Articles from CoreLogic

CoreLogic®, a leader in global property information, analytics and data-enabled solutions, released its 2025 Severe Convective Storm Risk Report aimed to guide risk management decisions across the insurance ecosystem including the underwriting, claims and restoration industries. The report highlights trends and patterns in frequency, severity and geographic distribution of severe convective storm (SCS) activity over the last year and into 2025. This year’s report also leverages CoreLogic’s Climate Risk Analytics solutions to detail how and where climate resilient buildings need to be developed.

By CoreLogic · Via Business Wire · February 18, 2025

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2024.

By CoreLogic · Via Business Wire · February 6, 2025

CoreLogic®, a leader in global property information, analytics and data-enabled solutions, announced a new strategic alliance with Vexcel Imaging, a global leader in aerial imagery.

By CoreLogic · Via Business Wire · January 24, 2025

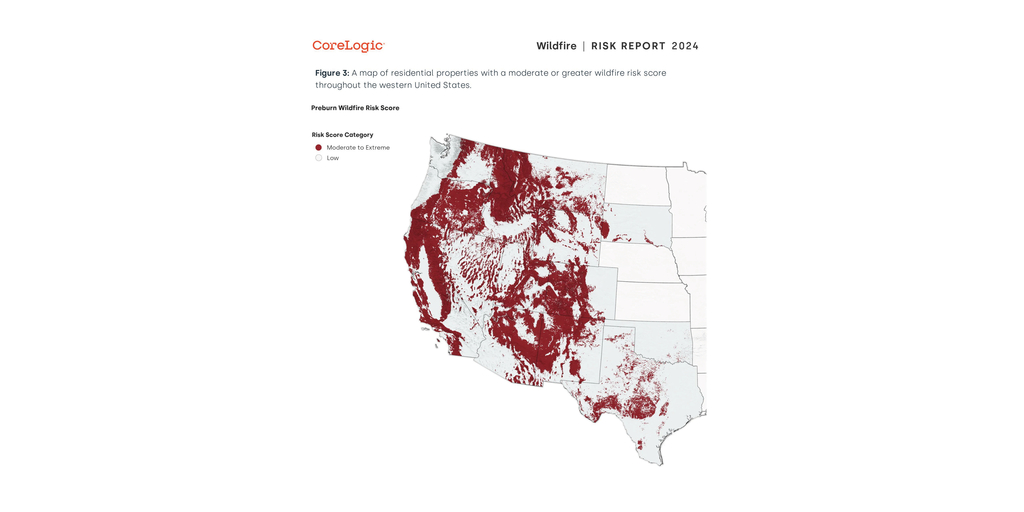

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today announced preliminary residential and commercial loss estimates for the Eaton and Palisades Fires in Los Angeles, California. According to this new data analysis, ongoing losses from the Los Angeles wildfires are estimated to be between $35 to $45 billion, as both fires are less than 50% contained as of Thursday afternoon. CoreLogic will provide final insured loss estimates once the fires have been fully contained.

By CoreLogic · Via Business Wire · January 16, 2025

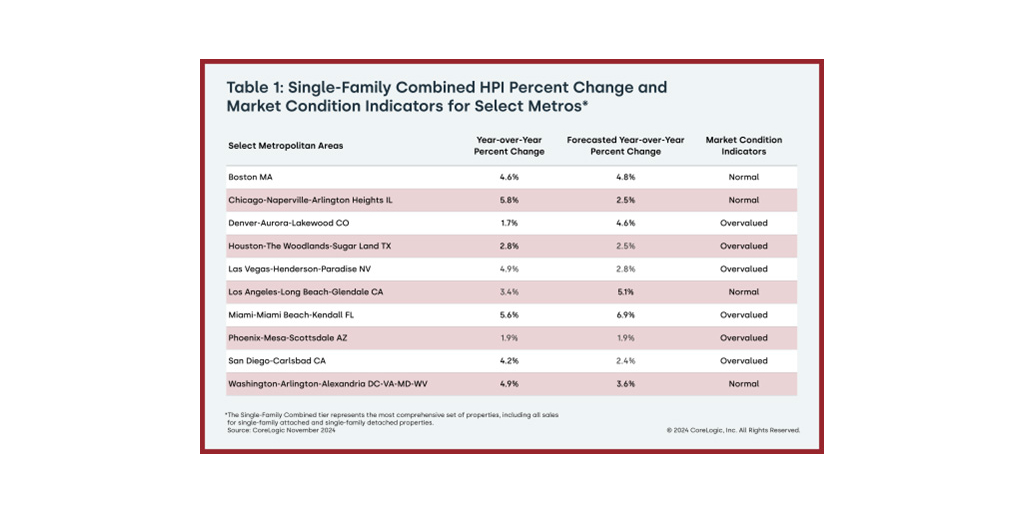

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2024.

By CoreLogic · Via Business Wire · January 7, 2025

CoreLogic®, a global leader in property information, analytics, and data-enabled solutions, today announces its acquisition of Prime Ecosystem, a prominent technology firm specializing in construction, restoration, and maintenance management platforms in Australia. This strategic acquisition aims to extend Prime Ecosystem's proven contractor technology from Australia to other international markets, starting with the United Kingdom, and further support Prime’s rapid growth in its home markets.

By CoreLogic · Via Business Wire · January 7, 2025

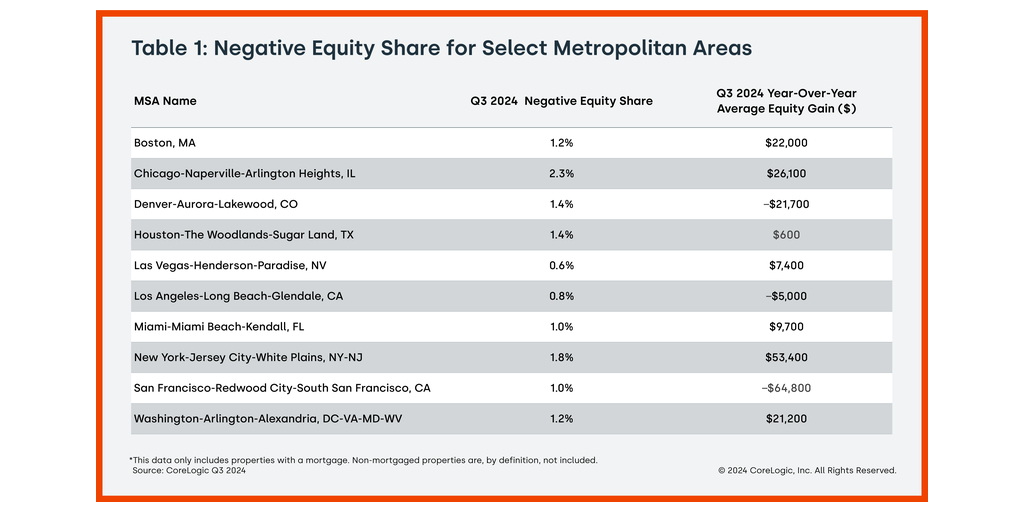

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report (HER) for the third quarter of 2024. The report shows that U.S. homeowners with mortgages (which account for roughly 62% of all properties) saw home equity increase by $425 billion since the third quarter of 2023, a gain of 2.5% year over year, bringing the total net homeowner equity to over $17.5 trillion in the third quarter of 2024.

By CoreLogic · Via Business Wire · December 6, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2024.

By CoreLogic · Via Business Wire · December 3, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for September 2024.

By CoreLogic · Via Business Wire · November 5, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, announced initial residential and commercial wind and flood loss estimates for Hurricane Milton. According to this initial data analysis, CoreLogic estimated that industry-wide insured wind and flood losses from Hurricane Milton are expected to be between $17 billion and $28 billion, and that total amount of damage, including losses to uninsured property, will be between $21 billion and $34 billion.

By CoreLogic · Via Business Wire · October 17, 2024

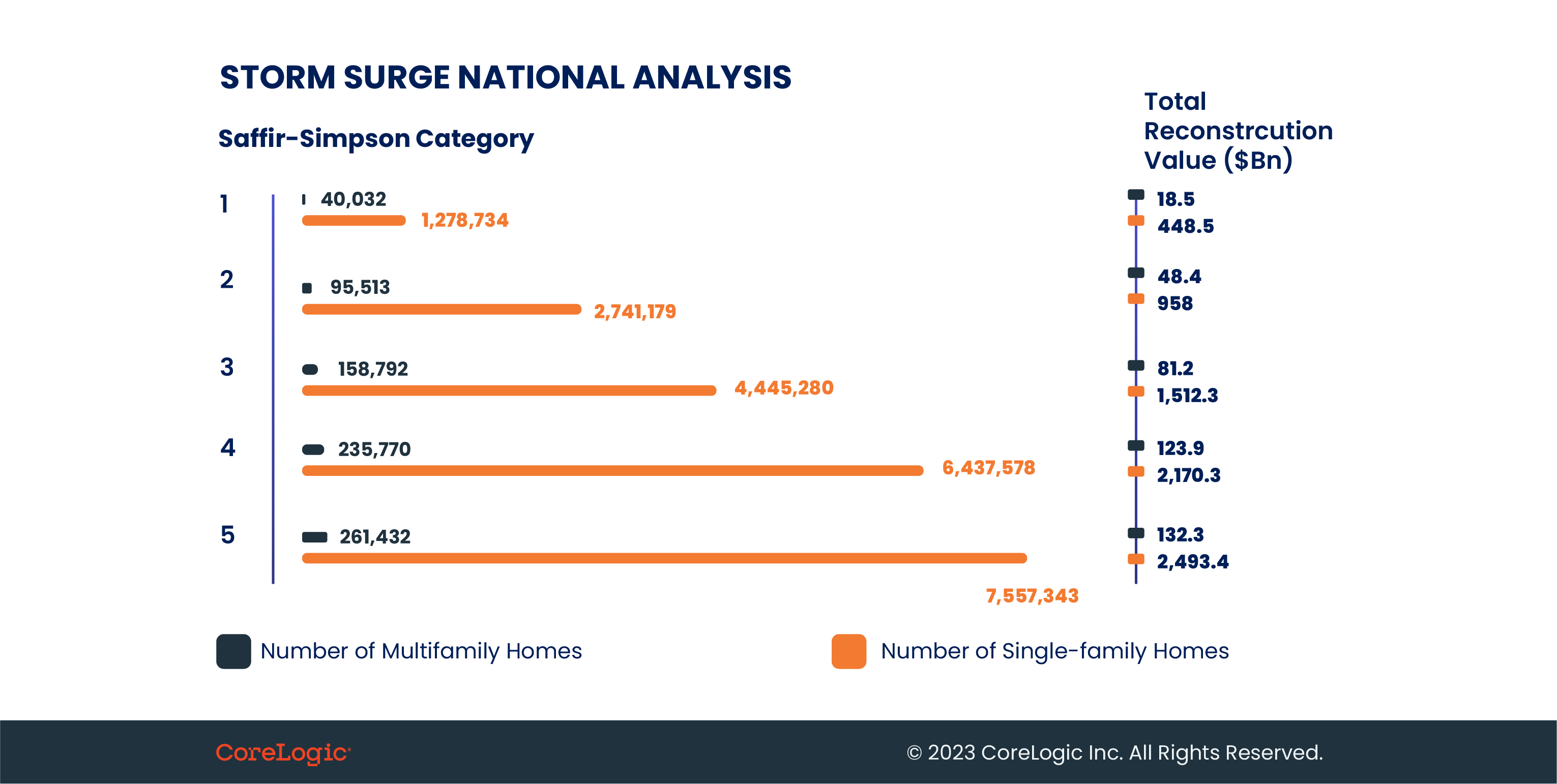

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released data analysis showing 500,000 single-family and multifamily homes in Tampa Bay and Sarasota, Florida metropolitan areas with a reconstruction cost value (RCV) of approximately $123 billion are at potential risk of storm surge damage from Hurricane Milton. These figures assume Hurricane Milton makes landfall as a Category 3 hurricane and are based on the October 8, 2024, National Hurricane Center 11 a.m. E.T. forecast.

By CoreLogic · Via Business Wire · October 8, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, announced its updated and final damage estimates for Hurricane Helene.

