The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how construction and maintenance services stocks fared in Q1, starting with Construction Partners (NASDAQ:ROAD).

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 13 construction and maintenance services stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 5.2%.

Luckily, construction and maintenance services stocks have performed well with share prices up 20.7% on average since the latest earnings results.

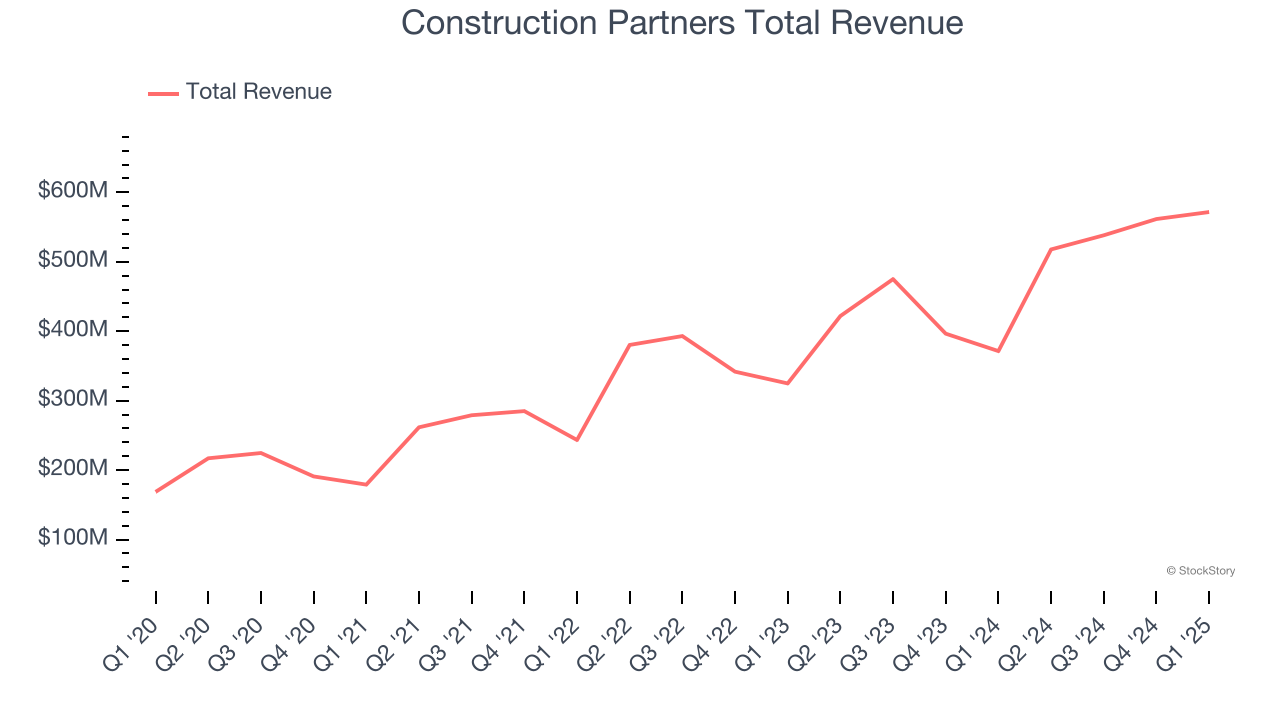

Construction Partners (NASDAQ:ROAD)

Founded in 2001, Construction Partners (NASDAQ:ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Construction Partners reported revenues of $571.7 million, up 53.9% year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Fred J. (Jule) Smith, III, the Company's President and Chief Executive Officer, said, "We are pleased to report a strong second quarter marked by significant year-over-year growth in revenues, net income and Adjusted EBITDA, leading to an Adjusted EBITDA margin of 12.1%, up more than 400 basis points from the same quarter last year. Continuing the substantial momentum established in the first quarter of our fiscal year, the operational performance of our family of companies was outstanding, especially during this winter quarter, when shorter days and colder weather typically limit construction activity. Throughout our Sunbelt footprint, our local teams continued to win more project work, growing our project backlog to a record $2.84 billion. We are well-positioned for continued success to build out this record backlog as we move into the busy construction work season in the second half of our fiscal year. We continue to experience healthy federal and state project funding across our geographies in addition to a steady workflow of commercial projects, with many of our local markets representing some of the fastest growing MSAs in the Sunbelt."

Construction Partners scored the fastest revenue growth and highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 16.8% since reporting and currently trades at $108.15.

