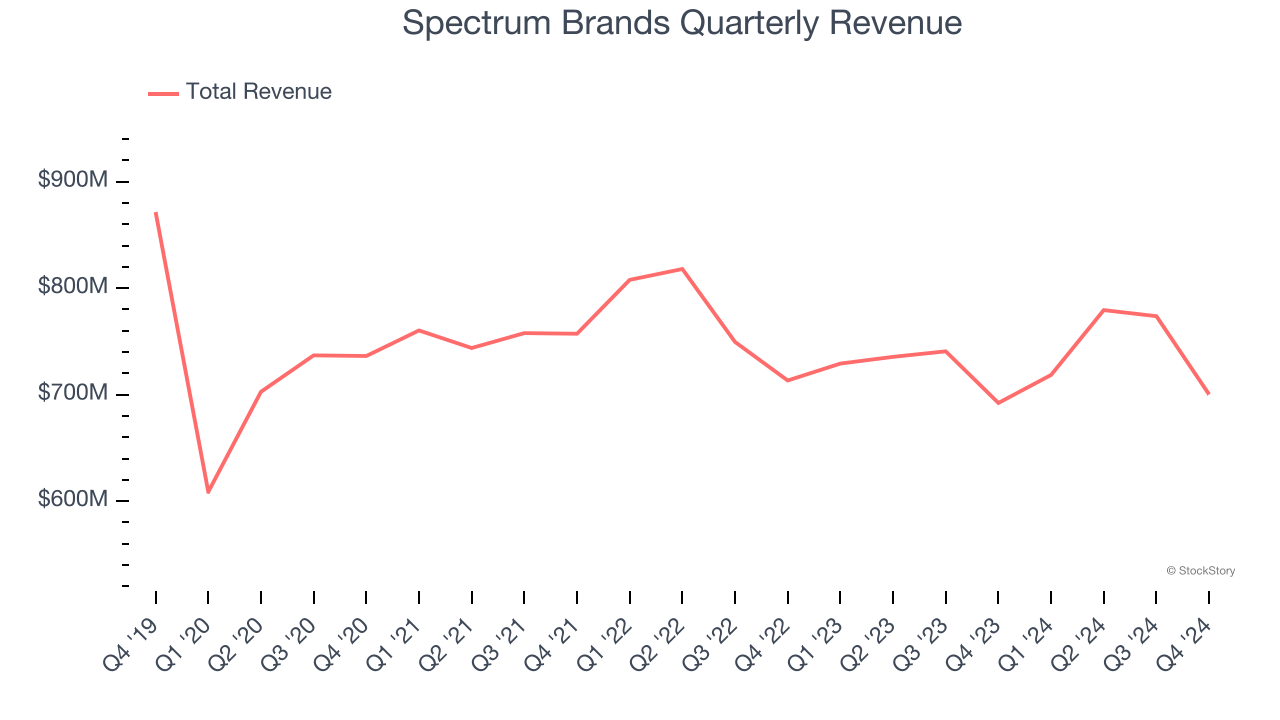

As you can see below, Spectrum Brands struggled to increase demand as its $2.97 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, Spectrum Brands’s revenue grew by 1.2% year on year to $700.2 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months. Although this projection implies its newer products will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

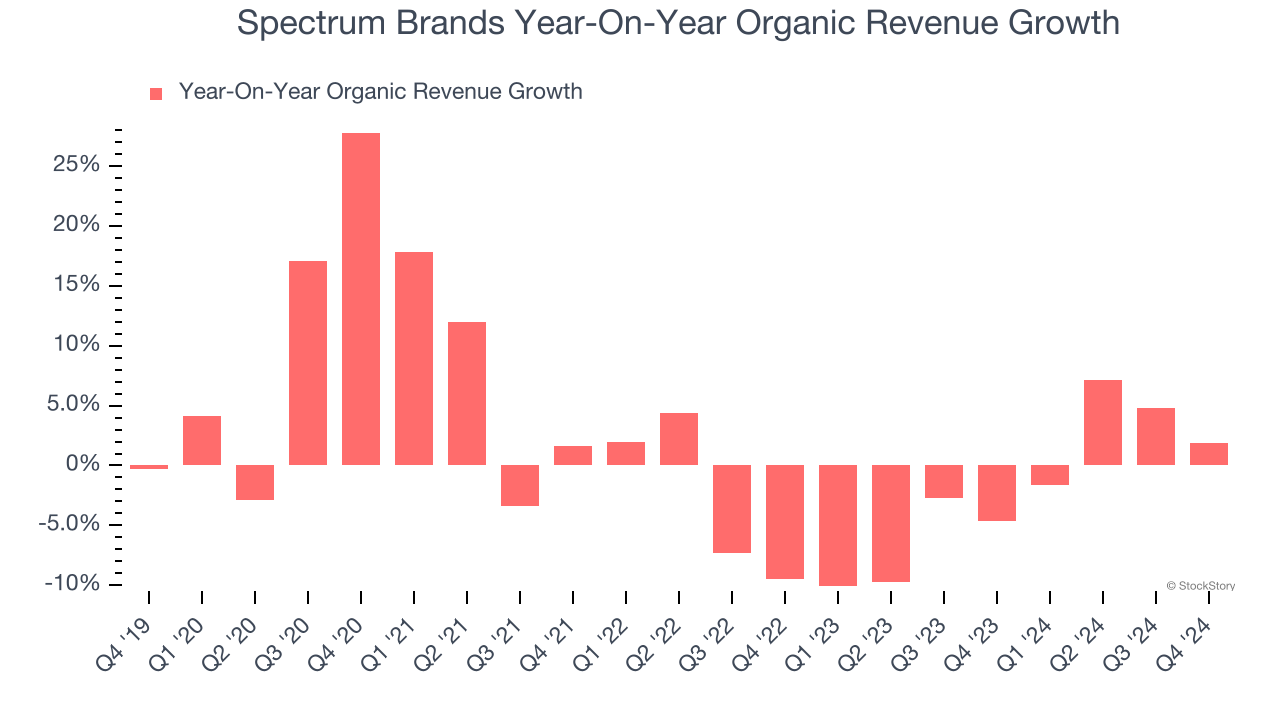

Spectrum Brands’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 1.9% year on year.

In the latest quarter, Spectrum Brands’s organic sales rose by 1.9% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Spectrum Brands’s Q4 Results

We liked that Spectrum Brands handily beat EBITDA and EPS expectations this quarter. On the other hand, its revenue slightly missed and its organic revenue fell short of Wall Street’s estimates. The company maintained its previously-provided guidance. Overall, this quarter was mixed, and shares traded down 3.4% to $80.05 immediately after reporting.

Big picture, is Spectrum Brands a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.