Latest News

Paramount is offering $30 per share in cash, and the company stated that the proposed transaction is for the entirety of WBD, including the Global Networks segment.

Via Stocktwits · December 8, 2025

Carvana joins S&P 500, making Viking Global's Andreas Halvorsen and Coatue's Philippe Laffont potential paper profit of $540 million.

Via Benzinga · December 8, 2025

American Electric Power has outperformed the Dow Jones index over the past year. Moreover, Wall Street analysts remain moderately optimistic about its prospects.

Via Barchart.com · December 8, 2025

Via Benzinga · December 8, 2025

Via Benzinga · December 8, 2025

CoreWeave Inc (NASDAQ:CRWV) shares are trading lower Monday after the company announced a proposed offering of convertible senior notes.

Via Benzinga · December 8, 2025

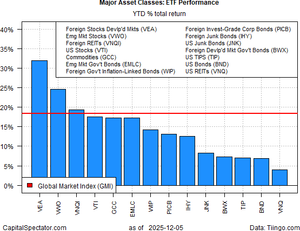

With three-and-a-half weeks of trading left for 2025, all the major asset classes are holding on to gains, based on a set of ETFs.

Via Talk Markets · December 8, 2025

Morgan Stanley analyst Andrew Percoco downgraded Rivian to ‘Underweight’ from ‘Equal Weight’, maintaining a $12 price target.

Via Stocktwits · December 8, 2025

Via Benzinga · December 8, 2025

ONEOK has underperformed other midstream energy stocks over the past year. However, Wall Street analysts remain moderately optimistic about its prospects.

Via Barchart.com · December 8, 2025

Via Benzinga · December 8, 2025

ServiceNow Inc. (NYSE: NOW) pledges $110 million for AI adoption in Canada, including 100 new jobs and a local data center.

Via Benzinga · December 8, 2025

The company said Monday patients who took its obesity treatment lost up to 15.3% more weight than placebo recipients.

Via Investor's Business Daily · December 8, 2025

Via Benzinga · December 8, 2025

(BPT) - Did you know over half of adults worldwide (57%) faced at least one scam attempt this past year? As the holiday season kicks into high gear, scammers aren't taking time off - they're cashing in on the season of goodwill. And many of them are successful: Scammers are expected to steal an estimated $442 billion globally by the end of 2025.

Via Brandpoint · December 8, 2025

(BPT) - For 36-year-old Austin, Texas, resident David R., kidney disease was something he never expected. After months of feeling sluggish, nauseous and experiencing cramping in his hands and feet, he made an appointment to see his doctor to discuss his health. However, just two days before his appointment, the pain moved to David's abdomen, and he was raced to the emergency room.

Via Brandpoint · December 8, 2025

Via Benzinga · December 8, 2025

Antero Resources To Buy HG Energy’s Upstream Assets For $2.8Bstocktwits.com

Via Stocktwits · December 8, 2025

Why IBM Thinks Confluent Can Speed Up Its AI Strategystocktwits.com

Via Stocktwits · December 8, 2025

USD/CAD trades near its lowest level since late September after Friday’s strong Canadian jobs data.

Via Talk Markets · December 8, 2025

The chipmaker has an excellent track record.

Via The Motley Fool · December 8, 2025

Via Benzinga · December 8, 2025

Though ResMed has lagged behind the S&P 500 Index over the past year, analysts are moderately optimistic about the stock’s prospects.

Via Barchart.com · December 8, 2025

Dollar General Corp.

Via Benzinga · December 8, 2025

Via Benzinga · December 8, 2025

His distinctly dovish leanings suggest deeper rate cuts ahead, unsettling bond investors and raising questions about policy credibility.

Via Stocktwits · December 8, 2025

ResMed (RMD) is a high-quality dividend stock with a secure payout, strong profitability, and a rock-solid balance sheet, ideal for sustainable passive income growth.

Via Chartmill · December 8, 2025

A drastic portfolio shift just impacted one of retail’s biggest comeback stories — here’s what long-term investors should take from it.

Via The Motley Fool · December 8, 2025

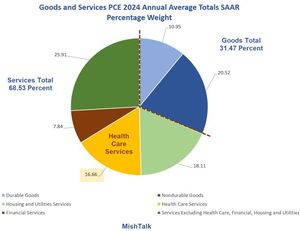

A look at 2026 health care premiums and what they mean to the Fed’s preferred measure of inflation.

Via Talk Markets · December 8, 2025

Hunt small and gain big with this potential future stock market winner.

Via The Motley Fool · December 8, 2025

Dogecoin (CRYPTO: DOGE) has slipped nearly 20% over the past month, but analysts say the meme coin is now approaching one of its strongest

Via Benzinga · December 8, 2025

One hedge fund is doubling down on Flowserve as its shares race toward record highs.

Via The Motley Fool · December 8, 2025

Via Benzinga · December 8, 2025

One major hedge fund is leaning into a beaten-down West Coast office REIT — here’s what they may be seeing.

Via The Motley Fool · December 8, 2025

One fund just walked away from BrightView — here’s what the numbers suggest long-term investors should really pay attention to.

Via The Motley Fool · December 8, 2025

One major fund just walked away from Baidu — here’s what the move might reveal about the stock’s recent rebound.

Via The Motley Fool · December 8, 2025