iShares Latin America 40 ETF (ILF)

36.16

+1.04 (2.96%)

NYSE · Last Trade: Jan 27th, 7:11 PM EST

Detailed Quote

| Previous Close | 35.12 |

|---|---|

| Open | 35.76 |

| Day's Range | 35.74 - 36.20 |

| 52 Week Range | 20.97 - 36.21 |

| Volume | 6,138,392 |

| Market Cap | 24.41M |

| Dividend & Yield | 0.4020 (1.11%) |

| 1 Month Average Volume | 4,033,434 |

Chart

News & Press Releases

Emerging markets are outperforming the S&P 500 by the widest margin since 2009, driven by strong earnings growth, reforms and valuations.

Via Benzinga · November 19, 2025

Vale's (VALE) shares down on Friday due to 4% decline in net operating revenue, missed consensus estimate and lower iron ore and nickel prices.

Via Benzinga · April 25, 2025

Emerging markets thrive despite tariff chaos, best positioned to weather volatility: India, UAE, LatAm, and Australia stand out. Defensive sectors and gold are also key for a tariff-resistant portfolio.

Via Benzinga · April 24, 2025

VALE shares down premarket after reporting Q1 production and sales performance, iron ore production and pellet production fell, copper and nickel up.

Via Benzinga · April 16, 2025

Latin American equity indices outperformed in 2022, as they benefitted from having less exposure to sectors that were most affected by higher interest rates.

Via Talk Markets · January 4, 2023

VALE reported Q4 results, beating consensus, with iron ore production at highest since 2018. C1 cash costs at US$ 18.8/t in Q4.

Via Benzinga · February 20, 2025

Petrobras shares up on Business Plan 2025-2029 with focus on replenishing reserves, boosting production, expanding portfolio, and increased investments.

Via Benzinga · November 22, 2024

Petrobras reports strong performance in Q3 with record oil processing and production, as well as participation in new projects.

Via Benzinga · October 8, 2024

Axon, MercadoLibre, and e.l.f. Beauty pulled back with the broad market, yet still hold potential for gains following a rare three-weeks-tight trading pattern.

Via MarketBeat · January 5, 2024

In this video, we're going to do a market recap and cover crypto, indices, sectors, etc.

Via Talk Markets · December 15, 2023

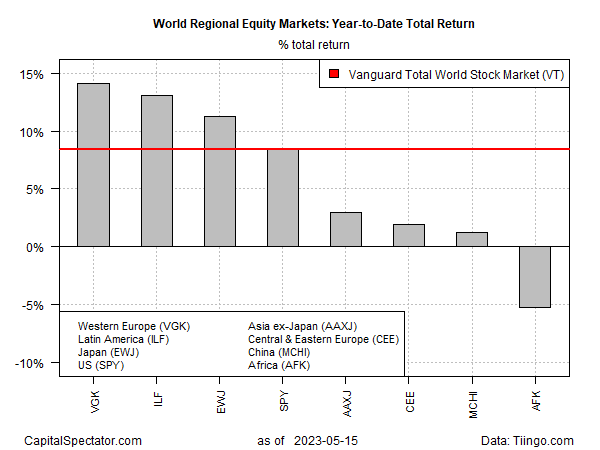

After world shares ex-US enjoyed a rare if unimpressive win over American shares in 2022, by losing less, the odds don’t look encouraging for a repeat run of outperformance in 2023.

Via Talk Markets · November 10, 2023

The dominance of the US stock market over its foreign counterparts has for years been taken as a sign of the new world order for global asset allocation that forever and always favors American shares.