By CoreLogic · Via Business Wire · October 4, 2024

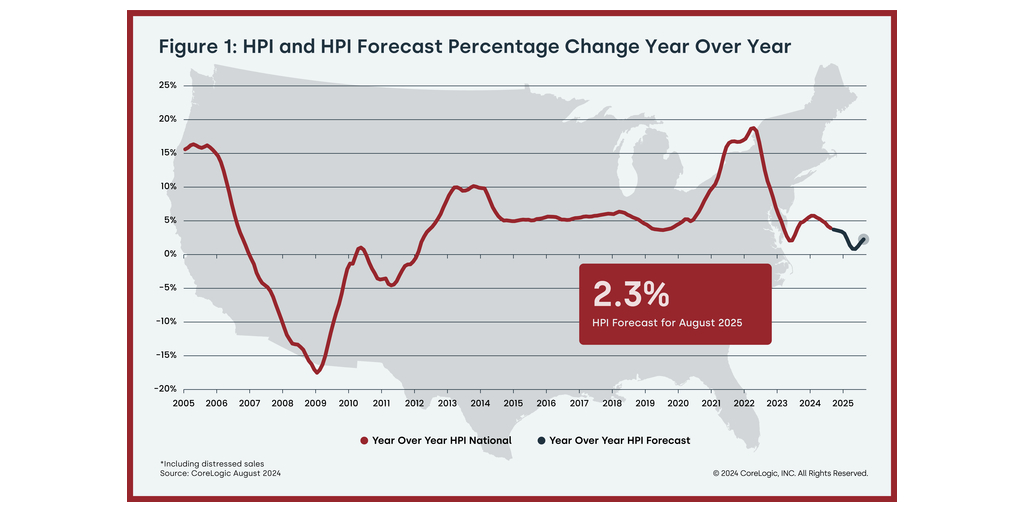

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2024.

By CoreLogic · Via Business Wire · October 1, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, announced initial residential and commercial storm surge and wind loss estimates for Hurricane Helene. According to this initial data analysis, wind and storm surge losses for insured residential and commercial properties in Florida and Georgia are expected to be between $3 and $5 billion. Updated damage estimates that will also include inland flood loss will be announced early next week after the storm has subsided.

By CoreLogic · Via Business Wire · September 27, 2024

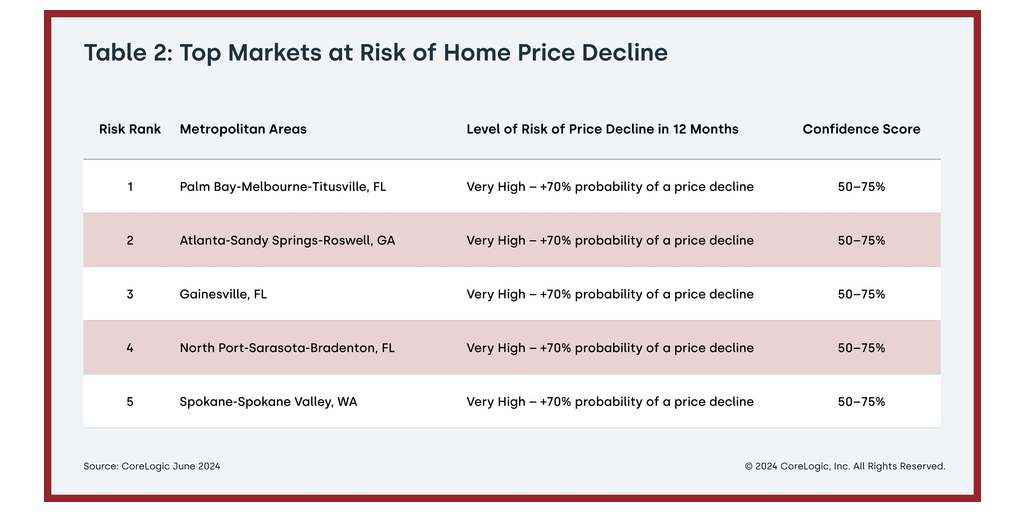

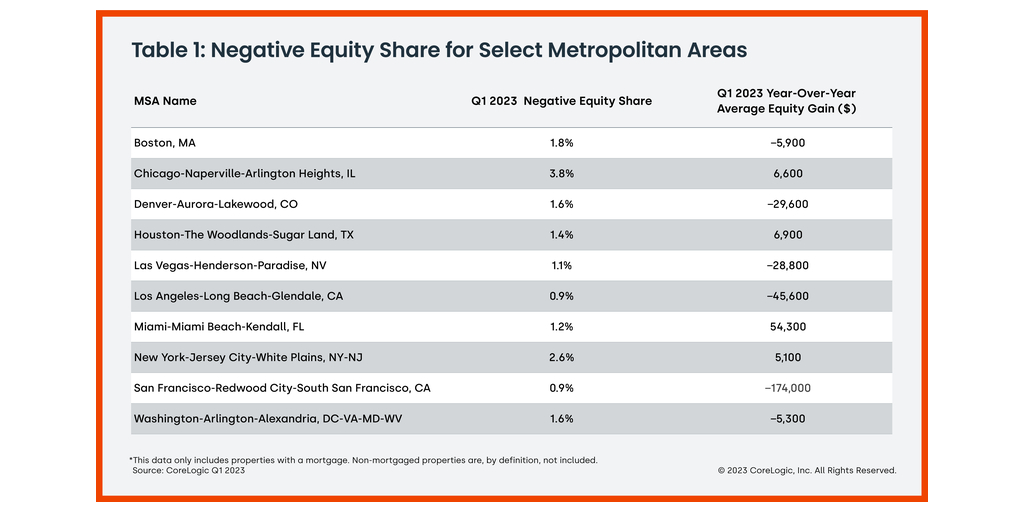

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report (HER) for the second quarter of 2024. The report shows that U.S. homeowners with mortgages (which account for roughly 62% of all properties) saw home equity increase by 8.0% year over year, representing a collective gain of $1.3 trillion and an average increase of $25,000 per borrower since the second quarter of 2023, bringing the total net homeowner equity to over $17.6 trillion in the second quarter of 2024

By CoreLogic · Via Business Wire · September 12, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for July 2024.

By CoreLogic · Via Business Wire · September 10, 2024

Natural disasters are becoming more intense as a result of changing weather patterns and wildfires are no exception. The 2024 CoreLogic Wildfire Risk Report found more than 2.6 million homes across 14 states are at moderate to very high risk of wildfire damage during the 2024 wildfire season, with a total reconstruction cost of $1.3 trillion. With those figures as a backdrop, the report also highlights the importance of mitigation techniques, both on an individual property and community wide basis—which have benefits for both homeowners and insurers.

By CoreLogic · Via Business Wire · August 13, 2024

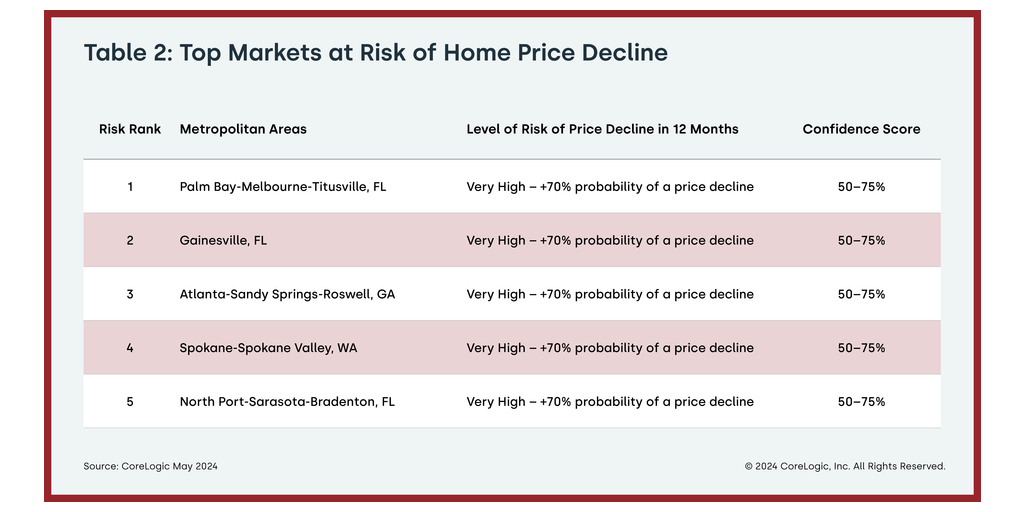

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for June 2024.

By CoreLogic · Via Business Wire · August 6, 2024

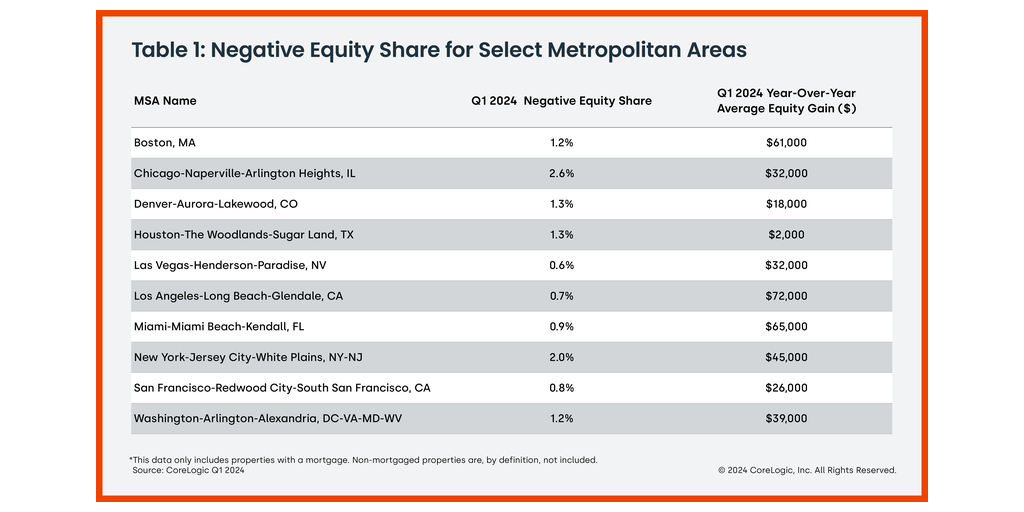

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2024.

By CoreLogic · Via Business Wire · July 2, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report (HER) for the first quarter of 2024. The report shows that U.S. homeowners with mortgages (which account for roughly 62% of all properties) saw home equity increase by 9.6% year over year, representing a collective gain of $1.5 trillion and an average increase of $28,000 per borrower since the first quarter of 2023. This brought total net homeowner equity to more than $17 trillion at the end of Q1 2024.

