NBT Bancorp currently trades at $42.80 per share and has shown little upside over the past six months, posting a small loss of 2%. The stock also fell short of the S&P 500’s 16.5% gain during that period.

Is there a buying opportunity in NBT Bancorp, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is NBT Bancorp Not Exciting?

We don't have much confidence in NBT Bancorp. Here are three reasons there are better opportunities than NBTB and a stock we'd rather own.

1. Low Net Interest Margin Hinders Flexibility

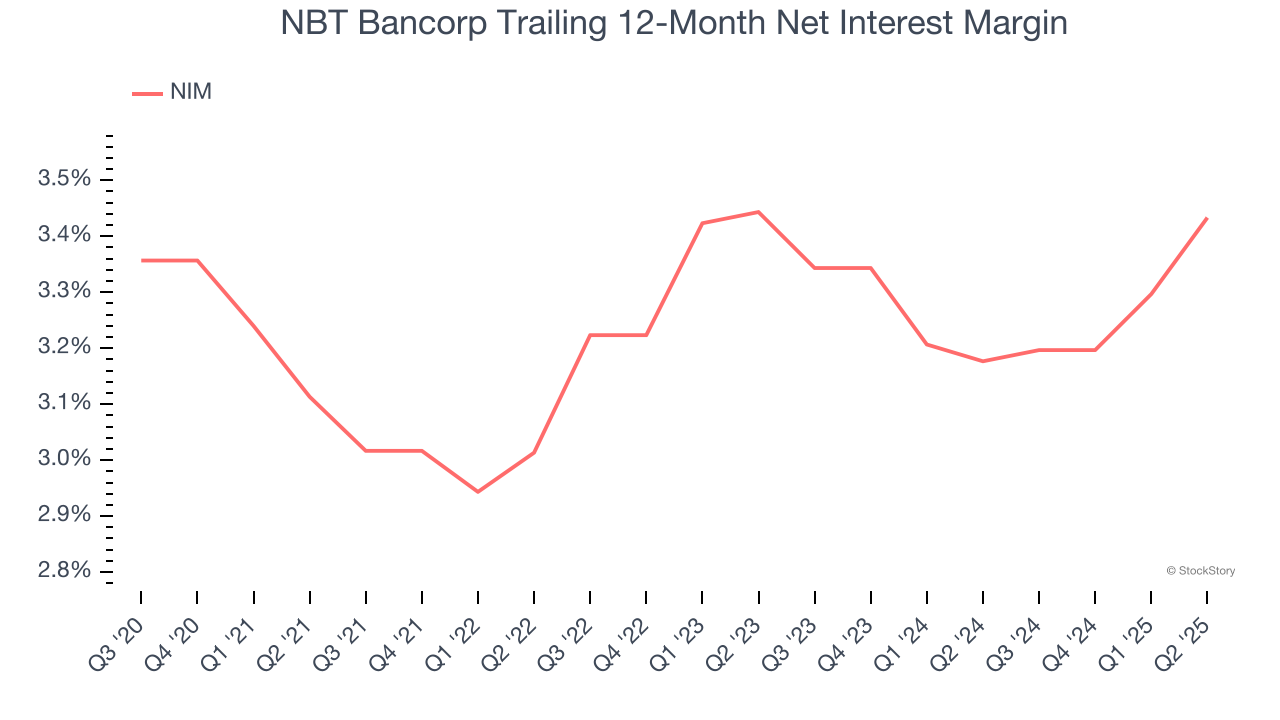

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that NBT Bancorp’s net interest margin averaged a subpar 3.3%, indicating the company has weak loan book economics.

