Athletic apparel company Under Armour (NYSE:UAA) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 11.4% year on year to $1.18 billion. On the other hand, next quarter’s revenue guidance of $1.13 billion was less impressive, coming in 3.4% below analysts’ estimates. Its non-GAAP loss of $0.08 per share was in line with analysts’ consensus estimates.

Is now the time to buy Under Armour? Find out by accessing our full research report, it’s free.

Under Armour (UAA) Q1 CY2025 Highlights:

- Revenue: $1.18 billion vs analyst estimates of $1.17 billion (11.4% year-on-year decline, 1.3% beat)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.08 (in line)

- Adjusted EBITDA: $19.92 million vs analyst estimates of -$4.15 million (1.7% margin, significant beat)

- Revenue Guidance for Q2 CY2025 is $1.13 billion at the midpoint, below analyst estimates of $1.17 billion

- Adjusted EPS guidance for Q2 CY2025 is $0.02 at the midpoint, above analyst estimates of $0

- Operating Margin: -6.1%, down from -0.3% in the same quarter last year

- Free Cash Flow was -$231 million compared to -$156.7 million in the same quarter last year

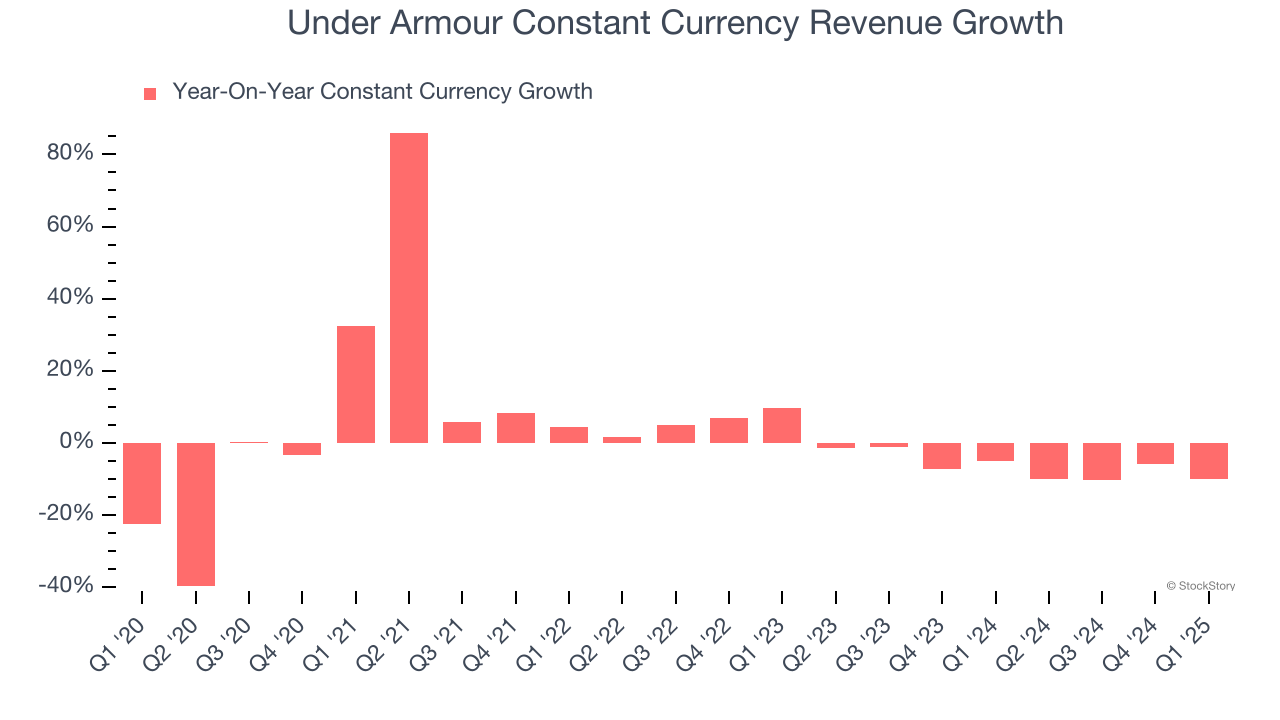

- Constant Currency Revenue fell 10% year on year (-4.9% in the same quarter last year)

- Market Capitalization: $2.60 billion

"One year into our strategic reset, we're laying the groundwork for a more focused Under Armour. By elevating products and storytelling, tightening distribution, and refining our operating model, we are in the process of reigniting brand relevance and positioning the business for sustainable, profitable growth," said Under Armour President and CEO Kevin Plank.