By CoreLogic · Via Business Wire · June 7, 2024

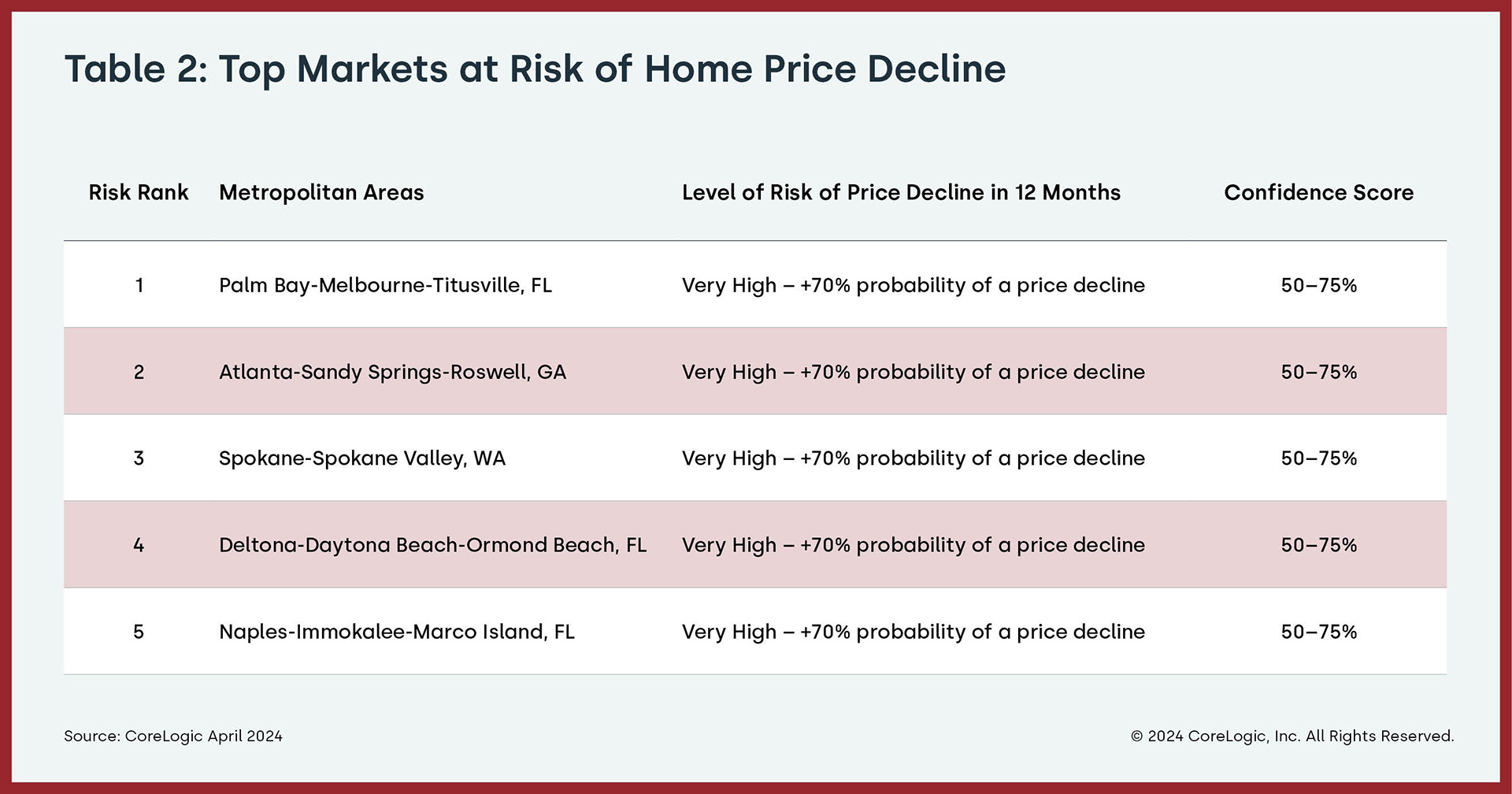

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for April 2024.

By CoreLogic · Via Business Wire · June 4, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for February 2024.

By CoreLogic · Via Business Wire · April 2, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report (HER) for the fourth quarter of 2023. The report shows that U.S. homeowners with mortgages (which account for roughly 62% of all properties) saw home equity increase by 8.6% year over year, representing a collective gain of $1.3 trillion and an average increase of slightly more than $24,000 per borrower since the fourth quarter of 2022. This brought total net homeowner equity to more than $16.6 billion at the of 2023.

By CoreLogic · Via Business Wire · March 7, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2024.

By CoreLogic · Via Business Wire · March 5, 2024

CoreLogic®, a leading global provider of property data and analytics, has announced the expansion of its strategic alliance with Google Cloud, solidifying a successful collaboration that has thrived over the past half-decade.

By CoreLogic · Via Business Wire · February 14, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2023.

By CoreLogic · Via Business Wire · February 6, 2024

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2023.

By CoreLogic · Via Business Wire · January 9, 2024

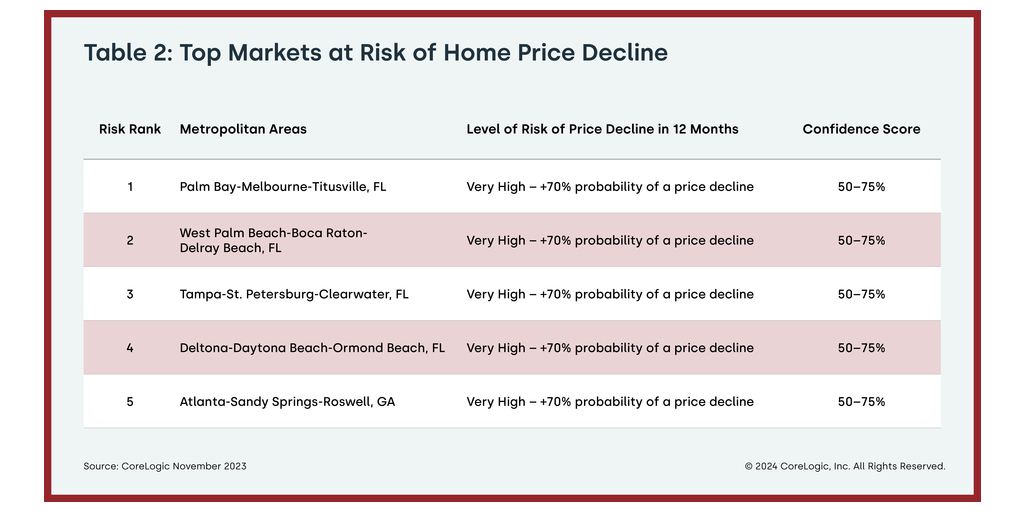

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2023.

By CoreLogic · Via Business Wire · December 5, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released its monthly Southern California home sales report for September 2023. The report includes data for new and resale single-family homes and resale condominiums from six counties in the region: Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura.

By CoreLogic · Via Business Wire · November 10, 2023

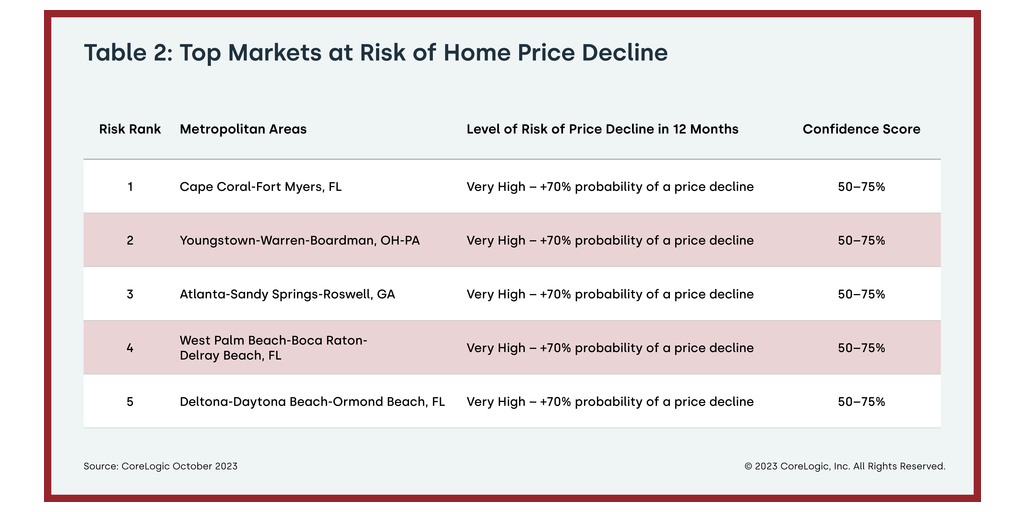

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for September 2023.

By CoreLogic · Via Business Wire · November 7, 2023

CoreLogic®, a leader in global property information, analytics and data-enabled solutions, has announced enhancements to its AutomatIQ Borrower Verification of Employment and Income (VOE/I) to offer lenders more flexibility in employment and income verification*. With a combination of four different verification options, lenders can streamline operations by creating custom waterfall verification solutions to meet individual objectives around speed, coverage and cost savings.

By CoreLogic · Via Business Wire · November 2, 2023

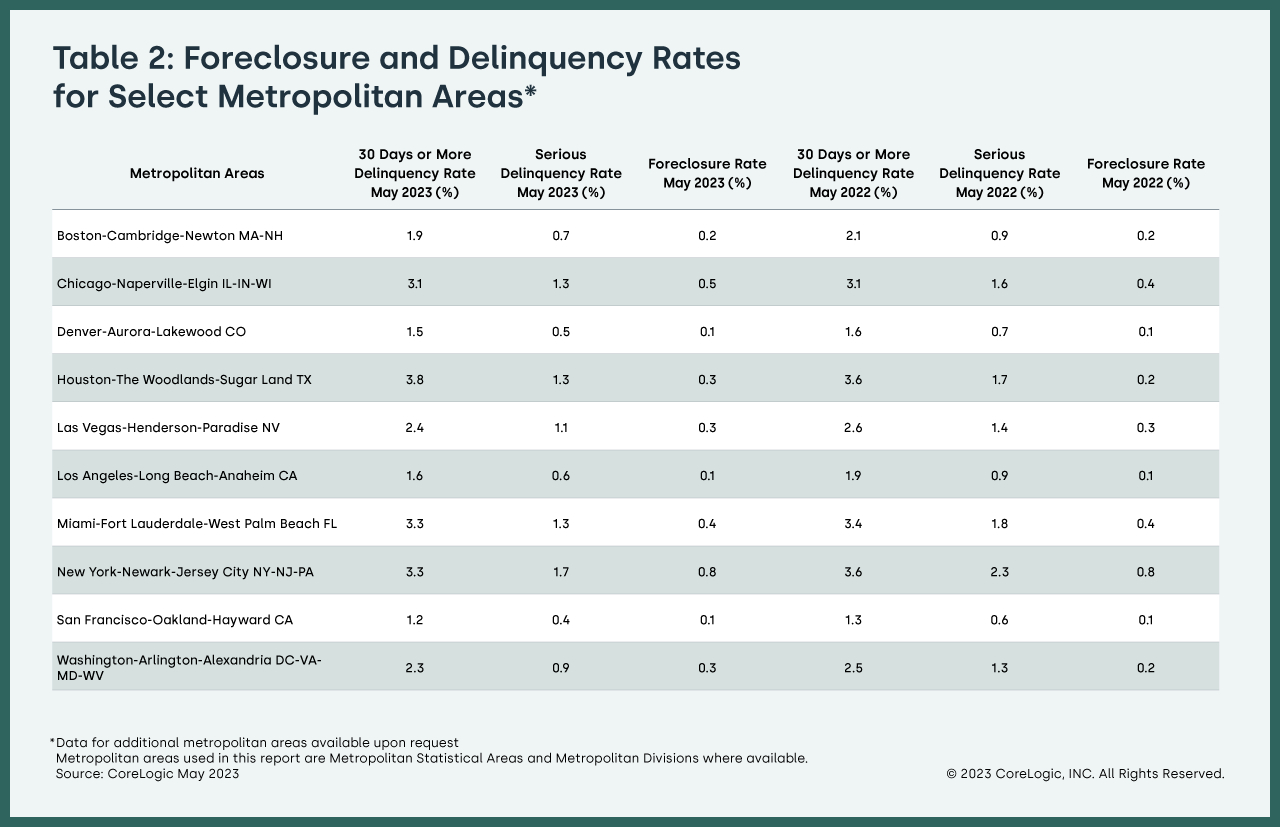

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for August 2023.

