El Pollo Loco’s stock price has taken a beating over the past six months, shedding 24.4% of its value and falling to $9.76 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in El Pollo Loco, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we're cautious about El Pollo Loco. Here are three reasons why you should be careful with LOCO and a stock we'd rather own.

Why Do We Think El Pollo Loco Will Underperform?

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ:LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

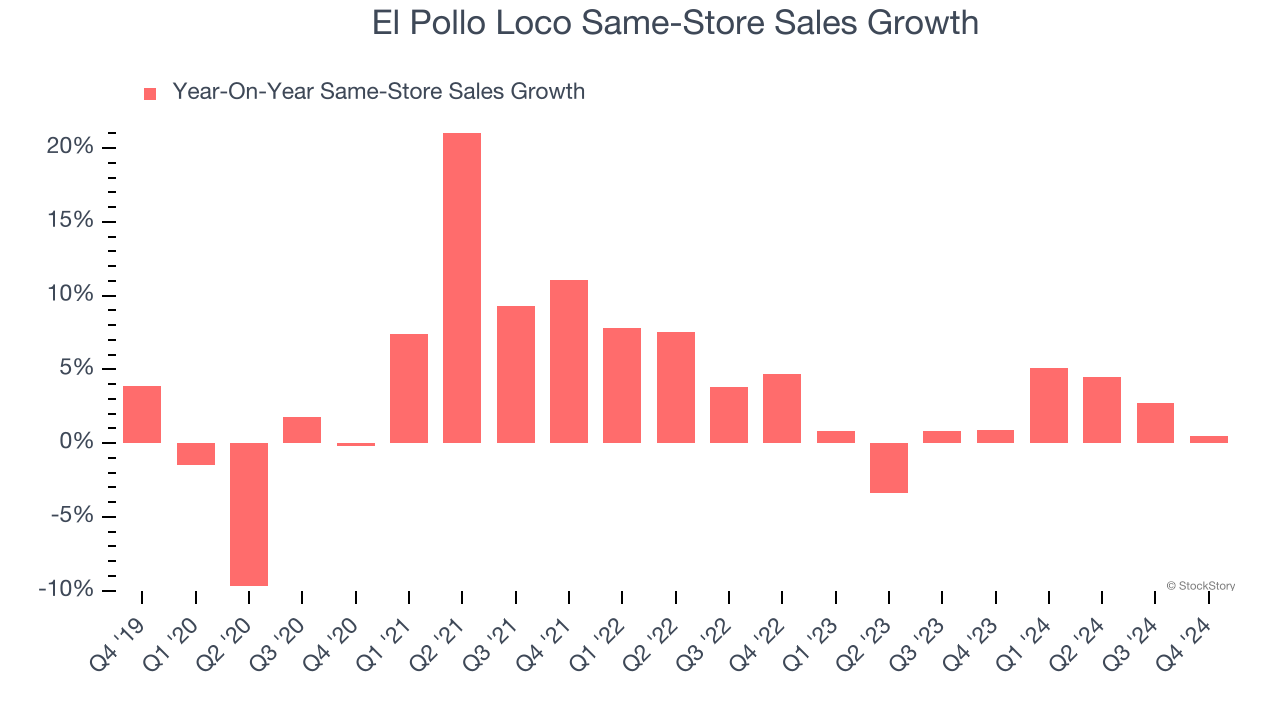

1. Same-Store Sales Falling Behind Peers

Same-store sales is a key performance indicator used to measure organic growth at restaurants open for at least a year.

El Pollo Loco’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.5% per year.

2. Fewer Distribution Channels Limit its Ceiling

With $473 million in revenue over the past 12 months, El Pollo Loco is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect El Pollo Loco’s revenue to rise by 4.6%. Although this projection suggests its newer menu offerings will catalyze better top-line performance, it is still below average for the sector.

Final Judgment

We see the value of companies helping consumers, but in the case of El Pollo Loco, we’re out. Following the recent decline, the stock trades at 10.2× forward price-to-earnings (or $9.76 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than El Pollo Loco

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.