ProShares Short S&P500 (SH)

38.31

-0.08 (-0.21%)

NYSE · Last Trade: Sep 9th, 2:44 AM EDT

Detailed Quote

| Previous Close | 38.39 |

|---|---|

| Open | 38.31 |

| Day's Range | 38.25 - 38.40 |

| 52 Week Range | 38.10 - 51.37 |

| Volume | 4,215,076 |

| Market Cap | 11.62M |

| Dividend & Yield | 1.672 (4.36%) |

| 1 Month Average Volume | 3,726,350 |

Chart

News & Press Releases

September's stock slump has a history. This year, ETFs like SPY, TLT, and VIXY could be at the center as investors hedge against rising volatility.

Via Benzinga · August 29, 2025

A rare warning signal has reappeared in the market, with a low bull-bear spread and high investor indecision.

Via Benzinga · July 21, 2025

Via The Motley Fool · April 27, 2025

Markets in turmoil as trade war fears reignite, S&P 500 loses $1.5 trillion. Use VIX to hedge, consider low-volatility ETFs, and follow trends.

Via Benzinga · March 4, 2025

The global sell-off will result in huge demand for inverse or inverse-leveraged ETFs as these fetch outsized returns on bearish sentiments in a short span.

Via Talk Markets · February 3, 2025

In this podcast episode, I talk about how traders have to be willing to change their biases and outlooks as the market changes.

Via Talk Markets · September 14, 2024

In this episode, I talk about the the market sell-off that started off of the July highs, and how I traded during the market turmoil that followed.

Via Talk Markets · August 11, 2024

In this week's video, we'll review the latest chart studies and data sets to help us answer the question: Are stocks on the verge of a major correction?

Via Talk Markets · March 15, 2024

Looking at five stocks seeing increased interest from Benzinga readers during the week and what it could mean.

Via Benzinga · February 23, 2024

Runaway government spending, tensions in the Middle East, spikes in interest rates and oil prices - at what point do they become too much for the bull market?

Via Talk Markets · October 13, 2023

If you don’t trust the bullish narrative of a soft landing materializing anytime soon, you can try your hand at these inverse ETFs.

Via InvestorPlace · October 9, 2023

While the benchmark is heading toward a bull market, following a 19.7% rally from the October 2022 lows, traders have raised their bearish bets on the index.

Via Talk Markets · June 7, 2023

The latest FX & Rates Survey from Bank of America reveals that bond investors are hunting for long-dated Treasuries, put options on the stock market, and long positions in the Japanese Yen (JPY) versus high-beta currencies to shield themselves from the dangers connected with the