By CoreLogic · Via Business Wire · October 26, 2023

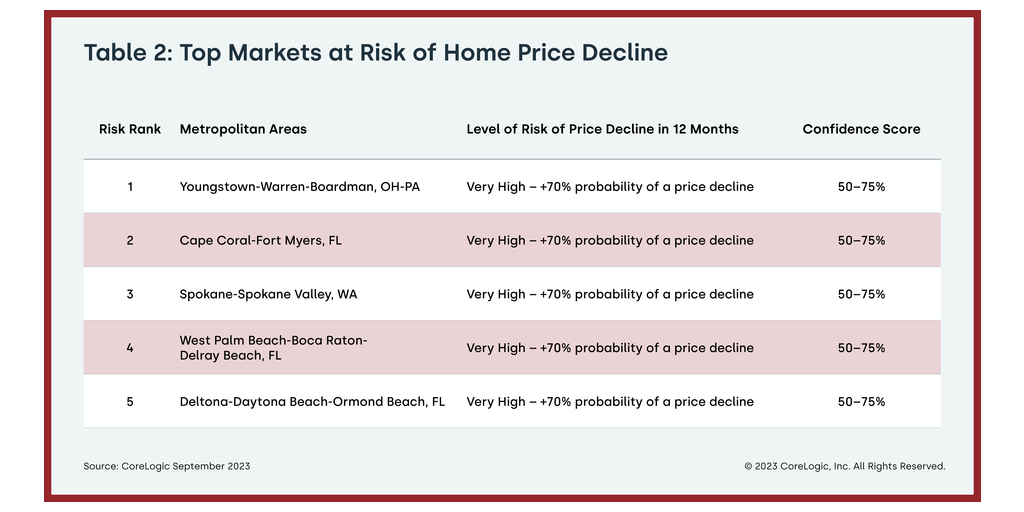

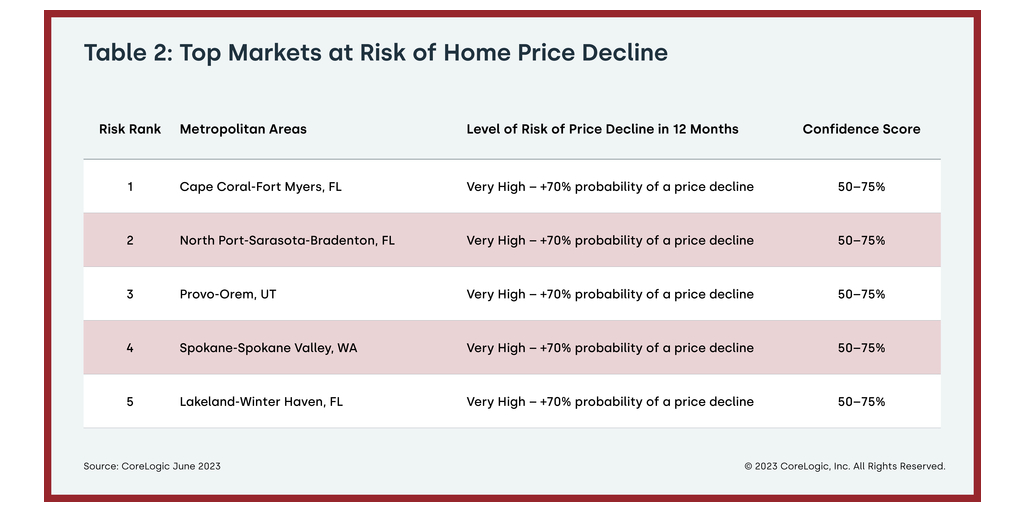

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2023.

By CoreLogic · Via Business Wire · October 3, 2023

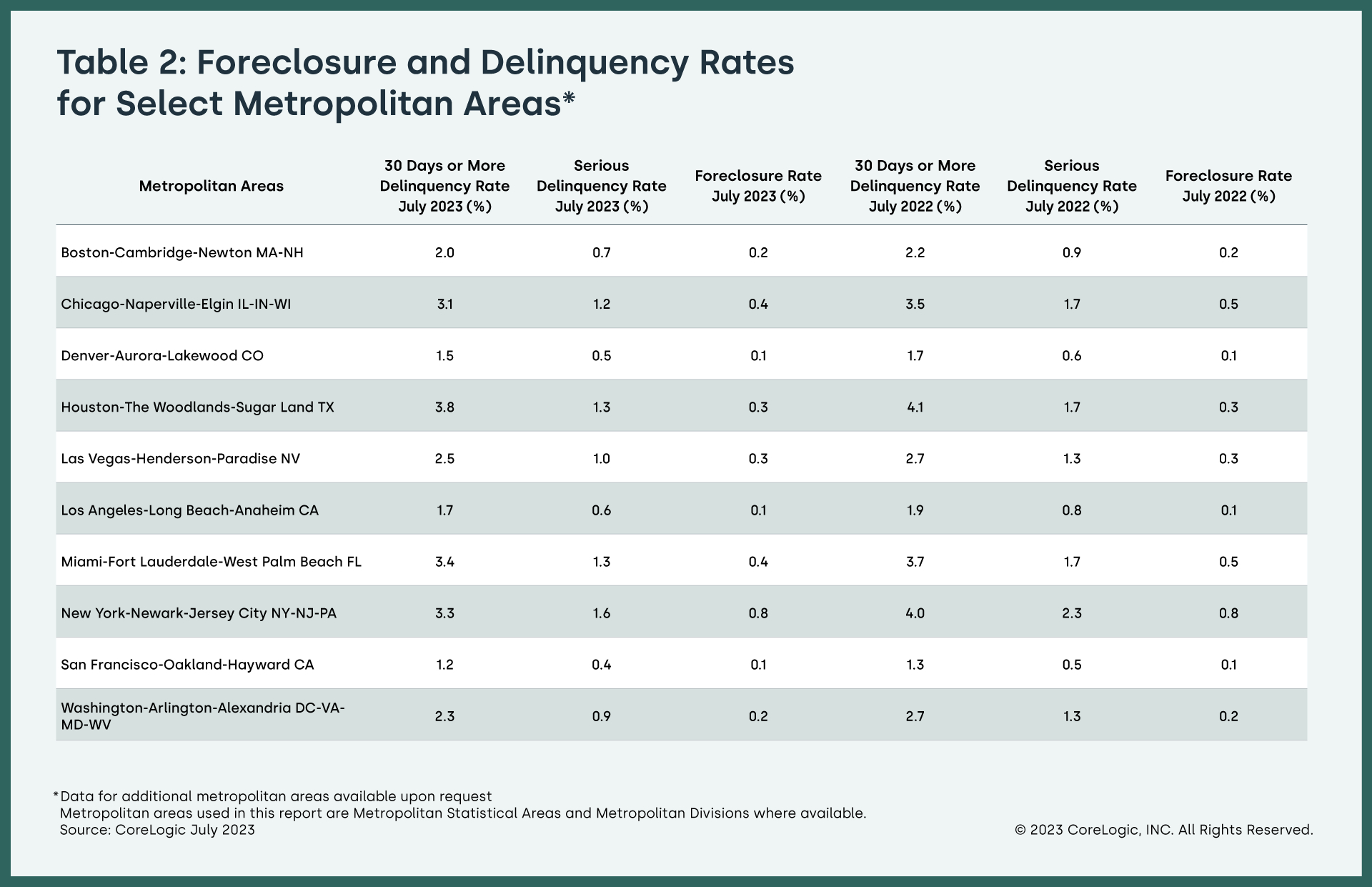

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for July 2023.

By CoreLogic · Via Business Wire · September 28, 2023

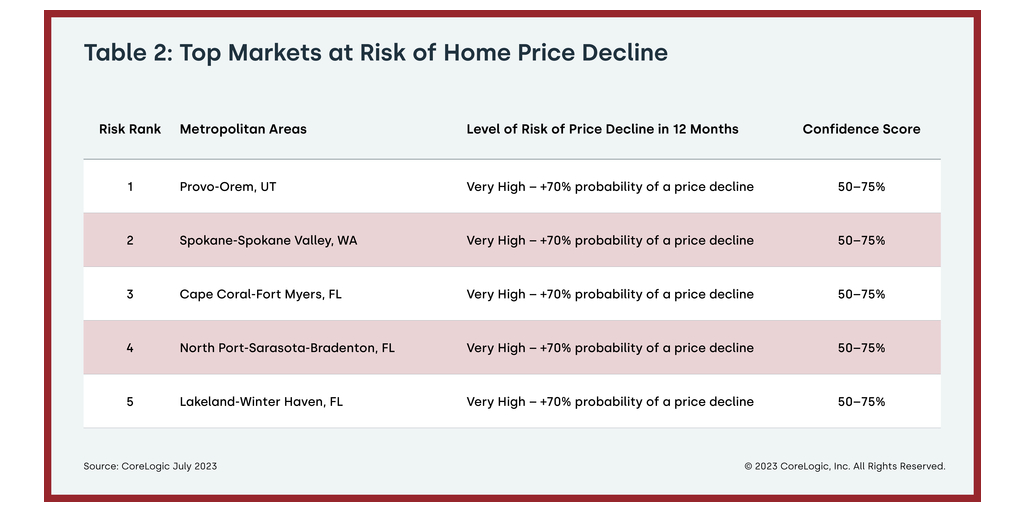

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for July 2023.

By CoreLogic · Via Business Wire · September 12, 2023

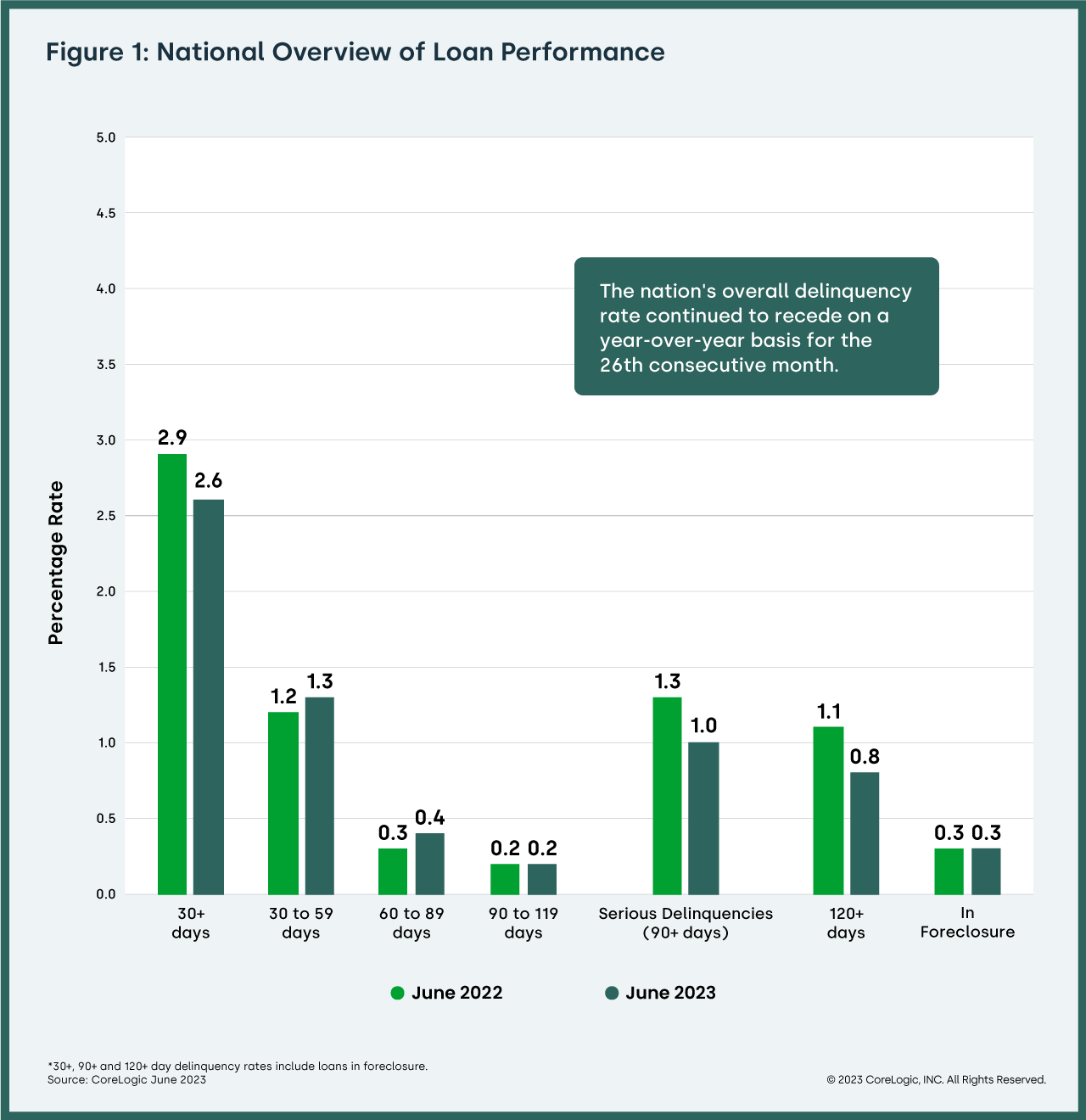

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for June 2023.

