Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Byrna (NASDAQ:BYRN) and the best and worst performers in the aerospace and defense industry.

Emissions and automation are important in aerospace, so companies that boast advances in these areas can take market share. On the defense side, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression toward Taiwan–have highlighted the need for consistent or even elevated defense spending. As for challenges, demand for aerospace and defense products can ebb and flow with economic cycles and national defense budgets, which are unpredictable and particularly painful for companies with high fixed costs.

The 31 aerospace and defense stocks we track reported a strong Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, aerospace and defense stocks have performed well with share prices up 10.6% on average since the latest earnings results.

Byrna (NASDAQ:BYRN)

Providing civilians with tools to disable, disarm, and deter would-be assailants, Byrna (NASDAQ:BYRN) is a provider of non-lethal weapons.

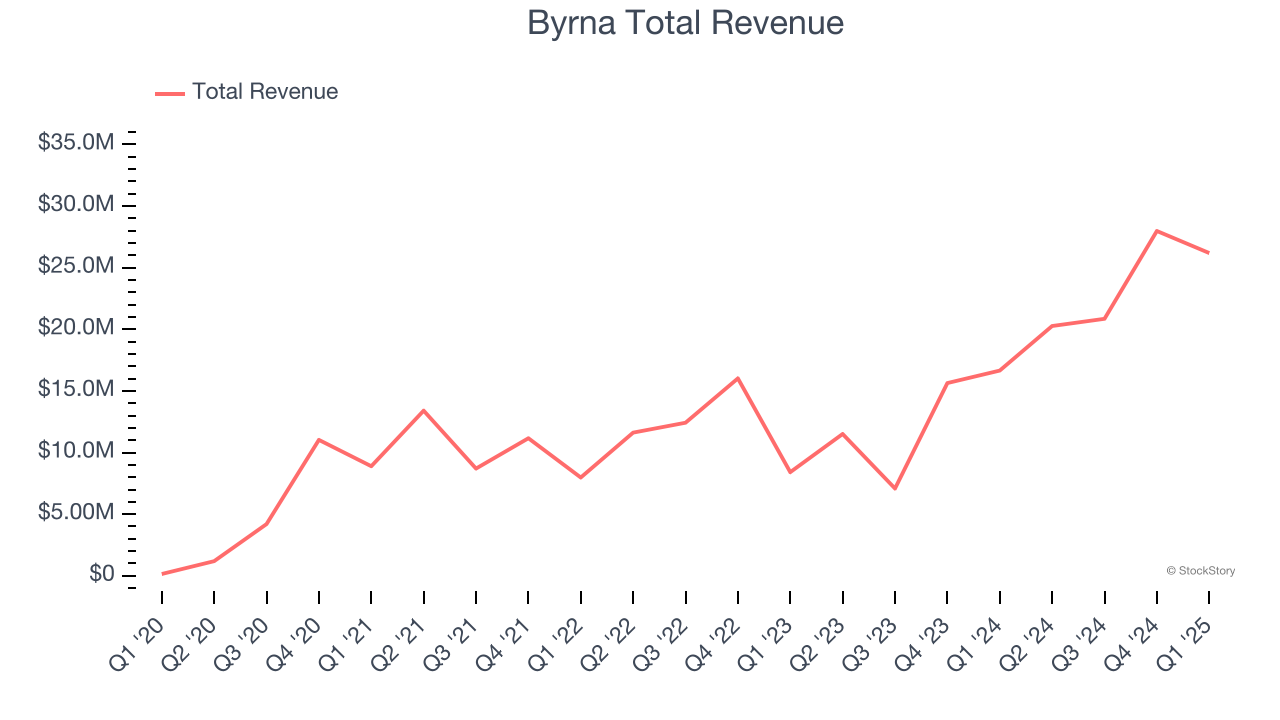

Byrna reported revenues of $26.19 million, up 57.3% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

Byrna CEO Bryan Ganz stated: “We delivered a strong start to the fiscal year with 57% revenue growth and our second-highest quarter ever, only 6% below our record $28 million Q4, despite Q1 traditionally being our slowest seasonal period. The strong results reflect continuing sales momentum, increasing adoption of less-lethal self-defense options, and rising brand visibility. As expected, January sales softened due to post-holiday consumer fatigue and waning consumer confidence; however, we saw daily sales improve month-over-month in both February and March. Looking ahead, we believe our performance will continue to be supported by Byrna’s expanding retail footprint, growing Amazon presence, and sustained awareness-building efforts – all of which lay the groundwork for the upcoming Compact Launcher release."

