The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Herc (NYSE:HRI) and the rest of the specialty equipment distributors stocks fared in Q4.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 8 specialty equipment distributors stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.8% since the latest earnings results.

Herc (NYSE:HRI)

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE:HRI) provides equipment rental and related services to a wide range of industries.

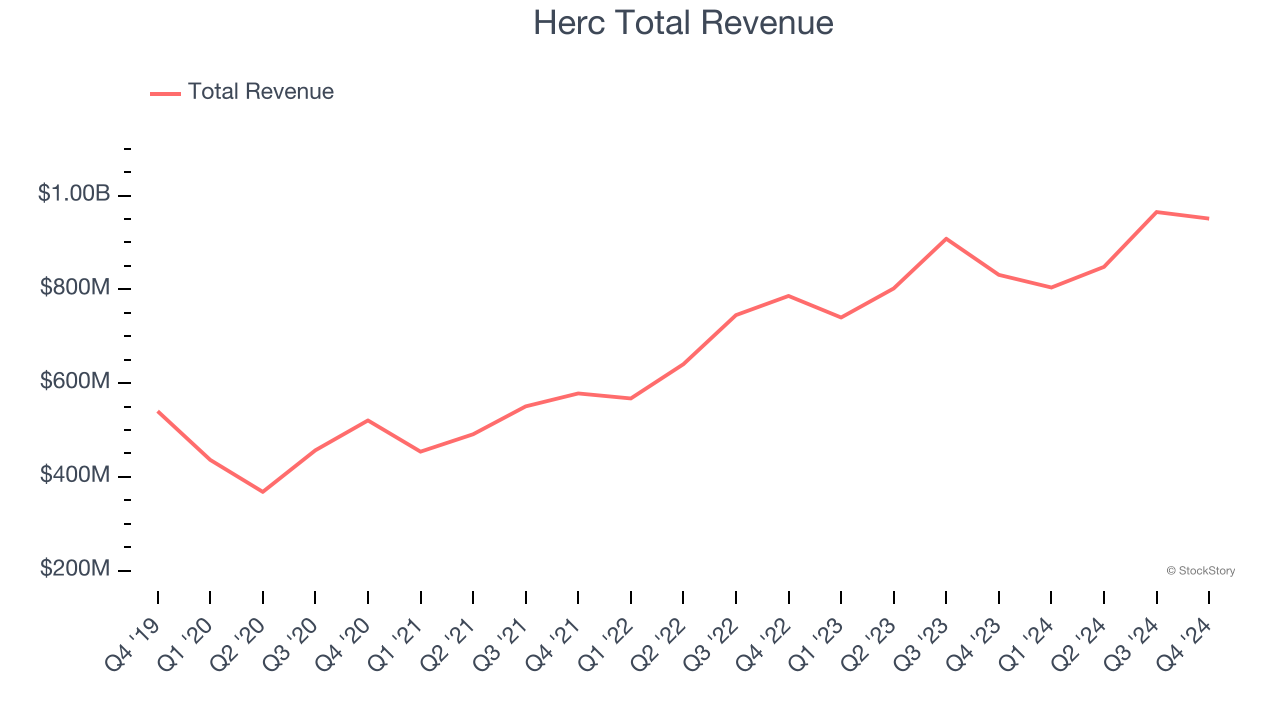

Herc reported revenues of $951 million, up 14.4% year on year. This print exceeded analysts’ expectations by 2.5%. It was still a decent quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

"In 2024, despite a more challenging market than anticipated, we delivered another year of record results, significantly outperforming industry revenue growth by leveraging the strength of tenured customer relationships, the value derived from strategic capital-allocation priorities and our diversified position across products, geographies and end markets," said Larry Silber, president and chief executive officer.

Herc achieved the fastest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 19% since reporting and currently trades at $137.43.

Is now the time to buy Herc? Access our full analysis of the earnings results here, it’s free.

