Qualcomm, Inc. (QCOM)

137.00

-2.51 (-1.80%)

NASDAQ · Last Trade: Mar 5th, 10:52 PM EST

Investors are evaluating whether accelerating AI chip demand and Broadcom’s $100 billion AI revenue target can sustain its momentum in the expanding AI data center market.

Via The Motley Fool · March 5, 2026

As of today, March 5, 2026, Broadcom Inc. (NASDAQ: AVGO) stands at the undisputed epicenter of the global artificial intelligence infrastructure. While Nvidia (NASDAQ: NVDA) captured the early headlines of the generative AI revolution with its H100 and Blackwell GPUs, Broadcom has quietly become the "architect of the back-end." By providing the high-speed networking switches [...]

Via Finterra · March 5, 2026

As of March 5, 2026, Intel Corporation (Nasdaq: INTC) stands at the most critical juncture in its 58-year history. After a tumultuous period characterized by manufacturing delays, leadership changes, and a stinging loss of market dominance to NVIDIA (Nasdaq: NVDA) and AMD (Nasdaq: AMD), the Silicon Valley pioneer is attempting a "Great Pivot." Under the [...]

Via Finterra · March 5, 2026

Via Talk Markets · February 24, 2026

Via MarketBeat · March 5, 2026

Wells Fargo upgraded Qualcomm due to its data center strategy.

Via Barchart.com · March 4, 2026

Chip stock QCOM is down sharply in 2026. Does this pullback offer a smart entry point, or signal deeper trouble for investors?

Via Barchart.com · March 3, 2026

Keysight Technologies announces collaboration with Qualcomm Technologies to enhance RF digital twins and optimize 5G/6G networks.

Via Benzinga · March 3, 2026

Qualcomm (NASDAQ: QCOM) sees robotics as its next major growth engine, with CEO Cristiano Amon predicting significant scale within 2 years.

Via Benzinga · March 3, 2026

Over the past six months, Qualcomm’s stock price fell to $142.16. Shareholders have lost 10.5% of their capital, which is disappointing considering the S&P 500 has climbed by 7.7%. This may have investors wondering how to approach the situation.

Via StockStory · March 2, 2026

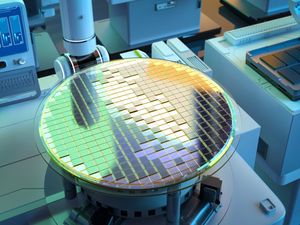

With data center fever gripping the world, which is the best single company to invest in to profit from it? Taiwan Semiconductor makes a compelling case for itself.

Via The Motley Fool · February 27, 2026

Via MarketBeat · February 27, 2026

As the financial world looks toward the spring of 2026, the semiconductor landscape is bracing for its most significant shift since the launch of the original Blackwell architecture. Nvidia (NASDAQ:NVDA) is reportedly preparing to officially unveil its "N1" and "N1X" system-on-chips (SoCs) at the upcoming GTC 2026 conference in

Via MarketMinute · February 26, 2026

As the final week of February 2026 draws to a close, the financial markets have emerged from what analysts are calling the most consequential “Heavyweight Week” of the post-pandemic era. The triple-threat earnings reports from Alphabet Inc. (NASDAQ: GOOGL), Qualcomm Inc. (NASDAQ: QCOM), and Eli Lilly and Company (NYSE: LLY)

Via MarketMinute · February 26, 2026

The global financial markets reached a critical crossroads this week as the final, most anticipated piece of the quarterly earnings puzzle fell into place. NVIDIA Corporation (NASDAQ:NVDA), the silicon powerhouse that has become the de facto barometer for the modern economy, released its fourth-quarter fiscal 2026 results on February

Via MarketMinute · February 26, 2026

As of February 26, 2026, Broadcom Inc. (Nasdaq: AVGO) stands as a titan of the digital era, positioned at the critical intersection of generative artificial intelligence (AI) and enterprise software infrastructure. With the company’s fiscal first-quarter 2026 earnings report scheduled for March 4, the financial community is buzzing with anticipation. Broadcom has transitioned from a [...]

Via Finterra · February 26, 2026

Analog Devices has outperformed its semiconductor peers over the past year and analysts are very bullish on its future growth potential.

Via Barchart.com · February 26, 2026

CEOs of Apple and major chip-makers like Nvidia were briefed by the CIA in 2023 on intelligence indicating China could move to take over Taiwan in 2027, according to the NYT.

Via Stocktwits · February 25, 2026

As the sun begins to set on Jerome Powell’s tenure at the helm of the world’s most powerful central bank, the financial world is bracing for a tectonic shift in economic governance. The nomination of Kevin Warsh to succeed Powell as Chairman of the Federal Reserve in May

Via MarketMinute · February 24, 2026

Qualcomm Inc (NASDAQ:QCOM) shares are popping Tuesday after the chipmaker received a pair of bullish upgrades.

Via Benzinga · February 24, 2026

Stay updated with the S&P500 stocks that are on the move in today's pre-market session.chartmill.com

Via Chartmill · February 24, 2026

Via Benzinga · February 24, 2026

Via Benzinga · February 24, 2026

In a move that marks the end of the traditional x86 processor's decades-long dominance, Nvidia (NASDAQ:NVDA) today officially unveiled its N1 and N1X series of AI-powered laptop processors. Announced at the 2026 AI Mobile Summit in Barcelona, these chips represent Nvidia’s first comprehensive push into the consumer System-on-a-Chip

Via MarketMinute · February 23, 2026

MarketBeat Week in Review – 02/16 - 02/20marketbeat.com

If investors are waiting for less market volatility, they’ll have to wait a little longer. The markets continued to oscillate between losses and gains as investors digested the impact of the U.S. Supreme Court’s decision to strike down the emergency tariffs imposed by the Trump administration.

Via MarketBeat · February 21, 2026