Latest News

Via Benzinga · December 4, 2025

C3.ai shares rose after securing a HHS contract even as mixed earnings and analyst skepticism kept debate over the stock’s outlook alive.

Via Stocktwits · December 4, 2025

Via Benzinga · December 4, 2025

Via Benzinga · December 4, 2025

Via Benzinga · December 4, 2025

Via Benzinga · December 4, 2025

Discover how asset base, fund age, and dividend yield distinguish these Treasury ETFs for various investor priorities.

Via The Motley Fool · December 4, 2025

Understanding how to find the intrinsic value of a stock is the cornerstone of sound, long-term investing.

Via Talk Markets · December 4, 2025

D-Wave stock has advanced 206% in 2025, tops among quantum computing stocks. Evercore ISI started D-Wave coverage with out-perform rating.

Via Investor's Business Daily · December 4, 2025

Can the smaller chipmaker continue to outperform its more famous peer in the new year?

Via The Motley Fool · December 4, 2025

Via Benzinga · December 4, 2025

Via Benzinga · December 4, 2025

SAIC stock looks cheap, if it can just find a way to resume growing.

Via The Motley Fool · December 4, 2025

Brown-Forman delivered softer quarterly earnings and lower sales but said performance matched expectations and reaffirmed outlook.

Via Benzinga · December 4, 2025

The company projected fiscal 2026 total sales to be up about 2% and comparable sales to be up about 3% compared to the previous year, down from the prior forecast for total sales to be up 3% to 4% and comparable sales up 4% to 5%.

Via Stocktwits · December 4, 2025

MicroCloud has developed a quantum-powered 3D modelling system to produce 3D images and models.

Via Stocktwits · December 4, 2025

Five Below said holiday season sales have been strong, including the Black Friday weekend. Q3 results and Q4 guidance impressed analysts.

Via Benzinga · December 4, 2025

Coal may be out of favor, but one fund’s latest move reveals why the story isn’t as simple as it looks.

Via The Motley Fool · December 4, 2025

The report added that at least one of these companies expects to fulfill the multi-billion-dollar investment pledge in full by Jan. 1, 2029.

Via Stocktwits · December 4, 2025

Microsoft denies reducing sales targets for AI products, eases stock losses. Microsoft is actively shaping a clear vision for enterprise AI.

Via Benzinga · December 4, 2025

March arabica coffee (KCH26 ) today is up +5.60 (+1.50%), and January ICE robusta coffee (RMF26 ) is up +10 (+0.23%). Coffee prices recovered from early losses today and turned higher due to dry weather forecasts for Brazil and a stronger Brazilian r...

Via Barchart.com · December 4, 2025

Oracle stock is down nearly 40% from its 52-week high, presenting an opportunity for long-term investors.

Via Barchart.com · December 4, 2025

After a 60% surge in 2025, the World Gold Council says the next gold's move depends on shifting macroeconomic regimes.

Via Benzinga · December 4, 2025

Silver trades on the back foot on Thursday as bulls take a breather and book partial profits after the metal climbed to record highs near $58.98 on Wednesday.

Via Talk Markets · December 4, 2025

Tokenized real estate shifts from hype to legit market as Wall Street institutions embrace on-chain property income and 24/7 liquidity.

Via Benzinga · December 4, 2025

Shares of Pattern Group are trading lower Thursday morning after short-focused research outlet The Bear Cave published a new report.

Via Benzinga · December 4, 2025

OpenAI’s Sam Altman has reportedly sounded a “code red” after the company’s user total fell following the release of Gemini 3. Should you buy GOOG stock here despite the YTD outperformance?

Via Barchart.com · December 4, 2025

If you're looking for growth and can handle some risk, these energy stocks have immense potential.

Via The Motley Fool · December 4, 2025

This holiday, find a tech gift for every family member

(BPT) - Are you still trying to find gifts for everyone on your list? Sometimes it can be challenging to find just the right present for each of your loved ones. That's why T-Mobile is helping you gift yourself a stress-free season this year with a handy holiday gift guide. Read on to discover some of the season's best tech that you can slip under the tree at a price you'll love.

Via Brandpoint · December 4, 2025

January WTI crude oil (CLF26 ) today is up +0.61 (+1.03%), and January RBOB gasoline (RBF26 ) is up +0.0017 (+0.09%). Crude oil and gasoline prices are moving higher today on dollar weakness as the dollar index (DXY00 ) dropped to a 5-week low. Also...

Via Barchart.com · December 4, 2025

Macro investor Jordi Visser says Bitcoin (CRYPTO: BTC) is early in a major bull market because the next wave of demand will come from billions of new

Via Benzinga · December 4, 2025

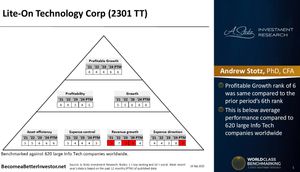

Lite-On Technology Corporation is a Taiwanese company. The company designs, manufactures, and sells a wide range of electronic components and products.

Via Talk Markets · December 4, 2025

Cresent Biopharma shares were trading higher Thursday but have since reversed and begun trading lower after the company announced a partnership with Sichuan Kelun-Biotech Biopharmaceutical.

Via Benzinga · December 4, 2025

The AI revolution shifts from GPUs to gigawatts as Palantir and Nvidia partner to address the bottleneck in energy and compute infrastructure.

Via Benzinga · December 4, 2025

The artificial intelligence (AI)-driven warehouse automation specialist announced a secondary stock offering that spooked investors.

Via The Motley Fool · December 4, 2025

Shares of Hims & Hers are trending Thursday morning. The San Francisco-based telehealth company announced an international expansion.

Via Benzinga · December 4, 2025

This streaming platform for live sports and entertainment reported a notable insider sale amid strong one-year share price gains.

Via The Motley Fool · December 4, 2025

AI is driving sales growth for both companies, but one stands out as a superior investment.

Via The Motley Fool · December 4, 2025

A congressman bought and sold Cracker Barrel stock in November, netting a profit for investing in the restaurant stock after the logo controversy.

Via Benzinga · December 4, 2025

LCM will supply Compass Diversified’s unit Arnold with ex-China rare-earth metals and alloys for advanced permanent magnet production

Via Stocktwits · December 4, 2025

The S&P 500 Index ($SPX ) (SPY ) is down by -0.06%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is down by -0.04%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is down by -0.28%. December E-mini S&P futures (ESZ25 ) are down -0.07%, and Dece...

Via Barchart.com · December 4, 2025

Via Benzinga · December 4, 2025

A regulatory change in India could give silver another boost. Beginning in April 2026, Indians will be able to use silver assets as collateral for loans from banks, non-banking financial companies, and household finance firms.

Via Talk Markets · December 4, 2025

Via MarketBeat · December 4, 2025

Market expectations have turned more dovish for 2026, with investors pricing 2–3 Fed rate cuts and Kevin Hassett emerging as Trump's likely pick to succeed Jerome Powell.

Via Benzinga · December 4, 2025

Tesla was ranked ninth in terms of new car reliability and fifth in terms of maintenance and repair costs, according to Consumer Reports.

Via Stocktwits · December 4, 2025

USA Rare Earth shares are trading higher Thursday amid a key partnership aimed at fortifying the Western rare earth supply chain.

Via Benzinga · December 4, 2025