Byrna scored the fastest revenue growth of the whole group. The stock is up 61.6% since reporting and currently trades at $26.80.

We think Byrna is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q1: HEICO (NYSE:HEI)

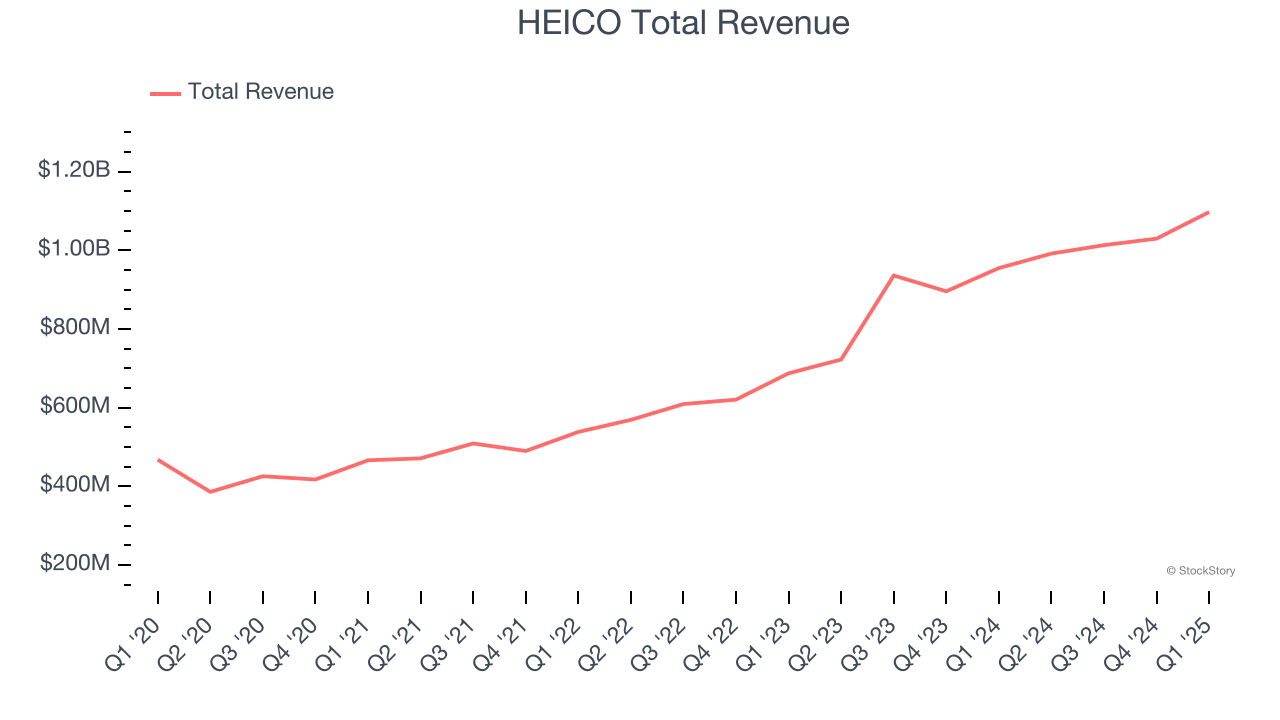

Founded in 1957, HEICO (NYSE:HEI) manufactures and services aerospace and electronic components for commercial aviation, defense, space, and other industries.

HEICO reported revenues of $1.10 billion, up 14.9% year on year, outperforming analysts’ expectations by 3.5%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 9.2% since reporting. It currently trades at $299.64.

Is now the time to buy HEICO? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Hexcel (NYSE:HXL)

Founded shortly after World War II by a group of engineers from UC Berkley, Hexcel (NYSE:HXL) manufactures lightweight composite materials primarily for the aerospace and defense sectors.

Hexcel reported revenues of $456.5 million, down 3.3% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Hexcel delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 4.8% since the results and currently trades at $52.89.

Read our full analysis of Hexcel’s results here.

Textron (NYSE:TXT)

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron reported revenues of $3.31 billion, up 5.5% year on year. This number topped analysts’ expectations by 2.3%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ organic revenue estimates.

The stock is up 12% since reporting and currently trades at $74.03.

Read our full, actionable report on Textron here, it’s free.

Mercury Systems (NASDAQ:MRCY)

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $211.4 million, up 1.5% year on year. This result beat analysts’ expectations by 4.6%. It was a strong quarter as it also put up an impressive beat of analysts’ organic revenue and EBITDA estimates.

The stock is down 2.3% since reporting and currently trades at $49.27.

Read our full, actionable report on Mercury Systems here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.