Best Q4: United Rentals (NYSE:URI)

Owning the largest rental fleet in the world, United Rentals (NYSE:URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

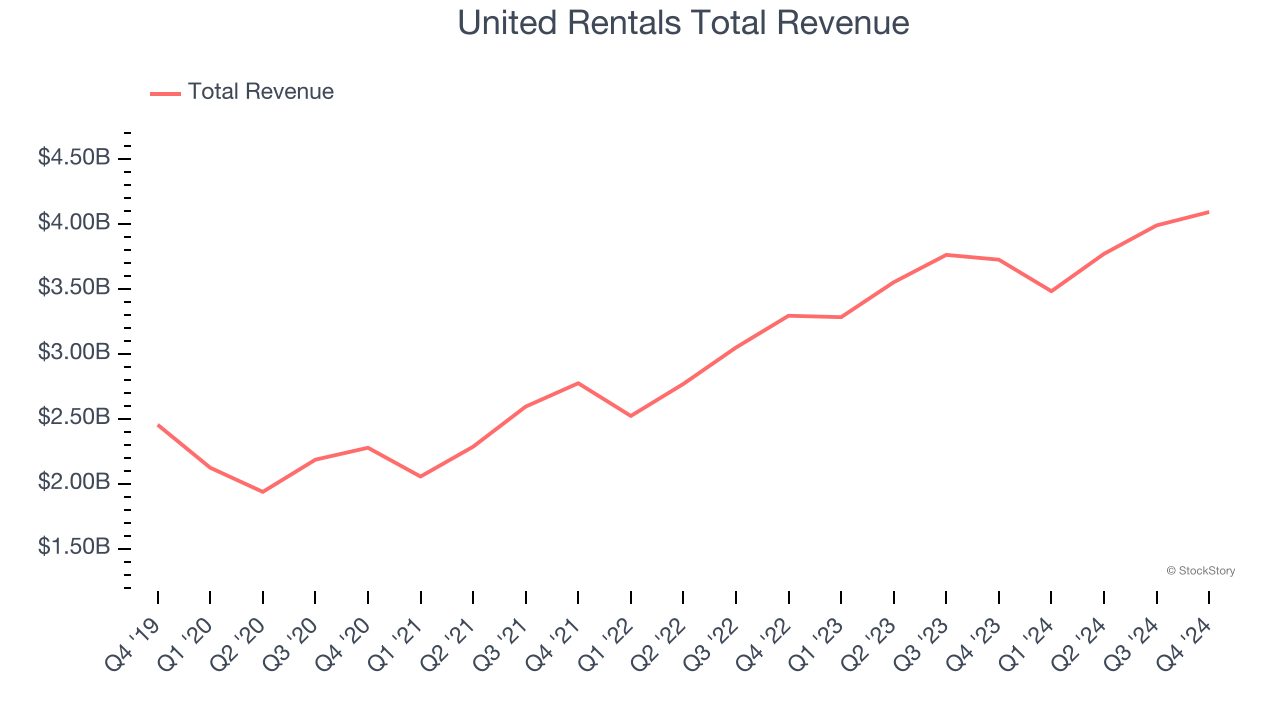

United Rentals reported revenues of $4.10 billion, up 9.8% year on year, outperforming analysts’ expectations by 3.9%. The business had a strong quarter with an impressive beat of analysts’ organic revenue and adjusted operating income estimates.

United Rentals delivered the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 19% since reporting. It currently trades at $614.20.

Is now the time to buy United Rentals? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Richardson Electronics (NASDAQ:RELL)

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $49.49 million, up 12.1% year on year, falling short of analysts’ expectations by 3.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 23.1% since the results and currently trades at $11.31.

Read our full analysis of Richardson Electronics’s results here.

Alta (NYSE:ALTG)

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $498.1 million, down 4.5% year on year. This number beat analysts’ expectations by 2.6%. Aside from that, it was a slower quarter as it logged a significant miss of analysts’ adjusted operating income estimates.

The stock is down 14.2% since reporting and currently trades at $4.37.

Read our full, actionable report on Alta here, it’s free.

Custom Truck One Source (NYSE:CTOS)

Inspired by a family gas station, Custom Truck One Source (NYSE:CTOS) is a distributor of trucks and heavy equipment.

Custom Truck One Source reported revenues of $520.7 million, flat year on year. This print missed analysts’ expectations by 3.7%. Aside from that, it was a strong quarter as it produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

Custom Truck One Source delivered the highest full-year guidance raise among its peers. The stock is up 7.7% since reporting and currently trades at $4.31.

Read our full, actionable report on Custom Truck One Source here, it’s free.

Market Update

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.