ProShares UltraPro Short QQQ (SQQQ)

70.50

+3.93 (5.90%)

NASDAQ · Last Trade: Dec 14th, 3:34 PM EST

Detailed Quote

| Previous Close | 66.57 |

|---|---|

| Open | 67.79 |

| Day's Range | 67.31 - 71.20 |

| 52 Week Range | 63.40 - 289.00 |

| Volume | 55,697,913 |

| Market Cap | - |

| Dividend & Yield | 4.860 (6.89%) |

| 1 Month Average Volume | 44,816,725 |

Chart

News & Press Releases

AXS Investments made a bearish bet on the Nasdaq-100 index in the third quarter. Check out the trade and how it serves the investment firm's needs.

Via The Motley Fool · November 6, 2025

ProShares, a premier provider of ETFs, announced today forward and reverse share splits on 22 of its ETFs. The splits will not change the total value of a shareholder’s investment.

By ProShares · Via Business Wire · November 4, 2025

A significant surge in capital flowing into short-bias Exchange-Traded Funds (ETFs) has sent a clear signal through the financial markets: investor sentiment is shifting towards caution and a potential stock market pullback. This notable trend, particularly pronounced in recent weeks, suggests that a growing number of investors are actively positioning

Via MarketMinute · October 9, 2025

October 6, 2025 – The financial markets witnessed a significant event today as the ProShares UltraPro Short QQQ (NASDAQ: SQQQ), an exchange-traded fund designed to deliver three times the inverse of the daily performance of the NASDAQ-100 Index, plunged to a new 12-month low of $14.65 during mid-day trading. This

Via MarketMinute · October 6, 2025

Leveraged ETFs see a 74% inflow as investor risk appetite hits a multi-year high despite Trump induced tariff lows from April.

Via Benzinga · October 2, 2025

The artificial intelligence sector is showing critical warning signs that suggest a significant correction may be approaching.

Via Benzinga · September 25, 2025

ProShares UltraPro Short QQQ is soaring in Friday afternoon trading. A perfect storm of severe geopolitical threats and dismal economic data sends investors fleeing from technology stocks.

Via Benzinga · August 1, 2025

SQQQ jumps as tech stocks slide on surging Treasury yields. Weak bond auction and deficit fears drive rates above 5%.

Via Benzinga · May 21, 2025

Shares of ProShares UltraPro Short QQQ fell 4.75% on Friday. A strong rally in technology stocks and upbeat U.S. economic data weighed heavily on the ETF.

Via Benzinga · May 2, 2025

March proved to be one of the wildest months for the U.S. stock market, given the ongoing trade uncertainty. In such an environment, leveraged and inverse-leveraged ETFs may look appealing. Here is a glance at some ETFs that gained in March.

Via Talk Markets · March 30, 2025

SQQQ jumped as surging inflation expectations and weak consumer sentiment triggered a Nasdaq selloff. Rising rate fears hurt tech stocks, boosting the inverse ETF, which profits from Nasdaq declines.

Via Benzinga · March 28, 2025

Market downturns can be both terrifying and opportunistic for investors because while some see drops as a reason to panic, others view them as a chance to buy assets at a discount.

Via Benzinga · March 19, 2025

ProShares UltraPro Short QQQ gained 2% Wednesday afternoon. The Federal Reserve delivered a dovish tone during its December meeting.

Via Benzinga · December 18, 2024

ProShares, a premier provider of ETFs, announced today forward and reverse share splits on 22 of its ETFs. The splits will not change the total value of a shareholder’s investment.

By ProShares · Via Business Wire · October 28, 2024

ProShares UltraPro Short QQQ shares are trading higher by 5% during Tuesday's session. SQQQ is up amid reports Iran has launched a ballistic missile attack against Israel.

Via Benzinga · October 1, 2024

Here are 10 ETFs that have seen higher average volumes in the third quarter and are thus the top 10 funds in terms of trading volume.s

Via Talk Markets · September 30, 2024

Global equity markets under pressure due to US recession fears. Despite expansion in services, concerns of slowing economy causing market turmoil. Interest rate futures show high probability of rate cuts. 5 ETFs rally amid market selloffs.

Via Benzinga · August 5, 2024

Trying to beat the overall stock market with clever trading is one surefire way to underperform it. Just keep things simple.

Via The Motley Fool · June 27, 2024

As investors search for safe havens in volatile markets, bear market funds are gaining popularity as a diversified asset class.

Via MarketBeat · April 18, 2024

As investors search for safe havens in volatile markets, bear market funds are gaining popularity as a diversified asset class.