By CoreLogic · Via Business Wire · August 31, 2023

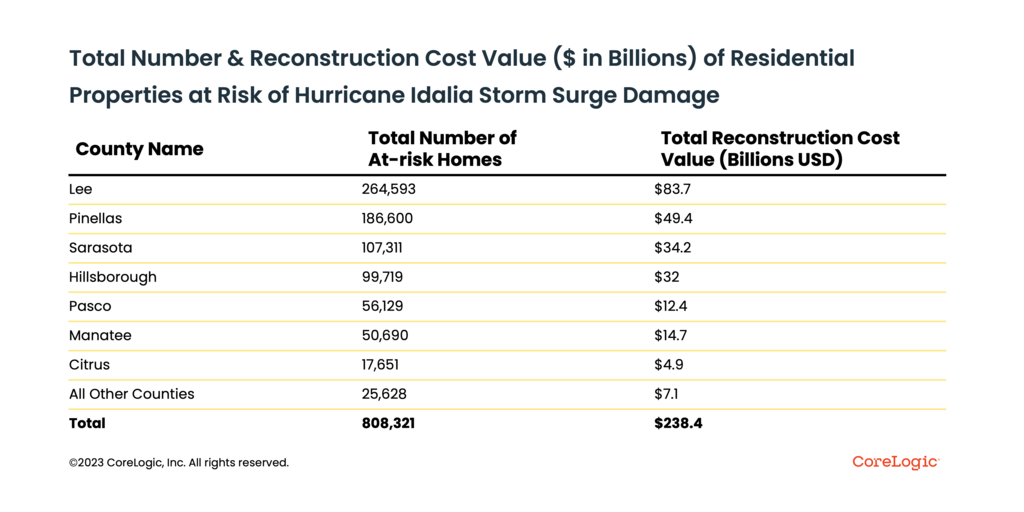

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released data analysis showing 808,321 single-family and multifamily homes along the Florida gulf coast with a reconstruction cost value (RCV) of approximately $238.4 billion are at potential risk of storm surge damage from Hurricane Idalia. These figures assume Hurricane Idalia makes landfall as a Category 3 hurricane and are based on the August 29, 2023 National Hurricane Center 5 a.m. E.T. forecast.

By CoreLogic · Via Business Wire · August 29, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released its monthly Southern California home sales report for June 2023. The report includes data for new and resale single-family homes and resale condominiums from six counties in the region: Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura.

By CoreLogic · Via Business Wire · August 9, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for June 2023.

By CoreLogic · Via Business Wire · August 1, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for May 2023.

By CoreLogic · Via Business Wire · July 27, 2023

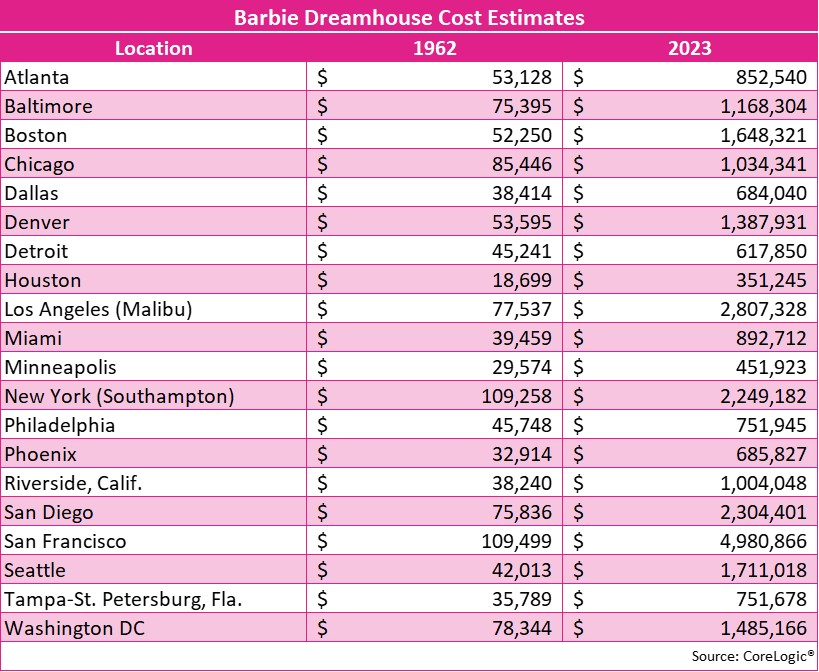

CoreLogic®, a leading global provider of property data and analytics, has done an estimated home price analysis of the iconic Barbie Dreamhouse prices in 1962 compared to 2023. The Dreamhouse debuted in 1962 and while the iconic toy underwent renovations over the years, this price comparison is for the pink palace we know today. The research sheds light on the notable changes in the real estate market across several major cities in the United States over the past six decades—particularly for multi-level pink houses outfitted with elevators.

By CoreLogic · Via Business Wire · July 24, 2023

CoreLogic®, a leading provider specializing in property information, analytics, and data-enabled solutions, has announced an enhancement to the CoreLogic Discovery Platform™. This robust, cloud-based platform is known for its innovative data exchange, property analytics and integration with major cloud and tech providers, further positioning CoreLogic as a premier property and location intelligence service provider.

By CoreLogic · Via Business Wire · July 12, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2023.

By CoreLogic · Via Business Wire · July 11, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for April 2023.

By CoreLogic · Via Business Wire · June 29, 2023

CoreLogic®, a leader in global property information, analytics, and data-enabled solutions, has announced its integration with Databricks Marketplace, a move that significantly expands the accessibility of CoreLogic's comprehensive datasets and analytics tools. This strategic collaboration amplifies CoreLogic’s commitment to meet clients in their world, in their cloud, and within their tech stack allowing a wider range of real estate, insurance and mortgage professionals to directly incorporate CoreLogic's data and insights into their existing workflows. This results in quicker and more impactful decision-making capabilities and improved business performance.

By CoreLogic · Via Business Wire · June 28, 2023

CoreLogic®, a leader in global property information, analytics and data-enabled solutions, is reducing the time to insight from months to minutes with its new Self-Serve Clip App available on the Snowflake Marketplace. Built natively for Snowflake, the new app integrates seamlessly with the Snowflake platform and other cloud stacks, empowering insights delivered directly in a client’s environment. The Self-Serve CLIP app allows users to easily assign CoreLogic’s property identifier to their property portfolio to unlock CoreLogic’s data easily from within their own Snowflake instance.

By CoreLogic · Via Business Wire · June 27, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report (HER) for the first quarter of 2023. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw home equity decrease by 0.7% year over year, representing a collective loss of $108.4 billion, and an average loss of $5,400 per borrower since the first quarter of 2022.

By CoreLogic · Via Business Wire · June 8, 2023

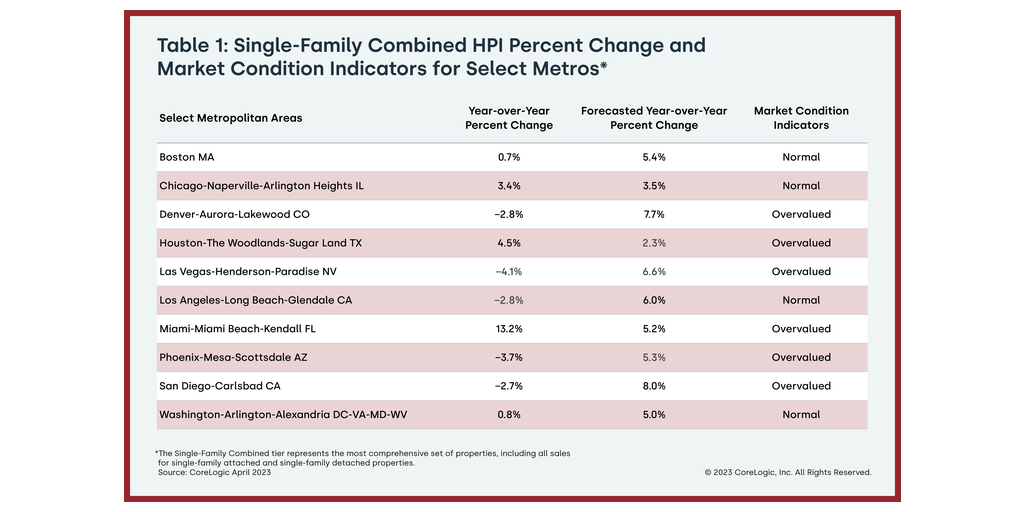

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for April 2023.

By CoreLogic · Via Business Wire · June 6, 2023

To mark the start of the 2023 Atlantic Hurricane Season, CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its 2023 Hurricane Risk Report, shedding light on the evolving landscape of hurricane risk in the face of climate change. The report analyzes risks for single-family residences (SFRs) and multifamily residences (MFRs) along the U.S. Gulf and Atlantic Coasts.

By CoreLogic · Via Business Wire · June 1, 2023

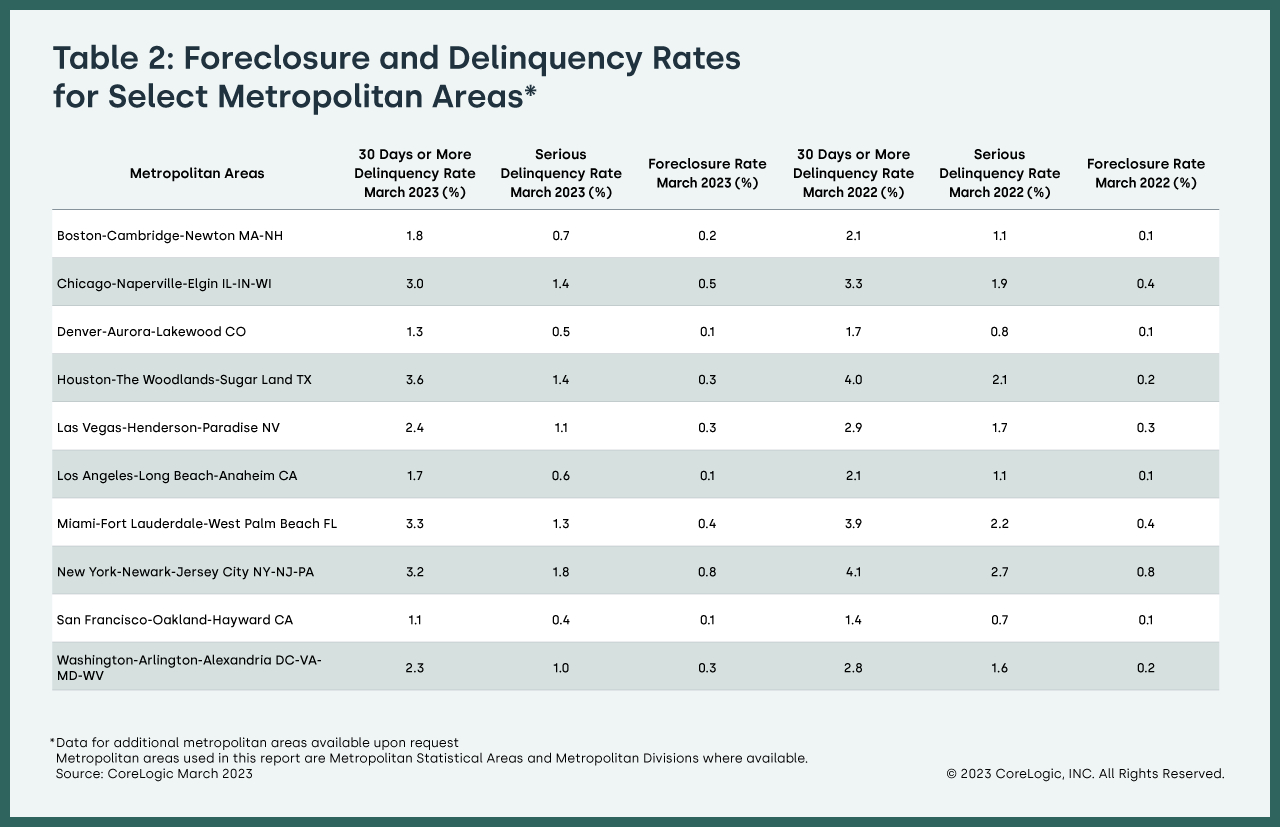

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for March 2023.