Company Overview

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE:UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

Sales Growth

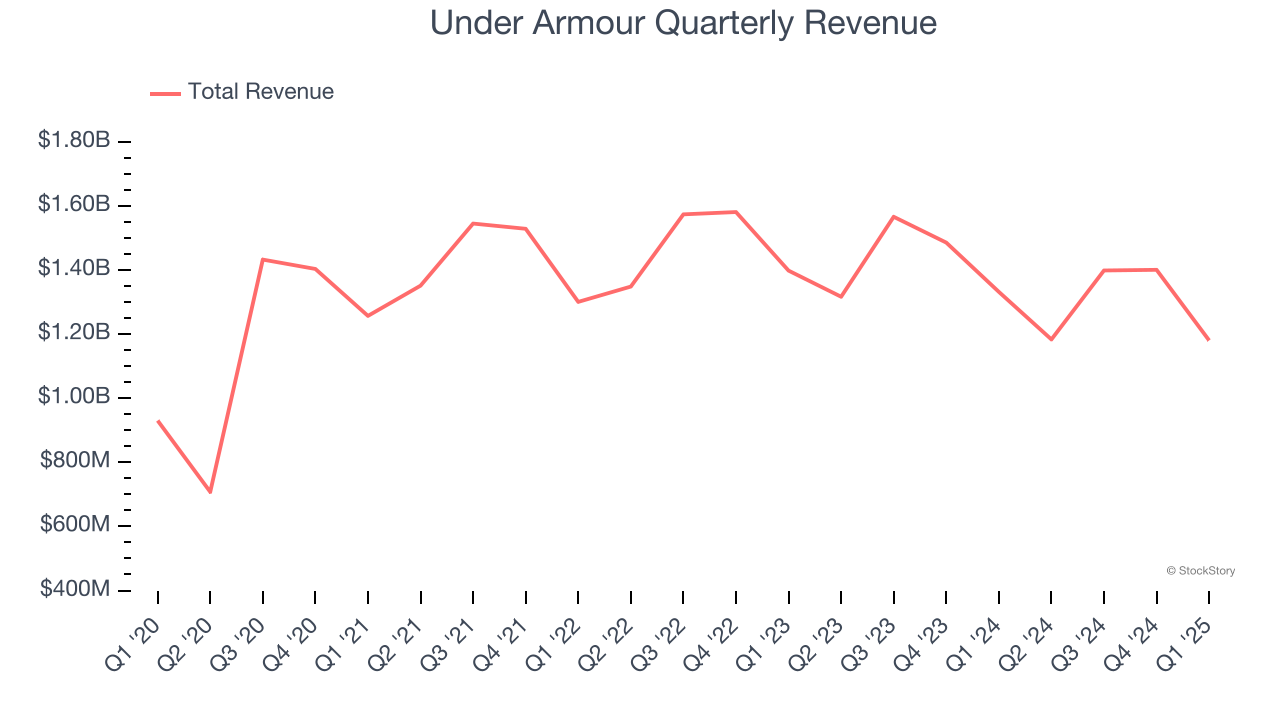

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Under Armour struggled to consistently increase demand as its $5.16 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