Via Benzinga · May 12, 2023

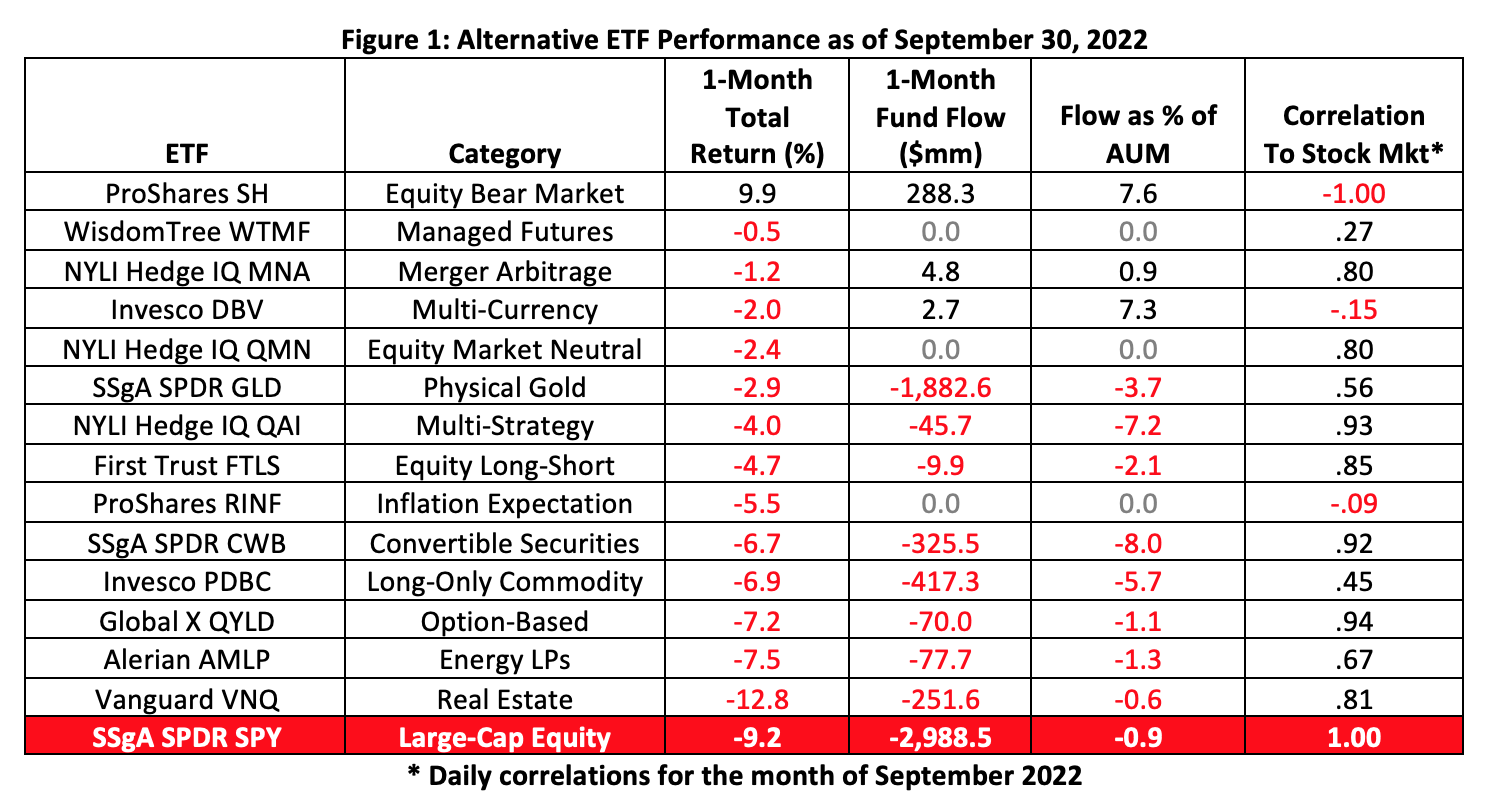

The concept of diversification has long been lauded as the holy grail of investing. However, there is a growing concern that diversification can lead to over-diversification and a poorly performing portfolio. This can be called 'diworsification.'

Via Talk Markets · March 5, 2023

Investors may want to DIY in 2023.

Via Talk Markets · January 4, 2023

A U.S. Senator who previously bet against the stock market in 2022 has placed a new bet with an ETF that shorts U.S. listed companies. Here are the details.

Via Benzinga · November 4, 2022

They may actually exacerbate risk during market crashes.

Via Talk Markets · October 10, 2022

A rare stock market signal combining technical and economic data was recently flashed. What can we learn from history regarding stock market/recession probabilities?

Via Talk Markets · September 24, 2022

Stocks rallied sharply on Friday, July 15. Is this time different?

Via Talk Markets · July 15, 2022

Looking forward, two alternative strategies - a currency play and an inflation hedge - point to two different return prospects for the remainder of the year.

Via Talk Markets · July 8, 2022

An audience-requested triple-header contest between short or inverse ETFs AdvisorShares, ProShares, and Tuttle Capital Management.

Via Talk Markets · June 25, 2022

Although the stock market has been rising for the last few days, some investors believe that this rise is only temporary, and that we are in the beginning of a bear market. If you want to profit from downward markets, there are many ways to do so.

Via Talk Markets · May 29, 2022

The NY Fed wunderkind-turned-Credit Suisse strategist on why the Fed's helicopters are dropping

Via Talk Markets · May 17, 2022

Investors could easily go short on the S&P 500 Index, at least in the near term, with the help of inverse or leveraged inverse ETFs that offer inverse (opposite) exposure to the index.

Via Talk Markets · May 13, 2022

If history is a guide, there’s a chance that the recent selloff in the market may have just gotten started. As you can see on the below chart of the Dow Jones Industrial Average going back to 1897, the current move lower is barely visible. There have been many bear markets that lasted for many months or even years.

Via Benzinga · May 10, 2022