By CoreLogic · Via Business Wire · May 25, 2023

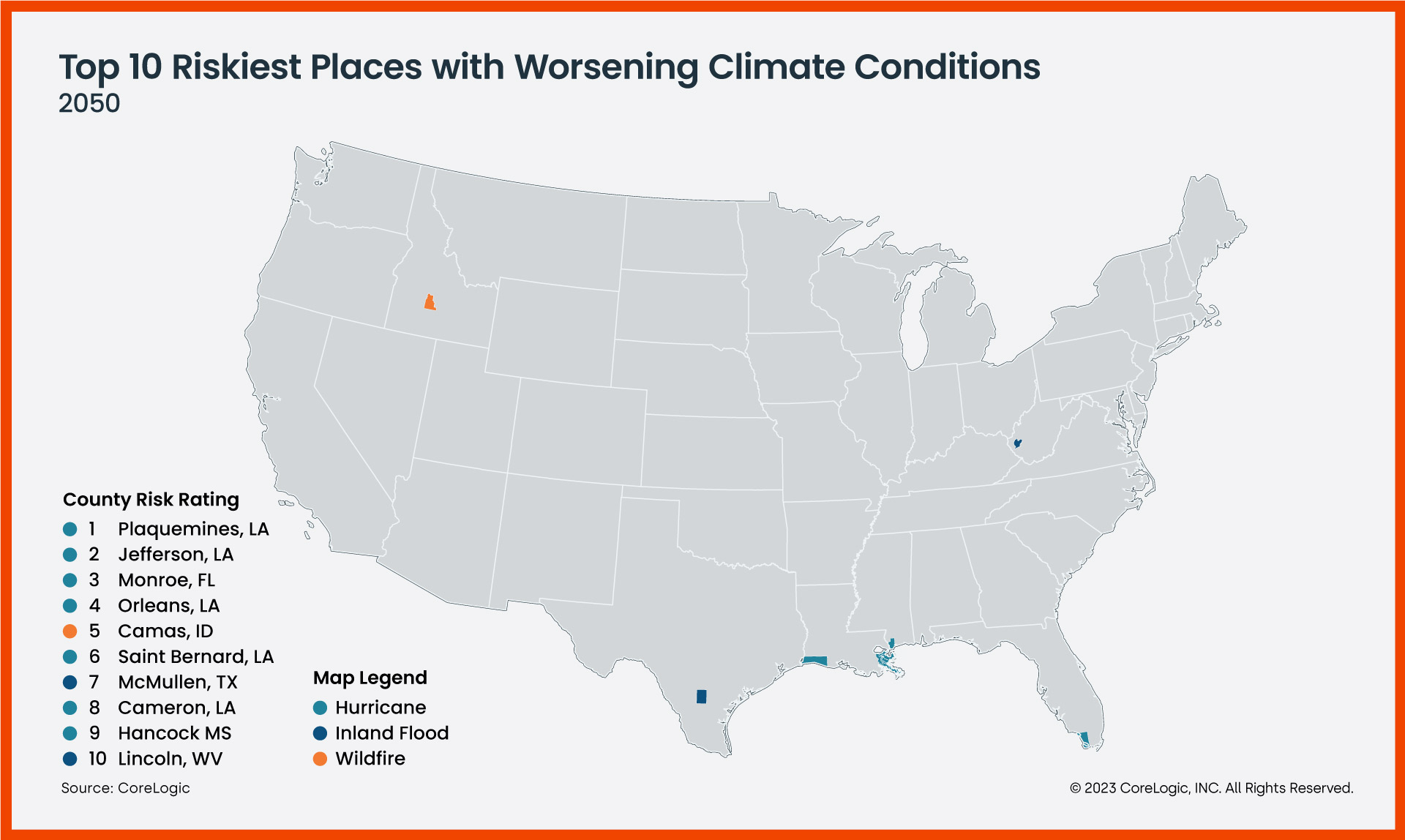

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, has announced the results of its riskiest places to live for natural disasters study. With exposure to hurricanes and inland floods Plaquemines Parish, Louisiana, emerged as the riskiest place for property owners due to damages from natural disasters. Areas on or near the U.S. Gulf Coast are particularly vulnerable to potential catastrophe damages, both currently and in the future.

By CoreLogic · Via Business Wire · May 24, 2023

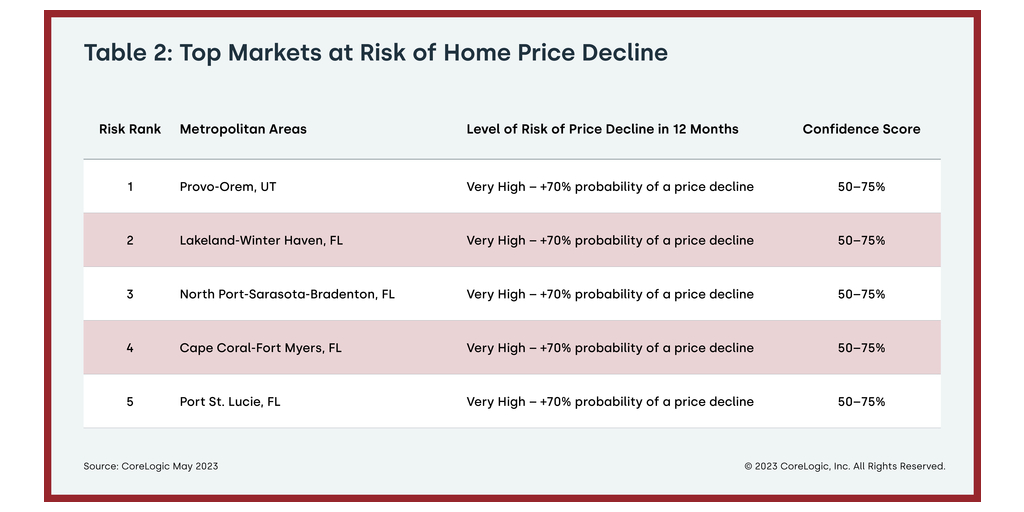

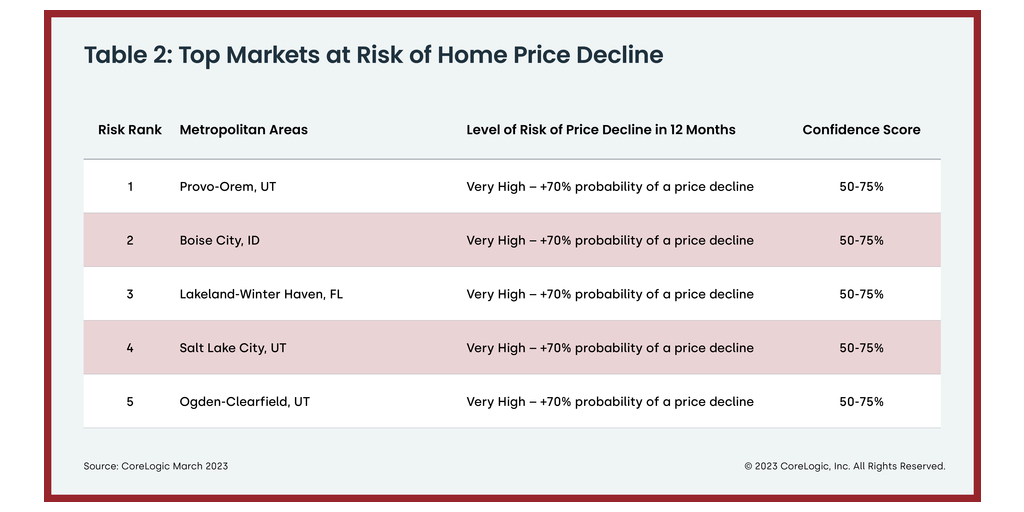

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2023.

By CoreLogic · Via Business Wire · May 2, 2023

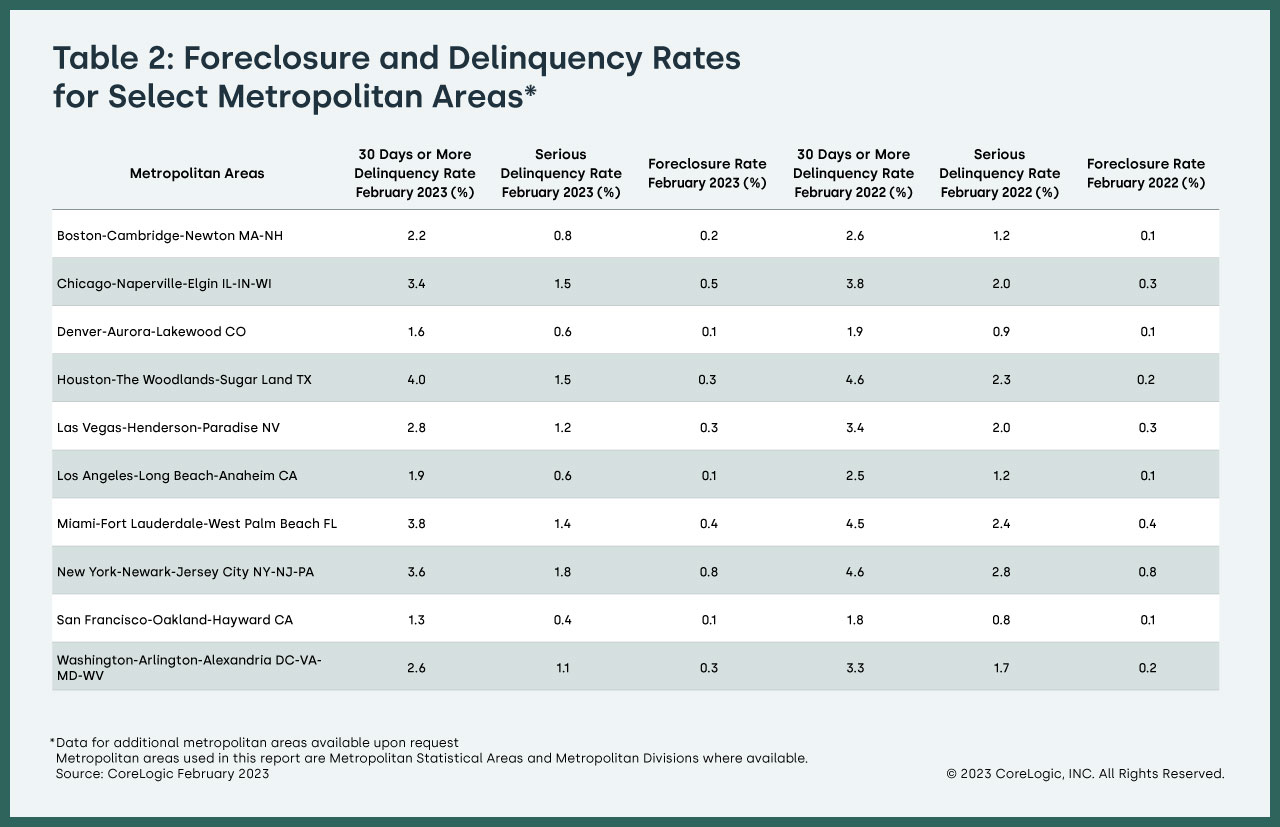

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for February 2023.