2. EPS Barely Growing

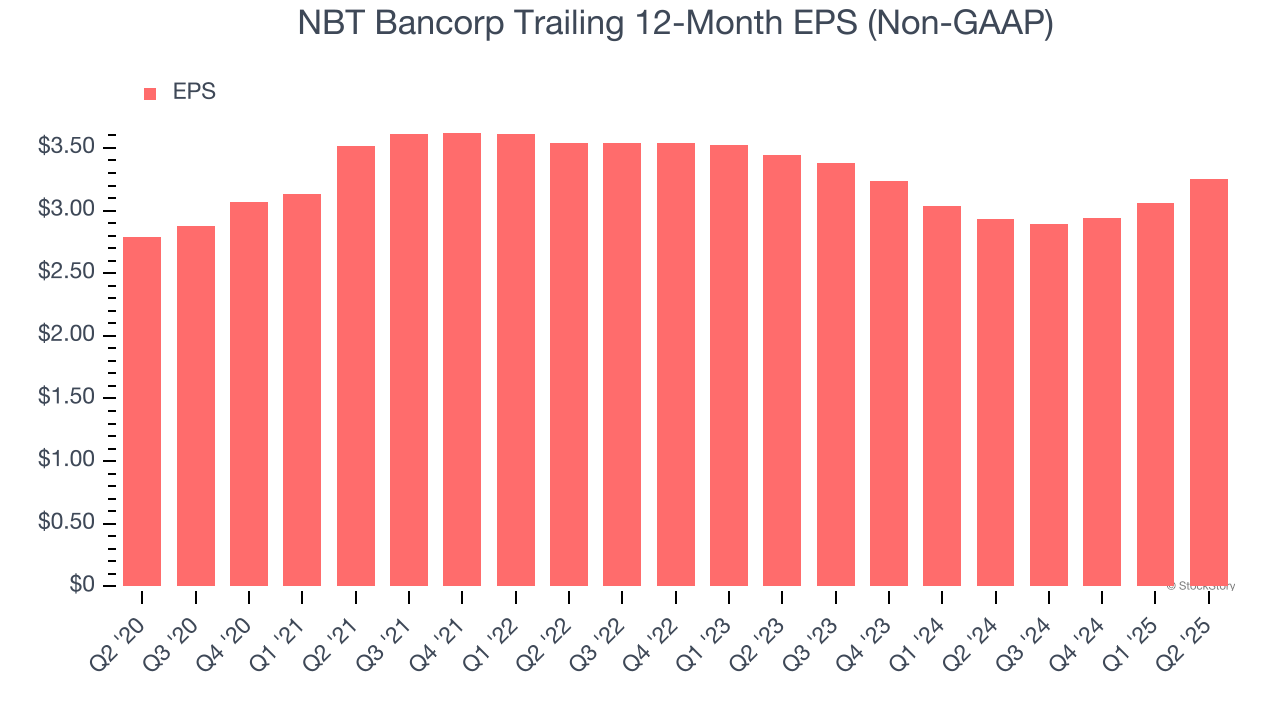

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

NBT Bancorp’s EPS grew at an unimpressive 3.1% compounded annual growth rate over the last five years, lower than its 6.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. Projected TBVPS Growth Is Slim

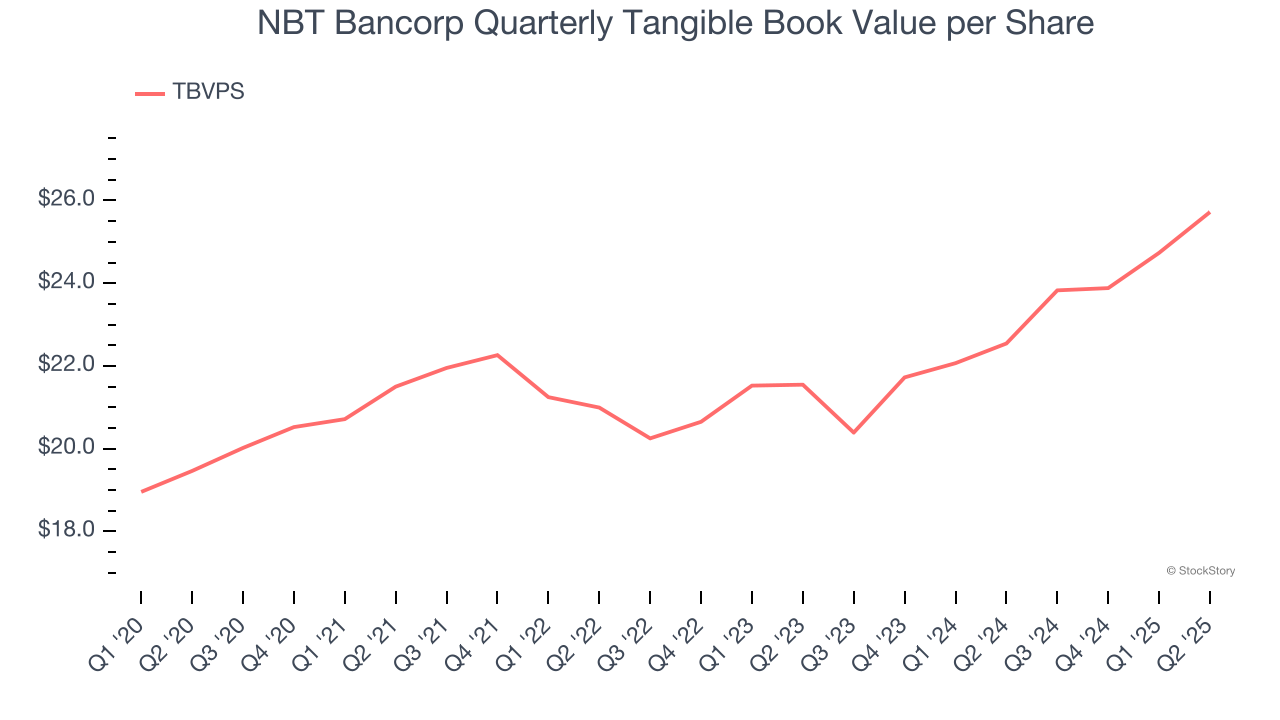

A bank’s tangible book value per share (TBVPS) increases when it generates higher net interest margins and keeps credit losses low, allowing it to compound shareholder value over time.

Over the next 12 months, Consensus estimates call for NBT Bancorp’s TBVPS to grow by 3.7% to $26.66, paltry growth rate.

Final Judgment

NBT Bancorp isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 1.2× forward P/B (or $42.80 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.