Via Talk Markets · May 16, 2023

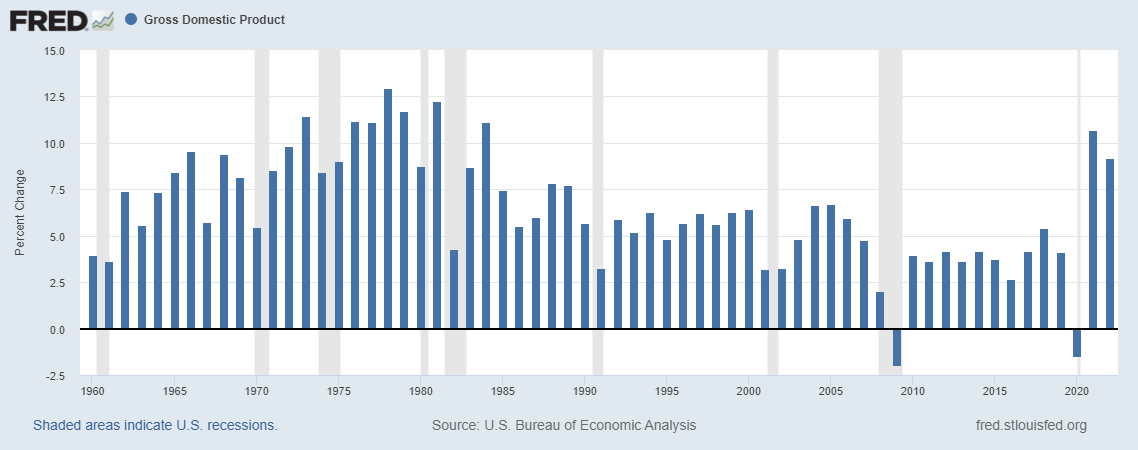

Studying the past doesn’t somehow allow us to predict the future. But it does tell us that there is a range of potential outcomes and we should be reluctant to make big changes to our portfolios based on any prediction.

Via Talk Markets · April 10, 2023

Here are the best South American stocks for investors who are ready to go beyond domestic equities in 2023.

Via InvestorPlace · January 26, 2023

For most equity strategies diversified across global markets, this year’s results will be painful. Short of a dramatic run higher between now and the end of 2022, red ink will prevail. But when losses dominate it’s time to start looking for bargains.

Via Talk Markets · November 30, 2022

Looking for the best stock charts to buy this week? Look no further. In this video, we'll show you exactly that.

Via Talk Markets · October 23, 2022

While returns have been mixed across countries and quarters, it’s clear that Chile and Brazil’s stellar performance contributed to Latin America’s overall gains.

Via Talk Markets · October 19, 2022

While markets overall are suffering in 2022, iShares Latin America 40 has managed to post a handsome gain year to date, rising nearly 11% through Wednesday’s close.

Via Talk Markets · October 13, 2022

Just past the west Texas border into Chihuahua, Mexico is one of the largest silver mines in the country. Further south, an even larger silver mine resides in Zacatecas. Mexico is by far the world’s leading producer of silver, boasting 5,600 metric tons in 2021 versus the number two producer, China, which netted 3,400 metric tons in the same year.