By CoreLogic · Via Business Wire · April 27, 2023

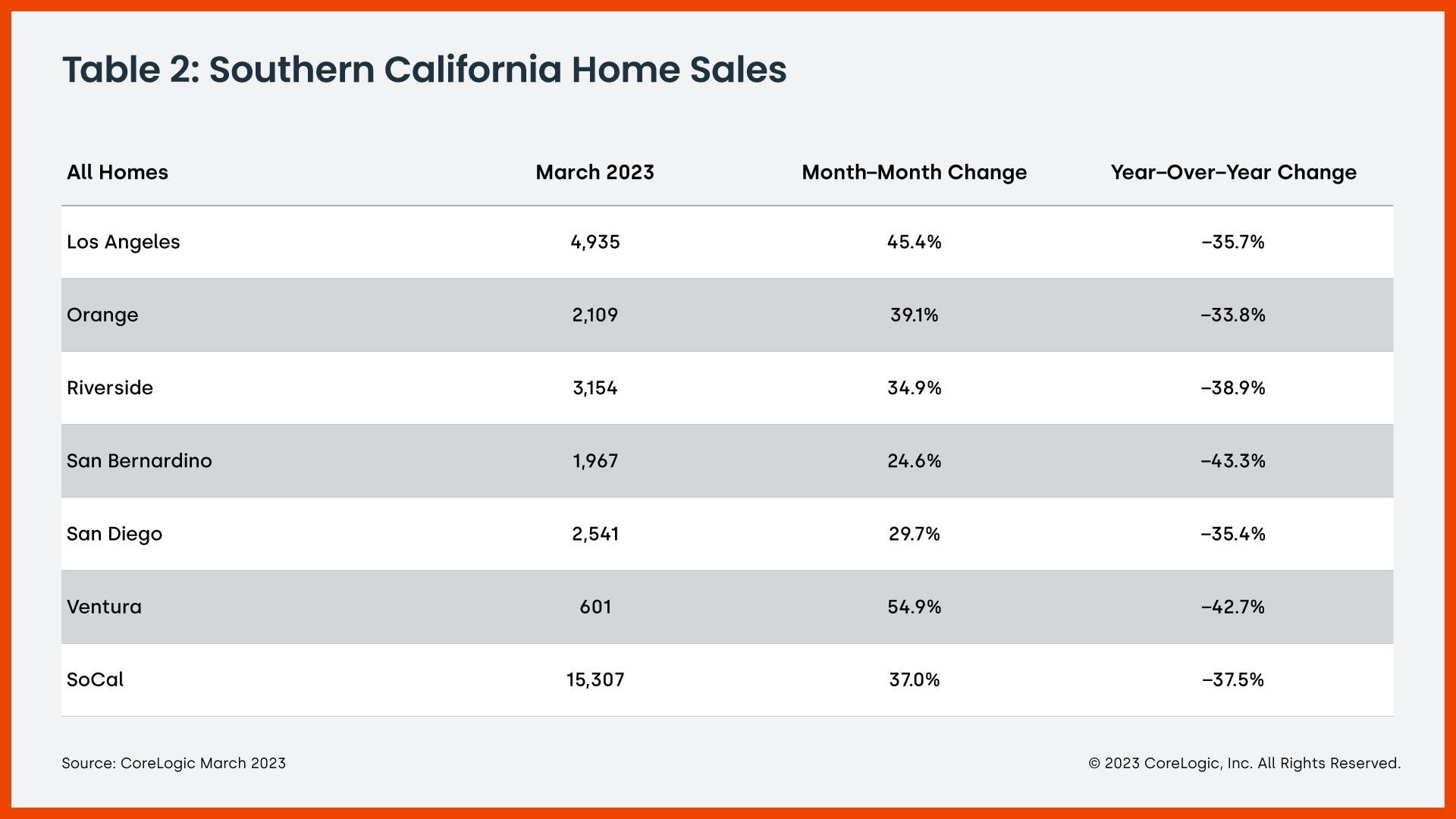

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released its monthly Southern California home sales report for March 2023. The report includes data for new and resale single-family homes and resale condominiums from six counties in the region: Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura.

By CoreLogic · Via Business Wire · April 26, 2023

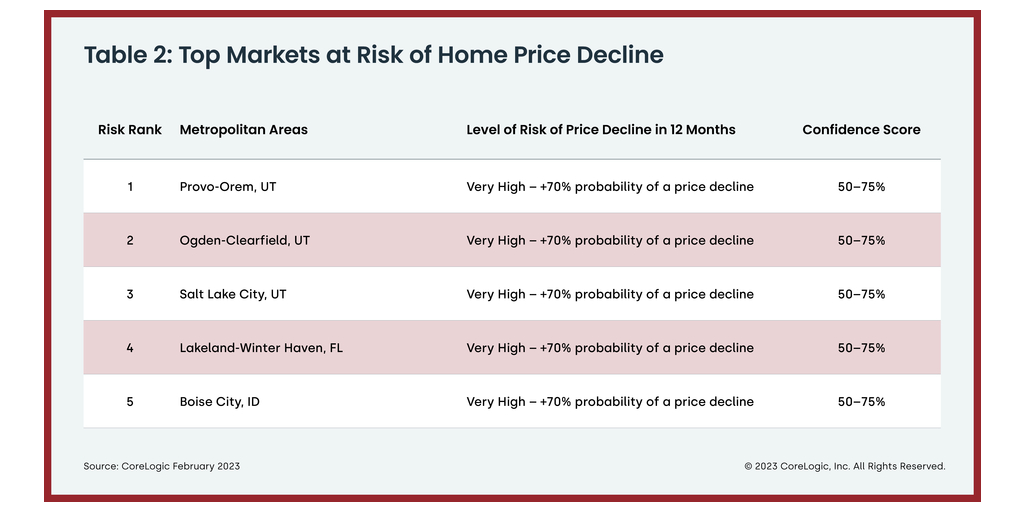

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for February 2023.

By CoreLogic · Via Business Wire · April 4, 2023

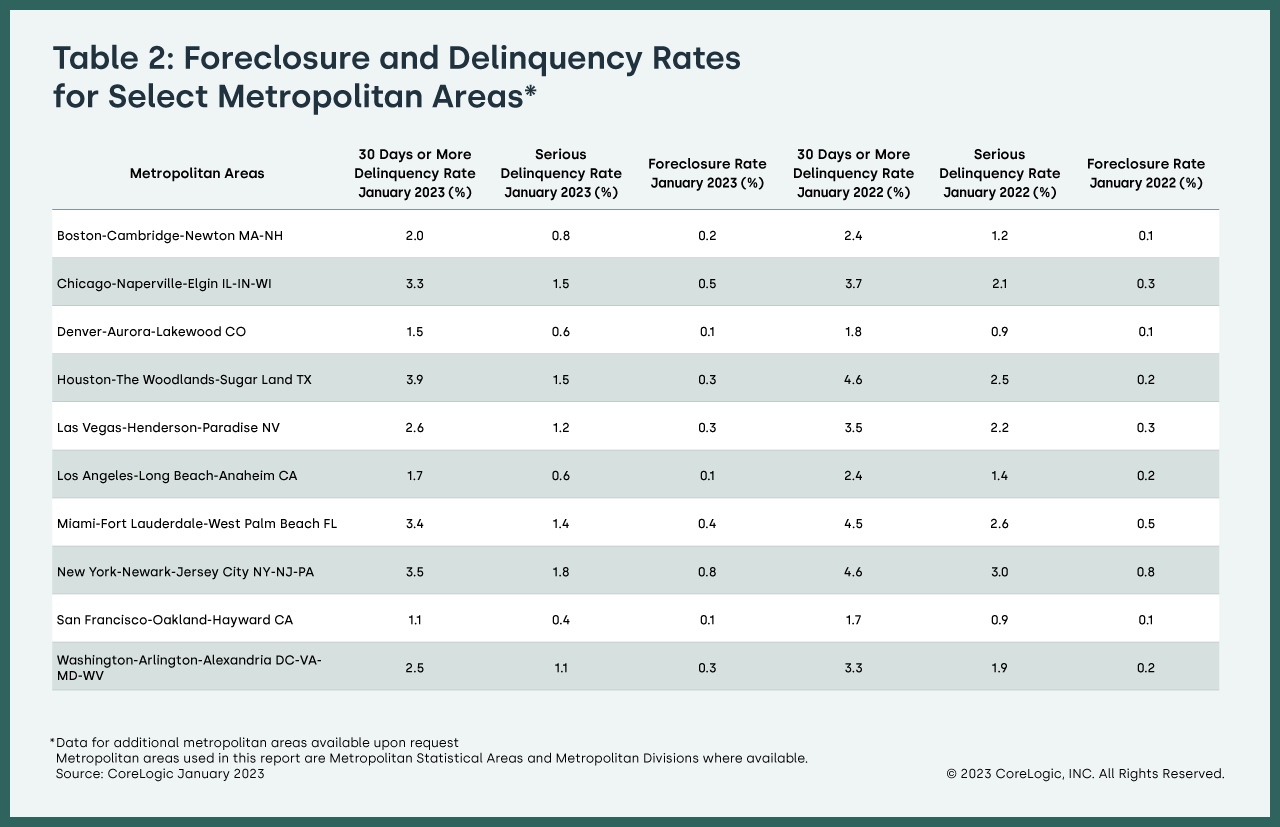

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for January 2023.

By CoreLogic · Via Business Wire · March 30, 2023

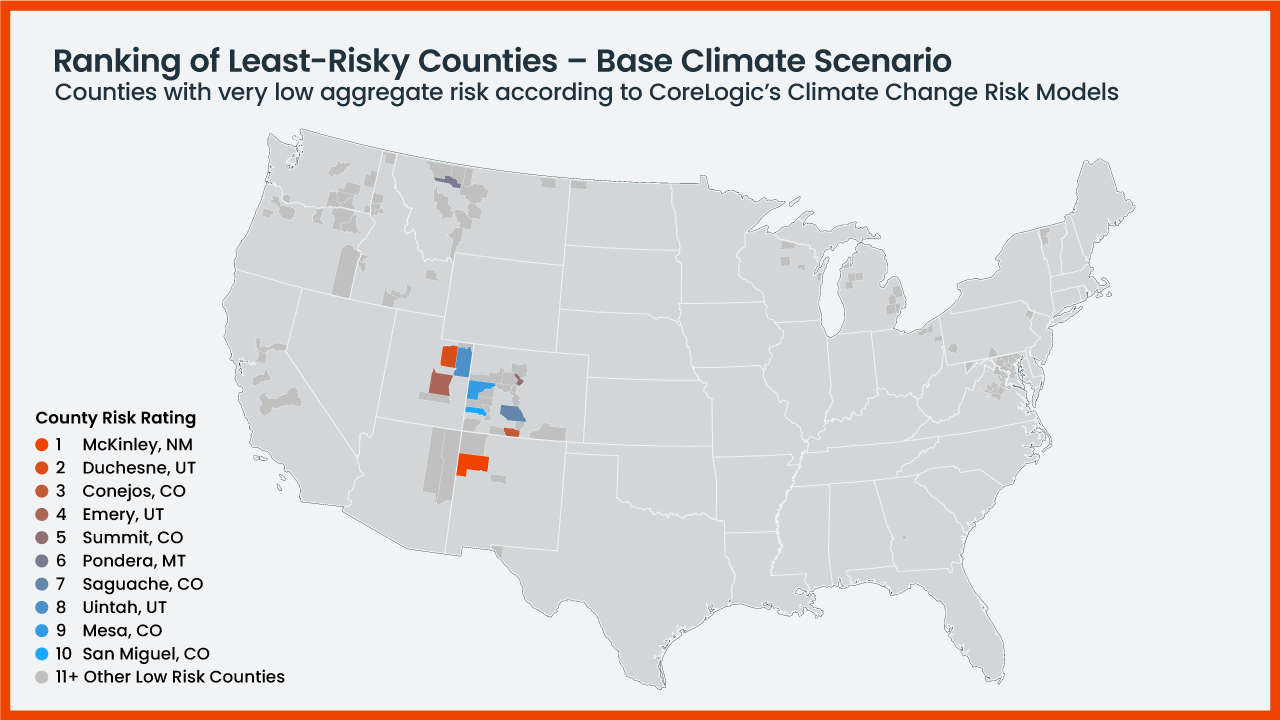

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, has announced the results of its “Safest Place to Live” study which details the least risky places to live in the U.S. from a natural hazard perspective. While severe convective storms and flooding pose risk to most homes in the U.S., McKinley County, New Mexico emerged as the least risky county to live due to its lack of hurricane and earthquake risk. Additionally, five counties in Colorado rank in the top 10 for lowest-risk areas for natural catastrophes.

By CoreLogic · Via Business Wire · March 23, 2023

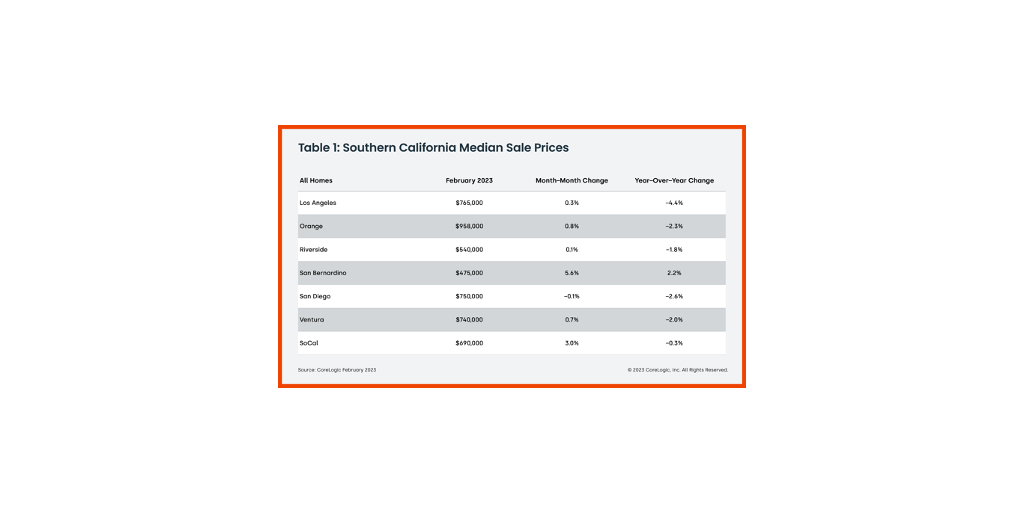

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released its monthly Southern California home sales report for February 2023. The report includes data for new and resale single-family homes and resale condominiums from six counties in the region: Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura.