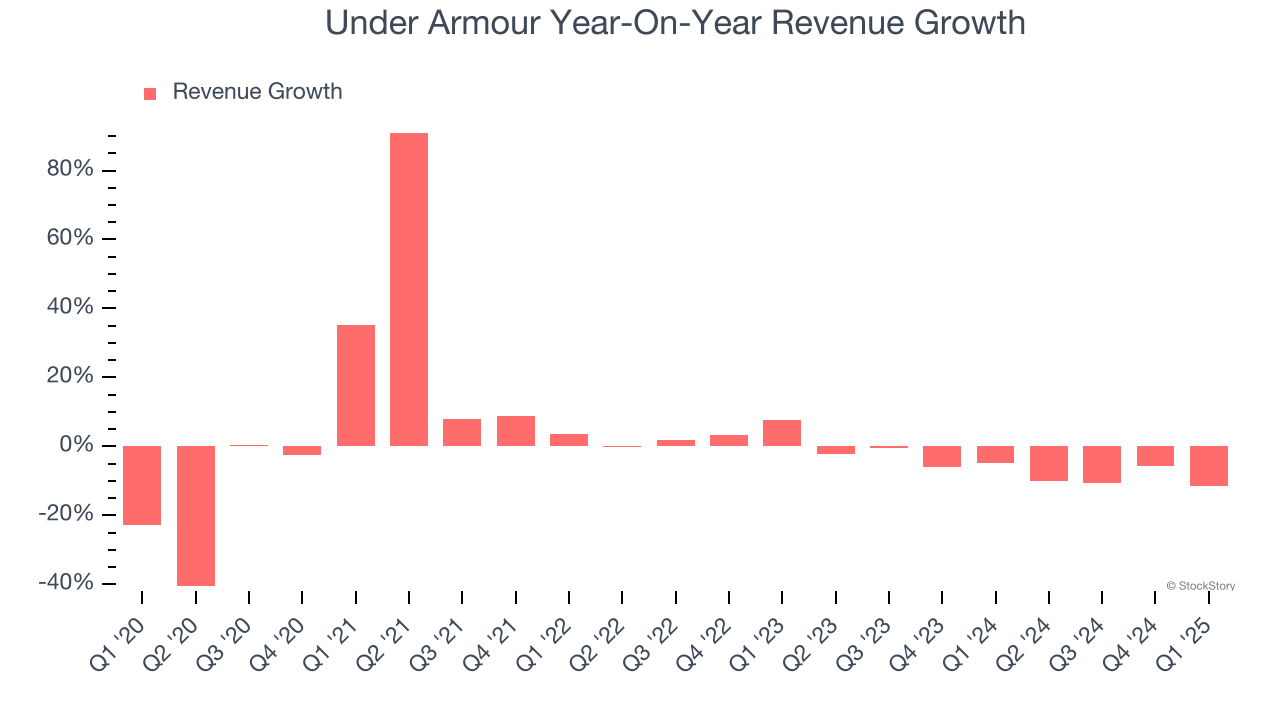

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Under Armour’s recent performance shows its demand remained suppressed as its revenue has declined by 6.5% annually over the last two years.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 6.3% year-on-year declines. Because this number aligns with its normal revenue growth, we can see that Under Armour has properly hedged its foreign currency exposure.

This quarter, Under Armour’s revenue fell by 11.4% year on year to $1.18 billion but beat Wall Street’s estimates by 1.3%. Company management is currently guiding for a 4.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