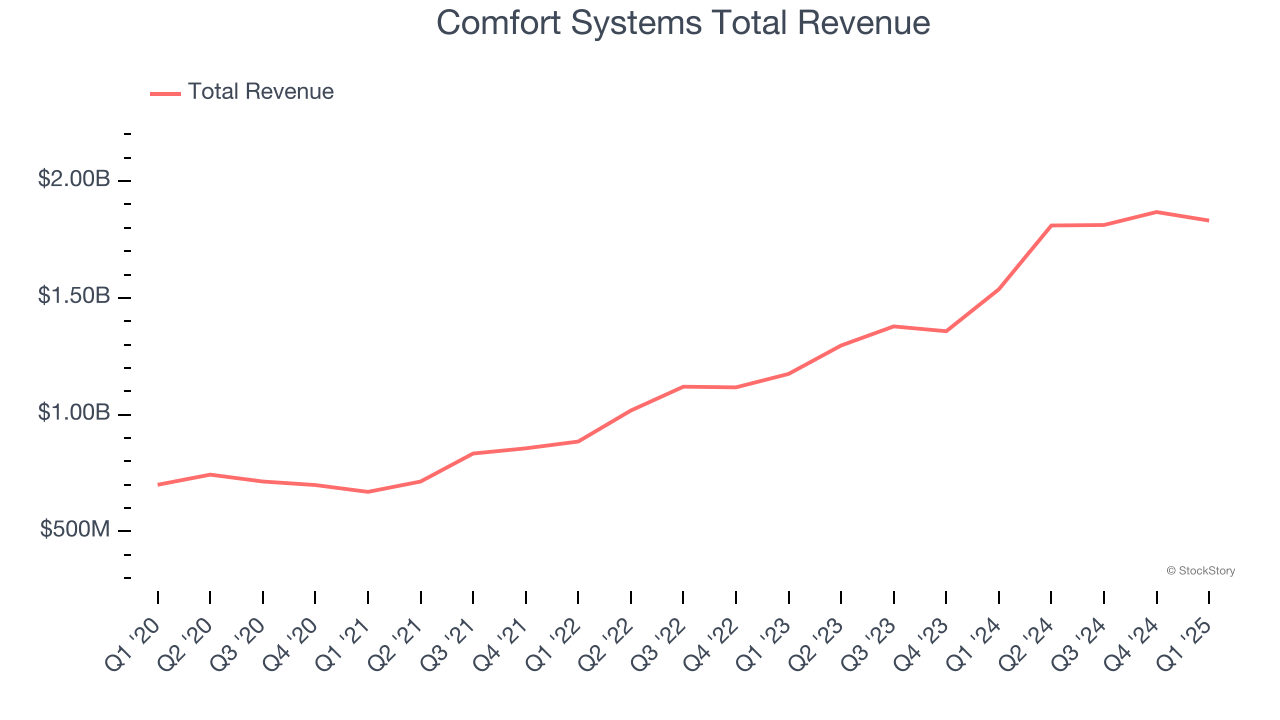

Best Q1: Comfort Systems (NYSE:FIX)

Formed through the merger of 12 companies, Comfort Systems (NYSE:FIX) provides mechanical and electrical contracting services.

Comfort Systems reported revenues of $1.83 billion, up 19.1% year on year, outperforming analysts’ expectations by 4.2%. The business had an incredible quarter with an impressive beat of analysts’ backlog estimates and a solid beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 32.6% since reporting. It currently trades at $499.16.

Is now the time to buy Comfort Systems? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Matrix Service (NASDAQ:MTRX)

Founded in Oklahoma, Matrix Service (NASDAQ:MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Matrix Service reported revenues of $200.2 million, up 20.6% year on year, falling short of analysts’ expectations by 6.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Matrix Service delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 2.2% since the results and currently trades at $11.97.

Read our full analysis of Matrix Service’s results here.

Great Lakes Dredge & Dock (NASDAQ:GLDD)

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ:GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Great Lakes Dredge & Dock reported revenues of $242.9 million, up 22.3% year on year. This print beat analysts’ expectations by 17.5%. Overall, it was an incredible quarter as it also produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Great Lakes Dredge & Dock delivered the biggest analyst estimates beat among its peers. The stock is up 19.2% since reporting and currently trades at $11.38.

Read our full, actionable report on Great Lakes Dredge & Dock here, it’s free.

MYR Group (NASDAQ:MYRG)

Constructing electrical and phone lines in the American Midwest dating back to the 1890s, MYR Group (NASDAQ:MYRG) is a specialty contractor in the electrical construction industry.

MYR Group reported revenues of $833.6 million, up 2.2% year on year. This result surpassed analysts’ expectations by 5%. It was a very strong quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 33% since reporting and currently trades at $162.

Read our full, actionable report on MYR Group here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.