Via Benzinga · May 5, 2022

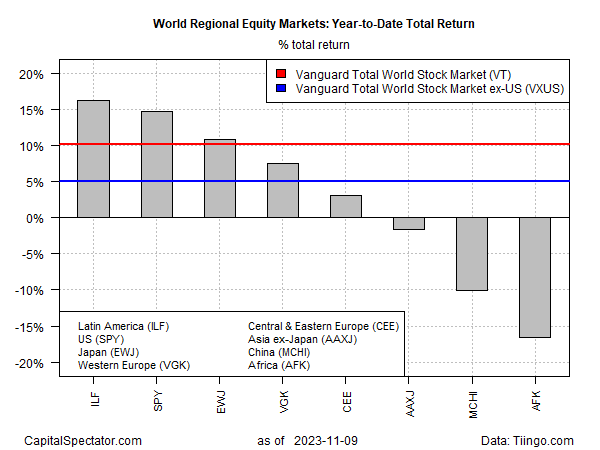

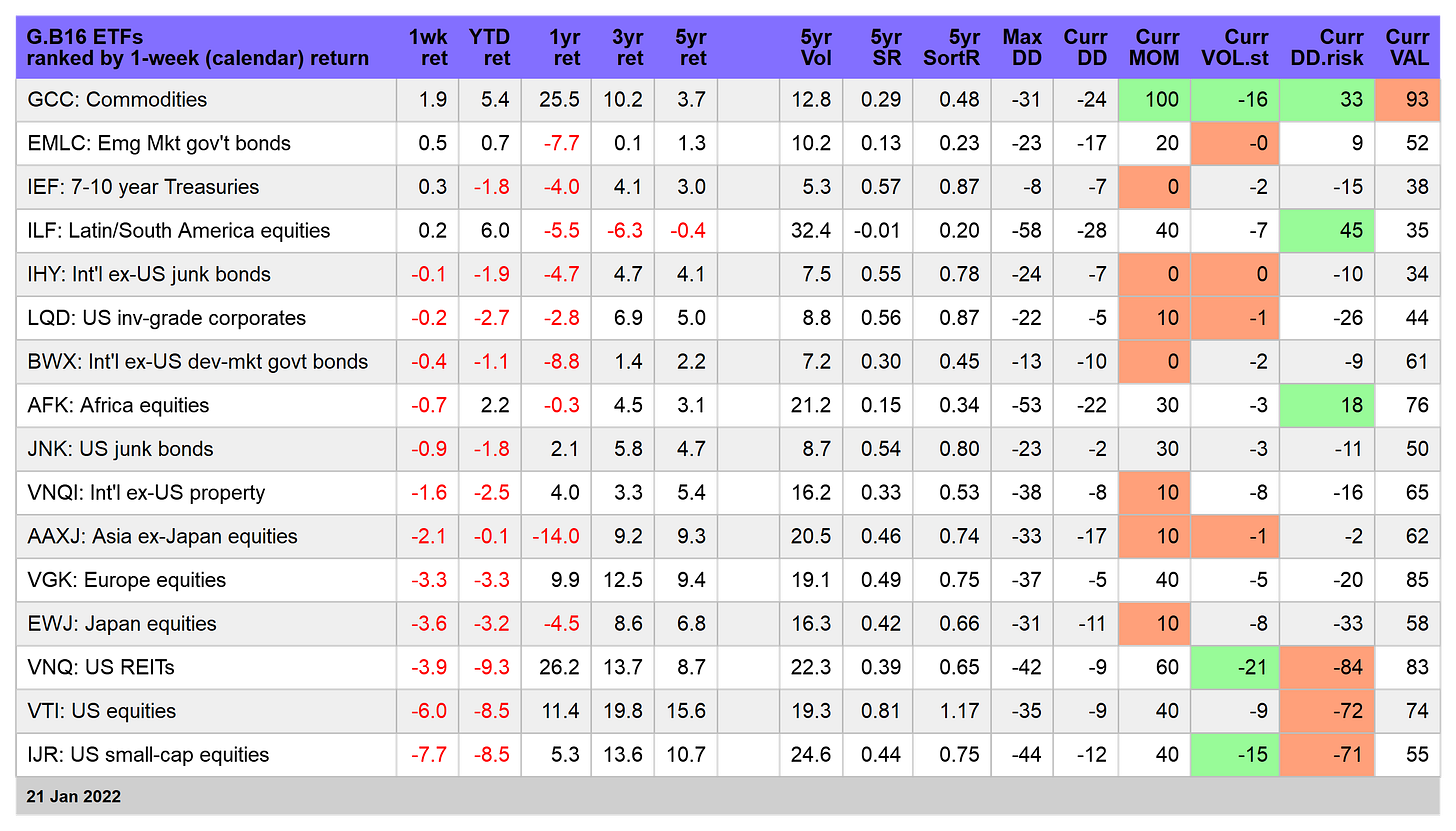

Risk assets took a hit this week, or at least most did. But some corners of the global market were havens. The main outlier: commodities. For a third straight week, WisdomTree Continous Commodity Index GCC rallied, rising 1.9% through Friday’s close.