Via MarketBeat · March 27, 2024

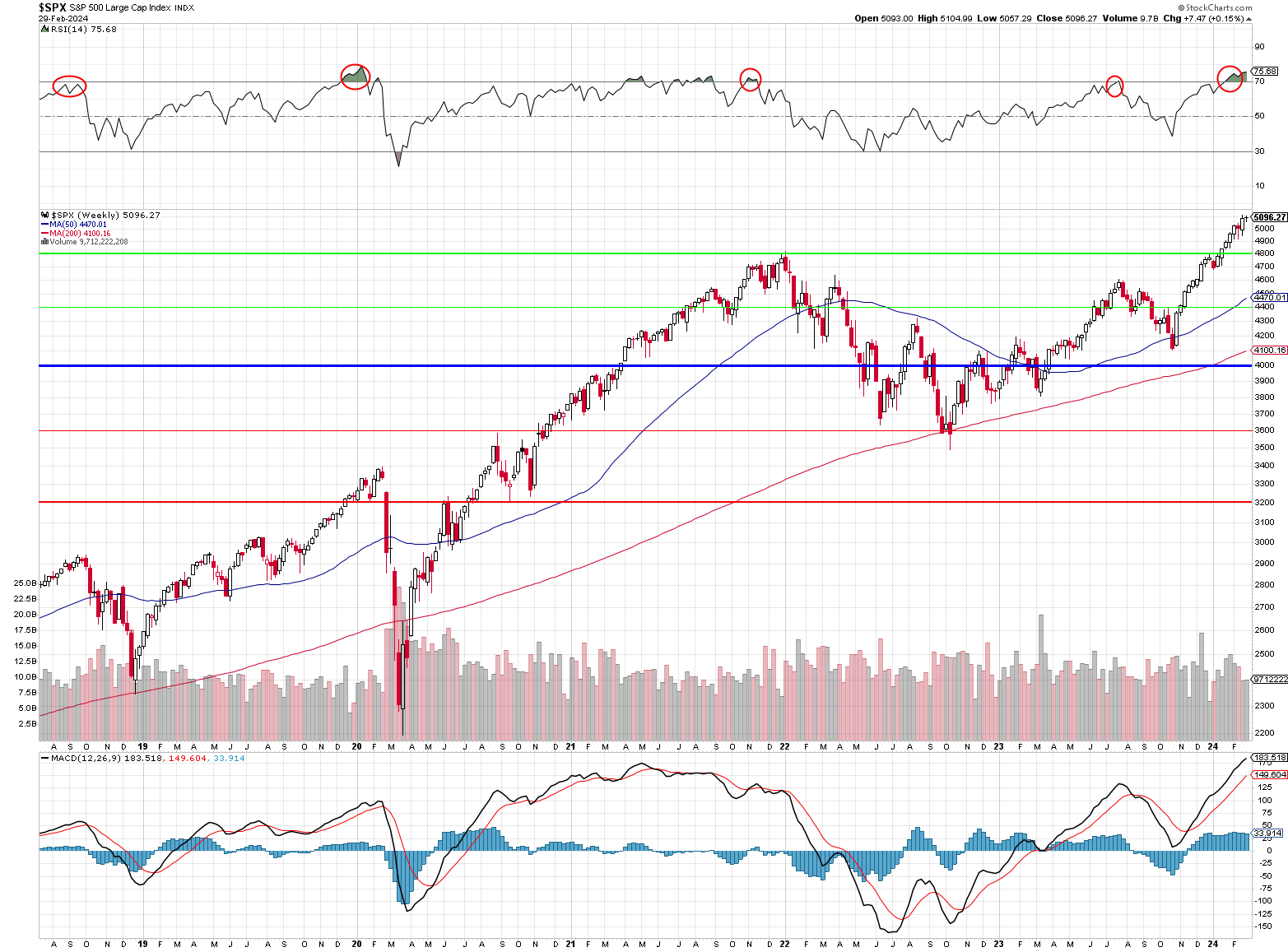

The Nasdaq closed over 18,000 yesterday and its RSI is also over 70 (overbought) but no one wants to say a bad thing about the markets at the moment.

Via Talk Markets · March 1, 2024

The ProShares Short UltraPro Short QQQ is a giant ETF with over $3 billion in assets. Its stock has plunged by more than 99% in the past five years.

Via Talk Markets · January 4, 2024

Here are 10 ETFs that have seen higher average volumes over the past three months and are thus the top 10 funds in terms of trading volume.

Via Talk Markets · December 25, 2023

Three hedge fund associations are jointly suing the Securities and Exchange Commission.

Via Benzinga · December 13, 2023

In 2023, retail investors made a comeback: 30 million new accounts opened, record levels of investment, diversifying into different asset classes, favoring ETFs and detaching from meme-stock stereotype.

Via Benzinga · December 12, 2023