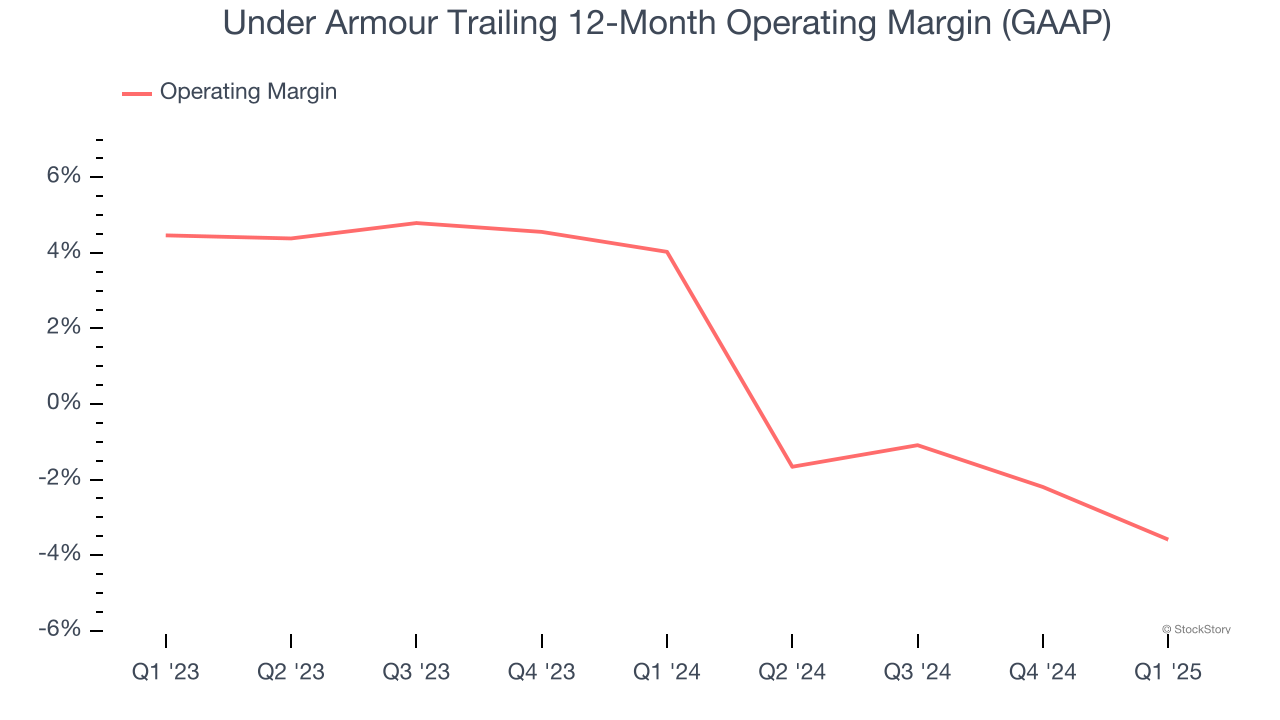

Operating Margin

Under Armour’s operating margin has been trending down over the last 12 months, and it ended up breaking even over the last two years. The company’s performance was inadequate, showing its operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q1, Under Armour generated an operating profit margin of negative 6.1%, down 5.8 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

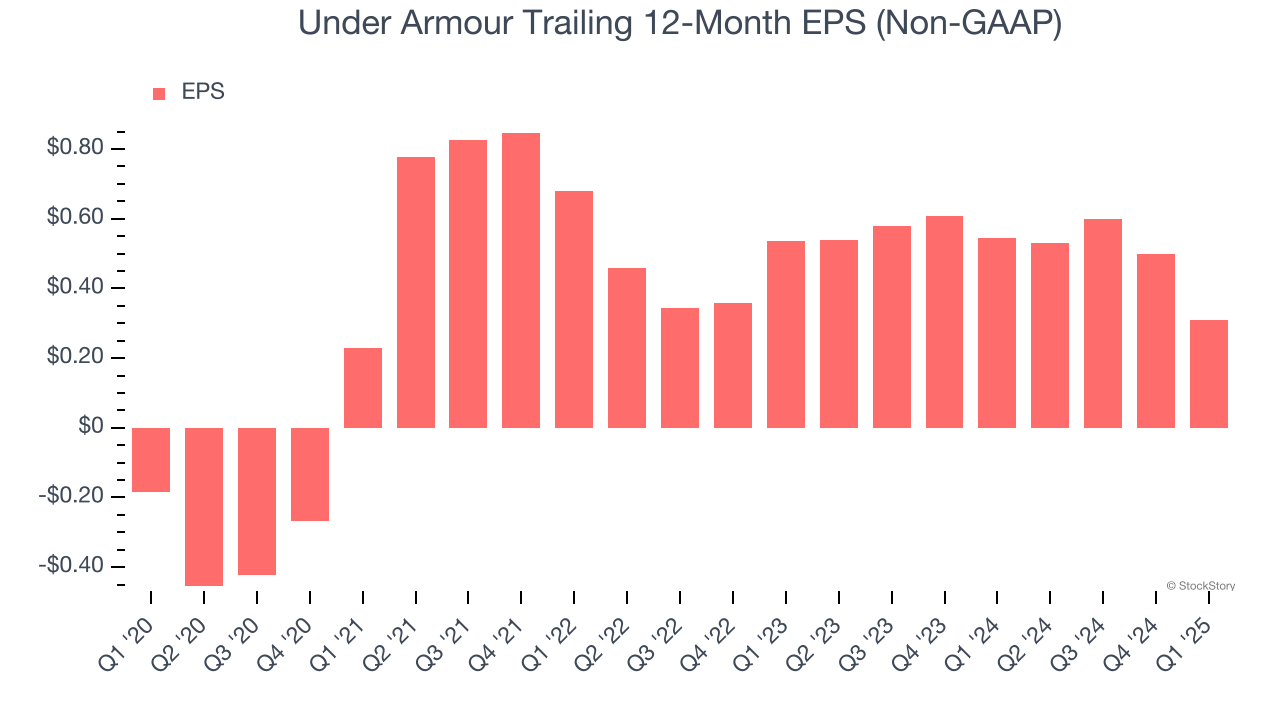

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Under Armour’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Under Armour reported EPS at negative $0.08, down from $0.11 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Under Armour to perform poorly. Analysts forecast its full-year EPS of $0.31 will hit $0.35.

Key Takeaways from Under Armour’s Q1 Results

We were impressed by Under Armour’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 2.3% to $6.36 immediately following the results.

Under Armour put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.