Via Talk Markets · January 22, 2022

While most global markets experienced strong performance in 2021, the S&P Latin America BMI finished the year down 12%, with negative returns in three out of four quarters.

Via Talk Markets · January 20, 2022

Stock markets around the world have generally tumbled so far this year, but shares in Latin America and Africa are notable exceptions, based on a set of ETFs tracking the major equity regions.

Via Talk Markets · January 20, 2022

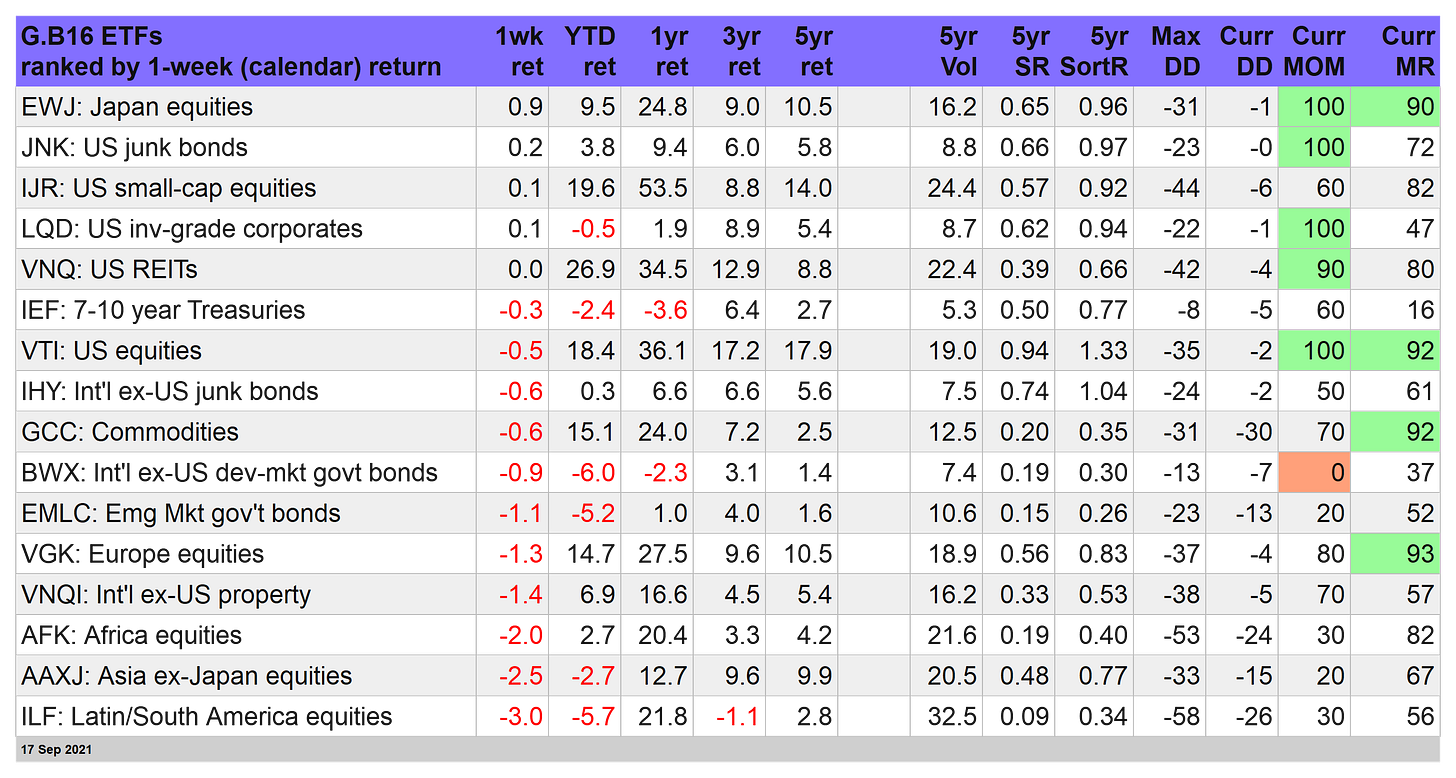

Losses continue to weigh on the global markets this week. But not entirely. Let's take a look.