By CoreLogic · Via Business Wire · March 22, 2023

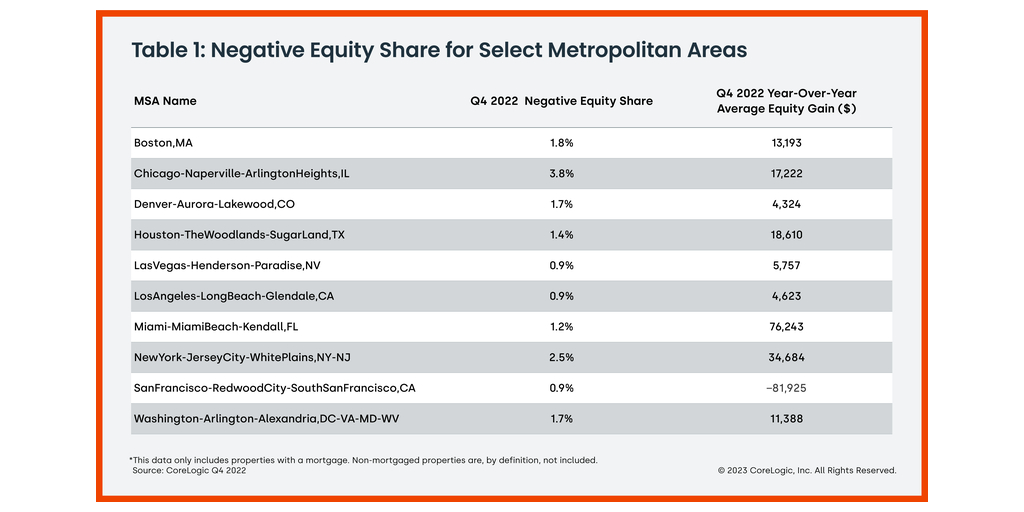

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report (HER) for the fourth quarter of 2022. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw equity increase by 7.3% year over year, representing a collective gain of $1 trillion, for an average of $14,300 per borrower, since the fourth quarter of 2021.

By CoreLogic · Via Business Wire · March 9, 2023

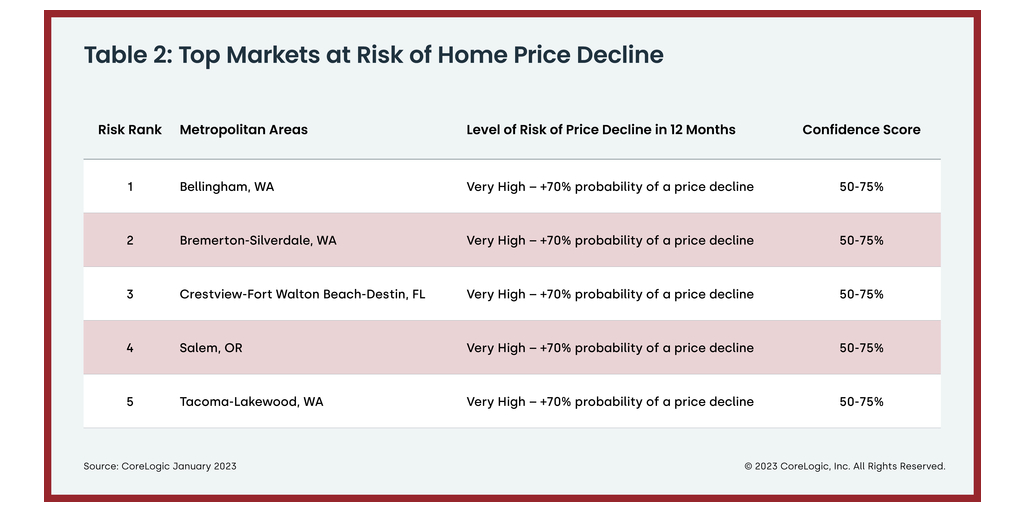

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2023.

By CoreLogic · Via Business Wire · March 7, 2023

Leading independent property data and analytics powerhouse CoreLogic International has completed its acquisition of Victorian-based proptech firm Plezzel, helping to expand its real estate industry technology solutions.

By CoreLogic · Via Business Wire · February 24, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for December 2022.

By CoreLogic · Via Business Wire · February 23, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, has acquired Roostify, a leading digital mortgage technology provider.

By CoreLogic · Via Business Wire · February 22, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2022.

By CoreLogic · Via Business Wire · February 7, 2023

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for November 2022.

By CoreLogic · Via Business Wire · January 26, 2023

CoreLogic® announced today that Selma Hepp has been appointed as Chief Economist. Selma was named interim chief economist in July 2022.

By CoreLogic · Via Business Wire · January 25, 2023

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, released the major U.S. housing trends wrap-up for 2022.

By CoreLogic · Via Business Wire · January 5, 2023

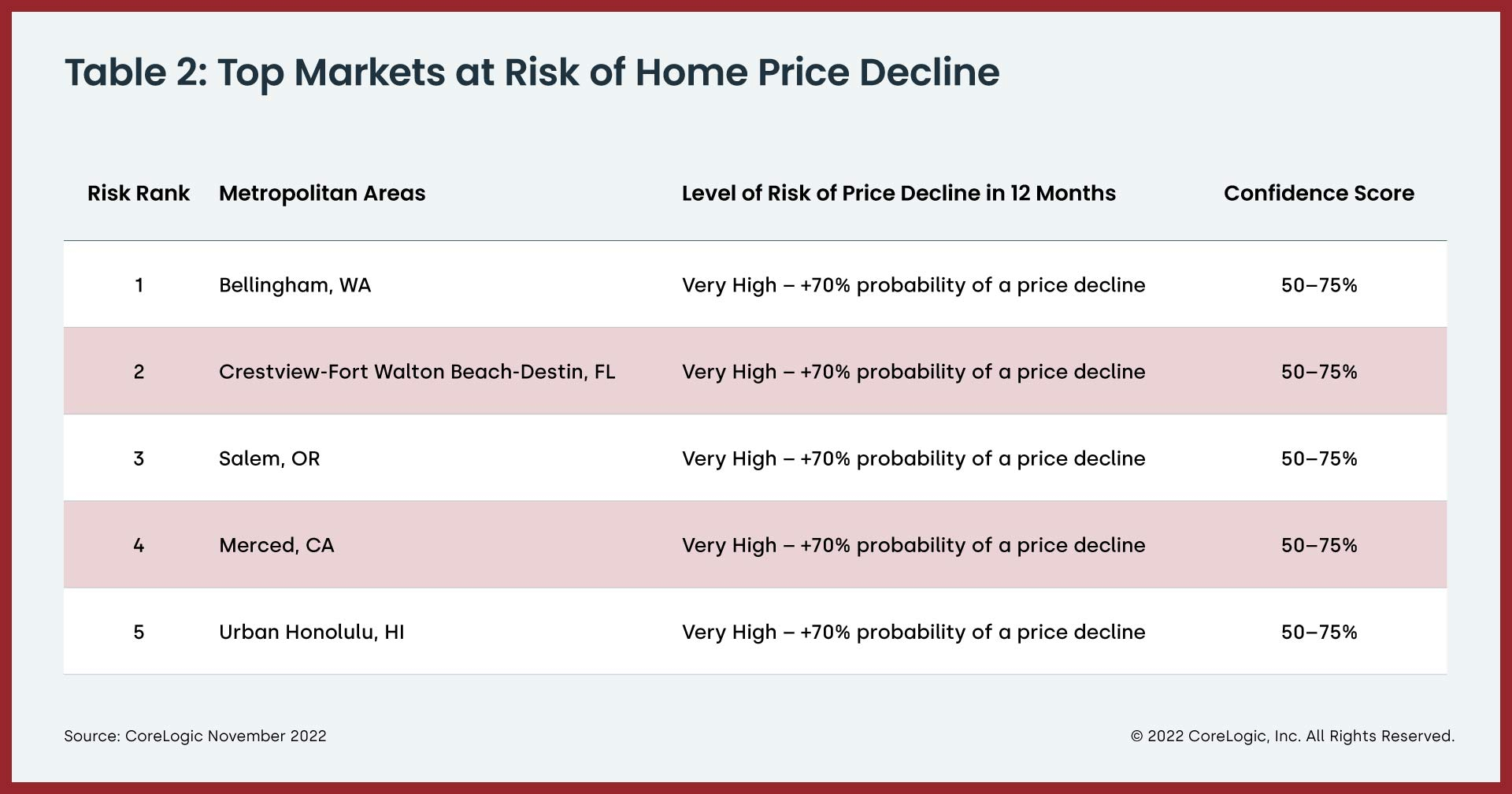

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2022.

By CoreLogic · Via Business Wire · January 3, 2023

CoreLogic®, a leading global property data and analytics-driven solutions provider, has announced the launch of Climate Risk Analytics™, designed to help government agencies and enterprises measure, model and mitigate the physical risks of climate change to the real estate industry, initially through 2050. This solution is built on Google Cloud’s secure and sustainable infrastructure

By CoreLogic · Via Business Wire · December 12, 2022

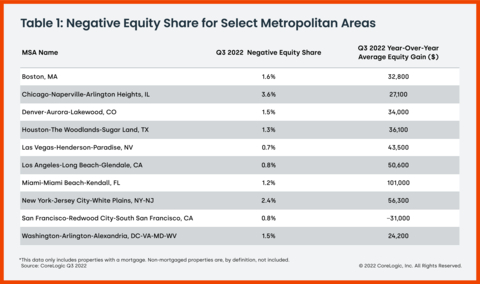

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report (HER) for the third quarter of 2022. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw equity increase by 15.8% year over year, representing a collective gain of $2.2 trillion, for an average of $34,300 per borrower, since the third quarter of 2021.

By CoreLogic · Via Business Wire · December 9, 2022

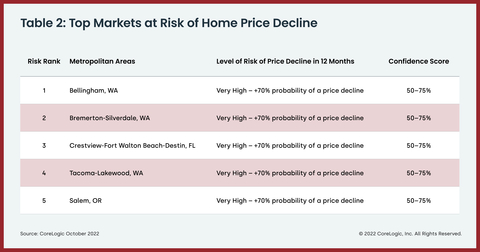

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2022.

By CoreLogic · Via Business Wire · December 6, 2022

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for September 2022.

By CoreLogic · Via Business Wire · November 1, 2022

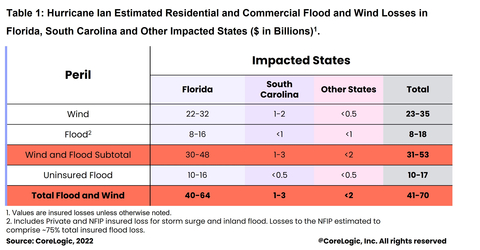

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today announced its updated and final damage estimates for Hurricane Ian.

By CoreLogic · Via Business Wire · October 6, 2022

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2022.

By CoreLogic · Via Business Wire · October 4, 2022

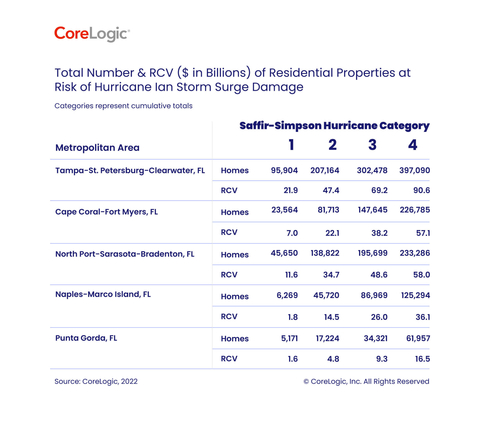

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released data analysis showing 1,044,412 single-family and multifamily homes along the Florida gulf coast with a reconstruction cost value (RCV) of approximately $258.3 billion are at potential risk of storm surge damage from Hurricane Ian. These figures assume Hurricane Ian makes landfall as a Category 4 hurricane and are based on the September 26, 2022 National Hurricane Center 11 a.m. E.T. forecast.

By CoreLogic · Via Business Wire · September 26, 2022