Via Talk Markets · September 18, 2021

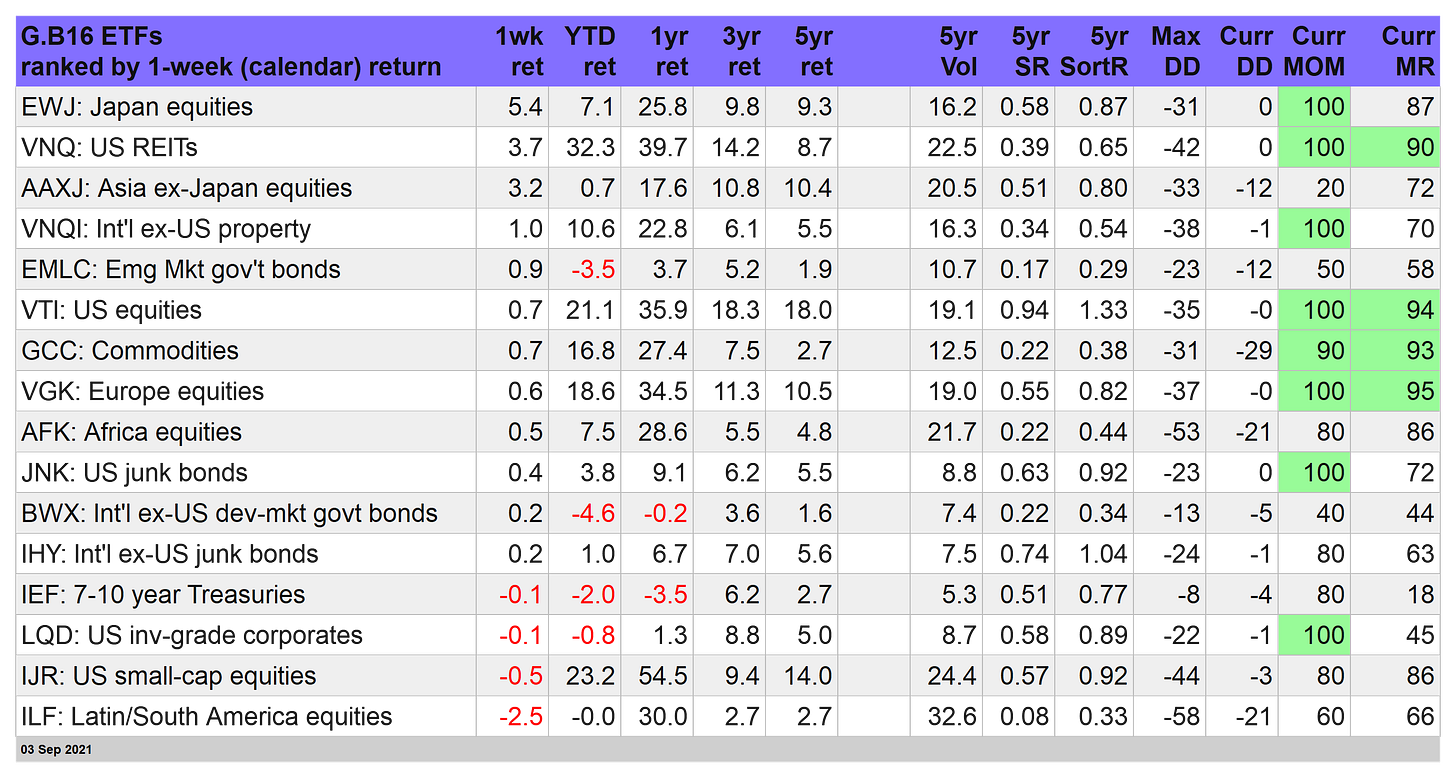

This is getting repetitive, but in a good (or at least profitable) way. The bullish momentum that’s been in force for much of the year remained in play this week as most global markets ended on a positive note by the close of trading through Friday.

Via Talk Markets · September 4, 2021

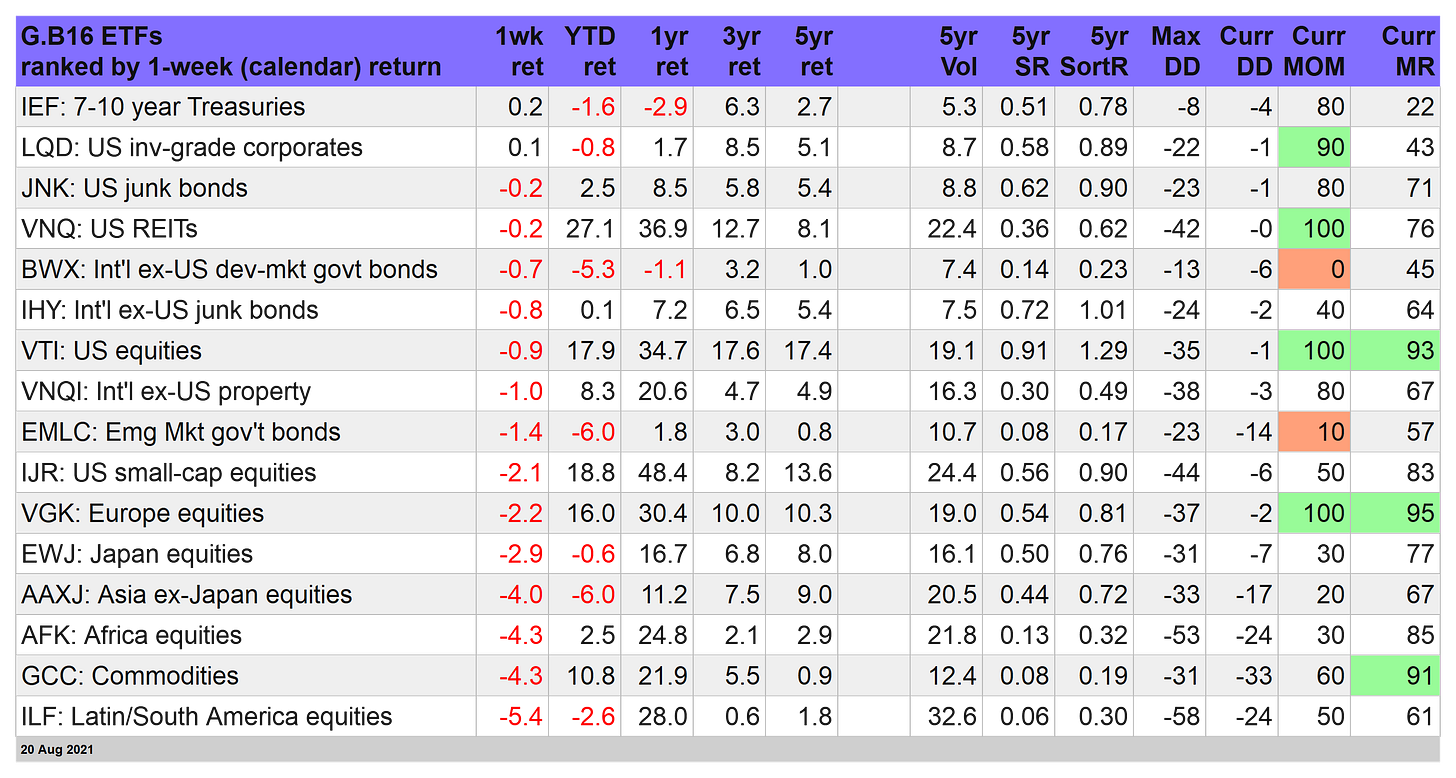

Red ink was nearly everywhere this past week. Save for Treasuries and investment-grade US corporates, our 16-ETF opportunity set was conspicuously biased to the downside for the trading week through Friday, Aug. 20.

Via Talk Markets · August 21, 2021